Category Archive: 6a) Gold and its Price

Uranium Squeeze AND the Case for Gold – Amir Adnani

Uranium Squeeze and the case for Gold are up for discussion with Amir Adnani CEO of GoldMining Inc. in this episode of GoldCore TV

He joins us to talk about the supply-side factors affecting the #goldprice, the #UraniumSqueeze, as well as why he is bullish on both of these yellow metals.

Also in this episode…

The supply-side factors that are driving Amir’s interest in gold.

Why gold is currently the most undervalued asset?

Why gold is not...

Read More »

Read More »

Lawrence Lepard – Why Every Portfolio Should Contain Sound Money

Lawrence Lepard Portfolio Manager and advocate of sound money, is our guest on this episode of GoldCore TV.

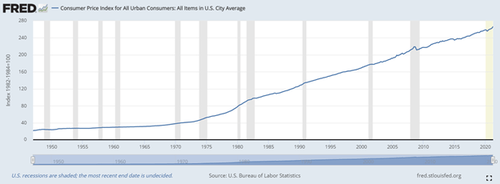

With 40% of money in the US being created in the last 2 years, we ask Lawrence if the Fed is trapped. If so will this mean that it is going to be very difficult for them to raise rates or attempt to taper their bond purchase in any meaningful way.

How long before inflation starts to bite hard and why does this suggest to him that a 50%...

Read More »

Read More »

Gold Price Forecast Gareth Soloway This Level Holds the Key

Gold Price Forecast

"This is a long term bullish pattern for gold!" - Gareth Soloway Gold

In this latest episode of GoldCore TV, Gareth Soloway joins Dave Russell to discuss what what the charts are suggesting for the stock markets, bond markets and #bitcoin. In addition to this he also takes a look at his gold price forecast 2021 and beyond.

Gareth identifies the key levels that are acting as resistance at the moment that if breach...

Read More »

Read More »

Tavi Costa- The Fed is Trapped

Tavi Costa- The Fed is Trapped

The Fed is trapped, and they know it! Fears of rising #inflation cause stock markets to slump. But what impact does this have on gold and silver? #TaviCosta of Crescat Capital joins Dave Russell of GoldCore TV this week. He highlights the basic pillars of inflation and why owning tangible assets like #goldandsilver is now more important than ever.

Highlights from the interview

Why the Fed will be forced to keep...

Read More »

Read More »

Silver Market Predictions – Ed Steer Talks about the Silver & Gold Price

Silver Market Predictions- Ed Steer Talks about the Silver & Gold Price

This week's guest on GoldCore TV #EdSteer, Author of Ed Steer's Gold and Silver Digest.

Ed discusses the Big Four Commercial Traders involved in trading precious metals futures on the COMEX and the control and influence they have on the gold price and #silverprice. But who are these Big Four Traders? Find out more in this episode

Highlights from this interview:

How do...

Read More »

Read More »

50 Jahre Abschaffung des Goldankers der Währungen: Vortrag Peter Boehringer, Friedberg, 12.9.2021

Zeitenwende in der Wirtschafts- und Finanzpolitik?

Fehlentwicklungen im Finanzsystem

4:30 Zeitenwende in der Finanz und Wirtschaftspolitik

5:56 Klassischer Goldstandard vor dem ersten Weltkrieg beendet

7:19 Hochzins heute nicht mehr möglich

8:58 Zentrales Vermögensregister der EU

11:33 EUrobonds

15:54 Heuchelpartei FDP

16:56 EU Green Deal

18:38 Finanzministertreffen und abschaltbarer Personalausweis

22:34 Sonderziehungsrechte Deutschlands sollen...

Read More »

Read More »

Are We In A Financial Bubble? Peter Grandich Interview

Are We in A Financial Bubble? – Peter Grandich Interview

Peter Grandich is Dave Russell’s guest on GoldCore TV this week and talks about how he believes that the US financial, political, and military reputation has been seriously damaged.

Highlights from this interview:

Are we in the midst of the largest financial bubble in American history?

What will happen when this bubble bursts?

Why are central banks continuing to buy gold?

Is the era...

Read More »

Read More »

Peter Boehringer, MdB: 50 Jahre Schließung des Goldfensters

Rede des Bundestagsabgeordneten Peter Boehringer in der Stadthalle in Friedberg am 12. September 2021.

Thema: 50 Jahre Schließung des Goldfensters – was bedeutet der Liquiditäts-Tsunami für unsere Zukunft?

Read More »

Read More »

Buy Physical Silver Now – Gary Savage

Buy Physical Silver Now- Gary Savage

The Fed has indicated that rates would be raised but has offered no indication of when or by how much. Will this cause a melt-up in stocks before we see a massive correction? We ask this of our guest on this episode of GoldCore TV, Gary Savage of Smart Money Tracker.

Will the stock market's meteoric rise continue this year if the Fed delays tightening monetary policy?

Will continued money printing fuel a...

