Category Archive: 6a) Gold and its Price

Main Author Keith Weiner

German and Swiss Precious Metals Refiners join forces as Heraeus acquires Argor-Heraeus

German precious metals group Heraeus Precious Metals (HPM), part of the Heraeus industrial group, has just announced the full acquisition of Swiss precious metals refining group Argor-Heraeus. Heraeus is headquartered in Hanau, just outside Frankfurt. Argor-Heraeus is headquartered in Mendrisio in the Swiss Canton of Ticino, beside the Italian border.

Read More »

Read More »

Putting Pennies in the Fuse Box – Precious Metals Supply and Demand

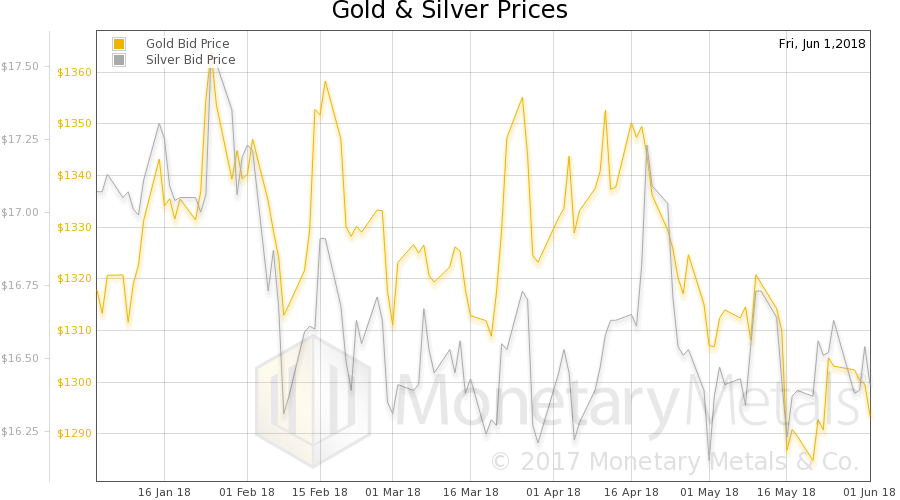

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Technical vs. Fundamental Analysis – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

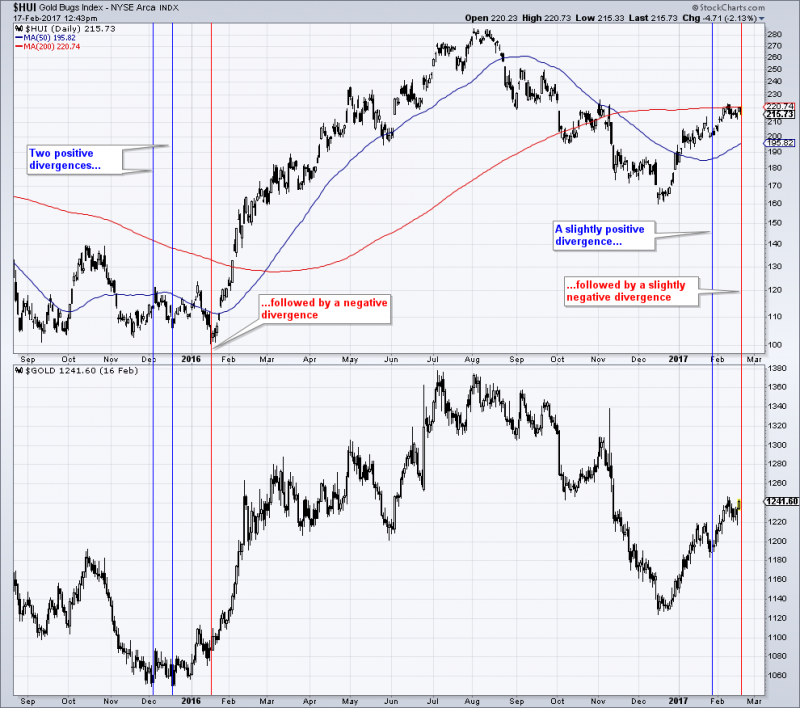

Gold Sector: Positioning and Sentiment

When last we wrote about the gold sector in mid February, we discussed historical patterns in the HUI following breaches of its 200-day moving average from below. Given that we expected such a breach to occur relatively soon, the post turned out to be rather ill-timed. Luckily we always advise readers that we are not exactly Nostradamus (occasionally our timing is a bit better).

