Category Archive: 6a) Gold & Monetary Metals

Money Metals Exchange Teams Up with Sound Money Defense League to Provide Gold Scholarship

https://www.moneymetals.com/scholarship Money Metals Exchange, a national precious metals dealer recently voted “Best in the USA” by an independent global ratings group, has teamed up with the Sound Money Defense League, a national public policy group, to offer the first gold-backed scholarship of the modern era. Starting in 2016, these groups set aside 100 ounces of …

Read More »

Read More »

Silver, Pot – Ross Clark. Markets, Tariffs – Marc Faber. India, China – James Corbett. AMY.V, CYP.V

Air Date: September 8, 2018 Ross Clark – Silver’s 31 Month Low. Marijuana Stocks. Guest’s website: https://chartsandmarkets.com/ Marc Faber – Only a Couple Stocks Keeping the US Stock Market Afloat. Tariff Wars and the World Economy. Guest’s website: https://www.gloomboomdoom.com/ James Corbett – India, China, Cryptocurrencies. Guest’s website: http://theinternationalforecaster.com/ Larry Reaugh President & CEO of American...

Read More »

Read More »

Evil Speculator Live Stream

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/

Read More »

Read More »

Evil Speculator Live Stream

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/

Read More »

Read More »

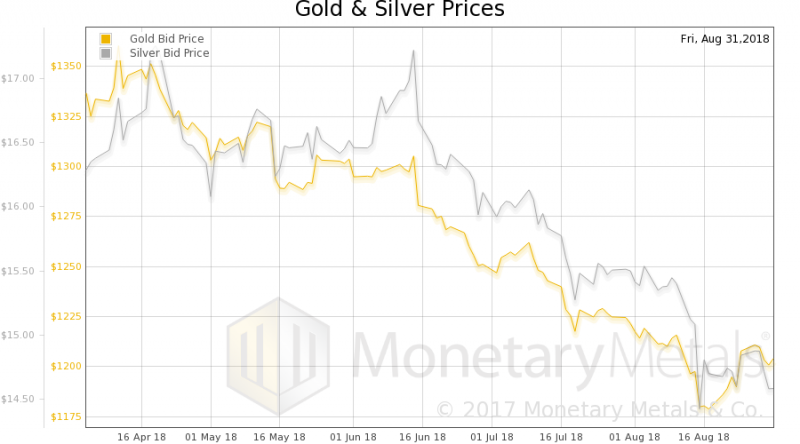

Gold & Silver Price Update for September 7, 2018 (Silver Down 2.7%)

Check gold & silver prices: https://www.moneymetals.com/precious-metals-charts The gold market kicked off trading in what is normally its strongest calendar month by oscillating around the $1,200 level. Spot prices for the yellow metal currently come in at $1,199 per ounce, down 0.3% since last Friday’s close. Silver, meanwhile, is down 2.7% for the week to trade …

Read More »

Read More »

Sprott Money News 9 7 18

This week, Eric Sprott discusses the surging demand for physical gold in nations such as India and notes that this development will almost certainly impact the gold price in the weeks ahead.

Read More »

Read More »

Gold Surges to Record Highs in Emerging Market Currencies

– As emerging market currencies internationally collapse in value, there is a real risk of contagion in bond and currency markets – Turkish lira falls 43.6% and Argentine peso falls 51% and are the 2nd worst and worst internationally traded and non pegged performing currencies in 2018 – Venezuelan bolivar has completely collapsed – Inflation …

Read More »

Read More »

David Morgan: We’re near a turning point for gold & silver, stock market topping

https://www.moneymetals.com/podcasts/2018/08/31/trump-boosts-401k-inflation-001608 David Morgan of The Morgan Report joins Mike Gleason of Money Metals Exchange to talk about what the coming months are likely to have in store for the metals and the markets, tells us how the smart money has already exited stocks and shares his secret to finding value and success in any market. …

Read More »

Read More »

Sprott Money News 8 31 18

Eric Sprott discusses the current price action in the precious metals and looks ahead to how trends may evolve over the final months of 2018.

Read More »

Read More »

Sound Money Index: Everything You Need to Know About Gold & Silver Laws in 2018

https://www.moneymetals.com/guides/sound-money-index The 2018 Sound Money Index is the first index of its kind, ranking all 50 states using nine indicators to determine which states offer the most pro-sound money environment in the country. ================== Follow Money Metals: ================== Facebook: https://www.facebook.com/MoneyMetals Instagram: https://www.instagram.com/moneymetals/ Twitter: https://twitter.com/MoneyMetals Google Plus:...

Read More »

Read More »

Will Indebted Nations Globally Follow Venezuela Into Hyperinflation?

Will your fiat paper or #digital #currency become worthless as currency wars deepen? – Fiat currency has become worth less than toilet paper in #Venezuela – Venezuela was once one of the wealthiest countries in South America – Currency collapse due to massive currency “printing”, digital currency creation and socialist government – A roll of …

Read More »

Read More »

Sprott Money News Ask the Expert August 2018 – Mickey Fulp

“Mercenary Geologist” Mickey Fulp answers questions on gold, gold mining companies and prospecting.

Read More »

Read More »

Is Silver Set for a Massive Breakout?

Is silver set for a massive breakout? Stephen Flood (GoldCore.com CEO) takes a look at the silver price chart with commodities technical analyst Carley Garner of DeCarleyTrading.com Silver looks to be forming a base with very strong support. After a long period of consolidation is silver set to soar? How will its volatility compare with …

Read More »

Read More »

What If Gold Breaks $1200?

Gold is technically still in an uptrend with higher lows still being achieved. The strong support level at $1,200 has now been breached since this video was recorded. So what is next for the price of gold? Are we going to see a further leg down in the price or will it rally from here? … Continue reading »

Read More »

Read More »