Category Archive: 5) Global Macro

Some Thoughts on the Latest Treasury FX Report

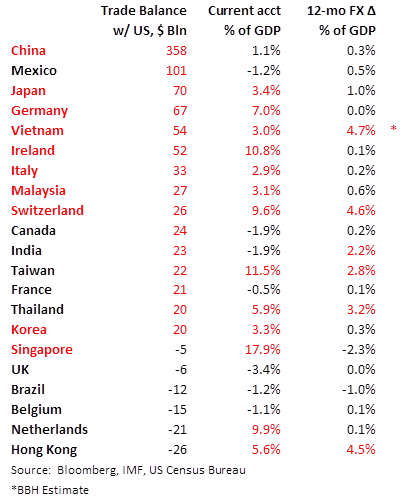

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners.

Read More »

Read More »

How science is changing the nature of families | The Economist

Science is enabling women to have children later in life as new technologies transform IVF success rates. But an increasingly globalised IVF trade also poses dangers. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Science is changing how and when families are made. Women are going to be able to have both career …

Read More »

Read More »

Repo Market: Discover New Insider Secrets (THIS WILL BLOW YOUR MIND!)

Repo market insider Jeff Snider reveals shocking new facts ?YOU CAN'T AFFORD TO MISS! ?The repo market survived the end of the year but the fed is still printing money to bail out the system. Repo market operations seem to have become permanent. But Jeff Snider has a completely different explanations, and as usually Jeff Sniders repo market explanations seem far better researched, articulated and probable. And of course I explain them to you so...

Read More »

Read More »

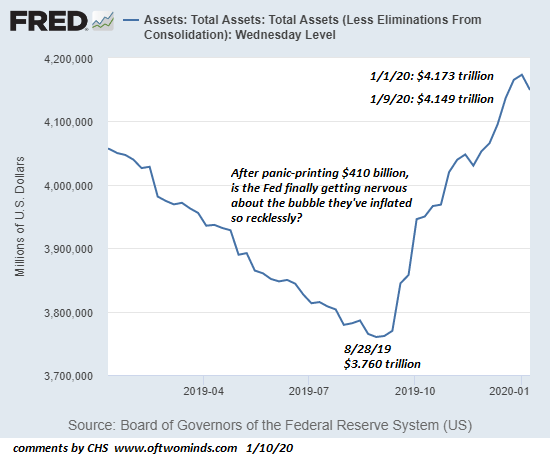

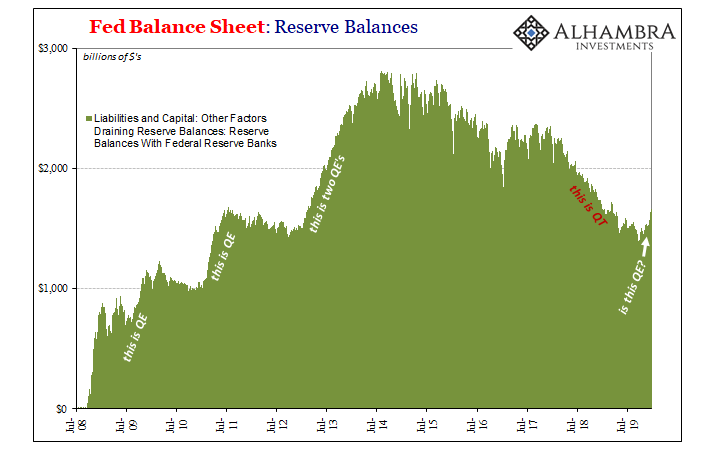

Just a Friendly Heads-Up, Bulls: The Fed Just Slashed its Balance Sheet

Perhaps even PhD economists notice that manic-mania bubbles always burst--always. Just a friendly heads-up to all the Bulls bowing and murmuring prayers to the Golden Idol of the Federal Reserve: the Fed just slashed its balance sheet--yes, reduced its assets. After panic-printing $410 billion in a few months, a $24 billion decline isn't much, but it does suggest the Fed might finally be worrying about the reckless, insane bubble it inflated:

Read More »

Read More »