Read More »

Read More »

Silver Price Manipulation- Chris Marcus – The Big Silver Short

Silver Price Manipulation- Chris Marcus - The Big Silver Short

Is the #silvermarket still being manipulated? We ask this of our this week's guest #ChrisMarcus of Arcadia Economics and author of The Big Silver Short.

Have the wall street banks really left the silver market in place for #shortsqueeze of a lifetime?

With the ongoing printing of money by the central banks of the world, particularly the United States Federal Reserve, is this...

Read More »

Read More »

David Hunter Contrarian Review: Market to Crash by 80%

David Hunter Contrarian Review: Market to Crash by 80%

This week on GoldCore TV, Dave Russell welcomes David Hunter, Chief Macro Strategist at Contrarian Macro Advisors, who expects a stock market meltdown. According to David, a global bust could occur in 2022, with a potential market crash of 80%.

He believes that while inflation will be a challenge for the Fed, it will not prevent what he predicts will be the stock market's last melt-up, with...

Read More »

Read More »

Flash Crash: Gold Markets Poised to Rebound?

Flash Crash News: Gold Markets Poised to Rebound?

After the dramatic #flashcrash that #gold suffered this week, when will the gold market rebound?

We ask this to our guest on GoldCore TV this week Louis Gave of GaveKal. Dave Russell discusses Louis' interpretation of the current state of financial markets and his views on central banks' digital currency and the future of #Bitcoin.

Also covered in this episode…

Will the Fed be able to implement...

Read More »

Read More »

Will Silver Break Out? Is Triple Digit Silver Still on the Cards?

Will Silver Break Out? Is Triple Digit Silver Still on the Cards?

With so much volatility in the #silver market, we ask the question - What on earth is going on with silver?? Patrick Karim of NorthStarBadCharts.com joins us on today's edition of GoldCore TV to give us his predictions for the silver price.

Patrick looks at long-term and short-term patterns in the silver market and suggests that the sideways consolidation will continue until...

Read More »

Read More »

Von aktuellen Messermorden über Regenbogenflaggen bis zu Währung, Schulden, BitCoin, Gold

Peter Boehringer im Gespräch mit Dirk Brandes, live übertragen am 28.06.2021

0:45 Vorstellung

1:12 Regenbogenflaggen

5:54 Messermorde von Würzburg

9:52 Schulden wegen Corona-Maßnahmen

38:30 Schulden der EU

40:36 EU-Steuern durch EU-Schulden?

42:07 Schuldgeldsystem & Digitaler Euro

45:36 Gold

59:27 Monetäre Transformation

1:06:32 BitCoin

1:16:24 Ewigkeitskredite

Quelle/Erstveröffentlichung: _ak

Mehr von Peter Boehringer hier:

✅...

Read More »

Read More »

Technical Analysis Of Gold – Time to Buy?

Today we are talking technical analysis of gold, #silver, bitcoin, stock markets, and bonds with Gareth Soloway of InTheMoneyStocks.com

Recent comments from the Federal Reserve Chairman Jerome Powell indicated that they may need to raise rates in 2023 (2 years away!). This is primarily due to the continued excessive money printing fueling a surge in inflation. Inflation is no longer transitory but could remain high for some time. All this should...

Read More »

Read More »

Gold Mining Operation Supply Issues Points to a Sustained Bull Market for Gold

Supply side issues in many a gold mining operation, caused by the reduction in gold reserves from the previous industry averages of 20-25 years down to 10 years, is sure to put further pressure on supply/demand imbalances in the gold market.

How will this development in the #goldmining process affect the gold price?

That's what we're asking on this episode of GoldCore TV with our special guest David Garofalo who has been in the gold supply...

Read More »

Read More »

Gold to 5000?

What will send gold to 5000 per ounce?

The latest In Gold We Trust report has just been published by Incrementum and is available to download at: https://ingoldwetrust.report/

Ronni Stoeferle of Incrementum is this week's guest on GoldCore TV with Dave Russell discussing what he see as the major drivers that will send gold 5000 an ounce and as high as $12,000 over the coming years.

Ronni has been warning about impending inflation and the...

Read More »

Read More »

Livestream mit Peter Boehringer ,MdB und Dirk Brandes

In diesem Livestream spricht Dirk Brandes mit Peter Boehringer, MdB und Vorsitzender des Haushaltsausschusses im Deutschen Bundestag, über den Bundeshaushalt.

Weitere interessante Themen werden sein, Bitcoin, Gold, Währung sowie der EU-Corona Hilfsfond.

Viele spannende Fragen beantwortet Peter Boehringer.

#PeterBoehringer #DirkBrandes #AfDHannover #Deutschlandabernormal

Read More »

Read More »

Gold’s Middle Finger To Lying Currencies

Authored by Matthew Piepenburg via GoldSwitzerland.com,Sensationalism, like central bankers and policy makers, has many faces, views and voices.This may explain why so many want to hold their ears, hug their knees and beg the heavens for a beacon of guiding light amidst a 24/7 fog of info-cycle pablum masquerading as information.

Read More »

Read More »