Category Archive: 6a) Gold & Monetary Metals

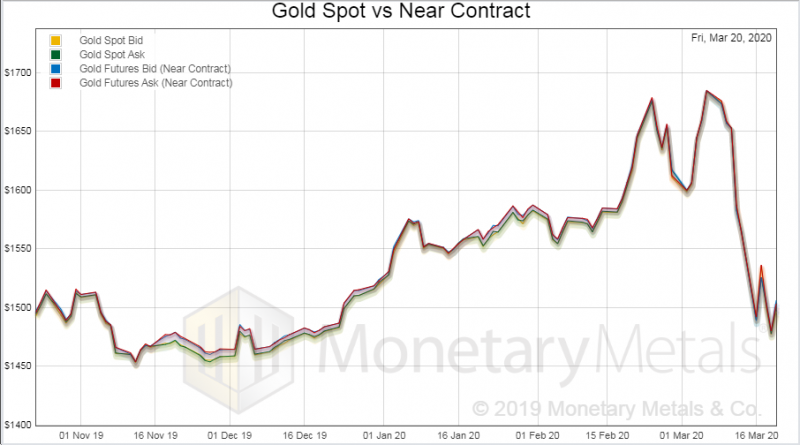

Gold & Silver Prices Rise as Senate Passes $2.2 Trillion Bailout

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤ https://instagram.com/moneymetals/

LINKEDIN ➤ https://www.linkedin.com/company/mone...

SOUNDCLOUD ➤ https://soundcloud.com/moneymetals

TUMBLR ➤ http://money-metals.tumblr.com/...

Read More »

Read More »

Gold & Silver Prices Rise as Senate Passes $2.2 Trillion Bailout

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤ https://instagram.com/moneymetals/ LINKEDIN ➤ https://www.linkedin.com/company/mone… SOUNDCLOUD ➤ https://soundcloud.com/moneymetals TUMBLR ➤ http://money-metals.tumblr.com/...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.27.20

Eric Sprott discusses the economic impact of the coronavirus how this is affecting the precious metals.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.27.20

Eric Sprott discusses the economic impact of the coronavirus how this is affecting the precious metals.

Read More »

Read More »

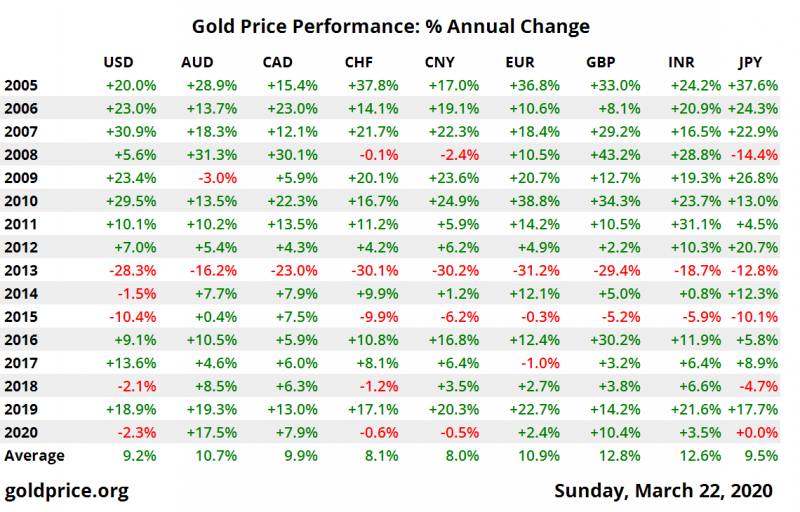

Is gold still a safe haven?

There have been moments in recent months when many gold owners, myself included, have asked themselves whether gold might have lost its safe haven status, at least in the western world. Was it enough for two generations, who grew up in a paper money system, to forget the history and the 5000-year-old status of gold as real money?

Read More »

Read More »

Alasdair Macleod⚠️RESET THE WORLD -Global Great Depression Dead Ahead?

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

Alasdair Macleod? why a Dollar Collapse is Inevitable? Digital Money replaces Cash !!

For the full transcript go to: https://www.financialanalysis.tv

#Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver

#Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill Holter #Bo Polny # economic collapse...

Read More »

Read More »

Alasdair Macleod-Will Financial Cancer Plus COVID 19 End Fiat Currencies?

Alasdair Macleod believes the dollar-based global fiat monetary system is doomed to fail given the cancerous growth of debt from the fiat monetary system.

Read More »

Read More »

Global Supply of Gold and Silver Coins and Bars Evaporated In Safe Haven Rush

◆ GoldCore remain open for business unlike many dealers, mints and refineries (see News below) and we continue to buy bullion coins and bars and sell gold bars (1 kilo). The supply situation changes hour to hour. ◆ We, like the entire industry have experienced record demand in recent days and the global supply of gold and silver bullion coins (legal tender 1 oz) and gold bars (in 1 oz and 10 oz formats) has quickly evaporated. We continue to have...

