Category Archive: 6a.) Monetary Metals

How Do They Get Away With It?

Picture, if you will, a government that deliberately inflicts bad policy on the people. I know this sounds crazy, and could never happen, but please bear with me. Suppose the government criminalizes hiring someone who produces less than an arbitrary threshold. Or it forces the closure of all businesses deemed to be non “essential”.

Read More »

Read More »

Where do gold and silver prices go from here?

One way to look at the price of gold, is that it dropped from its high around $1,900 in early June. Another way is to zoom out, and look at the big picture. Here is a 10-year chart of gold and silver prices.

For over four years, after the peak around $1,900 ten years ago (early September 2011), the price of gold moved down. By December 2015, it was just over $1,000. Then it was a sideways market until three years ago (August 2018), when the price...

Read More »

Read More »

What Trick did Tricky Dicky Pull 50 Years Ago Today?

Sometimes, bad luck can strike. But other times, a catastrophe comes from a series of bad decisions, each the reaction to the consequences of the previous one.

On August 15, 1971, President Nixon decreed that the US dollar would no longer be redeemable for the gold owed, even to foreign governments.

Read More »

Read More »

Is the Gold Standard the Economists’ Punching Bag?

The following article was written by Keith Weiner, CEO of Monetary Metals, as a counterpoint to this article, POINT: Should the US Return to the Gold Standard? No It was originally published at InsideSources, here: COUNTERPOINT: Is the Gold Standard the Economists’ Punching Bag?

Read More »

Read More »

Gold Price Smashdown vs Gold on Fire

No sooner did we write Silver Rorschach Test, than the price of gold flash-crashed, or was smashed down. On Sunday afternoon in Arizona—i.e. Monday morning in Australia and Asia—the gold price dropped sharply. Gold bug sources claim that the drop was $100, but as we can see from the price graph included in this report, the actual crash itself was about $70.

Read More »

Read More »

Motivated Reasoning About Silver

We’re seeing the argument, again, that silver stocks are being consumed in solar panels, medical applications, and of course, electronics. This argument has a certain temptation. After all, the standard assumption is that value is inversely proportional to quantity. Purchasing power is widely believed to be 1 / N (N is number of units of currency issued).

Read More »

Read More »

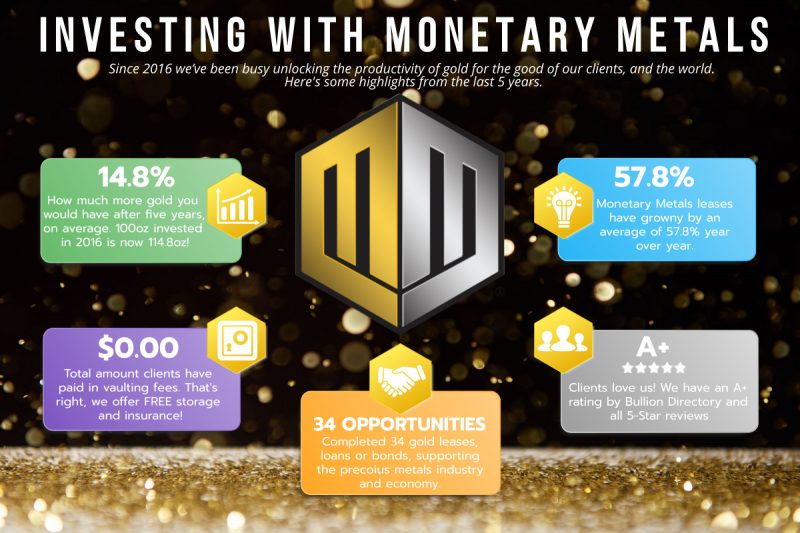

Celebrating Five Years of Interest on Gold

This month marks the five-year anniversary of Monetary Metals paying interest on gold. It was July 2016 when we offered our first Gold Fixed Income True Gold Lease. The gold lease was to Valaurum for manufacturing their flagship product, the Aurum®. It paid 3.0% interest on gold to investors (you can read the original press release here).

