Category Archive: 5) Global Macro

The Art of Survival, Taoism and the Warring States

Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the first essay, from June 2008. Thank you, Paul, for the suggestion. I'm not trying to be difficult, but I can't help cutting against the grain on topics like surviving the coming bad times when my experience runs counter to the standard received wisdom.

Read More »

Read More »

Covid-19: what the world has learned during lockdown | The Economist

Lockdowns appear to have slowed the spread of covid-19. But what has the world learned about the virus during this time? Ed Carr, The Economist's deputy editor, and Callum Williams, our senior economics correspondent, answer your questions. Read more here: https://econ.st/2WtcLGF

Further reading:

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ

Sign up to The Economist’s daily newsletter to keep up to date...

Read More »

Read More »

Covid-19: what the world has learned during lockdown | The Economist

Lockdowns appear to have slowed the spread of covid-19. But what has the world learned about the virus during this time? Ed Carr, The Economist’s deputy editor, and Callum Williams, our senior economics correspondent, answer your questions. Read more here: https://econ.st/2WtcLGF Further reading: Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ Sign up …

Read More »

Read More »

MACRO ANALYTICS – 04-30-20 – MAIN STREET Shock!

31 Minutes with 24 Supporting Slides If you enjoyed this video you will find the following integrating newsletters of value. They expand on the video content with associated security charts: VIDEO NEWSLETTER-1 https://conta.cc/2AdDiQQ – 05-08-20 – Focus: MONOLINES & MUNI’S VIDEO NEWSLETTER-2 https://conta.cc/3cywcom – 05-10-20 – Focus: Commercial REITS Notification Sign-Up for Free Video Newsletter …...

Read More »

Read More »

Why Assets Will Crash

This is how it happens that boats that were once worth tens of thousands of dollars are set adrift by owners who can no longer afford to pay slip fees. The increasing concentration of the ownership of wealth/assets in the top 10% has an under-appreciated consequence: when only the top 10% can afford to buy assets, that unleashes an almost karmic payback for the narrowing of ownership, a.k.a. soaring wealth and income inequality: assets crash.

Read More »

Read More »

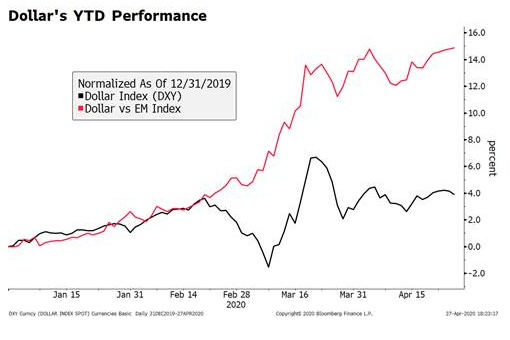

Dollar Remains Under Pressure as Europe Unveils Some Plans to Reopen

Global equity markets continue to trend higher; the dollar remains under pressure. The two-day FOMC meeting ends today; the first look at Q1 US GDP comes out. France and Spain laid out plans to reopen; the UK will rely on a contact tracing plan to limit the viral spread.

Read More »

Read More »

Some Thoughts on Recent Foreign Exchange Intervention

Dollar softness this week will take some pressure off of the foreign currencies but it’s too early to sound the all clear. This piece focuses on how central banks around the world may be intervening to influence their currencies. Most of the world, particularly EM, is grappling with supporting weak currencies but a select few are dealing with stronger currencies. This is a very opaque process and so we are simply making our best guesses.

Read More »

Read More »

Charles Hugh Smith on how COVID 19 will affect Jobs and the Economy

http://financialrepressionauthority.com/2020/05/01/the-roundtable-insight-charles-hugh-smith-on-how-covid-19-will-affect-jobs-and-the-economy/

Read More »

Read More »

