Category Archive: 5) Global Macro

Inching Closer To Another Warning, This One From Japan

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart.

Read More »

Read More »

Weekly Market Pulse: As Clear As Mud

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs.

Read More »

Read More »

How Breakdown Cascades Into Collapse

Maintaining the illusion of confidence, permanence and stability serves the interests of those benefiting from the bubbles and those who prefer the safety of the herd, even as the herd thunders toward the precipice.

Read More »

Read More »

Far right online: the rise of “extreme” gamers | The Economist

In America, the intelligence services deem far-right extremism a greater domestic threat than Islamist terrorism. The pandemic has exacerbated the spread of white supremacism and neo-Nazism.

Sign up to The Economist’s daily newsletter to keep up to date with our latest stories: https://econ.st/3gJBH8D

Find The Economist’s most recent coverage of what’s happening in the United States: https://econ.st/3thOHVJ

Read more about far-right extremism:...

Read More »

Read More »

Here’s Why America’s Labor-Shortage Will Drive Inflation Higher

America's labor shortage is complex and doesn't lend itself to the simplistic expectations favored by media talking heads. The Wall Street cheerleaders extol the virtues of "getting America back to work" which is Wall-Street-speak for getting back to exploiting workers to maximize corporate profits.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 15 juillet 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene.

Read More »

Read More »

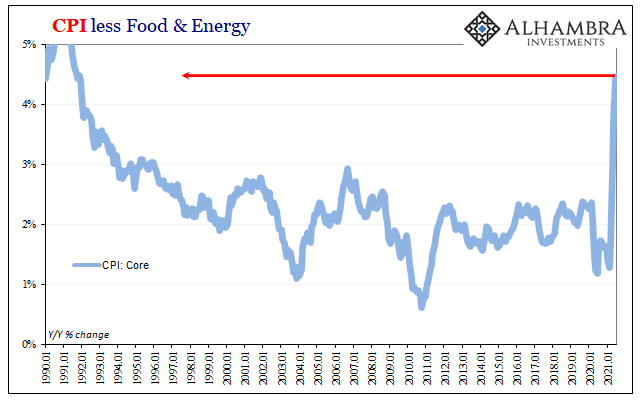

Third CPI In A Row, Yet All Eyes On That 30s Auction

Three in a row, huge CPI gains. According to the BLS, headline consumer price inflation surged 5.39% (unadjusted) year-over-year during June 2021. This was another month at the highest since July 2008 (the last transitory inflationary episode). The core CPI rate gained 4.47% last month over June last year, the biggest since November 1991.

Read More »

Read More »

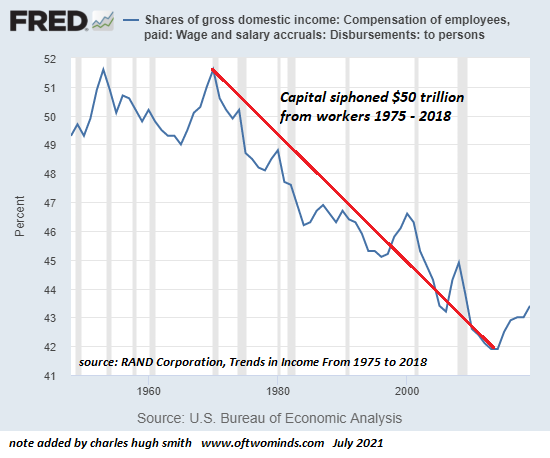

The $50 Trillion Plundered from Workers by America’s Aristocracy Is Trickling Back

The depth of America's indoctrination can be measured by the unquestioned assumption that Capital should earn 15% every year, rain or shine, while workers are fated to lose ground every year, rain or shine. And if wages should ever start ticking upward even slightly, then the Billionaires' Apologists are unleashed to shout that higher wages means higher inflation, which will kill the economic "recovery."

