Category Archive: 6a.) Monetary Metals

Irredeemable Currency Is a Roach Motel, Report 9 June

In what has become a four-part series, we are looking at the monetary science of China’s potential strategy to nuke the Treasury bond market. In Part I, we gave a list of reasons why selling dollars would hurt China. In Part II we showed that interest rates, being that the dollar is irredeemable, are not subject to bond vigilantes.

Read More »

Read More »

Dollar Supply Creates Dollar Demand, Report 2 June

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market.

Read More »

Read More »

The Crime of ‘33, Report 27 May

Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys: Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves If it doesn’t buy another currency, it merely tightens...

Read More »

Read More »

Keith Weiner, PhD, CEO & Founder of Monetary Metals

2019-05-22

by Keith Weiner

Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion.

Read More »

Read More »

China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy.

Read More »

Read More »

The Monetary Cause of Lower Prices, Report 12 May

We have deviated, these past several weeks, from matters monetary. We have written a lot about a nonmonetary driver of higher prices—mandatory useless ingredients. The government forces businesses to put ingredients into their products that consumers don’t know about, and don’t want. These useless ingredients, such as ADA-compliant bathrooms and supply chain tracking, add a lot to the price of every good.

Read More »

Read More »

Nonmonetary Cause of Lower Prices, Report 5 May

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc.

Read More »

Read More »

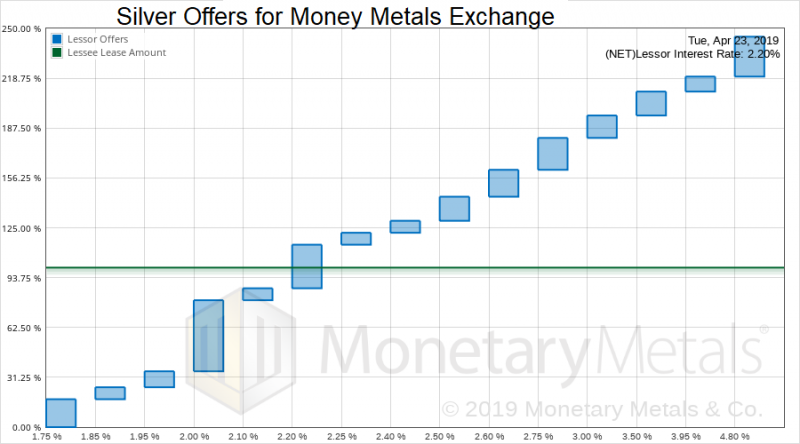

Money Metals Exchange Lease #1 (silver)

Monetary Metals leased silver to Money Metals Exchange, to support the growth of its gold and silver bullion business. The metal is held in the form of inventory in its vault. For more information see Monetary Metals’ press release.

Read More »

Read More »

Monetary Metals Leases Silver to Money Metals Exchange

Monetary Metals® announces that it has leased silver to Money Metals Exchange® to support the growth of its business of selling gold and silver at retail and wholesale. Investors earn 2.2% on their silver, which is held in Money Metals’ vault in the form of silver products.

Read More »

Read More »

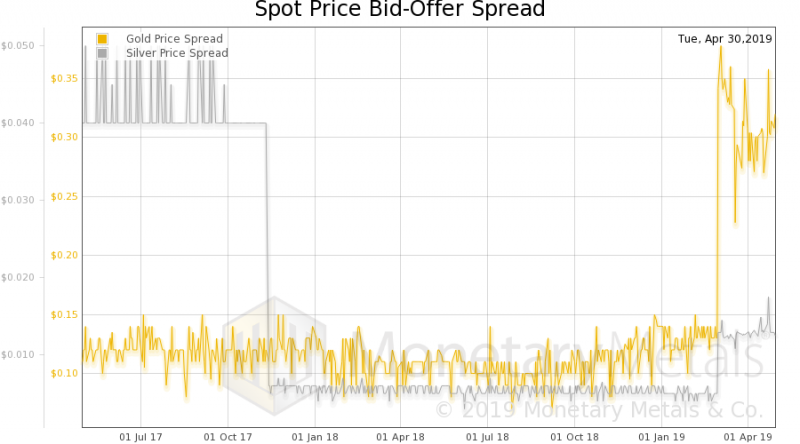

The Spreads Blow Out, Update 1 May

The bid-ask spread of both (spot) gold and silver has blown out. Both, on March 1. In gold, the spread had been humming along around 13 cents—gold is the most marketable commodity, and this is the proof, a bid-ask spread around 1bps—until… *BAM!* It explodes to around 35 cents, or two and half times as wide.