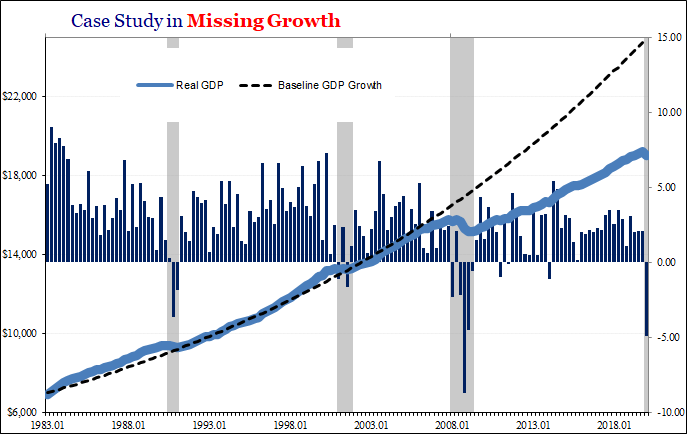

GDP + GFC = Fragile

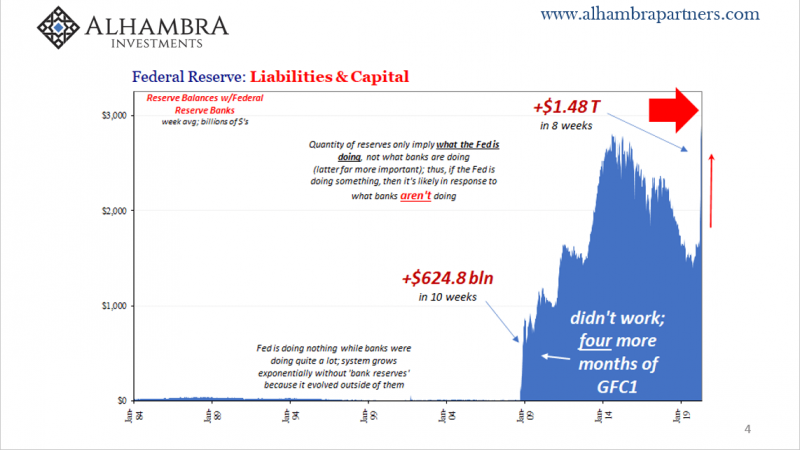

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation.

Read More »

Read More »

COT Black: No Love For Super-Secret Models

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust.

Read More »

Read More »

How to stop plastic getting into the ocean | The Economist

Plastic pollution poses a major threat to ocean life. Meet the engineers who are using rubbish-guzzling boats to stem the flow at its source. Read more here: https://econ.st/3d0bjCe

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

For more from Economist Films visit: http://films.economist.com/

Read More »

Read More »

How to stop plastic getting into the ocean | The Economist

Plastic pollution poses a major threat to ocean life. Meet the engineers who are using rubbish-guzzling boats to stem the flow at its source. Read more here: https://econ.st/3d0bjCe Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/

Read More »

Read More »

Unbounded Conversations Episode 7 – Jeffrey Snider

Alhambra Investments CIO Jeffrey Snider joins Zach & Jack for the seventh installment of Unbounded Conversations to discuss shadow money and its effects on the global economy.

The Unbounded Conversations video series features discussions between Unbounded Managing Partner Zach Resnick, Principals Dave Mullen-Muhr & Jack Laskey, & various guests building businesses on Bitcoin. In this series they discuss the possibilities of what...

Read More »

Read More »

Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot. As the week commences, a few markets such as Sri Lanka and Philippines are extending their lockdown periods while others such as Nigeria and Kenya continue to experience USD liquidity issues. Please see comments below.

Read More »

Read More »

All-Stars #103 Jeff Snider: The Myth of Central Bank Market Support (and liquidity)

Download chartbook: https://bit.ly/2YcW0lo

Alhambra Investments YouTube channel: https://bit.ly/2yU8Lqo

Please visit our website https://www.macrovoices.com to register your free account.

Read More »

Read More »

Follow-Up Question and Answer Session on Repos with Jeff Snider-April 28, 2020

FuturesTrader71 meets with Jeff Snider, head of Global Research at Alhambra Investment Partners to review follow up questions from the Repo market webinar held on April 15, 2020.

Read More »

Read More »

With Superfluous Demand in Free-Fall, What’s the Upside of Re-Opening a Small Business?

Since superfluous demand was the core driver of most consumer spending, and that demand is in free-fall, what's the upside of re-opening? The mainstream view assumes everyone will be gripped by an absolutely rabid desire to return to their pre-pandemic frenzy of borrowing and spending and consuming, the more the better.

Read More »

Read More »

The Puppet Show Is Powerful

I never said it wasn’t powerful. What I continue to show is that it doesn’t work. Ben Bernanke kept his job because despite the carnage, in times of turmoil people are willing to give anyone a second chance. And if the turmoil never ends, so much the luckier – for him.

Read More »

Read More »

Covid-19: the right way to leave lockdown | The Economist

Governments are starting to ease restrictions designed to curb covid-19. But with most of the world still vulnerable to the virus, what's the right way to leave lockdown? Read more here: https://econ.st/3bMn3YU

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

For more from Economist Films visit: http://films.economist.com/

Further reading:

Find The Economist’s most recent coverage of covid-19 here:...

Read More »

Read More »

Covid-19: the right way to leave lockdown | The Economist

Governments are starting to ease restrictions designed to curb covid-19. But with most of the world still vulnerable to the virus, what’s the right way to leave lockdown? Read more here: https://econ.st/3bMn3YU Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Further reading: Find The Economist’s most …

Read More »

Read More »