Category Archive: 5) Global Macro

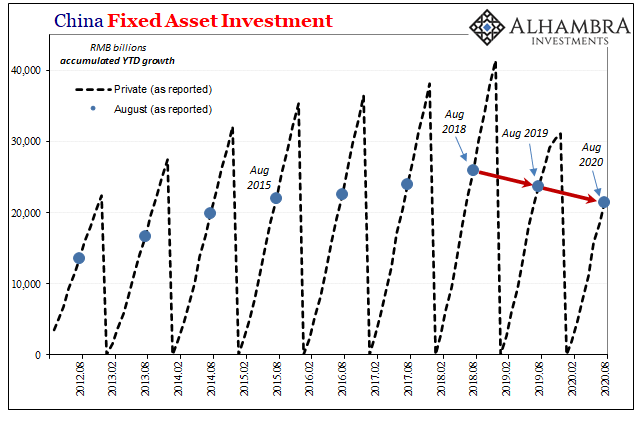

China’s Hole Puzzle

One day short of one year ago, on September 16, 2019, China’s National Bureau of Statistics (NBS) reported its updated monthly estimates for the Big 3 accounts. Industrial Production (IP) is a closely-watched indicator as it is relatively decent proxy for the entire goods economy around the world. Retail Sales in the post-Euro$ #2 context give us a sense of the Chinese economy’s persistent struggle to try to “rebalance” without the pre-2008 boost...

Read More »

Read More »

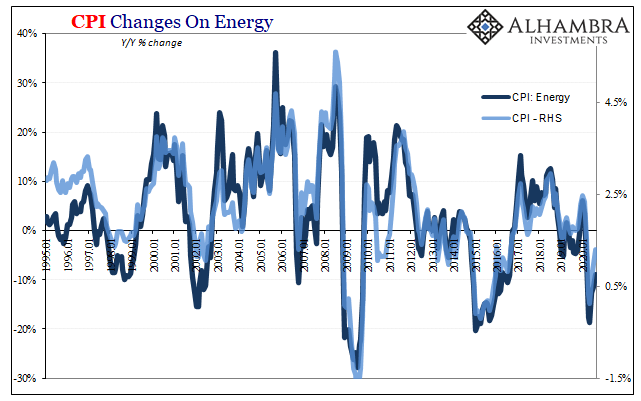

Inflation Karma

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements.

Read More »

Read More »

The Four D’s That Define the Future

When the money runs out or loses its purchasing power, all sorts of complexity that were previously viewed as an essential crumble to dust. Four D's will define 2020-2025: derealization, denormalization, decomplexification and decoherence. That's a lot of D's. Let's take them one at a time.

Read More »

Read More »

Dollar Bounce Ends Ahead of ECB Decision

The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill. US reports August PPI and weekly jobless claims; US will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday

BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25%.

Read More »

Read More »

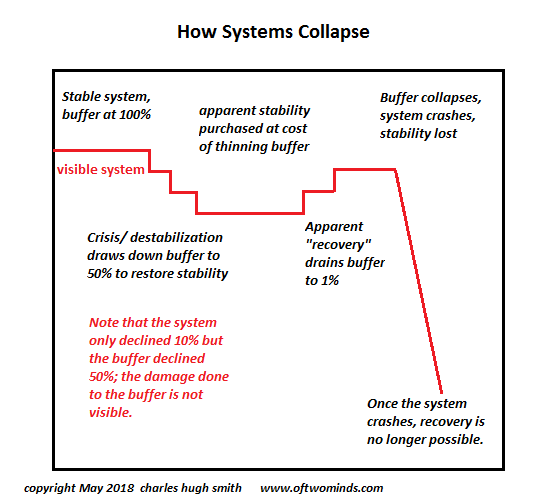

This Is How It Ends: All That Is Solid Melts Into Air

While the Federal Reserve and the Billionaire Class push the stock market to new highs to promote a false facade of prosperity, everyday life will fall apart. How will the status quo collapse? An open conflict--a civil war, an insurrection, a coup--appeals to our affection for drama, but the more likely reality is a decidedly undramatic dissolution in which all the elements of our way of life we reckoned were solid and permanent simply melt into...

Read More »

Read More »

Intolerance and Authoritarianism Accelerate Disunity and Collapse

Scapegoating dissenters only hastens the disunity and disarray that accelerates the final collapse. Authoritarianism is imposed on us, but its sibling intolerance is our own doing. Intolerance and authoritarianism are two sides of the same coin: as intolerance becomes the norm, the intolerant start demanding that the state enforce their intolerance by suppressing their enemies via increasingly heavy-handed authoritarian measures.

Read More »

Read More »

Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates?Not for nothing, every couple years when we do those (record low yields) that’s what “they”...

Read More »

Read More »

Netflix CEO: why you shouldn’t try to please your boss | The Economist Podcast

With 193m subscribers worldwide, Netflix has revolutionised the TV and film industry. Reed Hastings, the firm’s CEO, tells The Economist Asks podcast that its success is built on the radical management style he has created within the company.

00:00 How Netflix is managed

01:23 Why employees shouldn’t try to please their boss

03:09 Netflix's reputation for firing people

03:25 Unlimited holiday at Netflix

04:05 His management learning curve

Further...