Read More »

Read More »

Episode 22: Reimagining Physical Gold with Adam Trexler of Valaurum

Can there be innovation in physical gold? Absolutely! In our increasingly digital reality, innovation in the material world may seem a bit passé, but not to Dr. Adam Trexler, founder and President of Valaurum. Valaurum produces the Aurum® – the smallest verifiable unit of gold for investment available on the market today. Adam joined Keith and John for an invigorating discussion on what the future of gold is going to look like.

Read More »

Read More »

Basel III’s Effect on Gold and Silver

There is sometimes a tendency to confuse ends and means. For example, in traveling through an airport there is extensive inspection of passengers. Before you are allowed to board an airplane, you must go through a process that is intrusive and increasingly invasive.

Read More »

Read More »

Inflation or Lockdown Whiplash?

Mainstream analysis sees rising consumer prices, and looks for a monetary cause. Also, when it sees an increase in the quantity of dollars, it looks for rising consumer prices. It is a fact that the quantity of what the mainstream calls money (i.e. the dollar) has risen at an extraordinary rate.

Read More »

Read More »

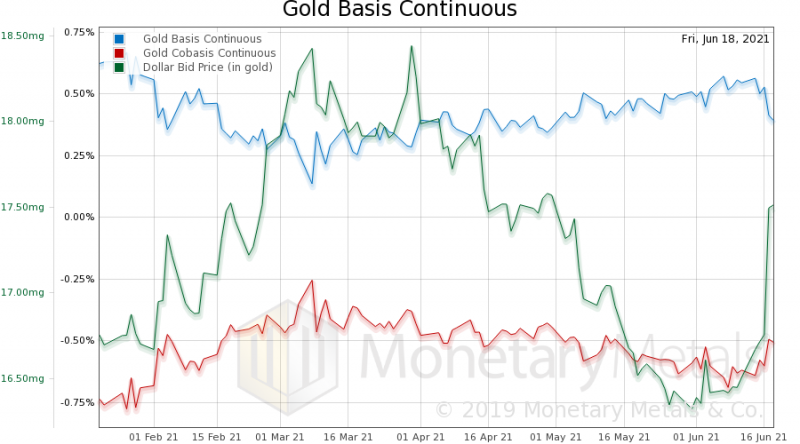

What the Heck Just Happened to the Price of Gold and Silver?!

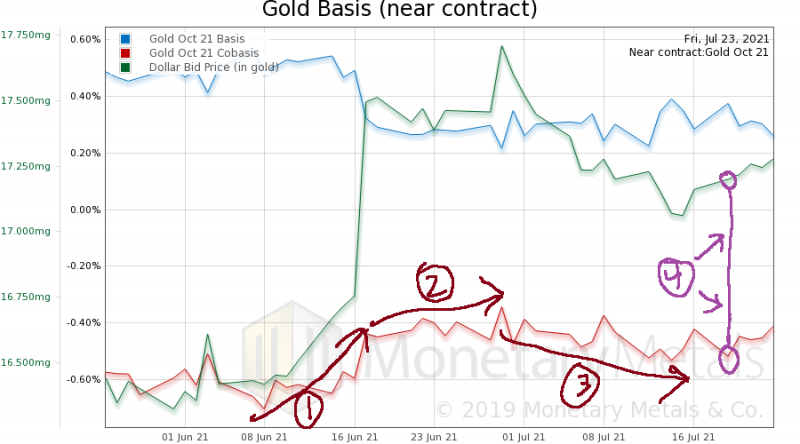

The price of gold (and silver) was on a tear in April and May. Then some sideways action. And then this week, thud. On Twitter, a popular meme is that the banks smashed the price by selling futures contracts, though there was no selling of gold bars. Let’s just say that if the price of an August contract fell by $120, while the price of a gold bar held steady, there would be a backwardation of around 40%!

