Category Archive: 6a.) Monetary Metals

?SPECIAL EDITION: THE KEITH WEINER INTERVIEW, THE RETURN TO THE GOLD STANDARD HR 5404?

2019-12-24

by Keith Weiner

SPECIAL EDITION, 12/24/2019 CEP https://www.currencyexchangeplanner.com/thedinarian Directions: Go to the link above, fill out the email information to gain access to your FREE Trial Version. If you do decide, you want the full version, use the Discount Code, “THEDINARIAN” at checkout for 20% OFF. The Money Metals Exchange: https://shareasale.com/r.cfm?b=696067&u=2229944&m=57542&urllink=&afftrack= Golden State Mint...

Read More »

Read More »

Keith Weiner Euthanasia of Capitalism by the Federal Reserve Bank

2019-12-18

by Keith Weiner

Keith Weiner, CEO & Founder of Monetary Metals, talks about our unsustainable economy and how both political parties are diagnosing and prescribing unworkable remedies.

Read More »

Read More »

Open Letter to John Taft, Report 17 Dec

Dear Mr. Taft: I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying: “Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.”

Read More »

Read More »

Keith Weiner: Uncle Sam’s Debt-Money System Is Immoral, Tantamount to Theft

2019-12-16

by Keith Weiner

Interview Begins ?️at 6:29 Full transcript ?: https://www.moneymetals.com/podcasts/2019/12/13/debt-money-system-is-immoral-001925 Live gold and silver prices ?? https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals...

Read More »

Read More »

The End of an Epoch, Report 8 Dec

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

Read More »

Read More »

Money and Prices Are a Dynamic System, Report 1 Dec

The basic idea behind the Quantity Theory of Money could be stated as: too much money supply is chasing too little goods supply, so prices rise. We have debunked this from several angles. For example, we can use a technique that every first year student in physics is expected to know. Dimensional analysis looks at the units on both sides of an equation.

Read More »

Read More »

Raising Rates to Fight Inflation, Report 24 Nov

Physics students study mechanical systems in which pulleys are massless and frictionless. Economics students study monetary systems in which rising prices are everywhere and always caused by rising quantity of currency. There is a similarity between this pair of assumptions. Both are facile. They oversimplify reality, and if one is not careful they can lead to spectacularly wrong conclusions.

Read More »

Read More »

The Perversity of Negative Interest, Report 17 Nov

Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is...

Read More »

Read More »

Monetary Metals Leases Platinum to Money Metals Exchange

Scottsdale, Ariz, October 25, 2019—Monetary Metals® announced today that it has leased platinum to Money Metals Exchange® to support its U.S.-based business of selling precious metals at retail and wholesale. Investors earn 3% on their platinum, which is held in Money Metals’ inventory vault in the form of platinum coins, bars, and rounds. The lease fee is paid in gold.

Read More »

Read More »

Lease your GOLD! – Keith Weiner – GAIC Conference – Sydney, OCT 26 2019

2019-11-12

by Keith Weiner

CEO of Monetary Metals: How to make money from leasing your gold. https://monetary-metals.com/

Read More »

Read More »

What’s the Price of Gold in the Gold Standard, Report 10 Nov

Let’s revisit a point that came up in passing, in the Silver Doctors’ interview of Keith. At around 35:45, he begins a question about weights and measures, and references the Coinage Act of 1792. This raises an interesting set of issues, and we have encountered much confusion (including from one PhD economist whose dissertation committee was headed by Milton Friedman himself).

Read More »

Read More »

Targeting nGDP Targeting, Report 3 Nov

Not too long ago, we wrote about the so called Modern Monetary so called Theory (MMT). It is not modern, and it is not a theory. We called it a cargo cult. You’d think that everyone would know that donning fake headphones made of coconut shells, and waving tiki torches will not summon airplanes loaded with cargo. At least the people who believe in this have the excuse of being illiterate.

Read More »

Read More »

Bitcoin Myths, Report 27 Oct

Keith gave a keynote address—the only speaker with an hour to cover his topic—at the Gold and Alternative Investments Conference in Sydney on Saturday. Said topic was the nature of money.

“Money is a matter of functions four: a medium, a measure, a standard, a store.”

Read More »

Read More »

Keith Weiner: Exponentially Rising Gold Price, Permanent Backwardation & The End Of Currency

2019-10-22

by Keith Weiner

A currency crisis is not a linear event. Everything seems okay, until one moment, abruptly, things aren’t okay. What does a currency crisis mean for the US dollar, and, more importantly, what does it mean for Main Street? Keith sat down with Half Dollar on Tuesday, October 22nd, 2019 for a robust discussion on a …

Read More »

Read More »

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them every year. Almost 1% of them.

