Category Archive: 6a) Gold & Monetary Metals

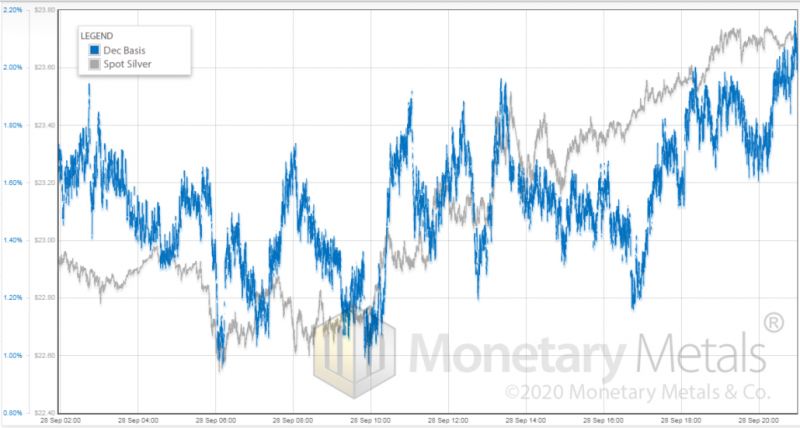

Heavy Metal Selling

Anxiety about an increase in Covid19 cases and fears of a second wave coupled with revelations of historic money laundering practices of major global banks weighed heavily on financial markets yesterday.

Read More »

Read More »

“The U.S. economy felt like a balloon in search of a needle” – Part II

In this surreal policy environment, how has the role and the investment process of the value investor evolved, especially over the last decade? How can one still identify value in a world of subsidized binge borrowing, extreme indebtedness, and stock buybacks?

Read More »

Read More »

Politicians Torn Between Bailouts & Supreme Court Drama

Failing to agree on a new stimulus package, Congress and the White House shifted focus to filling the Supreme Court seat once held by the late Ruth Bader Ginsberg, causing some volatility in metals and equity markets.

Read More »

Read More »

Sprott Money News Ask The Expert September 2020 – Rob McEwen, CEO of McEwen Mining

Rob McEwen, Chairman and CEO of McEwen Mining, joins us to answer your questions and share his insights about the mining industry.

Visit our website https://www.sprottmoney.com for more news.

You can submit your questions to [email protected]

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 9.25.20

Eric Sprott recaps a challenging week for the precious metals but looks forward to better days ahead for the sector.

Visit our website https://www.sprottmoney.com for more news.

You can submit your questions to [email protected]

Read More »

Read More »

Money Metals Exchange: Stefan Gleason Interview w/ Pimpy #Silver #Gold

Rice Report: Money Metals Exchange: Stefan Gleason Interview w Pimpy from Pimpys Investment Chat. In this episode, Pimpy and I do a duel interview with Stefan Gleason, the CEO of Money Metals Exchange.

Read More »

Read More »

Alasdair Macleod-Inflation & Other Revolutionary Forces at Work in America

Alasdair Macleod with a background as a stockbroker, banker and economist explains that we are in an inflationary economy and why its happening is a bad thing.

Read More »

Read More »

“The U.S. economy felt like a balloon in search of a needle” – Part I

As we move deeper and deeper into this covid crisis, more and more people understand that there’s a lot more to fear besides the disease itself. As the economic impact and the full scale of the damage caused by the lockdowns and the shutdowns become undeniable, there are too many questions lacking any sort of convincing answer and the future for so many employees, business owners, investors and ordinary savers seems bleak and uncertain.

Read More »

Read More »

Alasdair Macleod: Silver’s Role As Money In Our Future

While the #goldprice has hit new all-time highs, a rapidly growing number of analysts are now talking about silver.

Read More »

Read More »

ALASDAIR MACLEOD – Government Doing Everything Except The Right Thing To Resist The Dollar Collapse

The American government is doing everything it can to stop the dollar collapse, but only one thing; do the right thing.

Read More »

Read More »

Central Bank Cartel Promises Zero Interest Until 2024

Apparently Fed officials think they are smart enough to see into the future and know today that optimal interest rates will be zero for many years to come.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2020/09/18/fed-promise-zirp-until-2024-002128

Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

? SUBSCRIBE TO MONEY METALS EXCHANGE ON...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 9.18.20

Eric Sprott returns this week to discuss the latest developments in the precious metals and mining shares.

Visit our website https://www.sprottmoney.com for more news.

You can submit your questions to [email protected]

Read More »

Read More »