Category Archive: 5) Global Macro

What to expect from Donald Trump’s address to Congress

The White House press secretary, Sean Spicer, says the theme of Donald Trump’s address to Congress will be “the renewal of the American spirit”. What are the chances the president will turn the rhetoric into reality? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the …

Read More »

Read More »

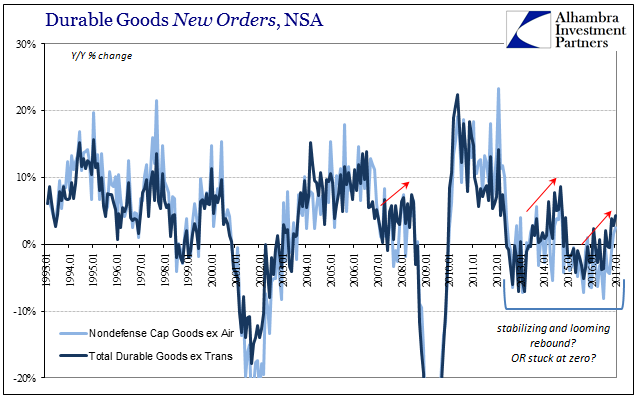

Durable Goods Groundhog

If the economy is repeating the after-effects of the latest “dollar” events, and it does seem more and more to be that case, then analysis starts with identifying a range for where it might be in the repetition. New orders for durable goods (ex transportation) rose 4.3% year-over-year in January 2017 (NSA, only 2.4% SA), the highest growth rate since September 2014 (though not meaningfully faster than the 3.9% rate in November 2016).

Read More »

Read More »

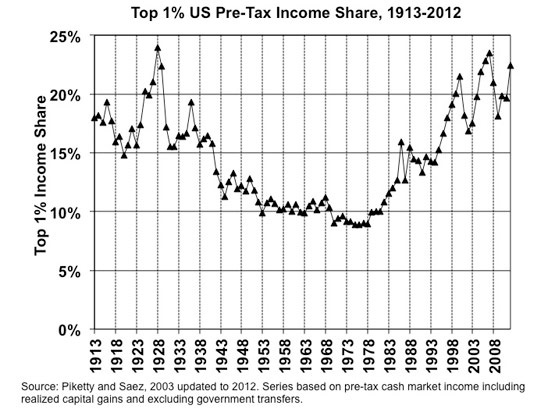

Virtue-Signaling the Decline of the Empire

Virtue-signaling doesn't signal virtue--it signals decline and collapse. There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, the status quo seeks to mask its self-serving rot behind high-minded "virtue-signaling" appeals to past glories and cost-free...

Read More »

Read More »

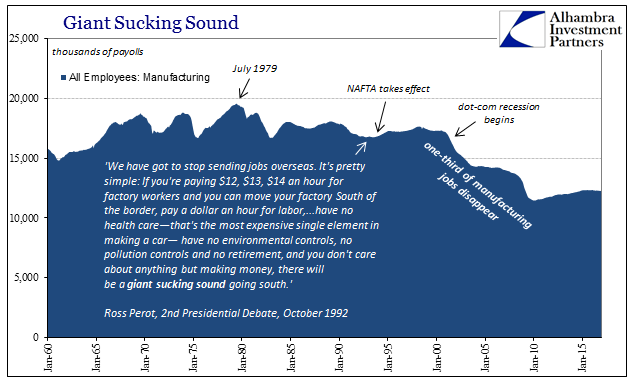

It Was ‘Dollars’ All Along

Ross Perot famously declared the “giant sucking sound” in the 1992 Presidential campaign. The debate over NAFTA did not end with George H. W. Bush’s defeat, as it simmered in one form or another for much of the 1990’s. Curiously, however, it seemed almost perfectly absent during the 2000’s, the very decade in which Perot’s prophecy came true. Americans didn’t notice because there was a bubble afoot.