Read More »

Read More »

Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »

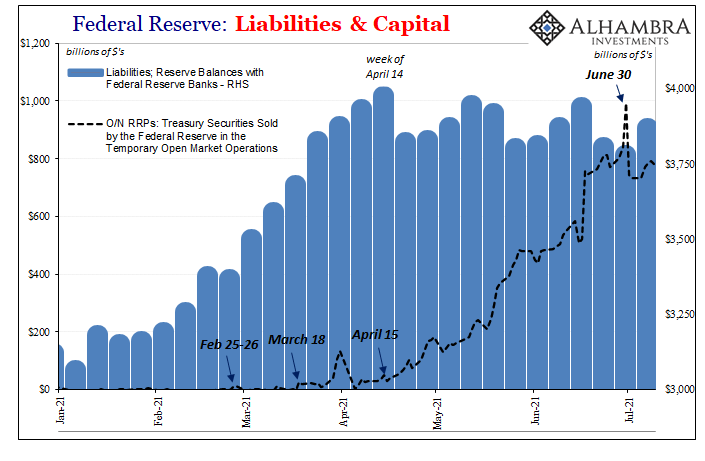

RRP No Collateral Coincidences As Bills Quirk, Too

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big.

Read More »

Read More »

Jeff Snider On Shadow Money, History, Eurodollar System, Central Banks, Repo, Collateral (RCS 117)

Topics- Were the Dot-Com Bubble and the Housing Bubble caused by the exponential growth of shadow money since the late 80s? Risk, liquidity, Credit Bubble of ’95, China, Eurodollar System. Rehypothecation and how it works: return, leveraging assets, Repo Market, treasuries, repledging, collateral, derivatives. Central Banks, Global Monetary System, Salomon Brothers. Collateral shortage: is that the problem?

Read More »

Read More »

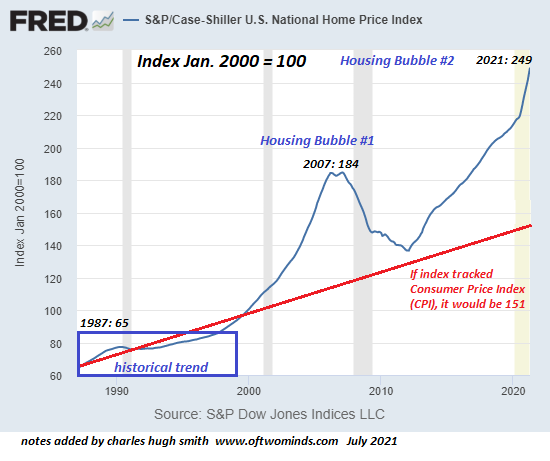

Housing Bubble #2: Ready to Pop?

The expansion of Housing Bubble #2 is clearly visible in these two charts of house valuations, courtesy of the St. Louis Federal Reserve database (FRED). The first is the Case-Shiller Index, which as you recall tracks the price of homes on an "apples to apples" basis, i.e. it tracks price movements for the same house over time. Note that this is an index chart where the index is set at 100 as of January 2000. It is not a chart of median housing...

Read More »

Read More »

Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 8 juillet 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Covid-19: why your life will never be the same again | The Economist

Across much of the world, covid-19 restrictions are starting to ease. The Economist has crunched the data to calculate how close countries are to pre-pandemic levels of normality—but will life ever be the same again? Read more here: https://econ.st/3AG9siz

Search the interactive normality tracker: https://econ.st/3hDGHum

How life is halfway back to pre-covid norms?: https://econ.st/3dQSy70

Read all of coronavirus coverage:...

Read More »

Read More »

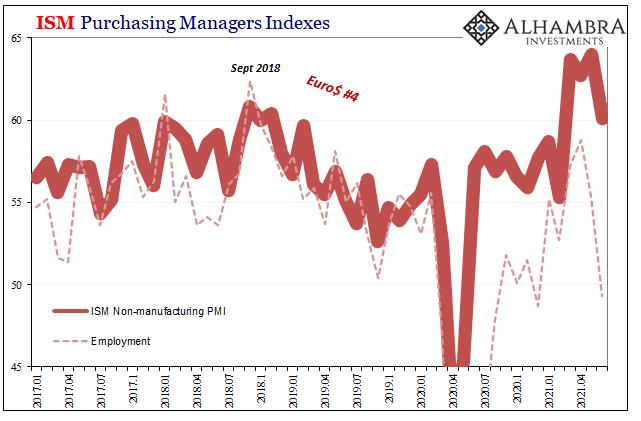

ISM’s Nasty Little Surprise Isn’t Actually A Surprise

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Read More »

Read More »

A Few Things About Reinforced Concrete High-Rise Condos

The second most remarkable thing about the sudden collapse of the Florida condo building was the rush to assure everyone that this was a one-off catastrophe: all the factors fingered as causes were unique to this building, the implication being all other high-rise reinforced concrete condos without the exact same mix of causal factors were not in danger.

Read More »

Read More »