Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Weekly Wrap-up – 5.17.19

Eric Sprott discusses the precious metals and the factors that influenced prices over the past week.

Read More »

Read More »

We Have The Power To End Gold Price Suppression – Chris Powell of GATA Interview Part 2

- "Over the long term, justice, fairness and decency will prevail ... that is the history of mankind...as seen in the ascent of man ... things tend to get better over the long term ..."

- The price suppression of gold and other natural resources has "real world consequences for the majority of the people on this planet ..."

- "We are fighting all the money and the power in the world ..."

- CALL To ACTION: Precious...

Read More »

Read More »

We Have The Power To End Gold Price Suppression – Chris Powell of GATA Interview Part 2

– “Over the long term, justice, fairness and decency will prevail … that is the history of mankind…as seen in the ascent of man … things tend to get better over the long term …” – The price suppression of gold and other natural resources has “real world consequences for the majority of the people …

Read More »

Read More »

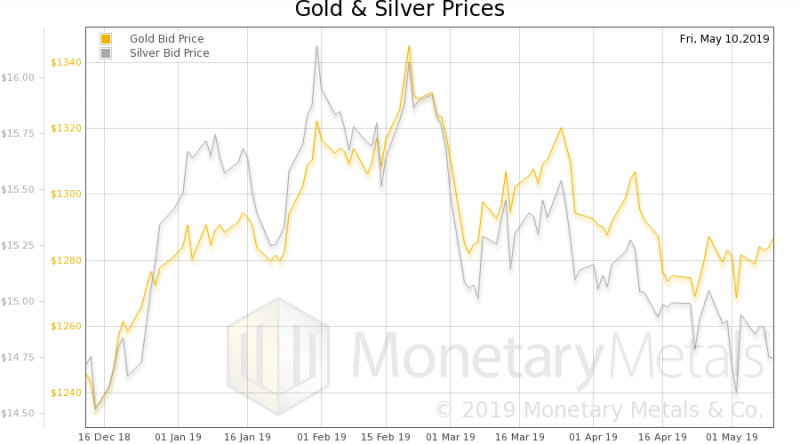

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

Gold sees safe haven demand push it to highest in one month as it breaches key $1,300/oz and £1,000/oz levels. U.S. China trade wars escalates as China retaliates and imposes tariffs on $60 billion of U.S. goods. Increased risk of war in Middle East after U.S. alleges Iran bombed Saudi oil vessels destined for the U.S.

Read More »

Read More »

Greg Weldon: Gold at $1,344 Will Start Real Fireworks on the Upside

Read the full transcript here ➤ https://www.moneymetals.com/podcasts/2019/05/10/gold-price-1344-fireworks-on-upside-001769 Check gold prices here ➤ https://www.moneymetals.com/precious-metals-charts/gold-price Coming up Greg Weldon of Weldon Financial joins me for a sensational interview on how he views the precious metals now and which one he favors over the others. Plus, Greg has some warnings about why a failure to finalize a trade …...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.10.19

Eric Sprott discusses current global events and how they impact gold and silver prices. He also mentions what he learned this week at the Kirkland Lake annual meeting.

Read More »

Read More »

End of Gold Price Suppression and The Dollar Empire – GATA’s Chris Powell (Part I)

- GOLD PRICE SUPPRESSION is "the BIGGEST ISSUE in the WORLD ... it involves the valuation of all capital, labor, goods and services in the world and these valuations are being set in a really imperialistic and totalitarian way and not in an open and transparent way & we think this is evil"

- Brief introduction to Chris Powell, Treasurer and Secretary of the Gold Anti-Trust Action Committee (GATA) and Bill Murphy of GATA and...

Read More »

Read More »

End of Gold Price Suppression and The Dollar Empire – GATA’s Chris Powell (Part I)

– GOLD PRICE SUPPRESSION is “the BIGGEST ISSUE in the WORLD … it involves the valuation of all capital, labor, goods and services in the world and these valuations are being set in a really imperialistic and totalitarian way and not in an open and transparent way & we think this is evil” – Brief …

Read More »

Read More »

New Federal Legislation Requires Full Audit of America’s Gold Reserves

Washington, DC (May 8, 2019) – U.S. Representative Alex Mooney (R-WV) introduced legislation this week to provide for the first audit of United States gold reserves since the Eisenhower Administration.