Read More »

Read More »

Is Keith Weiner an Iconoclast? Report 28 Apr

We have a postscript to our ongoing discussion of inflation. A reader pointed out that Levis 501 jeans are $39.19 on Amazon (in Keith’s size—Amazon advertises prices as low as $16.31, which we assume is for either a very small size that uses less fabric, or an odd size that isn’t selling). Think of the enormity of this. The jeans were $50 in 1983. After 36 years of relentless inflation (or hot air about inflation), the price is down to $39.31. Down...

Read More »

Read More »

The Two Faces of Inflation, Report 22 Apr

We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees.

Read More »

Read More »

New Inflation Indicator, Report 14 Apr

Last week, we wrote that regulations, taxes, environmental compliance, and fear of lawsuits forces companies to put useless ingredients into their products. We said: “For example, milk comes from the ingredients of: land, cows, ranch labor, dairy labor, dairy capital equipment, distribution labor, distribution capital, and consumable containers.”

Read More »

Read More »

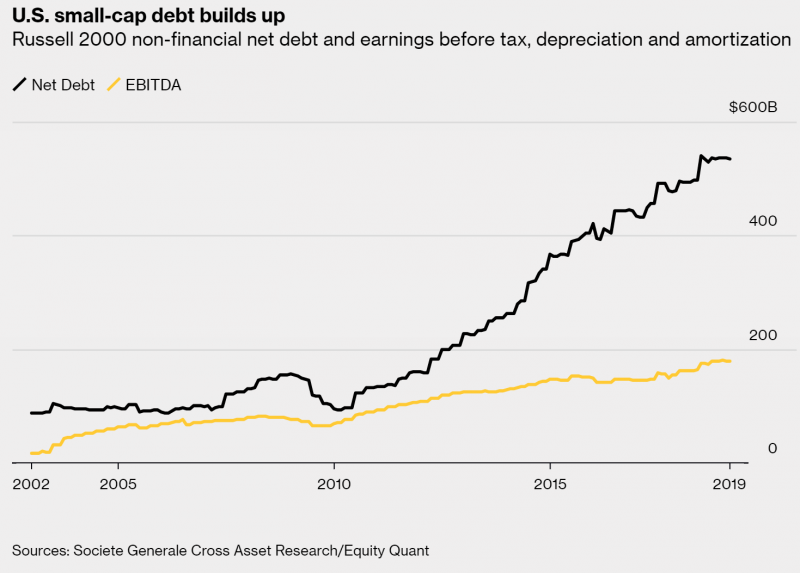

Debt and Profit in Russell 2000 Firms

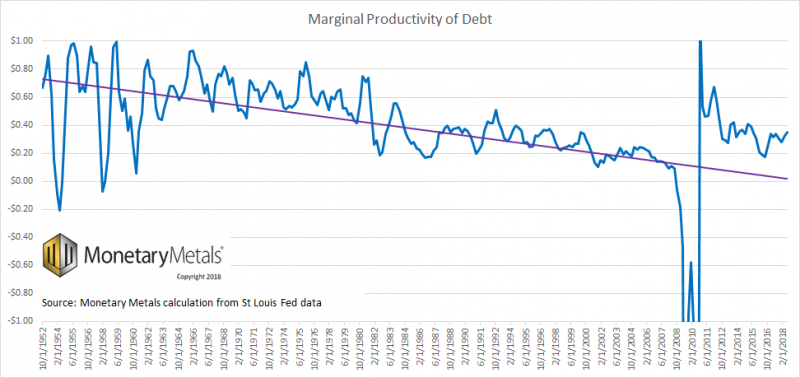

This week, the Supply and Demand Report featured a graph of debt vs profitability in the Russell 2000. Here’s the graph again: This graph shows a theme that we, and practically no one else(!) have been discussing for years. It is the diminishing marginal utility of debt. In this case, more and more debt is required to add what looks like less and less profit (we don’t have the raw data, only the graphic).

