Category Archive: 5) Global Macro

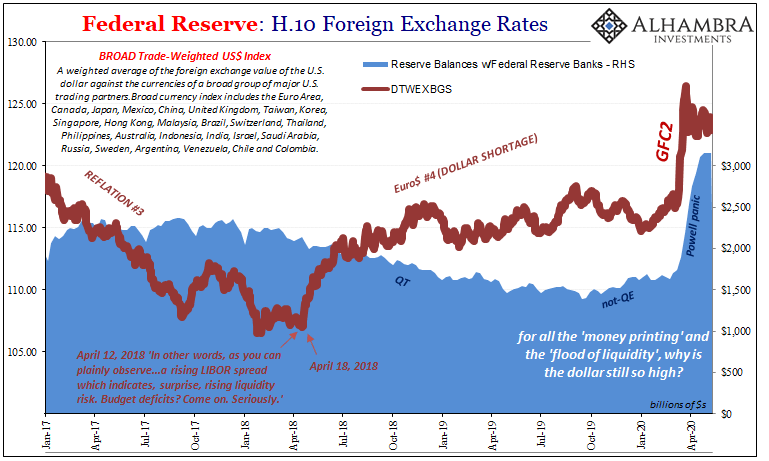

No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it.

Read More »

Read More »

Dollar Firm as US-China Tensions Flare

The virus news stream is mixed; the dollar has stabilized; US-China tensions continue to ratchet up. We will get some more US economic data for May; weekly jobless claims are expected at 2.4 mln. Eurozone and UK reported firm preliminary May PMI readings; BOE officials continue to take a very dovish tone.

Read More »

Read More »

What the Fed. w/ Jeff Snider & Emil Kalinowski; Crypto Liquidity, Inflation… and he hints at XRP

We have the honor of Hosting Alhambra Investments Chief Researcher, Jeff Snider and Eurodollar University's own Emil Kalinowski and we're going to peel back the layers or "perceived" layers of the Federal Reserve and Broader Financial Markets and ask the question... what would REAL US STIMULUS look like?

It's going to be an incredible Show!

Check out Eurodollar University - Alhambra Investments...

Read More »

Read More »

The Claims Podcast – Episode #1 – Jeff Snider

In the inaugural episode of The Claims Podcast, LSG COO Matthew Markham sits down with Jeff Snider of Gradient AI to discuss the future of predictive analytics in insurtech, legaltech and regtech. Both LSG and Gradient AI offer machine-learning-enabled software for insurance companies, TPAs and enterprises in order to bring down the cost of their legal spend, as part of a broader litigation spend management strategy.

***

ABOUT LSG

Website:...

Read More »

Read More »

Dollar Treads Water Ahead of FOMC Minutes

The virus news stream is mixed; the dollar has stabilized a bit. FOMC minutes will be released; Canada reports April CPI and March wholesale trade sales; the news from Brazil keeps getting worse. Another group of EU nations will release their own plan in a rebuttal of France and Germany; UK reported April CPI data.

Read More »

Read More »

So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal.That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected.

Read More »

Read More »

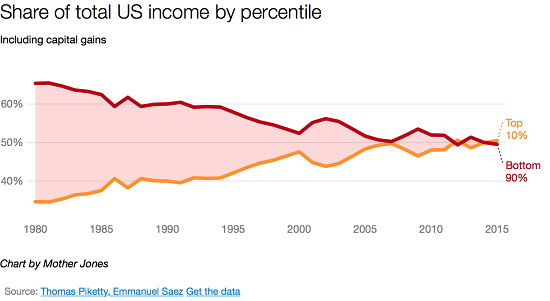

Consumer Spending Will Not Rebound–Here’s Why

Any economy that concentrates its wealth and income in the top tier is a fragile economy. There are two structural reasons why consumer spending will not rebound, no matter how open the economy may be. Virtually everyone who glances at headlines knows the global economy is lurching into either a deep recession or a full-blown depression, depending on the definitions one is using. Everyone also knows the stock market has roared back as if nothing...

Read More »

Read More »

Covid-19: Britain’s chief of the defence staff talks about the military challenges | The Economist

Armed forces around the world have mobilised to fight covid-19. General Sir Nick Carter, the most senior uniformed military adviser to the British government, talks to Anne McElvoy about the challenges—and dangers—posed by the pandemic. See all of The Economist’s podcasts here: https://econ.st/3g58fak China’s opacity has allowed conspiracy theories around covid-19’s origins to flourish. Where …

Read More »

Read More »

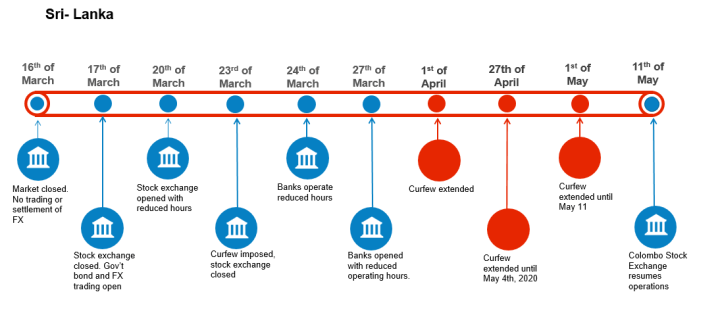

Restricted Market Trading Comments

Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below

Read More »

Read More »

There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates.No, stupid, declared Milton Friedman.