The Gold Reserve Transparency Act (H.R. 2559) – backed by the Sound Money Defense League and government accountability advocates – directs the Comptroller of the United States to conduct a “full assay, inventory, and audit of all gold reserves,...

Read More »

Read More »

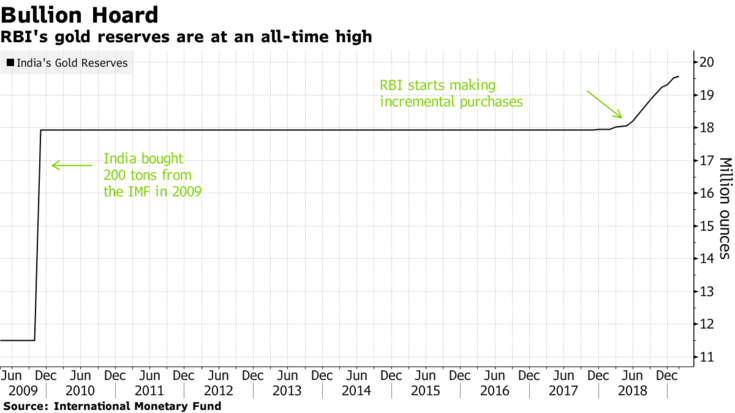

World’s Central Banks Want More Gold – India May Buy 1.5M Ounces In 2019

Royal Bank of India (RBI) may buy another 1.5 million oz this year according to OCBCMany other central banks including large creditor nations Russia and China are also adding to gold holdings. India’s central bank is likely to join counterparts in Russia and China scooping up gold this year, adding to its record holdings and lending support to worldwide gold bullion demand as top economies diversify their reserves.

Read More »

Read More »

Sprott Money News Sprott Money News Weekly Wrap-up – 4.26.19

Eric Sprott discusses the recent moves in precious metals and then looks forward to what will be a very busy and volatile week next.

Read More »

Read More »

MARC FABER: TÜRKLER DAHA ÇOK ALTIN ALMALI – GERÇEK EKONOMİ 15 – 26.04.2019

ekonomik kriz, ekonomist, ekonomi haberleri, ekonomi 2019, ekonomi okulum, ekonomistler, ekonomi dersleri, dolar, bitcoin, altın GERÇEK EKONOMİ 15. BÖLÜM MARC FABER: TÜRKLER DAHA ÇOK ALTIN ALMALI Türkiye’de bir ekonomik kriz var. Ancak bu yetmezmiş gibi dünya da tarihin en büyük küresel ekonomik krizine doğru hızla ilerliyor. Melis Hazal Karagöz’ün sunduğu Gerçek Ekonomi Programının 15. Bölümü’nde …

Read More »

Read More »

SWOT Analysis:Venezuela Sells $400 Million Worth Of Gold Bullion

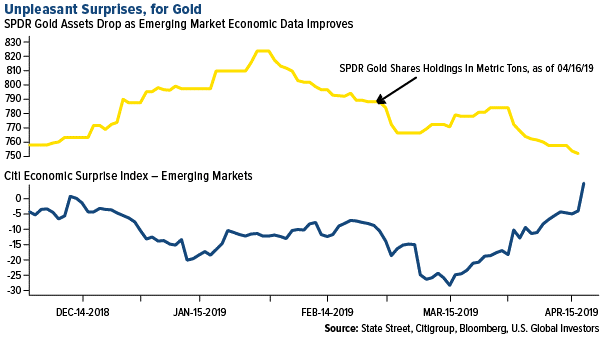

The best performing metal this week was palladium, up 3.52 percent as CPM Group noted that the price could climb to $1,800 on supply constraints. Gold traders and analysts switched from bullish to mostly neutral or bearish on the yellow metal this week, according to the weekly Bloomberg survey.

Read More »

Read More »