Read More »

Read More »

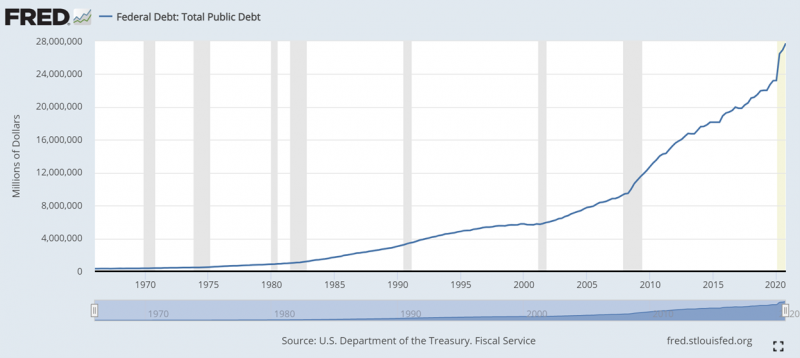

Resetting the Federal Debt

According to the US Treasury, the federal government owes $28.2 trillion. It crossed the “28” threshold on the last day of March. The debt was just under $25 trillion at the end of April a year ago. There’s no question it’s growing at a faster and faster pace, and now there’s the excuse of Covid to spend more.

Read More »

Read More »

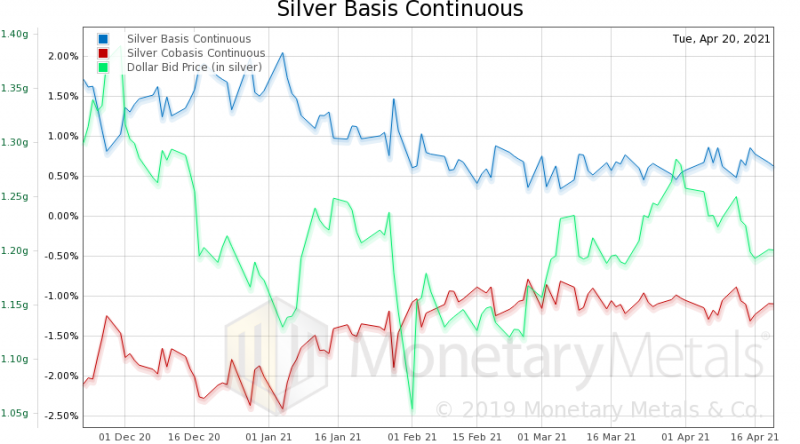

A Deeper Dive Into Silver

The prices of the metals hit their lows by the end of April. Gold traded for around $1,685, and is now over $1,900. Silver was around $24, and is now over $28. These are big moves (though of course nothing like bitcoin).

Read More »

Read More »

The Truth about the Silver Squeeze

Some recent videos about the silver market are generating more buzz than we have seen in a while. They make several points, but the main one is that there is a global shortage of silver. This assertion stands in contradiction to the fact that the silver price has dropped. As of the date of the first of these videos, it had dropped around 10% from its level just a month earlier.

Read More »

Read More »

Episode 19 – Bonus Episode! Theory of Interest and Prices Mises Conference 2021

Keith presented his Theory of Interest and Prices at the Mises’ Austrian Economics Research Conference earlier this year. Described as one of the most interesting talks of the entire event, this episode includes his fifteen-minute presentation as well as some follow-up thoughts by Keith himself at the end.

Read More »

Read More »

Monetary Metals Issues Gold Token

Scottsdale, Ariz, April 1, 2021— Monetary Metals® announces that it has issued a gold token. Unlike the company’s other products, this one is not designed to pay a yield.

In a sign of the times, the company intends this product to generate big speculative gains. It is designed to GO UP!

Read More »

Read More »

Episode 17: Why Fedcoin?