Read More »

Read More »

Motte and Bailey Fallacy, Report 13 Oct

This week, we will delve into something really abstract. Not like monetary economics, which is so simple even a caveman can do it. We refer to a clever rhetorical trick. It’s when someone makes a broad and important assertion, in very general terms. But when challenged, the assertion is switched for one that is entirely uncontroversial but also narrow and unimportant.

Read More »

Read More »

A Wealth Tax Consumes Capital, Report 6 Oct

It seems one cannot make a name for one’s self on the Left, unless one has a proposal to tax wealth. Academics like Tomas Piketty have proposed it. And now the Democratic candidates for president in the US propose it too, while Jeremy Corbyn proposes it in the UK. Venezuela finally added a wealth tax in July.

Read More »

Read More »

The Purchasing Power of Capital, Report 29 Sep

We discuss capital consumption all the time, because it is the megatrend of our era. However, capital consumption is an abstract idea. So let’s consider some concrete examples, to help make it clearer. First, let’s look at the case of Timothy Housetrader. Tim has a small two-bedroom house. Next door, his neighbor Ian Idjit, owns a four-bedroom house which is twice the size.

Read More »

Read More »

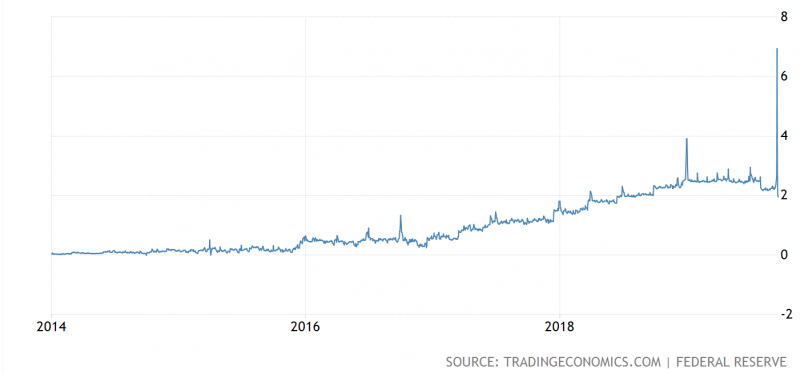

Treasury Bond Backwardation, Report 22 Sep

Something happened in the credit market this week. A Barron’s article about it began: “There have been disruptions in the plumbing of U.S. markets this week. While the process of fixing them was bumpy, it was more of a technical mishap than a cause for investor concern.” Keep Calm and Carry On. So, before they tell us what happened, they tell us it’s just plumbing, it’s been fixed, and that we should not be concerned.

Read More »

Read More »