Read More »

Read More »

Why Silver Went Down – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold and the Fed’s Looming Rate Hike in March

Long Term Technical Backdrop Constructive. After a challenging Q4 in 2016 in the context of rising bond yields and a stronger US dollar, gold seems to be getting its shine back in Q1. The technical picture is beginning to look a little more constructive and the “reflation trade”, spurred on further by expectations of higher infrastructure spending and tax cuts in the US, has thus far also benefited gold.

Read More »

Read More »

They’re Worried You Might Buy Bitcoin or Gold – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Importance of Hiding Gold Creatively and Securely If Taking Delivery

Why gold retains value? Interesting unknown gold facts. "Prepare your jaws for a sizeable drop!" History, finite, rare and peak gold. "It is beautiful to look at...". 'Heavy metal' - Thud sound of a gold bar (kilo). 'Going for gold' - Olympic gold medals to Chelthenham 'Gold Cup'.

Read More »

Read More »

The Gold-Silver Ratio Curiously Failed to Fall – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold Sector Update – What Stance is Appropriate?

We wanted to post an update to our late December post on the gold sector for some time now (see “Gold – Ready to Spring Another Surprise?” for the details). Perhaps it was a good thing that some time has passed, as the current juncture seems particularly interesting. We received quite a few mails from friends and readers recently, expressing concern about the inability of gold stocks to lead, or even confirm strength in gold of late. In light of...

Read More »

Read More »

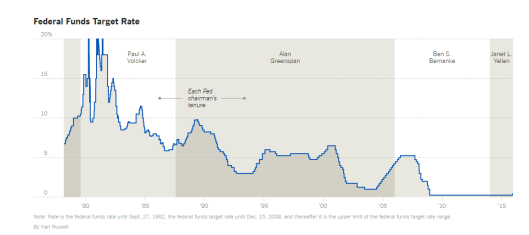

Are Rate Hikes Bad For Gold?

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Let’s take the fist chart and see what correlations exist between rate hikes and the US dollar index.

Read More »

Read More »

Don’t Short This Dog – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Silver Futures Market Assistance – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

What is Good for the Dollar is Bad for Gold

The Dollar Index is powering ahead, moving higher for the eighth consecutive session. Over the past 100 sessions, gold and the Dollar Index move in the opposite direction more than 90% of the time. The technical condition of gold is deteriorating.

Read More »

Read More »

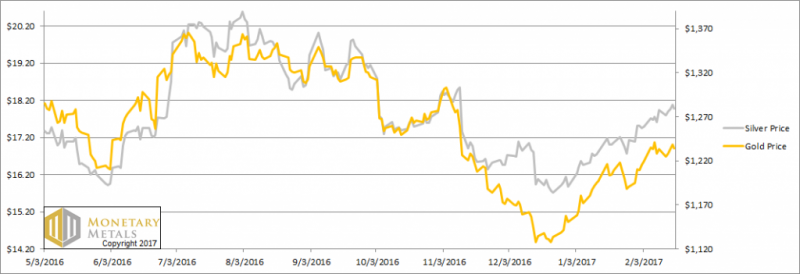

Gold and Silver Divergence – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

When Government Acts, “Unintended Consequences” Follow

In 1850, French economist Frédéric Bastiat published an essay that is misunderstood, or more often, unread, titled, “That Which is Seen, and That Which is Not Seen.” Bastiat brilliantly introduced the idea of opportunity cost and, through the parable of the broken window, illustrated the destructive effects of unintended consequences.

Read More »

Read More »

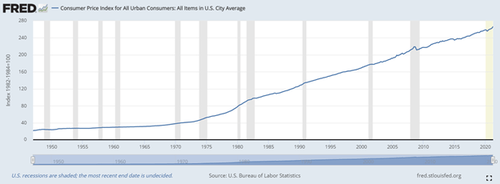

Ending Taxation on Monetary Metals

Imagine if you asked a grocery clerk to break a $20 bill, and he charged you $1.40 in tax. Silly, right? After all, you were only exchanging one form of money for another. But try walking to a local precious metals dealer in more than 25 states and exchanging a $20 bill for an ounce of silver.

Read More »

Read More »

Silver Speculators Gone Wild – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland's Gold Exports To China Surge To 158 Tonnes In December. Switzerland's gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November - a jump of 416%.

Read More »

Read More »

The Trump Weak Dollar Report – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: decreased by 15 billion francs compared to the previous four weeks

14 days ago -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24 -

2025-06-25 – Quarterly Bulletin 2/2025

2025-06-25

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 15 billion francs compared to the previous four weeks

14 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Why hasn’t Keir Starmer made bigger reforms?

