Category Archive: 5) Global Macro

Is this the Beginning of a Recession?

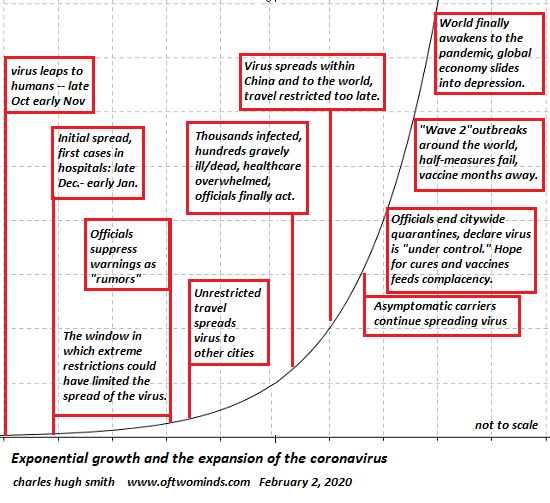

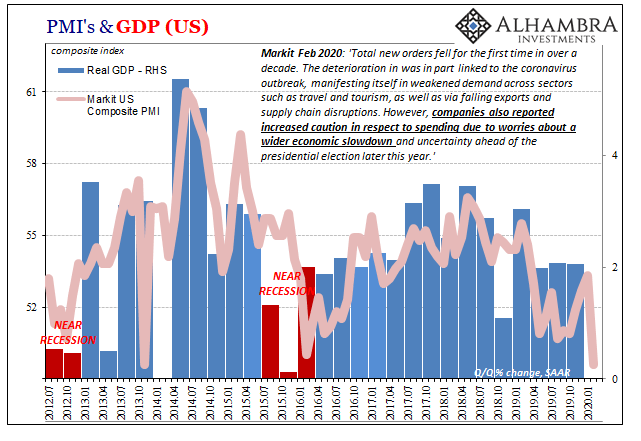

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn.

Read More »

Read More »

CHARLES HUGH SMITH Italian Top 3 in the Pandemic Deaths Surge 57% THIS GOES DEEP !

CHARLES HUGH SMITH- Italian- Top 3 in the Pandemic. Deaths Surge 57%. THIS GOES DEEP ! CHARLES HUGH SMITH- Italian- Top 3 in the Pandemic. Deaths Surge 57%. THIS GOES DEEP ! CHARLES HUGH SMITH- Italian- Top 3 in the Pandemic. Deaths Surge 57%. THIS GOES DEEP ! https://youtu.be/TPSmBmHLP5E

Read More »

Read More »

Dollar Firm as Global Financial Markets Calm

Global financial markets are finally seeing a measure of calm return; local Chinese media is sounding more confident that the situation is now under control. The White House will announce fiscal measures today; five states hold primaries and one holds a caucus with 352 total pledged delegates up for grabs.

Read More »

Read More »

CHARLES HUGH SMITH: Italian- Top 3 in the Pandemic. Deaths Surge 57%. THIS GOES DEEP !

For the full transcript go to: https://www.financialanalysis.tv #Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver #Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill …

Read More »

Read More »

Mangroves: how they help the ocean | The Economist

Mangrove forests are vital for the health of the planet, but they’re rapidly disappearing. Meet the the pioneering scientists who are harnessing the hidden power of mangroves to help tackle climate change. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video …

Read More »

Read More »

What the Fed Can Do: Print and Buy, Buy, Buy

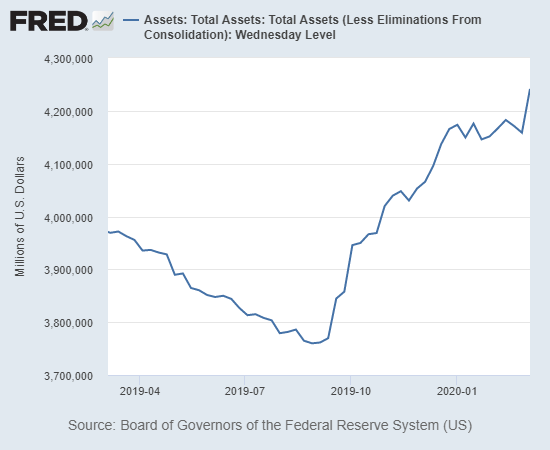

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon. Much has been written about what the Federal Reserve cannot do: it can't stop the Covid-19 pandemic or reverse the economic damage unleashed by the pandemic.

