Category Archive: 6a) Gold & Monetary Metals

Stock Market Rules & Myths by “Marc Faber “

Marc Faber is the publisher of the Gloom Boom & Doom Report and director of Marc Faber Ltd.

Read More »

Read More »

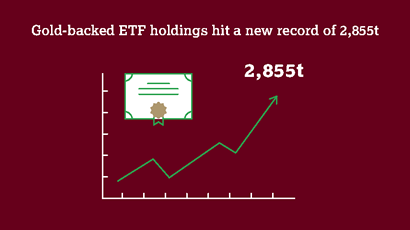

Gold ETF and Central Bank Gold Buying Supports Gold Demand In Q3

Gold demand grew modestly to 1,107.9 tonnes (t) in Q3 thanks to the largest ETF inflows since Q1 2016. A surge in ETF inflows (258t) outweighed weakness elsewhere in the market to nudge gold demand 3% higher in Q3. Global central bank buying remained healthy but significantly lower than the record levels of Q3 2018.

Read More »

Read More »

David Jensen: Gold & Silver to Head Dramatically Higher, Mirroring Palladium

Podcast begins at 5:41 For the full transcript ➡️➡️https://www.moneymetals.com/podcasts/2019/11/08/gold-silver-price-drop-trade-truce-001901 Check out gold prices ?https://www.moneymetals.com/precious-metals-charts/gold-price ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 11.8.19

Eric Sprott discusses this week’s downturn in precious metal prices while also providing his perspective on several mining companies which have recently reported quarterly earnings.Submit your questions to [email protected] or visit www.sprottmoney.com to get the transcript for the WWU.

Read More »

Read More »

Sound Money Scholarship Winners Announced – 7 Outstanding Thinkers Earn Nearly $10,000 in Tuition Assistance

Eagle, ID (November 6, 2019) – Seven outstanding students beat out over 100 of their high-school and college peers in making the best case for sound money through an international, gold-backed scholarship competition......and the winners walked away with almost $10,000 in scholarship awards for their exceptional, thought-provoking essays.

Read More »

Read More »

MARC FABER Explains Coming Financial Crisis & Stock Market Crash August 13th,2019

Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie,Paul Craig Roberts, and arguments many specialists about… SUBSCRIBE for Latest on FINANCIAL …

Read More »

Read More »

Has Germany Increased Its Gold Reserves For The First Time In 21 Years?

◆ Has Germany increased it's gold reserves for the first time in 21 years?

◆ Important story of how Bloomberg reported that Germany had added to its gold reserves and that “Germany’s reserves climbed to 108.34m oz in September, the first increase since 1998” and then "corrected the story"

◆ A screen grab of the original Bloomberg story (only covered by Bloomberg via the Bloomberg terminal) on October 23rd can be seen in our video and in...

Read More »

Read More »

Has Germany Increased Its Gold Reserves For The First Time In 21 Years?

◆ Has Germany increased it’s gold reserves for the first time in 21 years? ◆ Important story of how Bloomberg reported that Germany had added to its gold reserves and that “Germany’s reserves climbed to 108.34m oz in September, the first increase since 1998” and then “corrected the story” ◆ A screen grab of the …

Read More »

Read More »

Dr. Marc Faber and Yra Harris on the Markets and Investing

Dr. Marc Faber and Yra Harris on the Markets and Investing Click here for the full transcript: http://financialrepressionauthority.com/2019/11/04/the-roundtable-insight-dr-marc-faber-and-yra-harris-on-the-markets-and-investing/

Read More »

Read More »

Time To Replace Bonds With Gold

◆ “It may be time to replace bonds with gold”according to the just released excellent new Investment Update by the World Gold Council.◆ Central banks have shifted to a new regime of easy monetary policy, thus reducing expected bond returns.

Read More »

Read More »

SMN11 1 19

Eric Sprott discusses the news of the week and the impact on precious metal prices. He also fields listener questions regarding a few specific mining companies.

Read More »

Read More »

Global Economy Faces ‘Scary Situation’ – Billionaire Investment Manager Dalio Warns

Likely to have a downturn while “there is not effective monetary policy and that is a ‘scary situation’ – Billionaire Investment Manager Ray Dalio

Read More »

Read More »

How Is Palladium Mined?

https://www.moneymetals.com/precious-metals-charts/palladium-price#how-is-palladium-mined – The vast majority of palladium doesn’t come from primary palladium mines. In fact, only two major pure palladium producers exist. Most palladium is mined as a byproduct of mining for other metals – typically nickel, copper, gold, and/or platinum. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Why Is Palladium so Expensive?

https://www.moneymetals.com/precious-metals-charts/palladium-price#why-is-palladium-so-expensive – Rising demand from automakers has combined with constricting supplies to boost palladium prices. Since 2016, prices for the specialty metal have more than tripled as supply deficits have widened. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤...

Read More »

Read More »

Is Palladium a Good Investment?

https://www.moneymetals.com/precious-metals-charts/palladium-price#is-palladium-a-good-investment – Palladium is a good metal to hold in your investment portfolio for diversification. It shows little correlation with stocks, bonds, and other financial assets. Palladium often zigs while other asset classes – and even other precious metals – zag. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Is Palladium More Expensive Than Gold?

https://www.moneymetals.com/precious-metals-charts/palladium-price#is-palladium-more-expensive-than-gold – In 2019, palladium surged to a record high – surpassing the price of gold. Later in the year, gold embarked on a strong rally to reclaim the title of the priciest precious metal. Historically, gold tends to be more expensive palladium. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Why Nobody Chants “End the Fed” Anymore

Americans hated it when the Federal Reserve handed trillions of dollars to crooked Wall Street banks following the 2008 Financial Crisis. Politicians were confronted about the merits of central banking and bailouts.

For the first time in history, college students were chanting “End the Fed” at campaign rallies as Ron Paul took the central bank to task during his presidential campaigns.

Read More »

Read More »

Trump Pumps Market With Trade Talks, Stocks Move Higher, Gold Lower

Sue Trinh, Managing Director of global macro strategy at Manulife Investment Management, speaking on Bloomberg. She had some interesting comments regarding the current market structure, in the shadow of the FED, which is expected to drop rates yet again.

Read More »

Read More »

What is the Palladium Spot Price?

https://www.moneymetals.com/precious-metals-charts/palladium-price#what-is-the-palladium-spot-price –The term Spot price for palladium (and other precious metals) refers to the current price of the metal as it is traded via contracts in the futures markets. Technically speaking the spot price is the price of the most recent trade, for a contract with the nearest available delivery date. ? SUBSCRIBE TO MONEY …

Read More »

Read More »