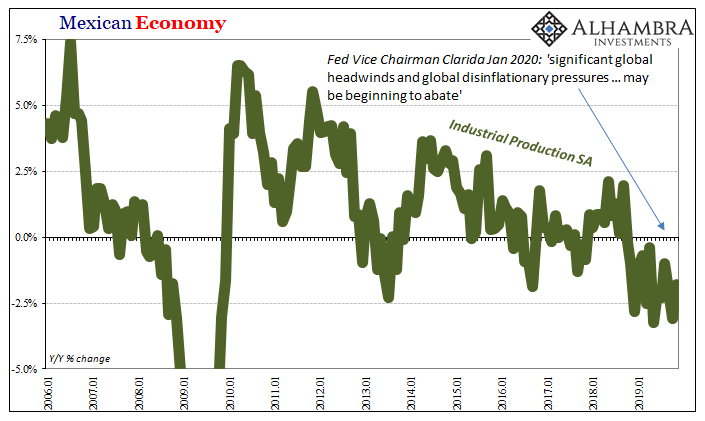

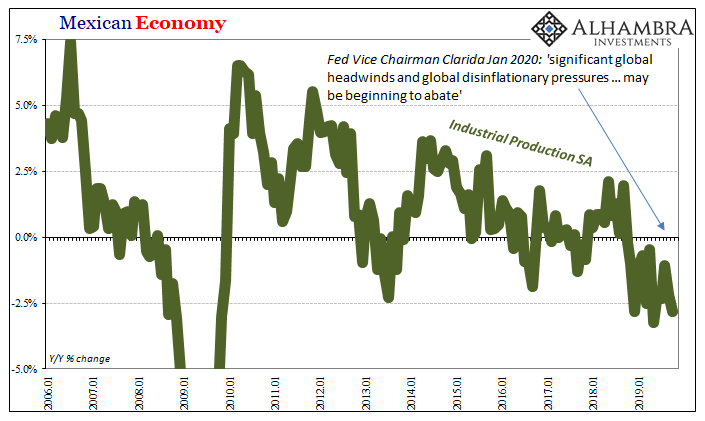

Not Abating, Not By A Longshot

Since I advertised the release last week, here’s Mexico’s update to Industrial Production in November 2019. The level of production was estimated to have fallen by 1.8% from November 2018. It was up marginally on a seasonally-adjusted basis from its low in October.

Read More »

Read More »

All-Stars #88 Jeff Snider: The Fed is avoiding the real issue driving divergences in their models

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »

Read More »

EM Preview for the Week Ahead

EM has been able to get some traction as markets basically shrugged off the risk-off sentiment after the Iran attacks. This week’s planned signing of the Phase One trade deal should help boost EM further, but we remain cautious. The Iran situation is by no means solved, and we see periodic bouts of risk-off sentiment coming from smaller skirmishes.

Read More »

Read More »

Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts).

Read More »

Read More »

The Fed Can’t Reverse the Decline of Financialization and Globalization

The global economy and financial system are both running on the last toxic fumes of financialization and globalization. For two generations, globalization and financialization have been the two engines of global growth and soaring assets. Globalization can mean many things, but its beating heart is the arbitraging of the labor of the powerless, and commodity, environmental and tax costs by the powerful to increase their profits and wealth.

Read More »

Read More »

Dollar Builds on Gains as Iran Tensions Ease

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction. The North American session is quiet in terms of US data. Mexico reports December CPI; Peru is expected to keep rates steady at 2.25%. German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney.

Read More »

Read More »

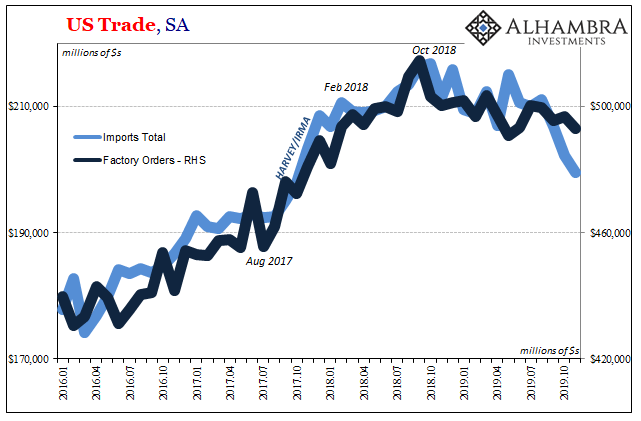

The Real Trade Dilemma

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are.

Read More »

Read More »

More Trends That Ended 2019 The Wrong Way

Auto sales in 2019 ended on a skid. Still, the year as a whole wasn’t nearly as bad as many had feared. Last year got off on the wrong foot in the aftermath of 2018’s landmine, with auto sales like consumer spending down pretty sharply to begin it. Spending did rebound in mid-year if only somewhat, enough, though, to add a little more to the worst-is-behind-us narrative which finished off 2019.