Read More »

Read More »

Keiser Report | Money Printing Go Brrrr | E1518

Check Keiser Report website for more: http://www.maxkeiser.com/

In this episode of the Keiser Report, Max and Stacy discuss the all out money printing from the US central bank failing to stop markets from continuing to tumble. They explore the deflationary bust driven by the soaring dollar against which most other currencies are tumbling. In the second half, Max interviews Alasdair Macleod of GoldMoney.com about gold in the age of pandemic. They...

Read More »

Read More »

MARC FABER 2020 The Economic Crash

Credit Suisse, Deutsche Bank, Petro-Dollar, Interest Rate Swaps, Gold price, Euro-Swissy, Consider JPMorgue, REPO market, subprime bond crisis, Chinese bitch coulee, Gold in their reserves, major banks, Global Economic RESET, golden crypto-currencies, Gold Trade, Chinese cryptos, The Dollar Crisis, Causes, Consequences, Cures, Revised Global recession, Silver, Stocks, Dollar Crash-Gold, Stock Market, real economy, global financial …...

Read More »

Read More »

GLOBAL GREAT DEPRESSION DEAD AHEAD? — Dr. Marc Faber

Get Your Back Up Solar Bank Now and Be Prepared! Click Here! http://www.backupsolarbank.com Get 15% OFF W/ Promo Code “SGT15” Dr. Marc Faber joins me to discuss coronavirus and its devastating impact on the global economy. Check out SGT Report’s THE PROPAGANDA ANTIDOTE podcast now on iTunes: https://podcasts.apple.com/us/podcast/the-propaganda-antidote/id1502568407 Please consider supporting SGT Report on Patron …

Read More »

Read More »

Marc Faber Monthly Market Commentary

Marc Faber Monthly Market Commentary: The other day, I came across an essay that aroused my interest because of its title: Universal Basic Income: A Dream Come True for Despots by Antony Sammeroff (he is the author of Universal Basic Income – For and Against. According to Sammeroff, although there are “heated disagreements between economists …

Read More »

Read More »

Sprott Money News Ask The Expert March 2020 – Rick Rule

Legendary resource investor Rick Rule answers questions regarding the impact of the coronavirus on the global economy, the precious metals and the mining sector.

Read More »

Read More »

Sprott Money News Ask The Expert March 2020 – Rick Rule

Legendary resource investor Rick Rule answers questions regarding the impact of the coronavirus on the global economy, the precious metals and the mining sector.

Read More »

Read More »

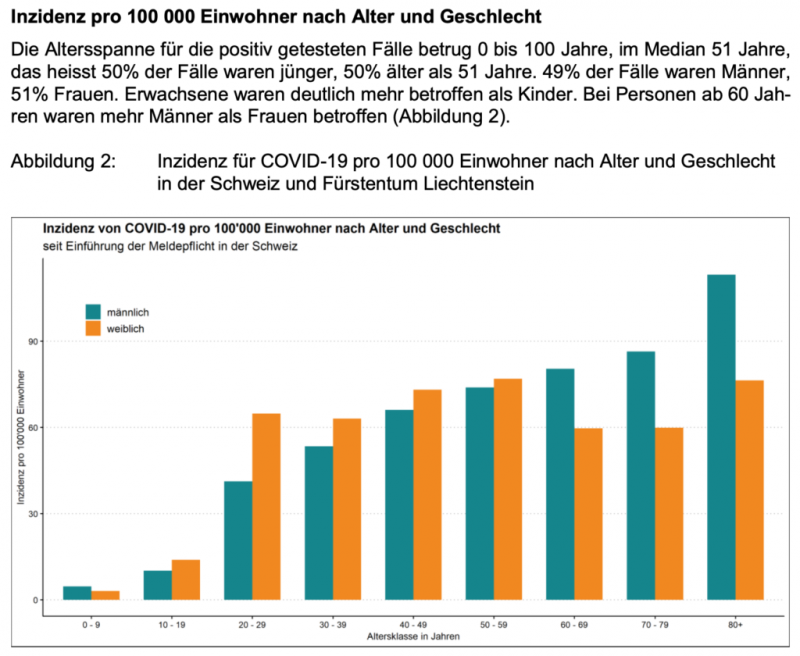

COVID-19 – Auslegeordnung

In den vergangenen Tagen habe ich mich immer wieder gefragt, “wo besteht eigentlich das Problem?” Zu oft habe ich das Gefühl, dass viele Experten, Medien und Politiker mit den Zahlen ein Durcheinander haben und so mehr zur Verwirrung als zur Klärung beitragen. Deshalb hier der Versuch einer strukturierten Aufschlüsselung.

Read More »

Read More »

? This Is Not a Recession. It’s an Ice Age. – Marc Faber

Make sure to subscribe, hit the like button and don’t forget to click the notification bell to get weekly updates. https://www.youtube.com/user/ameerrosic?sub_confirmation=1 Guest https://www.gloomboomdoom.com/ Dr Marc Faber was born in Zurich, Switzerland. He went to school in Geneva and Zurich and finished high school with the Matura. He studied Economics at the University of Zurich and, …

Read More »

Read More »

Marc Faber on The Income Generation | March 22, 2020

With Guest Marc Faber The Income Generation With David J. Scranton ***Disclaimer: Sound Income Strategies, LLC is a registered investment advisor. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, …

Read More »

Read More »

A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global...

Read More »

Read More »