Our recent article on Fedcoin – a digital currency being considered by the Federal Reserve – revealed the sinister and pernicious reasons behind such a move. This week’s episode of The Gold Exchange Podcast explores the topic further. In it, John Flaherty and CEO Keith Weiner discuss: Addl description of episode

Read More »

Read More »

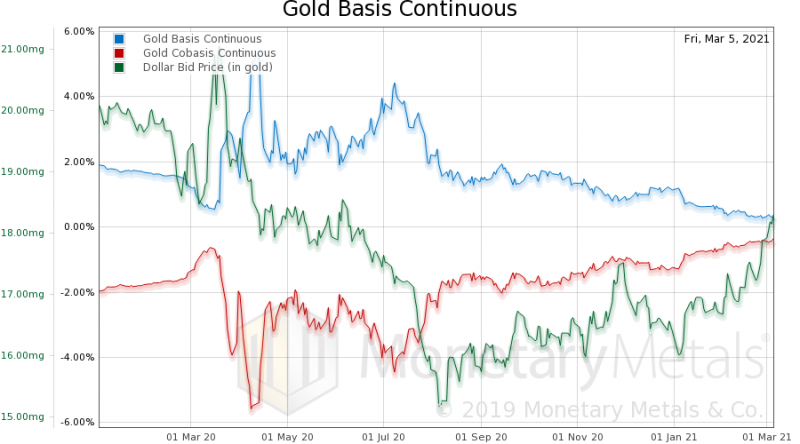

The Fedcoin is Coming, 8 March

Before we talk about Fedcoins, let’s look at the old school non-digital, non-blockchain, coin. Gold. And silver. Since January 4, the price has dropped about $244. And the price of silver has fallen about $4. Are these buying opportunities? Or the end of the brief gold bull market of 2020 (i.e. Covid)?

Read More »

Read More »

Episode 14: Unexpected Insights On Fractional Reserve Banking

Our previous episode on “money printing” veered into fractional reserve banking at a few points, so this week John Flaherty and Monetary Metals CEO Keith Weiner dive into that topic.

Read More »

Read More »

Episode 13: The Pressing Problem With “Money Printing”

The phrase “money printing” conjures images of a giant printing press spitting out sheets of hundred dollar bills somewhere in the basement of the Fed. But is that what’s actually happening lately? Absolutely not. Join John Flaherty and Monetary Metals CEO Keith Weiner for a conversation that will likely make you say “WOW!” or “Whaaat?” or maybe even “Oh, NOW I get it…”

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito” -

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste! -

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf! -

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani! -

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR -

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

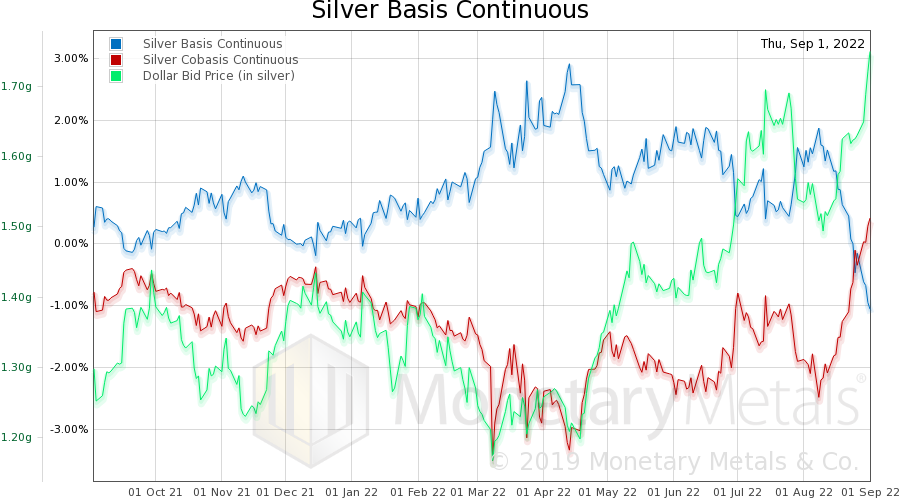

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022