Category Archive: 5) Global Macro

The Limits of Force: A Bayonet in the Back Will Not Restore China’s Economy

Force cannot restore legitimacy, trust or confidence, nor can it magically erase the consequences of a still-unfolding national trauma. The Chinese authorities threatening to punish workers who refuse to return to work are getting a lesson in the limits of force in an unprecedented national trauma: a bayonet in the back will not restore the legitimacy and confidence that have been lost.

Read More »

Read More »

Could the Covid-19 Pandemic Collapse the U.S. Healthcare System?

Disregard these second-order effects at your own peril. A great many systems that are assumed to be robust are actually fragile. Exhibit #1 is the global financial system, of course, but Exhibit #2 may well be the healthcare system globally and in the U.S.

Read More »

Read More »

Jeff Snider Part 2/2 (Repo Mkt/Eurodollar Expert) Rebel Capitalist Show Ep. 19

Jeff Snider reveals insights ?YOU CAN'T AFFORD TO MISS! ?This interview with Jeff Snider is so packed with knowledge bombs we had to turn it into 2 parts! This is PART 2 of 2, and trust me, it will blow your mind! As always, The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom. Jeff and I discuss how money is actually created and how US dollars (Eurodollars) have been created, outside the...

Read More »

Read More »

Dollar Mixed as Coronavirus News Stream Deteriorates

The virus news stream continues to deteriorate. Lower US yields and growing concerns about the spread of the coronavirus in the US are taking a toll on the greenback. OPEC officials are trying to work out another supply cut; The outlook for Turkey is going from bad to worse. Simply put, there is nothing the Fed can do to address the economic impact of supply chain disruptions and social distancing.

Read More »

Read More »

How can the Democrats beat Trump? | The Economist

As the 2020 US presidential election looms, many Democrats say they will vote for the candidate with the best chance of beating Donald Trump. So what is the best strategy to defeat him? Read more here: https://econ.st/2IdvpvD Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Further reading and listening: The Economist’s guide to …

Read More »

Read More »

Jeff Snider (Repo Mkt/Eurodollar Expert) Rebel Capitalist Show Ep. 19 Part 1 of 2

Jeff Snider reveals insights ?YOU CAN'T AFFORD TO MISS! ?This interview with Jeff Snider is so packed with knowledge bombs we had to turn it into 2 parts! This is PART 1 of 2, and trust me, it will blow your mind! As always, The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom. Jeff and I discuss how money is actually created and how US dollars (Eurodollars) have been created, outside the...

Read More »

Read More »

No, The Fed Will Not “Save the Market”–Here’s Why

The greater the excesses, speculative euphoria and moral hazard, the greater the reversal. A very convenient conviction is rising in the panicked financial netherworld that the Federal Reserve and its fellow dark lords will "save the market" from COVID-19 collapse. They won't. I already explained why in The Fed Has Created a Monster Bubble It Can No Longer Control (February 16, 2020) but it bears repeating.

Read More »

Read More »

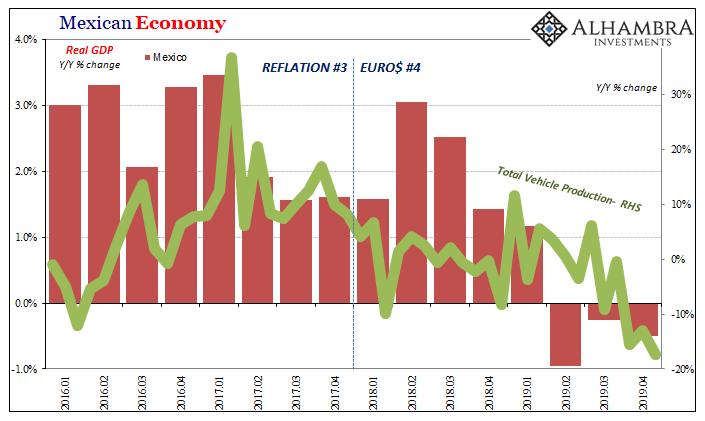

Economy: Curved Again

Earlier today, Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) confirmed the country’s economy is in recession. Updating its estimate for Q4 GDP, year-over-year output declined by 0.5% rather than -0.3% as first thought. On a quarterly basis, GDP was down for the second consecutive quarter which mainstream convention treats as a technical recession.

Read More »

Read More »

All-Stars #94 Jeff Snider: The slowdown started before the Coronavirus hit the tape!

Please visit our website https://www.macrovoices.com to register your free account to gain access to supporting materials.

Jeff Snider Chartbook: http://bit.ly/2T1IZbB

Read More »

Read More »

Schaetze To That

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil.