Read More »

Read More »

Drivers for the Week Ahead

Risk-off sentiment continues to build as the coronavirus spreads. Fed easing expectations continue to intensify; February inflation readings for the US will be reported this week. The ECB meets Thursday and markets are split; the stronger euro is doing the eurozone economy no favors. The UK has a heavy data release schedule Wednesday; UK government also releases its budget that day.

Read More »

Read More »

CHARLES HUGH SMITH: Coronavirus, Italian Nightmare – THIS GOES DEEP!

EXCLUSIVE REPORTS ON PRESIDENT TRUMP AND THE WITCH HUNT! LP(S) – Maga LP(S) – Media LP(S) – Epic LP(S) – Election EDUCATE YOURSELF IMMEDIATELY: LP(S) – Enemy LP(S) – Dead LP(S) – Ratio PREPARE FOR THE BEAR MARKET: LP(S) – Bear Warren Buffett, Ray Dalio, Charlie Munger And Other Notable Billionaires Have All Focused On …

Read More »

Read More »

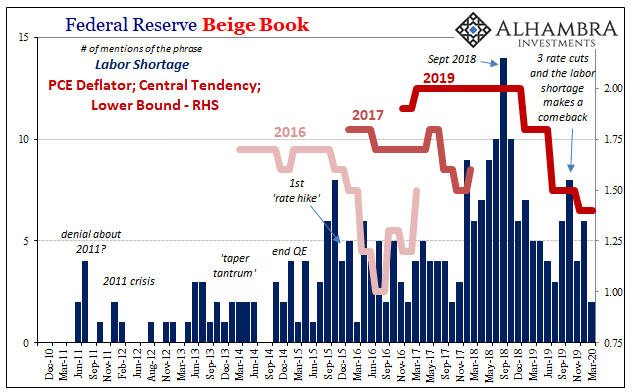

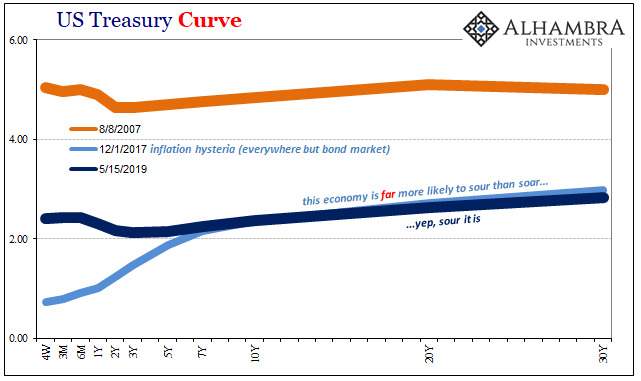

Like Repo, The Labor Lie

The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors.

Read More »

Read More »

The Gathering Storm: Could Covid-19 Overwhelm Us in the Months Ahead?

Either the science is wrong and the complacent will be proven correct, or the science is correct and the complacent will be wrong. The present disconnect between the science of Covid-19 and the status quo's complacency is truly crazy-making, as we face a binary situation: either the science is correct and all the complacent are wrong, or the science is false and all the complacent are correct that the virus is no big deal and nothing to fret about.

Read More »

Read More »

Charles Hugh Smith EXCLUSIVE: Coronavirus PARALYZES Global Economy – RECESSION 100%!

