Category Archive: 6a) Gold & Monetary Metals

Gold Up, Markets Fatigued As War Talk Boils Over

North Korea threatens to reduce the U.S. to ‘ashes and darkness’. Markets becoming used to ongoing provocations from North Korea. Russia and China continue to support watered down versions of sanctions on Kim’s regime. Both NATO and Russia running war games on one another’s borders. Putin says Russia will “give a suitable response” to NATOs threatening behaviour.

Read More »

Read More »

How to Tell if Gold is Real: 4 Easy Tests to Spot Fake Gold or Silver

(Learn 1 More Test to Avoid Fake Gold Here) .⇒ https://goo.gl/icuGMv

Buy REAL 1 Oz Krugerrand Coins here ⇒ https://www.moneymetals.com/south-african-krugerrand-gold-coin-one-ounce/20

See the Krugerrand Gold Coin here ⇒

Check gold prices here ⇒ https://www.moneymetals.com/precious-metals-charts/gold-price

Learn how to know if your gold or silver is fake!

Just about all bullion investors worry about counterfeits. Those concerns are magnified...

Read More »

Read More »

Money Metals President Stefan Gleason Speaks about the Buying “Dos and Don’ts”

Read the full transcript here: https://goo.gl/qYPFB5

Listen to this fascinating and informative interview with Money Metals' president Stefan Gleason gave recently for the Sustainable Money podcast. Stefan shares some of the history behind sound money, when and where the wheels came off our monetary system, some disturbing developments in the war on cash movement and also goes through some dos and don’ts when it comes to purchasing gold and...

Read More »

Read More »

How to Tell if Gold is Real: 4 Easy Tests to Spot Fake Gold or Silver

(Learn 1 More Test to Avoid Fake Gold Here) .⇒ https://goo.gl/icuGMv Buy REAL 1 Oz Krugerrand Coins here ⇒ https://www.moneymetals.com/south-african-krugerrand-gold-coin-one-ounce/20 See the Krugerrand Gold Coin here ⇒ https://www.youtube.com/watch?v=OmLQWTY25Vk Check gold prices here ⇒ https://www.moneymetals.com/precious-metals-charts/gold-price Learn how to know if your gold or silver is fake! Just about all bullion investors worry about...

Read More »

Read More »

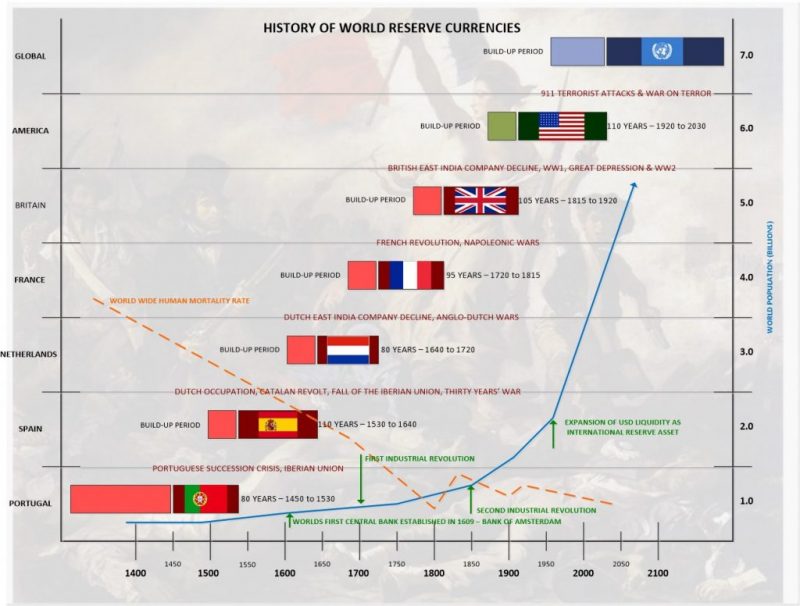

Oil Rich Venezuela Stops Accepting Dollars

President Maduro ” Venezuela will create a basket of currencies to free us from the dollar,”. Oil traders ordered to stop accepting U.S. dollar in exchange for crude oil. Order comes following calls from Russia and China to find alternatives to current reserve system. U.S. Dollar accounts for two-thirds of global trade. Venezuela has over ten-times more oil than United States. Super powers are gradually turning to gold to avoid using world’s main...