Why hasn’t Keir Starmer made bigger reforms? -

Schlafstörungen

Schlafstörungen -

16 Jahre Gewinnwachstum: Warum diese Aktie trotzdem 75% verlor!

16 Jahre Gewinnwachstum: Warum diese Aktie trotzdem 75% verlor! -

The USD is lower vs the JPY by 0.40%. Versus the EUR and GBP, the USDs decline is modest

The USD is lower vs the JPY by 0.40%. Versus the EUR and GBP, the USDs decline is modest -

Keir Starmer: Reform UK is “pro-Putin”

Keir Starmer: Reform UK is “pro-Putin” -

Keir Starmer on the dangers posed by Reform

Keir Starmer on the dangers posed by Reform -

Dollar’s Downside Momentum Stalls

Dollar’s Downside Momentum Stalls -

Brückentage 2026

Brückentage 2026 -

Eilmeldung: SPD Innenminister von Rheinland-Pfalz will Demokratie endgültig abschaffen!!!

Eilmeldung: SPD Innenminister von Rheinland-Pfalz will Demokratie endgültig abschaffen!!! -

Kapitalmarktjahr 2026 – Zeit für neue Sachlichkeit?

Kapitalmarktjahr 2026 – Zeit für neue Sachlichkeit?

More from this category

Gold’s Middle Finger To Lying Currencies

Gold’s Middle Finger To Lying Currencies2 Jun 2021

Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies, & Gold

Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies, & Gold29 Mar 2021

Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul

Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul5 Sep 2019

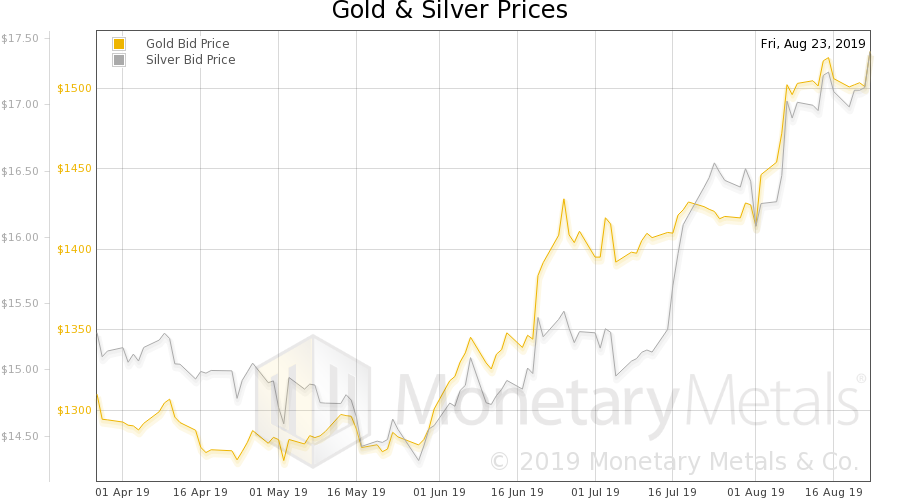

Directive 10-289, Report 25 Aug

Directive 10-289, Report 25 Aug26 Aug 2019

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran15 May 2019

Is Lending the Root of All Evil? Report 24 Feb

Is Lending the Root of All Evil? Report 24 Feb25 Feb 2019

Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU

Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU15 Feb 2019

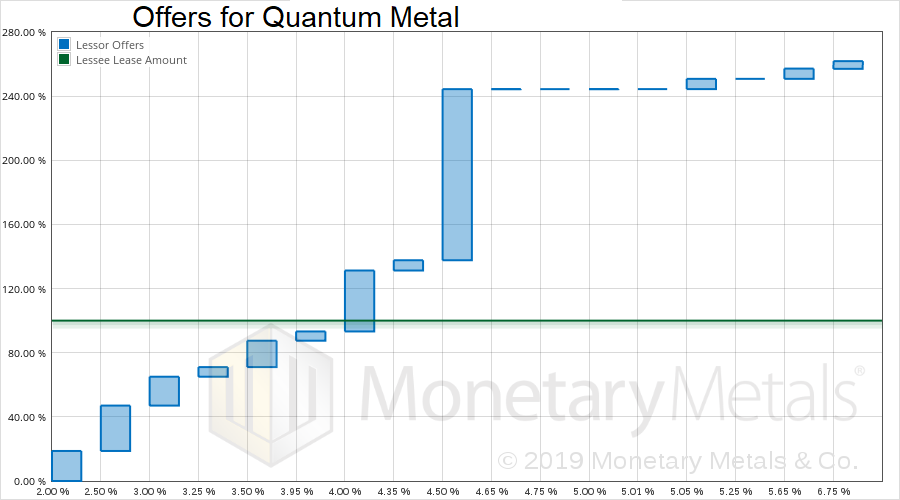

Quantum Metal Lease #1 (gold)

