Category Archive: 5) Global Macro

The World Has Changed More Than We Know

Put another way: eras end. While the mainstream media understandably focuses on the here and now of the pandemic, some commentators are looking at the long-term consequences. Here is a small sampling: While each of these essays offers a different perspective, let's focus on the last two: Ugo Bardi's essay on Hyperspecialization and the technological responses described in the MIT Technology Review essay.

Read More »

Read More »

How to treat covid-19 | The Economist

A vaccine for covid-19 is a long way off. In the meantime, could existing drugs be used to treat the novel coronavirus? Read more here: https://econ.st/2wtEOgf Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Further reading: Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: …

Read More »

Read More »

Lessons from Singapore?

Singapore has been hailed for its quick response to the coronavirus that limited initial infections, but the outlook is shifting. Despite their early success, they will have to revert to a lockdown. Can Singapore’s experience offer any lessons for European and the US policymakers?

Read More »

Read More »

Dollar Firm as Europe Fails to Deliver

The dollar is stabilizing; reports suggest the White House is developing a plan to reopen the US economy sooner rather than later. Both Hong Kong and Singapore just tightened restrictions on gathering and movement. FOMC minutes for the March 15 decision will be released today.

Read More »

Read More »

Fragile, Not Fortified

On Sunday, Argentina’s government announced it was postponing payment on any domestically-issued debt instruments denominated in foreign currencies. That means dollars, just not Eurobonds. At least not yet. In response, ratings agencies such as Fitch declared the maneuver a distressed debt exchange.In other words, technically a default.

Read More »

Read More »

What Will The Post-Coronavirus World Look Like? (Martenson, Rubino, Smith & Taggart)

If covid-19 is indeed hastening the permanent disruption of the status quo, what will life in a post-coronavirus world look like? This prognosticating session builds on last week’s Economic Shockwaves roundtable: https://www.peakprosperity.com/economic-shockwaves/ This time, John Rubino, Charles Hugh Smith and Adam Taggart — also joined by Chris Martenson this time — discuss the myriad ways …

Read More »

Read More »

Restricted Market Trading Comments

With many markets still under lockdown and some going out on Easter holidays this week, we continue to see amended trading hours. The most notable change has been in India with a reduction in trading hours, while in Nigeria we saw a small amount of liquidity being released by the Central Bank of Nigeria (CBN). Below are our updates for the week.

Read More »

Read More »

How Africa could one day rival China | The Economist

Africa is changing so fast, it is becoming hard to ignore. In the short term the continent faces many problems, including covid-19, but in the long term it could rival China’s economic might. Read more here: https://econ.st/2V8HGY9 doc See the UN’s World Population Prospects 2019 here: https://econ.trib.al/ClGiknr Read about covid-19 in African countries: https://econ.trib.al/LDMdqwr Click …

Read More »

Read More »

It’s Hard To See Anything But Enormous Long-term Cost

The unemployment rate wins again. In a saner era, back when what was called economic growth was actually economic growth, this primary labor ratio did a commendable job accurately indicating the relative conditions in the labor market. You didn’t go looking for corroboration because it was all around; harmony in numbers for a far more peaceful and serene period.

Read More »

Read More »

Dollar Mixed, Equities Higher as Virus News Stream Improves

It was a relatively good weekend in virus-related news; measures of implied volatility continue to trend lower. The dollar is trying to build on its recent gains; investors continue to try and gauge just how bad the US economy will get hit. The outlook for oil prices remains highly uncertain and volatile.

Read More »

Read More »

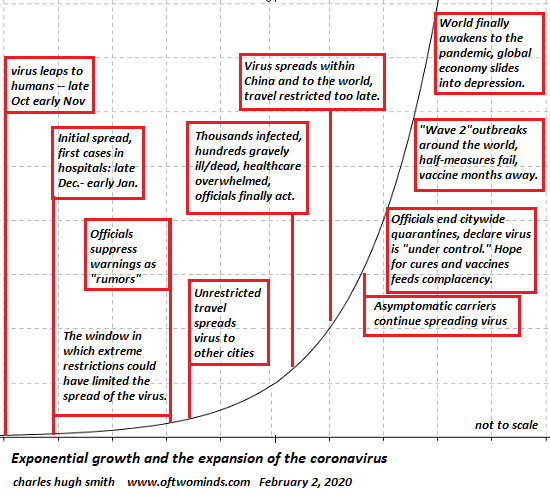

If Lockdown Is a Needless Over-Reaction, Then Why Did China Lockdown Half its Economy?

Recall that the initial deaths and related costs are only the first-order effects; policy makers have to consider the second-order effects. Everyone who reckons that the lockdown is needless and more destructive than the pandemic that triggered it has to answer this question: then why did China lockdown half its economy?

Read More »

Read More »

EM Preview for the Week Ahead

EM may get a little support from a potential OPEC+ deal to limit oil. Even if a deal is struck, the impact is likely to be fleeting as the global growth outlook remains terrible. We remain negative on EM for the time being.

Read More »

Read More »

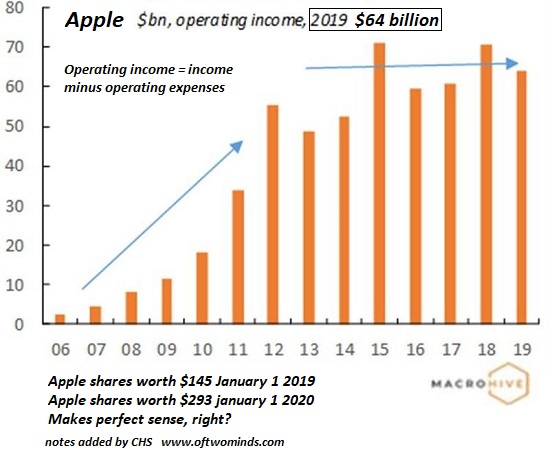

When Bulls Are Over-Anxious to Catch the Rocketship Higher, This Isn’t the Bottom

Everyone with any position in today's market will be able to say they lived through a real Bear Market. In the echo chamber of a Bull Market, there's always a reason to get bullish: the consumer is spending, housing is strong, the Fed has our back, multiples are expanding, earnings are higher, stock buybacks will push valuations up, and so on, in an essentially endless parade of self-referential reasons to buy, buy, buy and ride the rocketship...