Read More »

Read More »

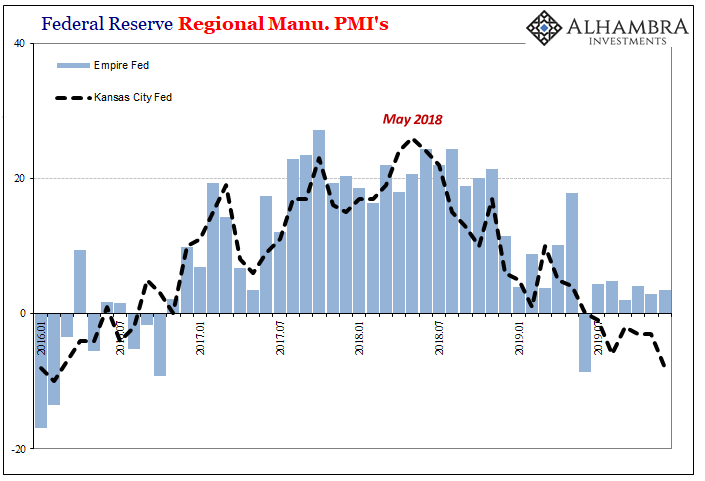

Manufacturing Clears Up Bond Yields

Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month.

Read More »

Read More »

WTF: What The Fed?! – Mike Maloney, Chris Martenson, Grant Williams, Charles Hugh Smith, A. Taggart

Watch the full event free at https://www.peakprosperity.com/wtf-what-the-fed/ “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a …

Read More »

Read More »

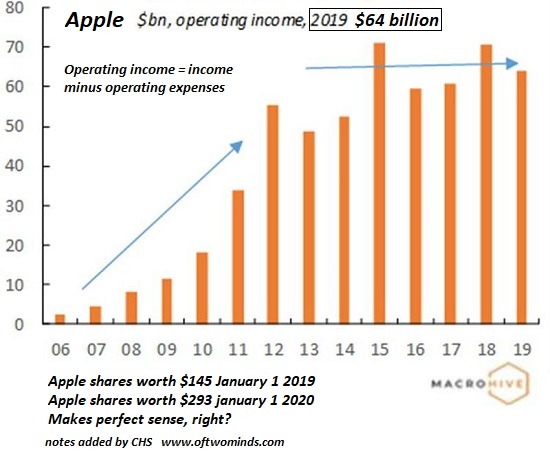

Is This “The Top”?

Parabolic moves end when the confidence that the parabolic move can't end becomes the consensus. The consensus seems to be that the stock market is on its way to much higher levels, and soon. The near-term targets for the S&P 500 (SPX, currently around 3,235) range from 3,500 to 4,000, with longer-term targets reaching "the sky's the limit."

Read More »

Read More »

EM Preview for the Week Ahead

While the global economic backdrop remains favorable for EM, rising geopolitical risks will be a growing headwind. The EM VIX surged above 18% Friday as Iran tensions escalated, the highest since early December. With these tensions likely to persist, EM may remain under some pressure for the time being. High oil prices are positive for the exporters in Latin America and the Middle East but negative for the importers in Asia and Eastern Europe.

Read More »

Read More »

2019: The Year of Repo

The year 2019 should be remembered as the year of repo. In finance, what happened in September was the most memorable occurrence of the last few years. Rate cuts were a strong contender, the first in over a decade, as was overseas turmoil. Both of those, however, stemmed from the same thing behind repo, a reminder that September’s repo rumble simply punctuated.

Read More »

Read More »

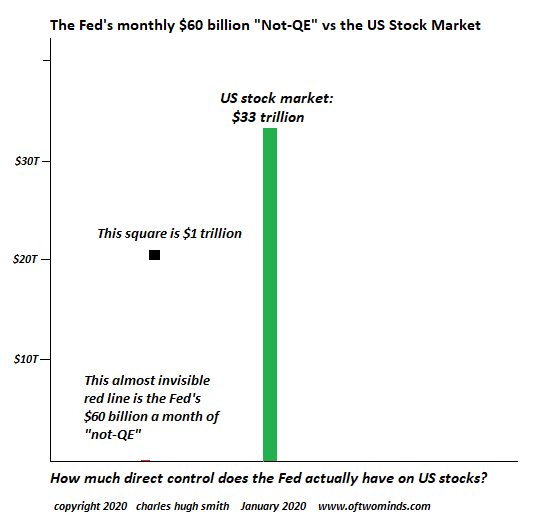

The Two Charts You Need to Ignore or Rationalize Away in 2020 (Unless You’re a Bear)

If you believe you've front-run the herd, you're now in mid-air along with the rest of the herd that has thundered off the cliff. We're awash in financial charts, but only a few crystallize an entire year. Here are the two charts that sum up everything you need to know about the stock market in 2020.

Read More »

Read More »

CHARLES HUGH SMITH – Huge Globalization Cycle Is Ending

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »

Read More »

What does gun violence in America look like? | The Economist

Mass shootings dominate the gun-violence debate in America, even though they account for less than 0.3% of gun-deaths. At The Economist’s Open Future festival in Chicago three leading campaigners against gun violence explored the problem and what should be done to stop it. Read more here: https://econ.st/37wOzH4 Click here to subscribe to The Economist on …

Read More »

Read More »