Category Archive: 6a) Gold & Monetary Metals

Money Metals President Stefan Gleason & Cong. Ron Paul Testify on Behalf of Gold & Silver Investors

Coming up on today’s program we’ll have a special report on some important new developments in sound money legislation at the state level. Be sure to stick around to find out which states are in the process of advancing the cause of restoring gold and silver as money. First, though, let’s take a brief look …

Read More »

Read More »

Frank Holmes: Gold Could Hit $1,500 in 2017 Amid Imbalances & Weak Supply

Read the full transcript here ⇨ https://goo.gl/3lUN62 Interview starts at: 6:36 Frank Holmes, CEO of U.S. Global Investors joins Money Metals Exchange to share his thoughts on Trump’s first 100 days, the resetting that’s going on the global political front and gives what he sees as a very realistic price target for gold before the …

Read More »

Read More »

Gold Sovereigns – ‘Treasure’ Trove Found In UK – Don’t Be The Piano Owner

The gold sovereigns – semi-numismatic gold coins made up of both gold sovereigns and half gold sovereigns dating from the reigns of Victoria, Edward VII and George V – were discovered inside an old piano after it was donated to a school last year.

Read More »

Read More »

Money Metals President Stefan Gleason on Managing Your Risks, How to Sell, and IRAs

Coming up we’ll here part two of a wonderful interview Money Metals president Stefan Gleason did with Alan James on the Sustainable Money Podcast. Stefan gives some more advice on what to look for when choosing a precious metals dealer, when and how to sell when the times comes one, and also talks about some of the ins and outs of gold and silver IRAs. Don’t miss the must-hear conclusion of this recent interview coming up after this week’s market...

Read More »

Read More »

Money Metals President Stefan Gleason on Managing Your Risks, How to Sell, and IRAs

Coming up we’ll here part two of a wonderful interview Money Metals president Stefan Gleason did with Alan James on the Sustainable Money Podcast. Stefan gives some more advice on what to look for when choosing a precious metals dealer, when and how to sell when the times comes one, and also talks about some …

Read More »

Read More »

MARC FABER | The Risk Of Global Economic Collapse

SUBSCRIBE for Latest ECONOMIC CRISIS ECONOMIC NEWS MONETARY INFORMATION OIL MARKET PETROL MARKET DOLLAR VALUE ECONOMIC FLUCTUATIONS ECONOMIC GROWTH AND DEVELOPMENT GLOBAL MARKET COLLAPSE GOLD SILVER FINANCIAL INVESMENT GLOBAL RESET BITCOIN AGENDA 21 GLOBAL RESET DAVOS 2017 GLOBAL RESET NEW WORLD ORDER

Read More »

Read More »

Silver, Platinum and Palladium as Investments – Research Shows Diversification Benefits

Silver, platinum and palladium see increased role as investment vehicles. Increase in academic output on the white precious metals is in line with this. Silver and particularly gold are safe haven assets. Silver was a safe haven at times during which gold failed to be. Platinum and palladium less so but have diversification benefits.

Read More »

Read More »

Trump To “Bully” Fed Into Printing Money – Negative for Stocks, Positive for Gold

David McWilliams has written an interesting article in which he puts forward the case that Trump is likely to turn on the “enemy within,” the Federal Reserve and bully them into “printing money.” He points out that this was seen in 1971 when Nixon bullied the Fed into printing and debasing the dollar. McWilliams says this would be bad for stocks markets which would fall in value as was seen in the 1970s.

Read More »

Read More »