Read More »

Read More »

Money Will be Taken Out From India to China: Marc Faber | CNBC TV18

Why will the money move from Indian markets to China? “Sentiments around China were very negative in the past six months to a year but that is now turning positive,” says Marc Faber. Equity markets across the world have performed very well as most markets in Asia have given a return of 20 to 25 … Continue...

Read More »

Read More »

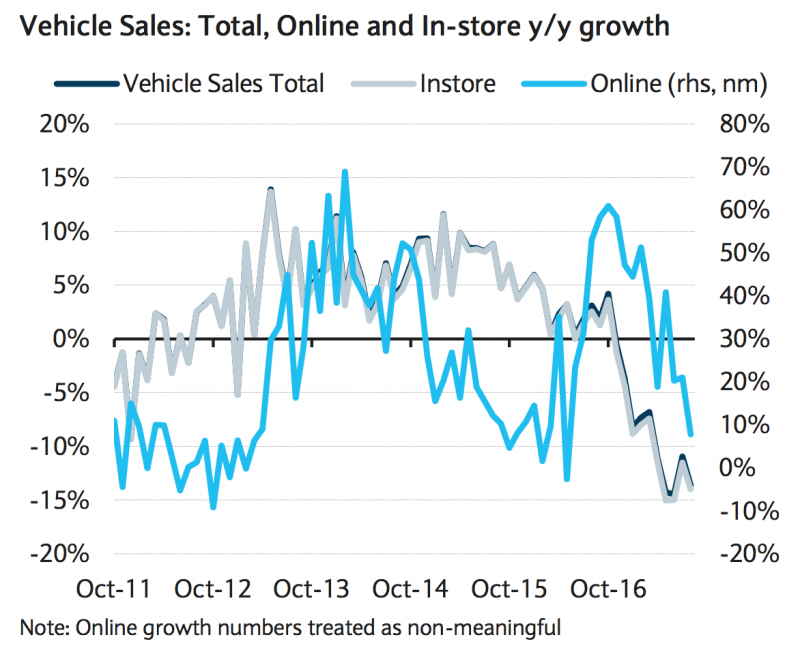

British People Suddenly Stopped Buying Cars

British people suddenly stopped buying cars. Massive debt including car loans, very low household savings. Brexit and decline in sterling and consumer confidence impacts. New cars being bought on PCP by people who could not normally afford them. UK car business has ‘exactly the same problems’ as the mortgage market 10 years ago, according to Morgan Stanley. Bank of England is investigating to make sure UK banks are not overly expose.

Read More »

Read More »

Retail Isn’t Dead

Coach, Burlington Stores, PVH and L Brands can withstand the Amazon threat, says Dana Telsey, retail analyst and founder of Telsey Advisory Group.

Thanks for Watching!!!!!

-----------------------------------------------------

Read More »

Read More »

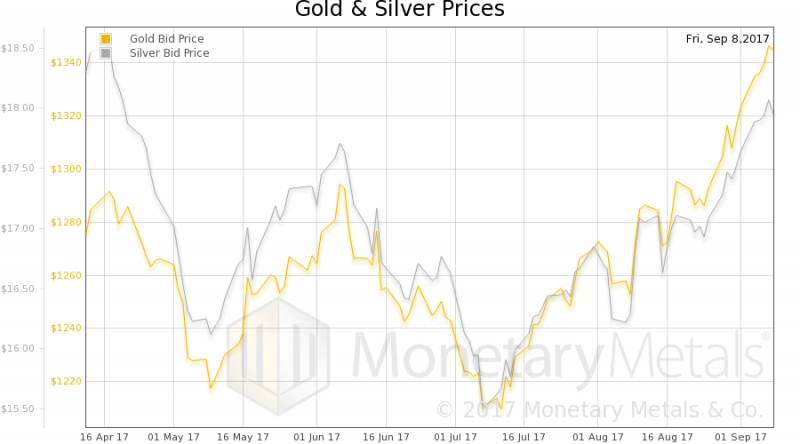

Trump’s Democrat Deal on Debt Ceiling Hits Dollar, Boosts Metals

As a massive storm bears down on Florida, concerns about political and financial storms emanating from Washington D.C. are helping drive precious metals markets higher.