EXCLUSIVE REPORTS ON PRESIDENT TRUMP AND THE WITCH HUNT! LP(S) – Maga LP(S) – Media LP(S) – Epic LP(S) – Election EDUCATE YOURSELF IMMEDIATELY: LP(S) – Enemy LP(S) – Dead LP(S) – Ratio PREPARE FOR THE BEAR MARKET: LP(S) – Bear Warren Buffett, Ray Dalio, Charlie Munger And Other Notable Billionaires Have All Focused On …

Read More »

Read More »

Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order

Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order http://financialrepressionauthority.com/2020/03/05/the-roundtable-insight-yossi-kaplan-and-charles-hugh-smith-on-the-virus-and-the-new-world-order/

Read More »

Read More »

Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January.

Read More »

Read More »

The Greenspan Moon Cult

Taking another look at what I wrote about repo and the latest developments yesterday, it may be worthwhile to spend some additional time on the “why” as it pertains to so much determined official blindness, an unshakeable devotion to otherwise easily explained lunar events.

Read More »

Read More »

Updated Democratic Primary Timeline

Super Tuesday has come and gone. Bloomberg has suspended his campaign after an extremely poor showing, and Warren is expected to follow suit soon. Here is our updated take on the likely Democratic candidate.

Read More »

Read More »

Election 2020: How do America’s presidential primaries work? | The Economist

As the Democratic primary race enters its busiest period, John Prideaux, The Economist’s US editor, gives his essential guide to understanding the process by which America’s presidential candidates are chosen. Read more here: https://econ.st/2IdvpvD Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/

Read More »

Read More »

A Day For Rate Cuts

Well, that wasn’t he had in mind. The whole point of a rate cut, any rate cut let alone an emergency fifty, is to signal especially the stock market that the Fed is in the business of…something. The public has been led, by and large, to assume that something good happens when the Fed Chair shows up on TV.

Read More »

Read More »

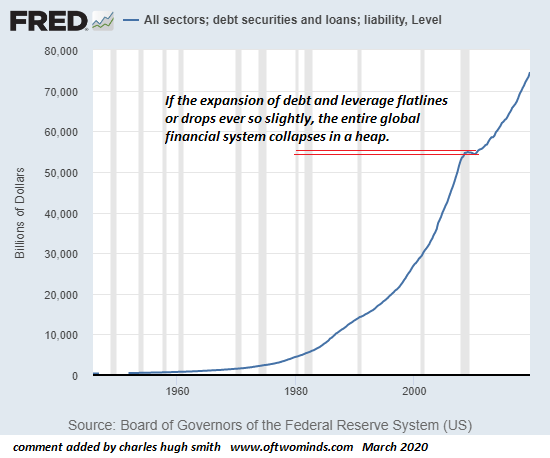

Did Covid-19 Just Pop All the Global Financial Bubbles?

Once confidence and certainty are lost, the willingness to expand debt and leverage collapses. Even though the first-order effects of the Covid-19 pandemic are still impossible to predict, it's already possible to ask: did the pandemic pop all the global financial bubbles? The reason we can ask this question is the entire bull mania of the 21st century has been based on a permanently high rate of expansion of leverage and debt.

Read More »

Read More »

Election 2020: What could Super Tuesday mean for the future of the Democratic Party? | The Economist

As America heads into Super Tuesday, the race to become the Democratic nominee for president is approaching a decisive moment. John Prideaux, The Economist’s US editor, discusses the implications on “Checks and Balance”, The Economist’s podcast about American politics. If you’d like to subscribe to our Checks and Balance podcast, click here: https://econ.st/39iBwKH Click here …

Read More »

Read More »

Drivers for the Week Ahead

The dollar has softened as Fed easing expectations have picked up. Late Friday, Chair Powell issued an unscheduled statement saying the Fed is monitoring the virus and will act as appropriate. This is a big data week for the US; the Fed releases its Beige Book report Wednesday. Super Tuesday comes this week; Bank of Canada meets Wednesday.

Read More »

Read More »