Category Archive: 6a) Gold & Monetary Metals

How Much Gold Do I Need In My Portfolio

How Much Gold Do I Need In My Portfolio

Last week we saw, Stephen Flood, CEO of GoldCore, Mark O'Byrne of Health Wealth Gold, and Dave Russell of GoldCoreTV, discussing if it is possible to build the #perfectportfolio for the next 10 years by identifying the current megatrends that we are seeing emerging and suggesting how they might affect your portfolio.

In this episode of the #Goldnomics podcast, they address which elements they believe...

Read More »

Read More »

Retail Silver Buying Gathers New Momentum

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

This week, part 1 of an interview Money Metals President Stefan Gleason gave with Palisades Gold Radio.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/04/30/retail-silver-buying-gathers-new-momentum-002278

Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 4.30.21

Legendary natural resource investor Rick Rule joins us to discuss the current state of the precious metals market and he also includes his current thoughts on uranium and the uranium miners.

You can submit your questions to [email protected]

Visit our website https://www.sprottmoney.com for more news.

Read More »

Read More »

Sprott Money News Ask The Expert April 2021 – Joe Mazumdar of Exploration Insights

Joe Mazumdar is a widely-respected mining analyst with over three decades of industry experience. He joins us this month to answer your questions on the mining sector and the precious metals.

Topics

0:00 - Introduction

3:08- Downtrend in PM mining shares

5:36 - Producers, juniors or exploration companies?

8:09 - Stock buy backs or increased dividends?

11:02 - Silver miners outperforming gold miners, will this continue?

13:21 - The Golden...

Read More »

Read More »

How to Build a Long Term Portfolio: For the Next 10 Years

How to Build a Long Term Portfolio: For the Next 10 Years

In today's new #Goldnomics Podcast, Stephen Flood, CEO of GoldCore and Mark O'Byrne of Health Wealth Gold joins Dave Russell of GoldCore to discuss if it is possible to build the #perfectportfolio for the next 10 years?

At GoldCore we believe that every portfolio should have an allocation to gold and silver, the percentage of that allocation should change depending on the current economic,...

Read More »

Read More »

Warum Max Otte KEIN “Crash-Prophet” ist

Oft als "Crash-Prophet" missverstanden, geht es Prof. Dr. Max Otte vielmehr darum, ökonomische Entwicklungen früh zu erkennen und darauf basierend gute Entscheidungen zu treffen.

Read More »

Read More »

Biden Administration Seeks to Raise Taxes on Investors

The gold market tested a key level this week. On Wednesday, prices rallied up to $1,800 an ounce. The following day, sellers came in to prevent gold from breaking out. As of this Friday recording, the monetary metal trades at $1,782 an ounce and is unchanged now for the week...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 04.23.21

Paul Wong of Sprott Inc joins us this week to discuss the long-term price and seasonality trends in both gold and silver.

You can submit your questions to [email protected]

Visit our website https://www.sprottmoney.com for more news.

Read More »

Read More »

Ohio House Votes to Fix Blunder, Remove Sales Tax on Sound Money

The Ohio House of Representatives just approved a bill which helps Buckeye State citizens protect themselves from the loss of monetary purchasing power caused by federal money printing. Introduced by Representative Oeslager, House Bill 110 includes a provision to eliminate the sales and use tax on purchases of gold, silver, platinum, and palladium coins and bullion in Ohio.

Read More »

Read More »

Zum Schluss ein Tagebucheintrag – Max Otte live “Auf der Suche nach dem verlorenen Deutschland”

Zur Veröffentlichung meines neuen Buches "Auf der Suche nach dem verlorenen Deutschland" habe ich am 23. März 2021 eine exklusive Lesung gehalten. In diesem Teil lese ich aus dem letzten Kapitel, einem Tagebucheintrag und der Coda.

Read More »

Read More »

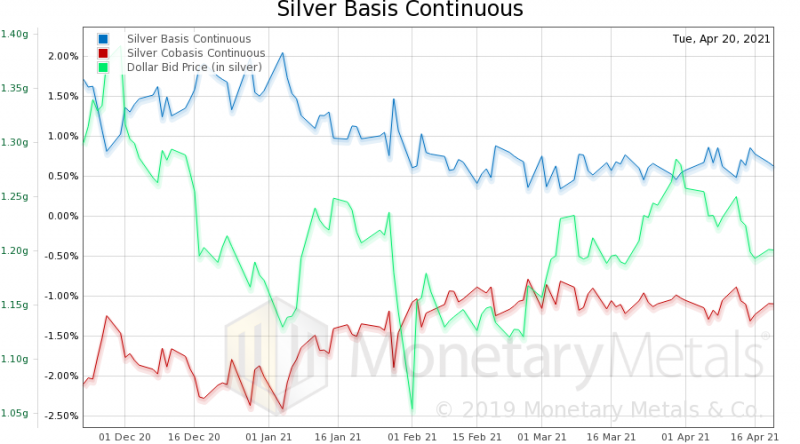

Is the Silver Squeeze Over? – Chris Vermeulen

Is the Silver Squeeze Over? Chris Vermeulen of TheTechnicalTraders.com is back on #GoldCoreTV with his charts to help us interpret the recent moves in silver and gold. In this video, we take a look at the silver price, the gold price, bitcoin and the S&P500.

We take a look at what's needed to continue the momentum of the #silvershortsqueeze, the movement spearheaded by Wall Street Silver & #WallStreetSilver

We look at the significance of...

Read More »

Read More »

Stefan Gleason: The Big Inflation Scam

Tom welcomes Stefan Gleason, president of Money Metals Exchange, to the show. The idea of sound money is something that holds it’s value over time in contrast to fiat currencies. The market has chosen gold and silver over thousands of years as the money that sustains and preserves purchasing power.

Read More »

Read More »

First the Gain, Then the Pain…

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. Gold and silver markets are exhibiting more signs of breaking out into a rally...

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/04/16/inflation-punishes-savers-squeezing-consumers-002267

Do you own precious metals you would rather not sell, but need access to cash? Get Started...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 4.16.21

Technical analyst Chris Vermeulen joins us this week to share his latest opinions on gold, silver and the mining shares.

You can submit your questions to [email protected]

Visit our website https://www.sprottmoney.com for more news.

Read More »

Read More »

Marriage of Gold and Cryptocurrencies: A New Future?

2021-04-16

by Stephen Flood

2021-04-16

Read More »