Read More »

Read More »

The Collapse of Main Street and Local Tax Revenues Cannot Be Reversed

The core problem is the U.S. economy has been fully financialized, and so costs are unaffordable. To understand the long-term consequences of the pandemic on Main Street and local tax revenues, we need to consider first and second order effects. The immediate consequences of lockdowns and changes in consumer behavior are first-order effects: closures of Main Street, job losses, massive Federal Reserve bailouts of the top 0.1%, loan programs for...

Read More »

Read More »

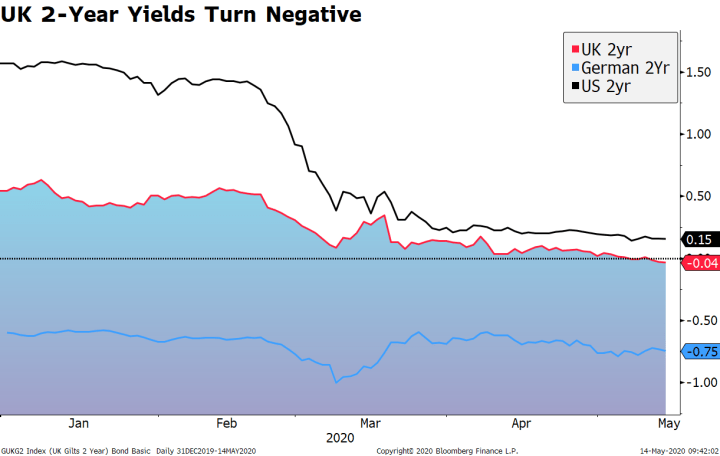

Dollar Firm as Risk-off Sentiment Intensifies

Risk-off sentiment has intensified; as a result, the dollar is getting some more traction. Fed Chair Powell pushed back against the notion of negative rates in the US; US Treasury completed its quarterly refunding. Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week; Mexico is expected to cut rates 50 bp to 5.5%

Read More »

Read More »

Can sea creatures adapt to climate change? | The Economist

Horseshoe crabs predate the dinosaurs and have survived mass extinctions and major climatic shifts. Meet the biologist who is researching these living fossils to see if they could hold evolutionary secrets for marine species in the face of climate change.

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

For more from Economist Films visit: http://films.economist.com/

Check out The Economist’s full video catalogue:...

Read More »

Read More »

Can sea creatures adapt to climate change? | The Economist

Horseshoe crabs predate the dinosaurs and have survived mass extinctions and major climatic shifts. Meet the biologist who is researching these living fossils to see if they could hold evolutionary secrets for marine species in the face of climate change. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films …

Read More »

Read More »

The global economy doesn’t care about the ECB (nor any central bank)

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.”They did it – and it didn’t take.Lagarde’s outreach was simply an act of admitting reality.

Read More »

Read More »

Dollar Mixed as Markets Await Fresh Drivers

The virus news stream is mixed; the dollar continues to consolidate; US-China tensions continue to rise. US Treasury wraps up its quarterly refunding; April budget statement is a harbinger of things to come; the next round of stimulus will be contentious. We got some dovish BOE comments yesterday; UK continues to play Brexit hardball; UK data was slightly better than expected but awful nonetheless.

Read More »

Read More »

Different Type of Crisis, Some Old Concerns

Over the past two months we have witnessed historic turmoil followed by unprecedented intervention by policy makers and central banks in supporting the capital markets (and more). In many ways the 2020 COVID-19 pandemic is very different from the 2008 global financial crisis, but for some, certain old concerns still linger. In the face of short selling bans and worries about market liquidity, we discuss below how best to navigate some of the common...

Read More »

Read More »

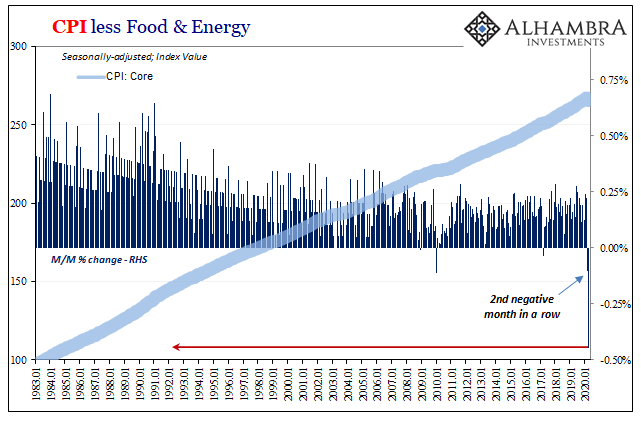

A Big One For The Big “D”

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy.

Read More »

Read More »

How covid-19 could change the financial world order | The Economist

America has dominated global finance for decades. But could covid-19 tip the balance of financial power in China's favour?

Further reading:

Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.trib.al/YD53WI6

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ

Read Matthieu Favas’ special report here: https://econ.st/3fAPKu1

How the pandemic is driving...

Read More »

Read More »

How covid-19 could change the financial world order | The Economist

America has dominated global finance for decades. But could covid-19 tip the balance of financial power in China’s favour? Further reading: Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.trib.al/YD53WI6 Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ Read Matthieu Favas’ special report here: …

Read More »

Read More »