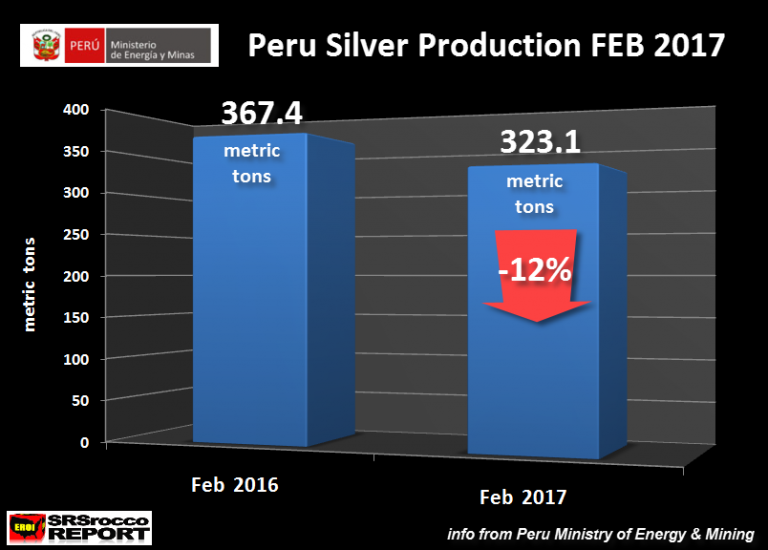

Silver Production Has “Huge Decline” In 2nd Largest Producer Peru

Silver production sees “huge decline” in Peru. Production -12% in one month in 2nd largest producer. Silver decline is due to ‘exhaustion of reserves’ in Peru. GFMS recognise that ‘Peak Silver’ was reached in 2015. Global silver market had large net supply deficit in 2016. Silver rallied 13.5% in Q1 in 2017. Base metal production accounts for 56% of silver mining.

Read More »

Read More »

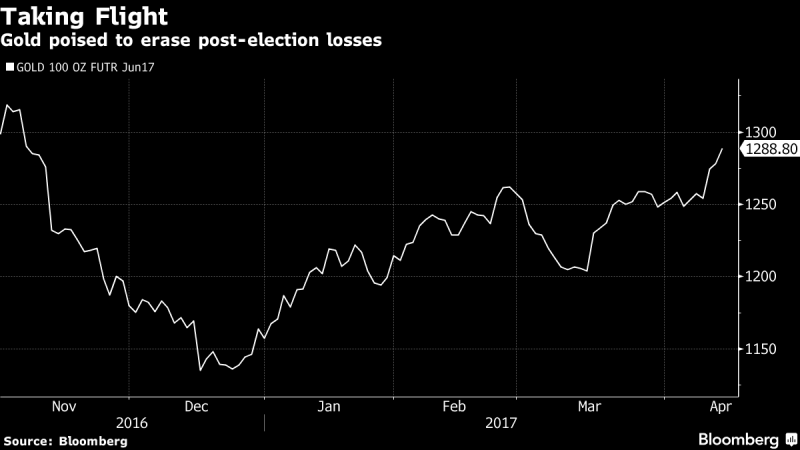

Gold Bullion Erases Post- Election Fall as Trump Wrong on Dollar – Daily Prophet

President Donald Trump sent currency markets into a tizzy late Wednesday when he signaled his preference for a weaker dollar. “I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me,” Trump told the Wall Street Journal.

Read More »

Read More »

Death Spiral for the LBMA Gold and Silver auctions?

In a bizarre series of events that have had limited coverage but which are sure to have far-reaching consequences for benchmark pricing in the precious metals markets, the LBMA Gold Price and LBMA Silver Price auctions both experienced embarrassing trading glitches over consecutive trading days on Monday 10 April and Tuesday 11 April. At the outset, its worth remembering that both of these London-based benchmarks are Regulated Benchmarks, regulated...

Read More »

Read More »

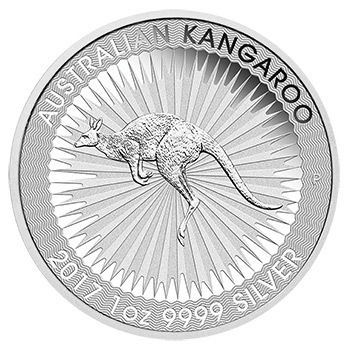

Perth Mint Silver Bullion Sales Rise 43 percent In March

Perth Mint’s silver bullion sales rise 43% in March. Perth Mint’s monthly gold coin, bars sales fall 12%. Gold silver ratio of 32 – 32 times more silver ounces sold. Gold: 22,232 oz and Silver: 716,283 oz – bullion coins and minted bars sold. Gold is 2.6% higher and silver surged 3.1% in the shortened week with markets closed for Good Friday tomorrow.

Read More »

Read More »

Gold Price Surges Above Key 200 Day Moving Average $1270 Level

Gold price breaks above key 200-day moving average. Gold hits 5-month high on back of investor nervousness. Safe haven has 10% gains in 2017 after 9% gains in 2016. Gold options signal more gains as ETF buying increases. Geopolitical uncertainty over North Korea & Middle East. Tensions high -World awaits US move & Russia response.

Read More »

Read More »

Bank of England Rigging LIBOR – Gold Market Too?

Bank of England implicated in LIBOR scandal by BBC. “We’ve had some very serious pressure from the UK government and the Bank of England about pushing our Libors lower.” “This goes much much higher than me”- UBS’ Tom Hayes. Libor distraction as all markets are manipulated today. Central bank’s “rigging” bond markets and likely gold.

Read More »

Read More »

.jpg)