Read More »

Read More »

The coral Noah’s Ark

In Hawaii, a group of scientists is creating the world’s only bank of coral sperm. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The world’s OCEANS cover 70% of our planet, are the frontline in the battle against climate change, and yet are relatively unknown. Dive down to their deepest depths to discover …

Read More »

Read More »

Corals are fighting back

In Palau, corals are thriving despite climate change. What’s their secret? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The world’s OCEANS cover 70% of our planet, are the frontline in the battle against climate change, and yet are relatively unknown. Dive down to their deepest depths to discover how scientists are using …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note despite lower US rates. The dollar regained some traction that it lost over the course of the week, when markets pushed out Fed tightening beyond March. Treasury Secretary Mnuchin also seemed to push out fiscal stimulus. There is a full slate of Fed speakers this week, and Wednesday sees the release of the Fed’s Beige book that was prepared for the March 15 FOMC meeting.

Read More »

Read More »

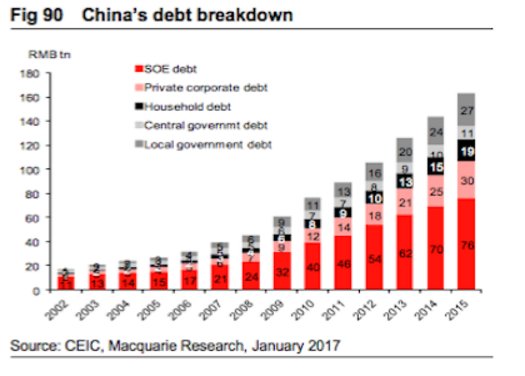

Emerging Markets: What has Changed

PBOC tweaked its process for determining the yuan reference rate. Singapore is reportedly studying measures to boost revenue, including higher taxes. Moody’s upgraded the outlook on Russia’s Ba1 rating from negative to stable. Nigerian President Buhari extended his stay abroad. Nigerian central bank tweaked its FX restrictions, but was aimed at retail demand. Brazil political risk is back on the table. Brazil’s central bank hinted at a faster pace...

Read More »

Read More »

There’s a Difference: Fake News and Junk News

The mainstream media continues peddling its "fake news" narrative like a desperate pusher whose junkies are dying from his toxic dope. It's slowly dawning on the media-consuming public that the MSM is the primary purveyor of "fake news"-- self-referential narratives that support a blatantly slanted agenda with unsupported accusations and suitably anonymous sources.

Read More »

Read More »

Not Recession, Systemic Rupture – Again

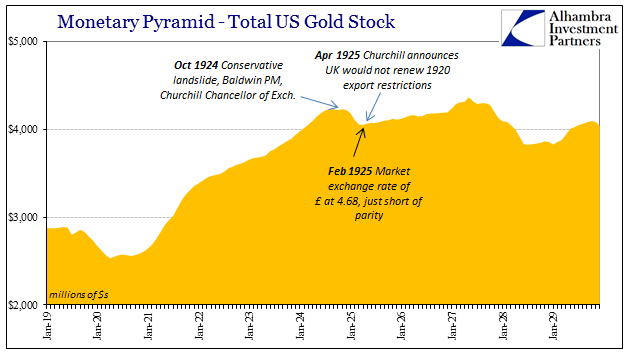

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed.

Read More »

Read More »

Where have all the fish gone?

The death of corals is already affecting the human communities that depend on the ocean for survival. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The world’s OCEANS cover 70% of our planet, are the frontline in the battle against climate change, and yet are relatively unknown. Dive down to their deepest depths …

Read More »

Read More »

The dirty secret of clean energy | The Economist

The road to a future with an unlimited supply of clean energy is a rocky one. Ed Carr, our deputy editor, explains why energy features on the cover of this week’s The Economist. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For …

Read More »

Read More »

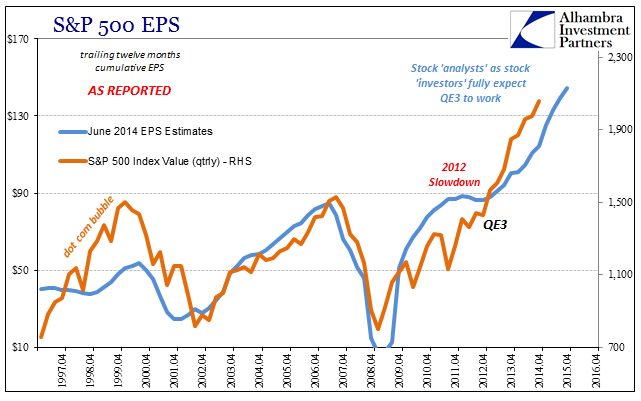

The Market Is Not The Economy, But Earnings Are (Closer)

My colleague Joe Calhoun likes to remind me that markets and fundamentals only sound like they should be related, an observation that is a correct one on so many different levels. Stock prices, in general, and GDP growth may seem to warrant some kind of expected correlation, but it has proven quite tenuous at times especially in a 21st century sense.

