Category Archive: 6a) Gold & Monetary Metals

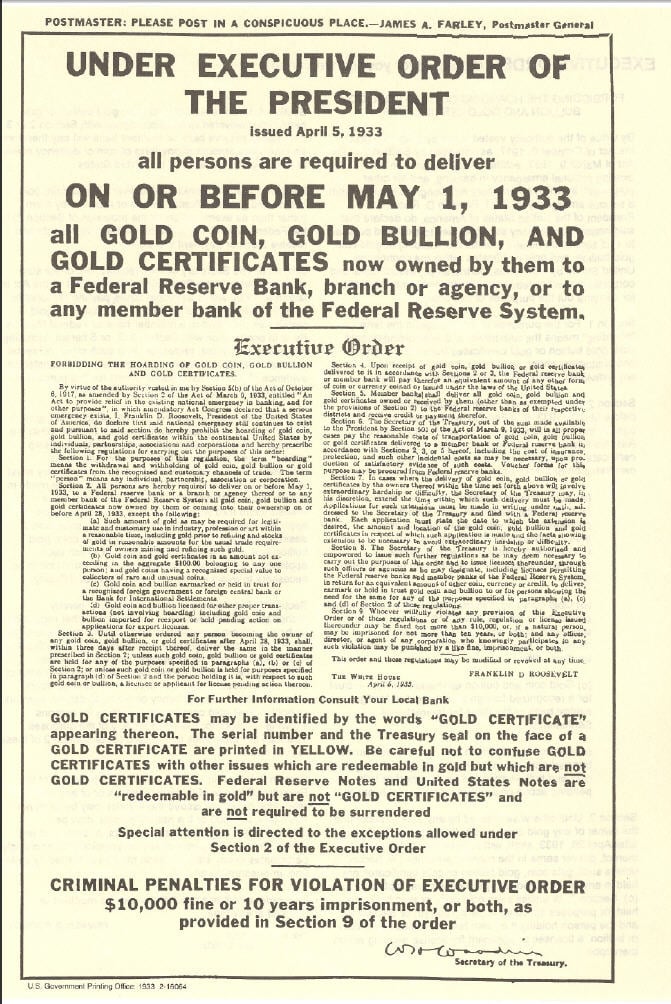

MAX OTTE: Das ist schlimmer als 1933! Der wahre Grund!

Max Otte (* 7. Oktober 1964 als Matthias Otte in Plettenberg,] ist ein deutsch-US-amerikanischer Ökonom. Er ist Leiter des von ihm im Jahr 2003 gegründeten Instituts für Vermögensentwicklung (IFVE) und als Fondsmanager tätig.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 2.12.21

Chris Marcus of Arcadia Economics sits in for Eric this week and addresses the ongoing run on physical metal and the impact this is having on the futures markets.

You can submit your questions for our Weekly Wrap Up to [email protected]

Visit our website https://www.sprottmoney.com for more news.

Read More »

Read More »

“So wird UNS alles genommen!”

Es sind verrückte Zeiten in denen wir uns bewegen. Die GameStop Aktie schießt nach oben, das Silber erlebt ebenfalls einen Preisanstieg und der E-Euro bahnt sich den Weg in unser Finanzsystem. In diesem Video sprechen wir mit Prof. Dr. Max Otte und er gibt uns seine Einschätzung zu der aktuellen Lage.

Read More »

Read More »

How to Prepare for the Coming Crash?

How to prepare for the coming crash?

Louis Gave of Gavekal, one of the world's leading independent providers of global investment research discusses how you portfolio will be affected by soaring inflation & why you must #OwnGold.

We also discuss why we can expect the US Dollar to weaken significantly as the effect of financial stimulus & #MoneyPrinting take hold, and #Bitcoin may not be all that it seems.

Louis explains how to prepare...

Read More »

Read More »

Wir investieren in eine Silbermine! Der Max Otte Vermögensbildungsfonds im Januar

Unser Max Otte Vermögensbildungsfonds schloss den Januar mit einem Plus von 3,3%. Der NAV von 157,17 EUR ist ein erneutes Allzeithoch. Die Gruppe unserer Vergleichsindizes konnten wir entspannt hinter uns lassen. Der DAX verlor im Januar 2,08%. Der MSCI World EUR schloss mit -0,35% und der Stoxx Europe 600 mit -0,80%.

Read More »

Read More »

A Slow Motion Silver Squeeze May Be Underway…

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Money Metals president Stefan Gleason on Arcadia Economics regarding the recent fireworks in the silver market, the shortage of physical supply of minted coins, rounds and bars, and why a short squeeze has not yet occurred in the silver price on the heels of an explosive GameStop situation over the past two weeks.

Read the full Transcript here:...

Read More »

Read More »

The Next Market Crash Is Coming: Fiat Currencies Collapse | Gold & Silver

In this video I sit down with Alasdair to discuss his personal viewpoints on the financial system. He believes the next market crash is coming, but it will be different, because it will include government currencies.

Read More »

Read More »

Kein schöner Land in dieser Zeit | Max Otte und junge Musikerinnen und Musiker singen…

Max Otte und junge Musikerinnen und Musiker singen... Viel Spaß mit dem "Kein schöner Land"-Lied!

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 2.5.21

Chris Vermeulen of The Technical Traders joins us to recap what was a volatile and eventful week for the precious metals.

You can submit your questions for our Weekly Wrap Up to [email protected]

Visit our website https://www.sprottmoney.com for more news.

Read More »

Read More »

Dr. Marc Faber: What just happened to the silver price?!

The price of #silver is down almost $2 today, despite record demand for virtually every form of available silver.

Read More »

Read More »

Silver industry responds to WallStreetBets silverqueeze: David Morgan, Alasdair Macleod, and more!

Now that the WallStreetBets group has turned its sights to silver, bullion dealers are getting sold out as the market awaits the Sunday night open.

Read More »

Read More »

Silver Short Squeeze 2021 is Over? Silver Guru David Morgan Weighs In

Is the Silver Short Squeeze 2021 over before it begins?

Silver Guru David Morgan discusses why #wallstreetbets and investors need to buy physical silver in a sustained manner instead of #SlvStock to drive up the #silverprice and really #shortsqueezesilver

Known as "The Silver Guru", David Morgan is the author of The Morgan Report an investment newsletter that specializes in the silver market and silver bullion. He joins Dave Russell in...

Read More »

Read More »

ALASDAIR MACLEOD WARNS “A REAL CRISIS IS IN THE WINDS” – YOU NEED TO HEAR THIS!!

Https://www.zerohedge.com/markets/could-take-dollar-down-alasdair-macleod-warns-theres-real-crisis-winds

https://sofrep.com/news/the-coming-economic-collapse-of-2021-and-how-to-benefit/

Read More »

Read More »

Gold Price Forecast – LBMA Survey Published

2021-02-14

by Stephen Flood

2021-02-14

Read More »