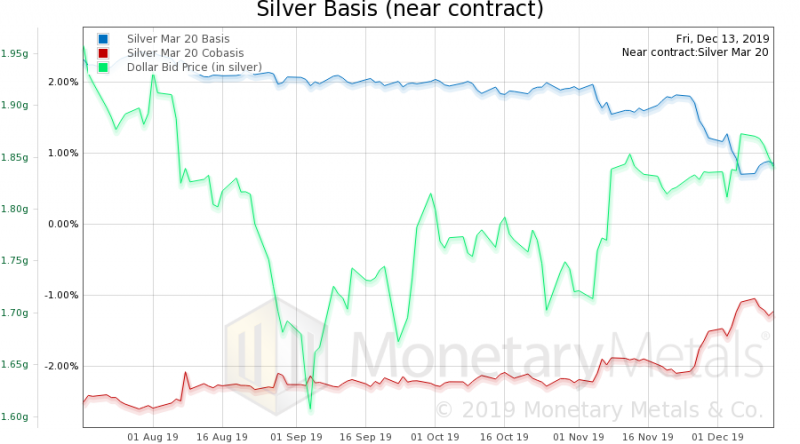

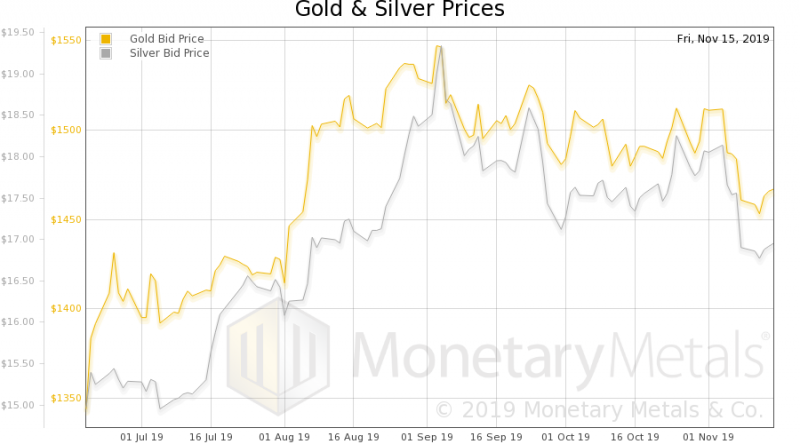

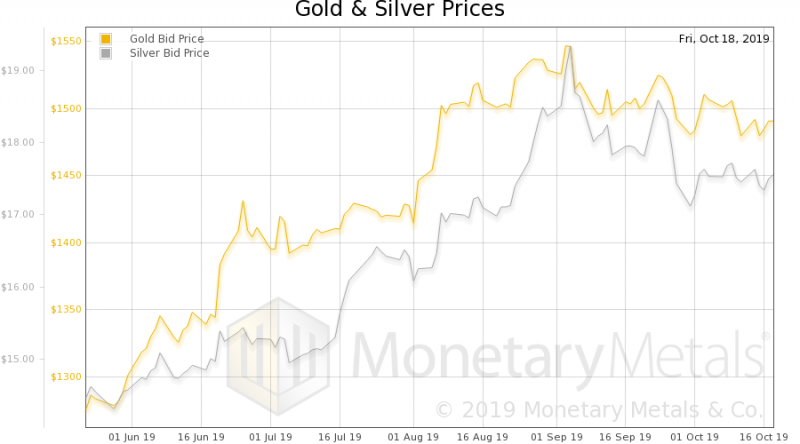

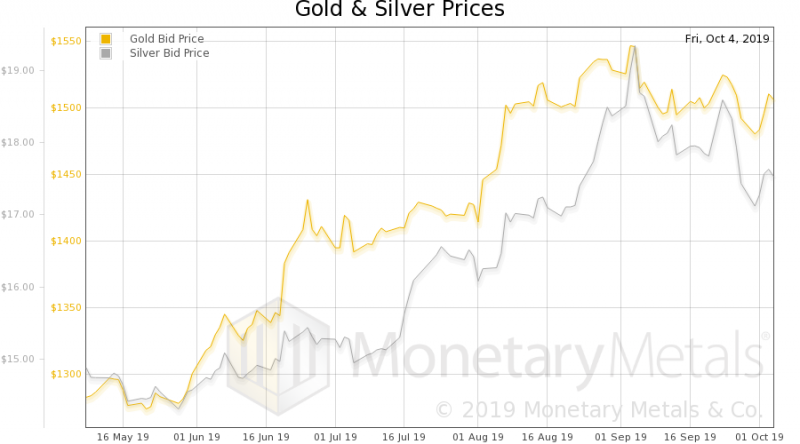

Why Are People Now Selling Their Silver? Report 15 Sep

This week, the prices of the metals fell further, with gold -$18 and silver -$0.73. On May 28, the price of silver hit its nadir, of $14.30. From the last three days of May through Sep 4, the price rose to $19.65. This was a gain of $5.35, or +37%. Congratulations to everyone who bought silver on May 28 and who sold it on Sep 4.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito” -

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste! -

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf! -

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani! -

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR -

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist

More from this category

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO22 Feb 2026

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!22 Feb 2026

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!21 Feb 2026

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito”21 Feb 2026

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!21 Feb 2026

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!21 Feb 2026

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani!21 Feb 2026

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR21 Feb 2026

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist21 Feb 2026

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”!

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”!21 Feb 2026

Optionshandel lernen: Warum du es einfach halten solltest

Optionshandel lernen: Warum du es einfach halten solltest21 Feb 2026

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen21 Feb 2026

Cash für Medaillen

Cash für Medaillen21 Feb 2026

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby20 Feb 2026

El Tribunal Supremo HUNDE los aranceles de Trump… ¿o NO?

El Tribunal Supremo HUNDE los aranceles de Trump… ¿o NO?20 Feb 2026

Achtung: Elon Musk zerstört gerade Wikipedia!

Achtung: Elon Musk zerstört gerade Wikipedia!20 Feb 2026

1776 Patriot Silver Bars Are Selling Out

1776 Patriot Silver Bars Are Selling Out20 Feb 2026

Die Mittelschicht muss aufwachen!

Die Mittelschicht muss aufwachen!20 Feb 2026

Ray Dalio Shares His Secret for Longevity

Ray Dalio Shares His Secret for Longevity20 Feb 2026

2-20-26 This Market Is Chasing Themes, Not Valuations

2-20-26 This Market Is Chasing Themes, Not Valuations20 Feb 2026