Category Archive: 6a) Gold & Monetary Metals

Trump provides ‘great entertainment’ overseas, Marc Faber says

‘The Gloom, Boom & Doom Report’ editor Marc Faber discusses why Amazon, Netflix and Tesla shares will each drop 10 percent in a single trading session, and his views on President Trump.

Read More »

Read More »

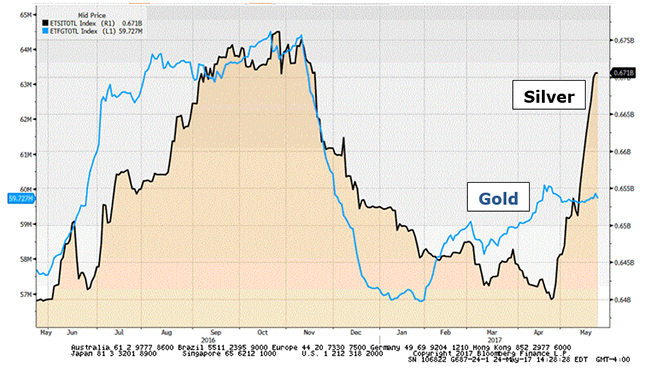

Silver Bullion In Secret Bull Market

Do you think silver is poised to go higher? I sure do. That’s because I’m watching what is going on in the world’s silver ETFs. I’m also watching the mountain of forces that are piling up to push the metal higher.

Look at this chart. It shows all the metal held by the world’s physical silver ETFs (black line). And all the metal held by the world’s physical gold ETFs (blue line) …

Read More »

Read More »

There Is A Bubble In The Most Popular Stocks: Marc Faber

Marc Faber, Author, The Gloom, Boom & Doom Report states that there is a bubble in the most popular stocks.

Read More »

Read More »

Michael Pento Warns of Exploding Debt, Inverted Yield Curve, and Then “Economic Armageddon”

Read full interview transcript here: https://goo.gl/twaKM2 Michael Pento of Pento Portfolio Strategies joins Money Metals Exchange and lays out a scenario he says is ahead for the economy, interest rates, and monetary policy – all of which point to a watershed moment for gold. ================== Follow Money Metals: ================== Facebook: https://www.facebook.com/MoneyMetals Instagram: https://www.instagram.com/moneymetals/ Twitter:...

Read More »

Read More »

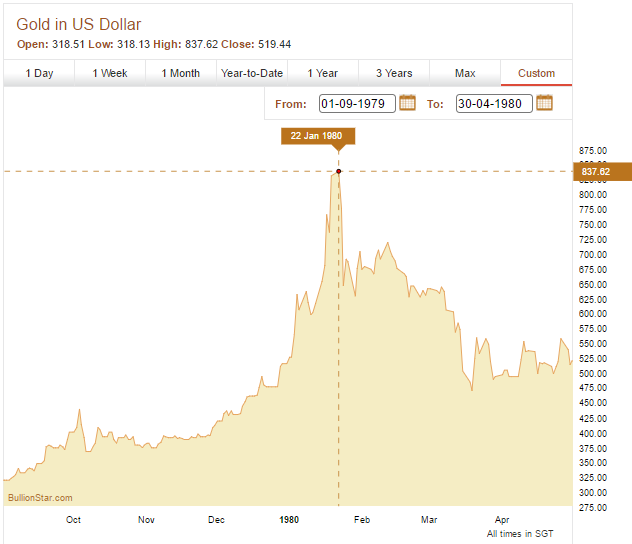

New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil

This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland.

Read More »

Read More »

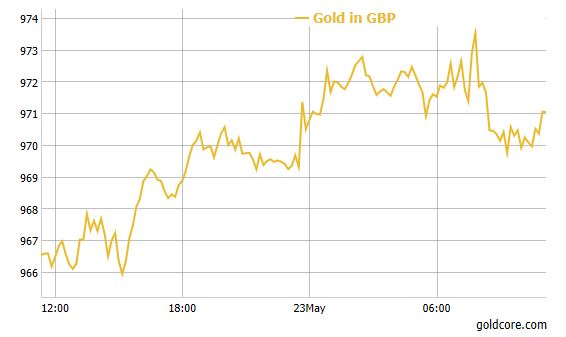

Manchester Attack Sees Asian Stocks Fall, Gold Firm

The appalling attack in Manchester overnight in which over 22 people have been killed has led to a slight uptick in risk aversion in markets. Investors are cautious after police said they were treating a bombing at a concert in the Manchester Arena as a “terrorist incident”.