Read More »

Read More »

Covid-19: how bad will it be for the economy? | The Economist

The coronavirus pandemic has killed thousands of people, crashed stockmarkets around the world, driven 10m Americans to claim unemployment and caused businesses to haemorrhage money. With economies in turmoil, how bad will the damage be? Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.trib.al/StVR1bU Find The …

Read More »

Read More »

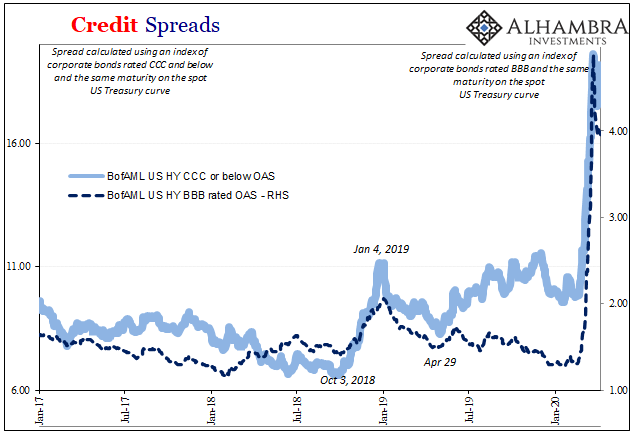

Banks Or (euro)Dollars? That Is The (only) Question

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes.

Read More »

Read More »

Dollar Bid as Market Sentiment Worsens

The virus news stream out of Europe has improved a bit. The US is already taking about the next relief bill; the Fed continues to roll out measures to address dollar funding issues. ADP and ISM manufacturing PMI are the US data highlights. Regulators across Europe are asking banks to stop paying dividends; eurozone and UK reported final manufacturing PMIs.

Read More »

Read More »

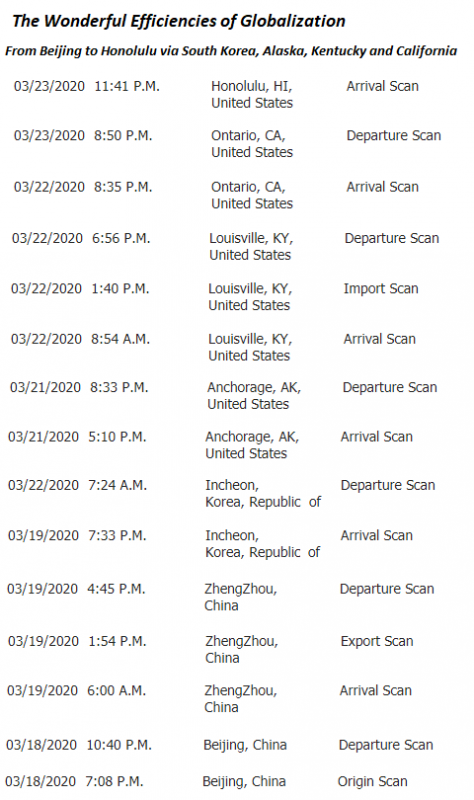

The Wonderful Insanity of Globalization

So here's an April Fools congrats to globalization's many fools. The tradition here at Of Two Minds is to make use of April Fool's Day for a bit of parody or satire, but I'm breaking with tradition and presenting something that is all too real but borders on parody: the wonderful insanity of globalization.

Read More »

Read More »

Gadfly Public Interview: Charles Hugh Smith – Of Two Minds Blog

Start your FREE 30-day subscription today https://thegadfly.vhx.tv/ Visit and support Charles with his work: https://www.oftwominds.com/blog.html

Read More »

Read More »

Charles Hugh Smith on the Social, Financial and Economic Implications of the Coronavirus!

Charles Hugh Smith on the Social, Financial and Economic Implications of the Coronavirus! http://financialrepressionauthority.com/2020/04/01/the-roundtable-insight-charles-hugh-smith-on-the-social-financial-and-economic-implications-of-the-coronavirus/

Read More »

Read More »

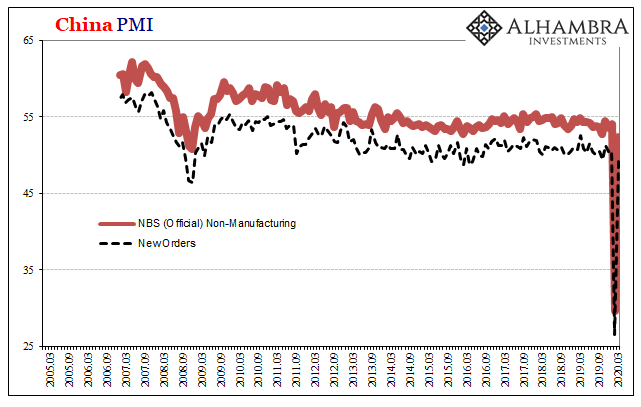

China’s Back!

The Washington Post began this week by noting how the US economy seems to have lost its purported zip just when it needed that vitality the most. Never missing a chance to take a partisan swipe, of course, still there’s quite a lot of truth behind the charge. An actual economic boom produces cushion, enough of one that President Trump and his administration may have been counting on it when opting for full-blown shutdown.

Read More »

Read More »