Quantum Metal Lease #1 (gold)13 Feb 2019

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week29 Jan 2019

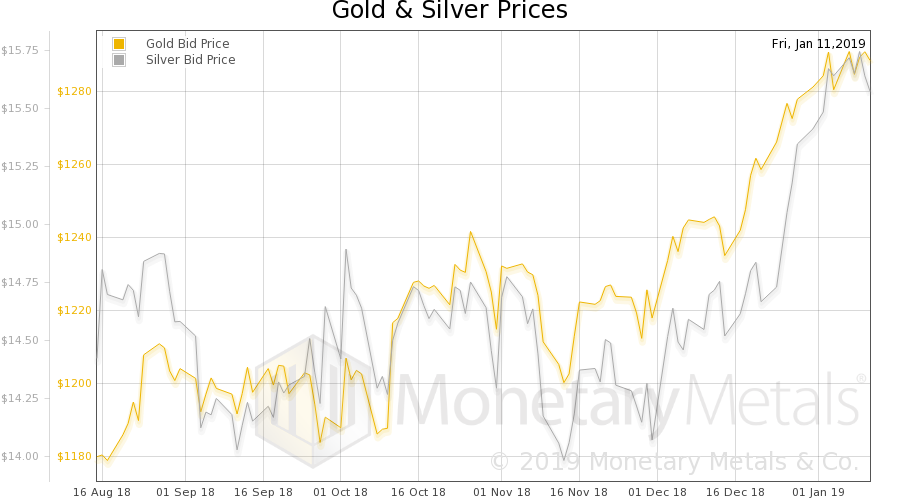

Rising Interest and Prices, Report 13 Jan 2019

Rising Interest and Prices, Report 13 Jan 201914 Jan 2019

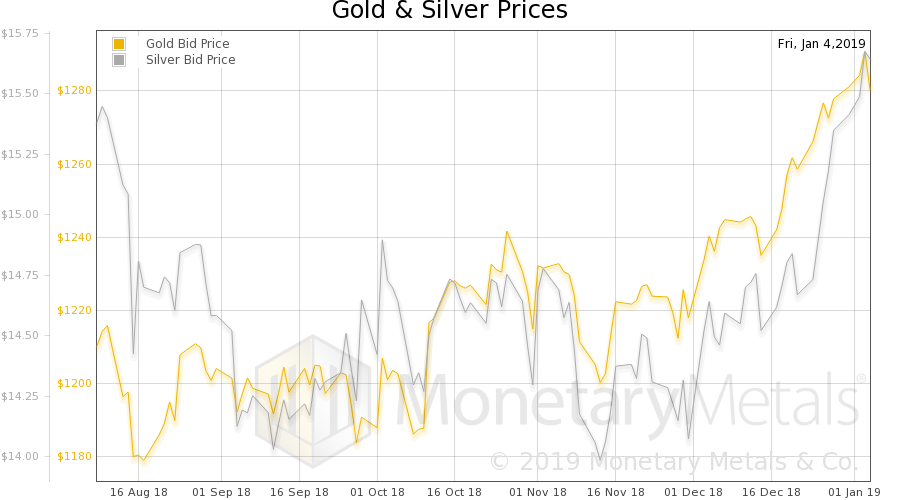

Surest Way to Overthrow Capitalism, Report 6 Jan 2019

Surest Way to Overthrow Capitalism, Report 6 Jan 20197 Jan 2019

Change is in the Air – Precious Metals Supply and Demand

Change is in the Air – Precious Metals Supply and Demand2 Jan 2019

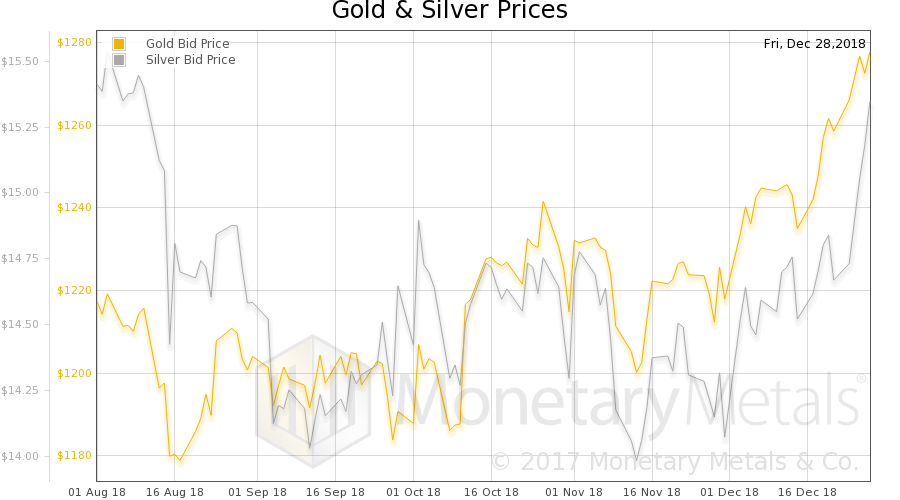

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents11 Dec 2018

What Can Kill a Useless Currency, Report 28 Oct 2018

What Can Kill a Useless Currency, Report 28 Oct 201829 Oct 2018