Read More »

Read More »

Gold Investment Is the Ultimate Guide for Tech Investors In 500 Words

Tech is the umbrella word for all things fashionable to invest in right now. Take the recent flotation of Snap Inc. (parent company of teen and narcissists’ favourite app SnapChat), everyone wanted in on the $20 billion flotation. Snap is likely a sign of a tech bubble that will cost a lot of savers and investors huge amounts of money … again.

Read More »

Read More »

Sprott Money News Ask the Expert May 2017 – Rob McEwen

Rob McEwen, legendary founder of Goldcorp and current CEO of McEwen Mining, joins us to field questions on gold prices, the global economy and the mining sector.

Read More »

Read More »

It’s Better to Buy Gold & Silver When It DOESN’T Feel Good (David Smith Interview)

Read the full transcript here: https://goo.gl/PYbJdM David Smith, Senior Analyst at The Morgan Report and MoneyMetals.com columnist shares his thoughts on the potential effects of the newfound rise of digital gold based investments. And he comments on some new industrial applications for gold and silver that could have a major impact on the supply-demand fundamentals …

Read More »

Read More »

New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.”

Read More »

Read More »

Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies

Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies – Cyberattacks expected to spread today in “second phase”– UK intelligence says scale of threat significant– Microsoft slams NSA for letting hacking tools cause global malware epidemic– Ransomware attack already crippled more than 200,000 computers in 150 countries– 1.3 million computer systems believed to be at risk

Read More »

Read More »

History of Gold – Interesting Facts and Changes Over 50 Years

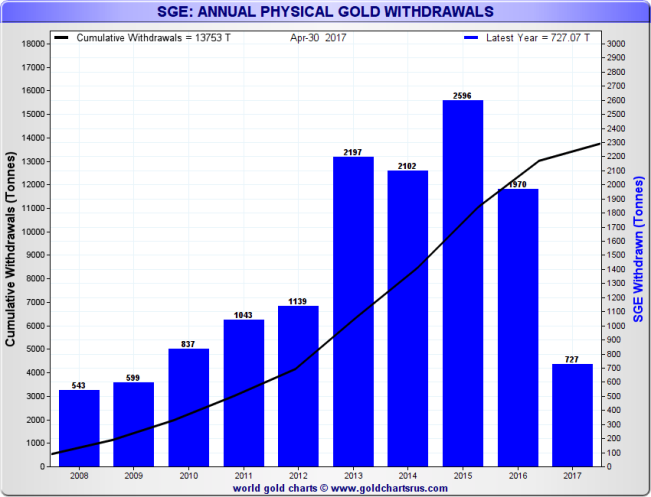

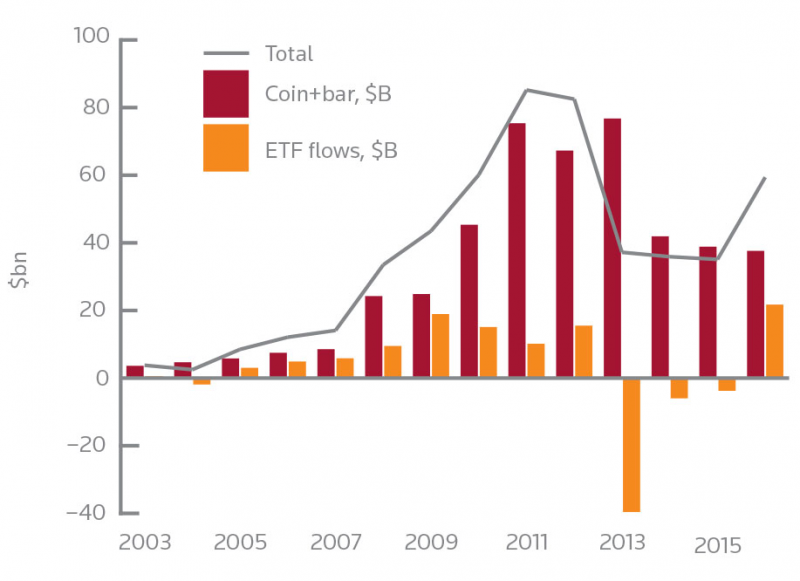

History of Gold – How the gold industry has changed over 50 years. Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years. Topics covered and interesting historical facts to note include: Gold market size– Gold mine production “peaked in 2015”. South African production collapse from 1,000 tonnes.

Read More »

Read More »

BullionStar’s Ronan Manly interviewed by Crush the Street

Kenneth Ameduri of Crush the Street interviews BullionStar’s Ronan Manly. The conversation covers such topics as the disconnect between physical and paper gold, and the secrecy with which central banks operate in the gold market.

Read More »

Read More »