Read More »

Read More »

Seven Big-Picture Considerations for Covid-19

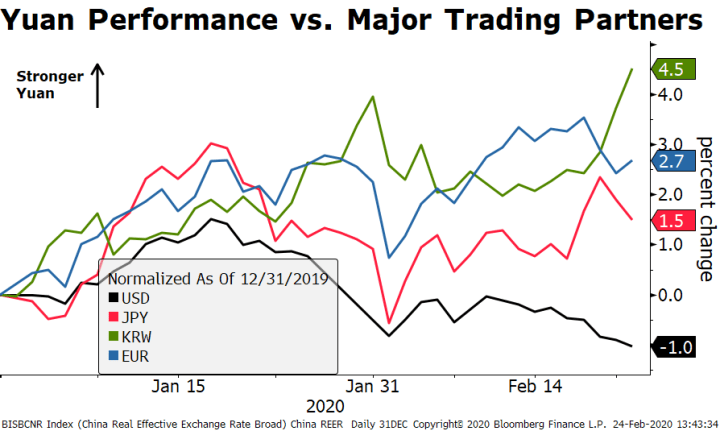

Below is a non-exhaustive list of medium- and long-term implications from the Covid-19. We discuss the yuan, China’s competitiveness, its position in the global production chains, the impact on the Phase One trade deal, and rising financial stability risks. Globally, the virus will bring about a new wave of fiscal spending and revive the discussions about the limits of monetary policy.

Read More »

Read More »

Was It A Midpoint And Did We Already Pass Through It?

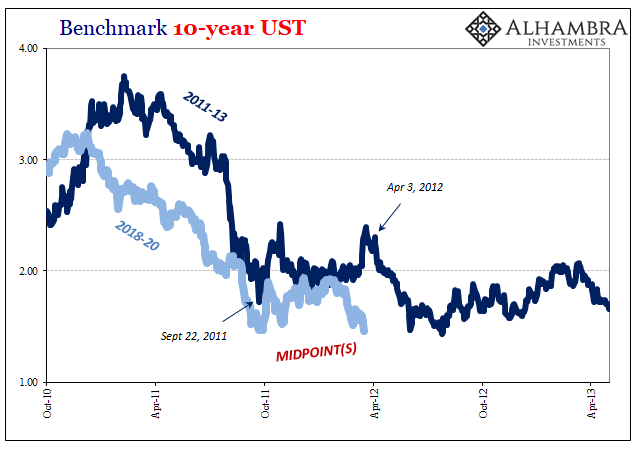

We certainly don’t have a crystal ball at the ready, and we can’t predict the future. The best we might hope is to entertain reasonable probabilities for it oftentimes derived from how we see the past. Which is just what statistics and econometrics attempt. Except, wherein they go wrong we don’t have to make their mistakes.

Read More »

Read More »

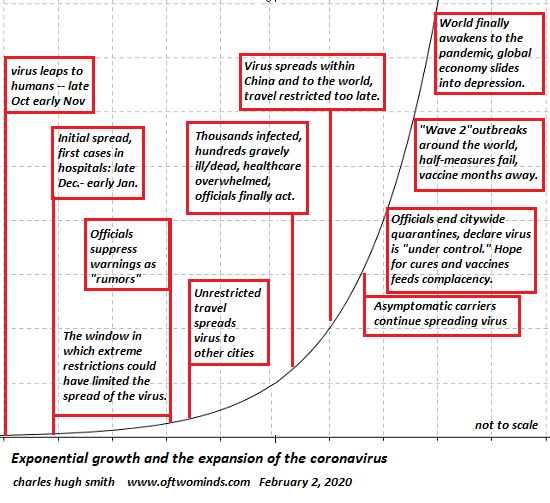

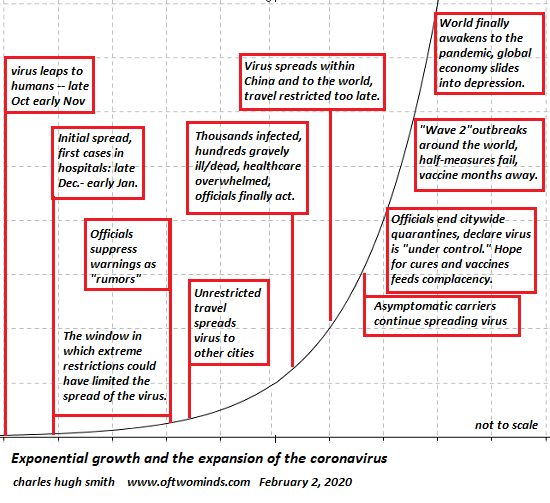

When Will We Admit Covid-19 Is Unstoppable and Global Depression Is Inevitable?

Given the exquisite precariousness of the global financial system and economy, hopes for a brief and mild downturn are wildly unrealistic. If we asked a panel of epidemiologists to imagine a virus optimized for rapid spread globally and high lethality, they'd likely include these characteristics: 1. Highly contagious, with an R0 of 3 or higher.