Yield Curve Compression – Precious Metals Supply and Demand

Yield Curve Compression – Precious Metals Supply and Demand3 Oct 2018

Another Gold Bearish Factor, Report 26 August 2018

Another Gold Bearish Factor, Report 26 August 201827 Aug 2018

Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand

Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand18 Aug 2018

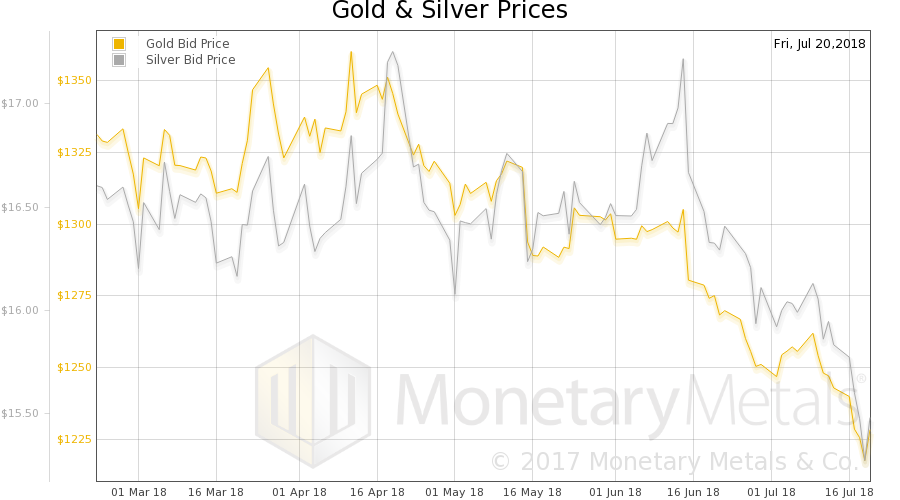

Crying Wolf, Report 22 July 2018

Crying Wolf, Report 22 July 201823 Jul 2018

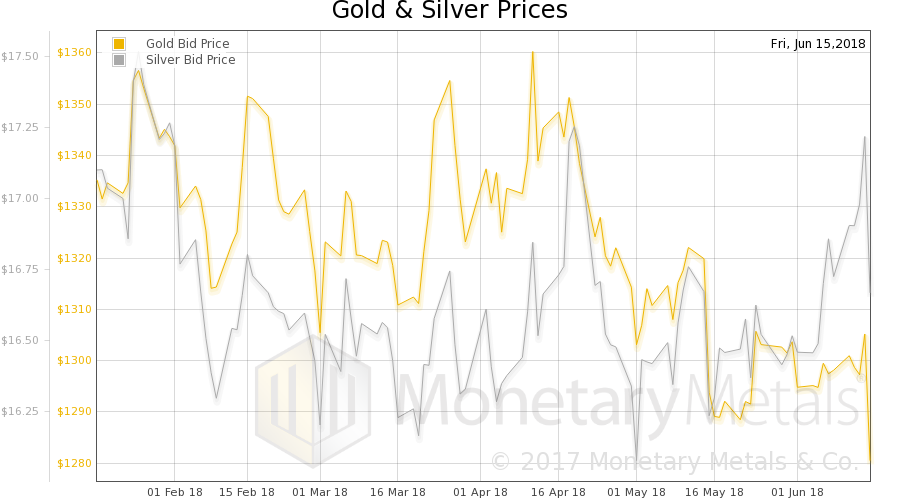

Lift-Off Not (Yet) – Precious Metals Supply and Demand

Lift-Off Not (Yet) – Precious Metals Supply and Demand19 Jun 2018

Industrial Commodities vs. Gold – Precious Metals Supply and Demand

Industrial Commodities vs. Gold – Precious Metals Supply and Demand6 Jun 2018