Read More »

Read More »

The Problem with Gold-Backed Currencies

Any currency is only truly "backed by gold" if it is convertible to gold. There is something intuitively appealing about the idea of a gold-backed currency --money backed by the tangible value of gold, i.e. "the gold standard." Instead of intrinsically worthless paper money (fiat currency), gold-backed money would have real, enduring value-it would be "hard currency", i.e. sound money, because it would be convertible to gold itself.

Read More »

Read More »

Corals: the largest organism on the planet

From providing much of the oxygen we breathe to hosting myriad forms of life, corals are a critical part of our planet’s eco-system. But they are dying. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The world’s OCEANS cover 70% of our planet, are the frontline in the battle against climate change, and …

Read More »

Read More »

Rex Tillerson: America’s new chief emissary | The Economist

Rex Tillerson, America’s secretary of state, will need all his nimble diplomacy when he meets Mexico’s president Enrique Pena Nieto to discuss trade and security. But any calming reassurance could be undermined the next time President Trump tweets. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day …

Read More »

Read More »

The Criminalization of Financial Independence

Just as the "war on drugs" criminalized and destroyed large swaths of African-American and Latino communities, the "war on cash" will further criminalize the few remaining avenues to financial independence and freedom. The introduction of "entitlement" welfare in the 1960s generated a toxic dependency on the state that institutionalized worklessness, a one-two punch that undermined marriage and family in America's working class of all ethnicities.

Read More »

Read More »

Saving corals from the effects of climate change

With the world’s corals threatened with extinction, scientists are using cutting edge technology to help these planetary treasures make a comeback. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 It covers more than 70% of the earths surface. The ocean is the planet’s lifeblood but its being transformed by climate change. Colonies of …

Read More »

Read More »

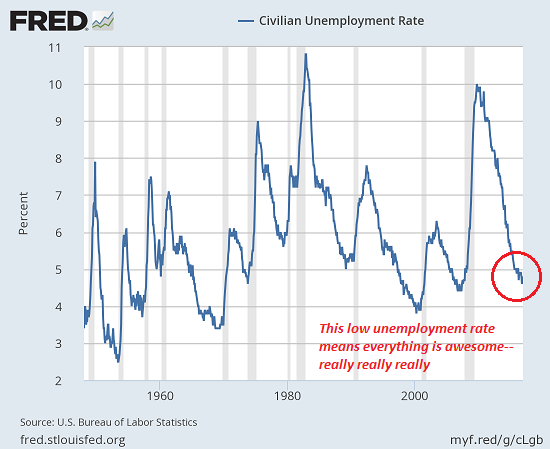

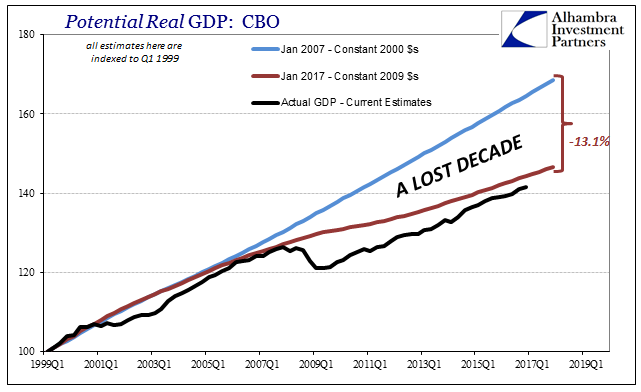

The Stinking Politics of It All

It is largely irrelevant, but still the political theater is fascinating. As is now standard operating procedure, whatever comes out of the Trump administration immediately is conferred as the standard for awful. This is not my own determination, mind you, but that of the mainstream, whatever that is these days. And so it is with the first set of budget figures that include very robust growth projections, a point of contention and an obvious one...

Read More »

Read More »

How Donald Trump plans to approach Iran | The Economist

How much tougher is Trump than Obama when it comes to Iran? Matthew Symonds, our defence and diplomatic editor, explains. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: …

Read More »

Read More »