Read More »

Read More »

What Causes Loss of Purchasing Power, Report 7 Apr

We have written much about the notion of inflation. We don’t want to rehash our many previous points, but to look at the idea of purchasing power from a new angle. Purchasing power is assumed to be intrinsic to the currency. We have said that the problem with the word inflation is that it treats two different phenomena as if they are the same.

Read More »

Read More »

Will Basel III Send Gold to the Moon, Report 2 Apr

A number of commentators have predicted that the rules of the Basel III bank regulations will cause gold to skyrocket (no, this article is not about our view that gold does not go up, that it’s the dollar going down, that the lighthouse does not go up, it’s the sinking ship going down in the storm).

Read More »

Read More »

On Board Keynes Express to Ruin, Report 24 Mar

Last week, I ranted about the problem with our monetary system and trajectory: falling interest rates is Keynes’ evil genius plan to destroy civilization. This week, I continue the theme—if in a more measured tone—addressing the ideas predominant among the groups who are most likely to fight against Keynes’ destructionism.

Read More »

Read More »

Keynes Was a Vicious Bastard, Report 17 Mar

My goal is to make you mad. Not at me (though I expect to ruffle a few feathers with this one). At the evil being wrought in the name of fighting inflation and maximizing employment. And at the aggressive indifference to this evil, exhibited by the capitalists, the gold bugs, and the otherwise-free-marketers.

Read More »

Read More »

The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings.

Read More »

Read More »

Is Capital Creation Beating Capital Consumption? Report 3 Mar

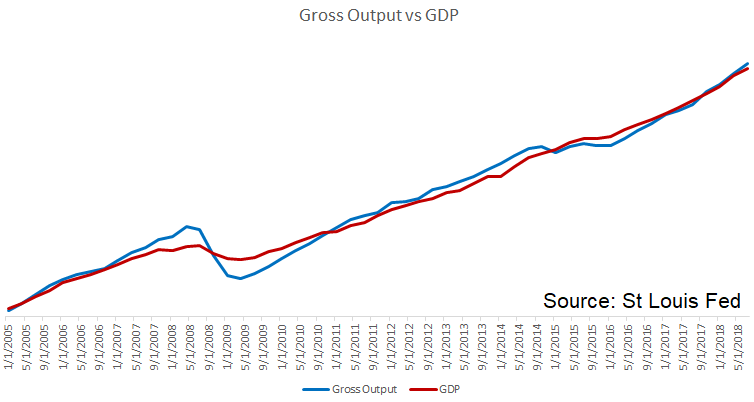

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP).

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito” -

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste! -

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf! -

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani! -

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR -

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

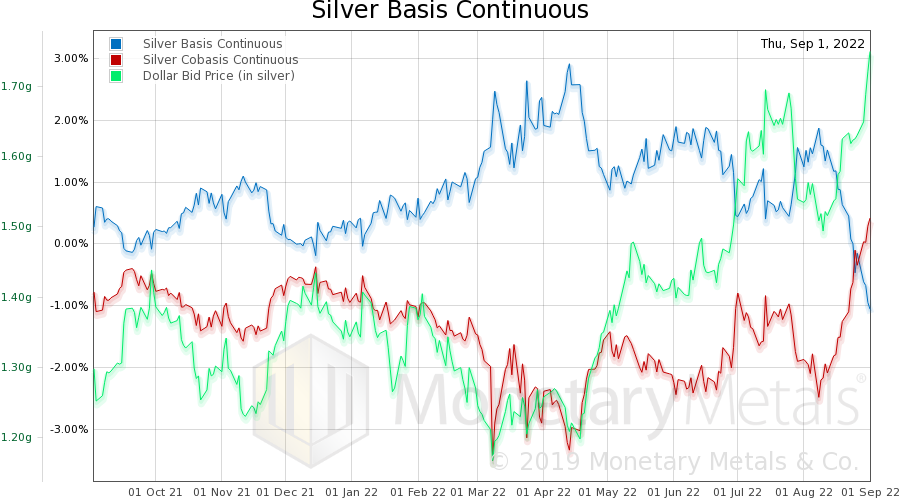

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022