Read More »

Read More »

EM Preview for the Week Ahead

The still-growing impact of the coronavirus should keep EM and risk sentiment under pressure this week. The weekend G20 meeting in Saudi Arabia acknowledged the risks to the global economy and said participants agreed on a “menu of policy options.” However, the G20 offered little specific in terms of a coordinated policy response.

Read More »

Read More »

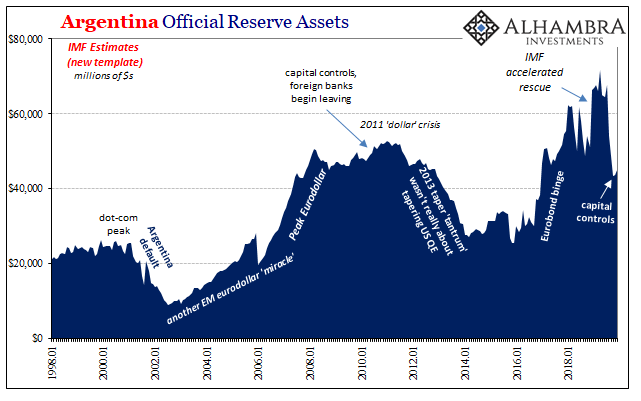

Time Again For Triple Digit Dollar

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig.

Read More »

Read More »

Covid-19: Global Retrenchment Will Obliterate Sales, Profits and Yes, Big Tech

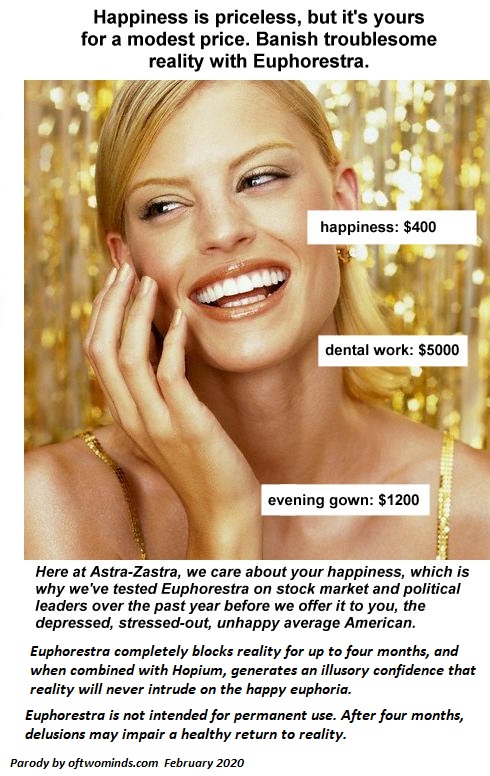

If you think global demand will rebound as global debt and confidence implode, you better not be making consequential decisions based on Euphorestra-addled magical thinking. Even before the Covid-19 pandemic, the global economy was slowing for two reasons: 1) everybody who can afford it already has it and 2) overcapacity. One word captures the end-of-the-cycle stagnation: saturation.

Read More »

Read More »

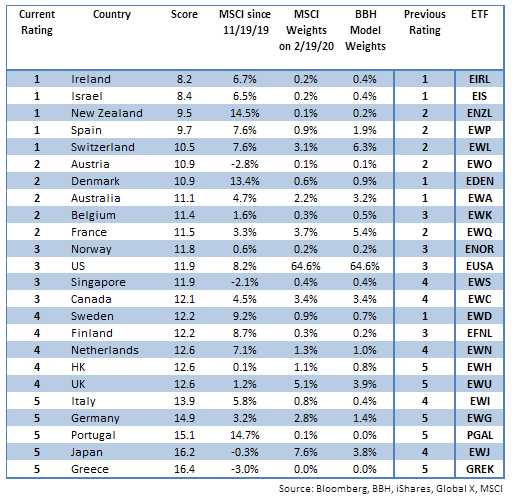

DM Equity Allocation Model For Q1 2020

Developed equity markets remain near the highs despite mounting concerns about the impact of the coronavirus. MSCI World made a new all-time high last week near 2435 and is up 2.5% YTD. Our 1-rated grouping (outperformers) for Q1 2020 consists of Ireland, Israel, New Zealand, Spain, and Switzerland.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Picks Up Again

Negative news on the coronavirus has kept risk appetite subdued across the board; the dollar rally continues. During the North American session, we will get some more clues to the state of the US economy; FOMC minutes were largely as expected. UK January retail sales came in firm; ECB releases the account of its January 23 meeting.

Read More »

Read More »

Afghanistan: why the Taliban can’t be defeated | The Economist

After almost 20 years of war with America, the Taliban control ever more territory in Afghanistan. Why has America failed to defeat them? Read more here: https://econ.st/2uS0lOX Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Further reading: “Mapping Taliban control in Afghanistan“ Long War Journal https://econ.trib.al/7T1u2aP Hub of Afghanistan coverage by The Economist: …

Read More »

Read More »