This week Democrat leaders convinced President Donald Trump to kick the can down the road another three months on raising the debt ceiling. So, in December Congress will have to come up with another funding scheme that will undoubtedly punt again and add hundreds of billions of...

Read More »

Read More »

Buy Gold for Long Term as “Fiat Money Is Doomed”

Buy gold for long term as fiat money is doomed warns Frisby. Gold’s “winning streak” will continue in long term. September is traditionally a good month for gold, as we head into the Indian wedding season. “It’s just a matter of time before gold comes good again…” by Dominic Frisby, Money Week. Today folks, by popular demand, we’re talking gold.. It’s had a nice summer run. What now?

Read More »

Read More »

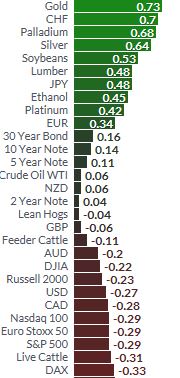

Safe Haven Gold Rises To $1338 as U.S. Warns of ‘Massive’ Military Response

Safe haven gold extends rally to 11-month high after North Korea nuke test and U.S. warns of ‘massive’ response. Asian and European stocks fall, bonds flat, gold, silver, palladium, Swiss franc rise as Korea tensions flare as North Korea tests ‘hydrogen bomb’. North Korea prepares for possible ICBM launch says S. Korea. U.S. warns of ‘massive,’ ‘overwhelming’ military response to North Korea after meeting with Trump. Trump weighing new economic...

Read More »

Read More »

Marc Faber: Interview with Dr. Doom himself! // 2017 bitcoin cnbc latest today bloomberg thailand

Marc Faber: Interview with Dr. Doom himself! // 2017 bitcoin cnbc latest today bloomberg thailand stock market crash this week august july investing gold silver bubble china collapse doom gloom economic jim rogers Dr. Faber’s website is GloomBoomDoom.com https://www.gloomboomdoom.com/ Learn more information about the charitable organization Child’s Dream at ChildsDream.org http://www.childsdream.org/ or by contacting Marc …...

Read More »

Read More »

“Things Have Been Going Up For Too Long” – Goldman CEO

“Things have been going up for too long…” – Goldman Sachs’ CEO. Lloyd Blankfein, Goldman CEO “unnerved by market” (see video). Bitcoin bubble is no outlier says Bank of America Merrill Lynch. Bubbles are everywhere including London property. $14 trillion of monetary stimulus has pushed investors to take more risks. We are now in a new era of bigger booms and bigger busts – BAML. “Seeing signs of bubbles in more and more parts of the capital market”...

Read More »

Read More »

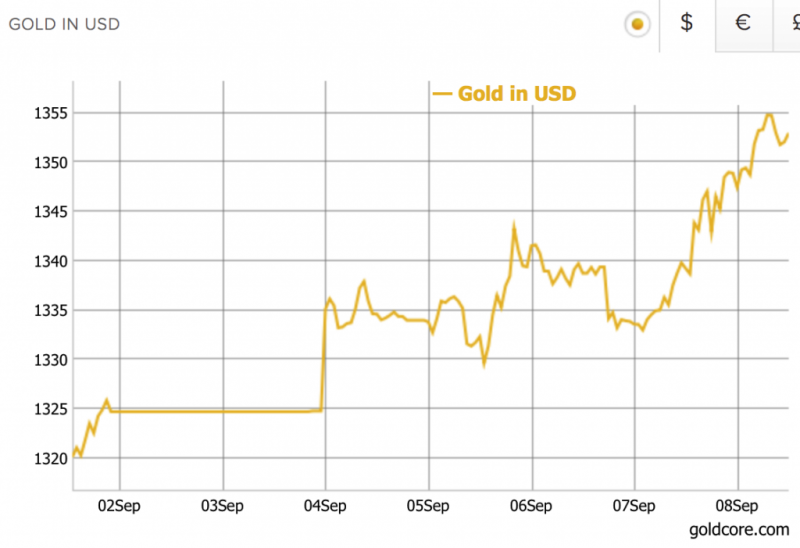

Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy. Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower. Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%. Geo-political concerns including North Korea, falling USD push gold 2.1% in week. Gold prices reach $1,355 this morning following Mexico earthquake. Safe haven demand sees gold over one year high, highest since August 2016.

Read More »

Read More »