Read More »

Read More »

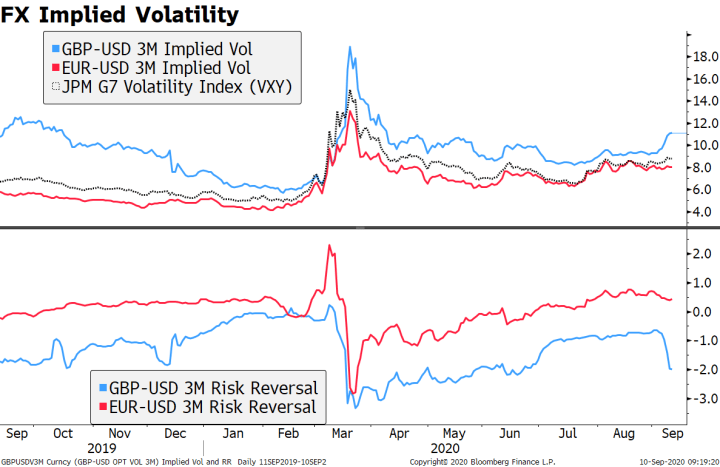

Sterling Pounded by Brexit Developments

The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today. Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation.

Read More »

Read More »

ECB Preview

The ECB meets tomorrow and is widely expected to stand pat. Macro forecasts may be tweaked modestly and there are some risks of jawboning against the stronger euro, but it should otherwise be an uneventful meeting. Looking ahead, a lot of room remains for further ECB actions.

Read More »

Read More »

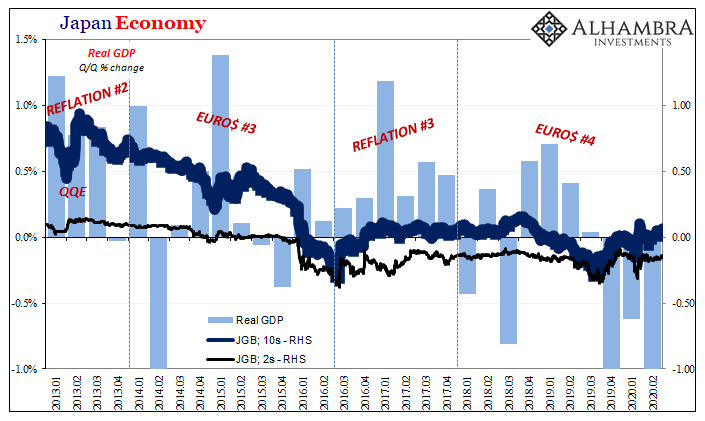

Bottleneck In Japanese

Japan’s yen is backward, at least so far as its trading direction may be concerned. This is all the more confusing especially over the past few months when this rising yen has actually been aiding the dollar crash narrative while in reality moving the opposite way from how the dollar system would be behaving if it was really happening.

Read More »

Read More »

The Economist Essentials: Public Debt | The Economist

The covid-19 pandemic is set to increase public debt to levels last seen after the second world war. But is rising public debt a cause for concern? New economic thinking suggests perhaps not, at least for now.

Further reading:

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/31E02VY

Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.st/3ghRh7W

Why economics...

Read More »

Read More »

Charles Hugh Smith on Intensifying Financial Repression Risks

Charles Hugh Smith on Intensifying Financial Repression Risks

http://financialrepressionauthority.com/2020/09/07/the-roundtable-insight-charles-hugh-smith-on-intensifying-financial-repression-risks/

Receive trading ideas weekly from Yra: https://cedarportfolio.com/yra-signup-form

Read More »

Read More »

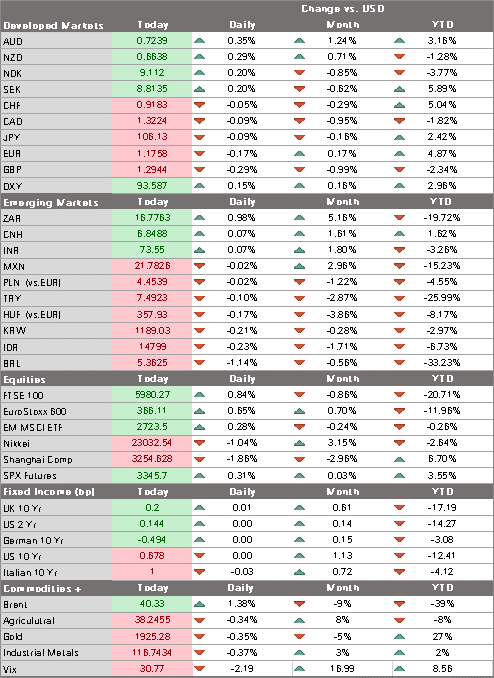

Monthly Market Monitor – August 2020

Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again.

Read More »

Read More »

EM Preview for the Week Ahead

EM performance this week will hinge crucially on whether US equity markets can find some traction. If sustained, last week’s equity rout could lead to a deeper generalized risk-off trading environment this week that would weigh on EM FX and equities.

Read More »

Read More »

Jeff Snider talks INFLATION, DEFLATION

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

?? Support! ;) http://www.ko-fi.com/aminray

#fed #reserve #trade #economy #dollar #bloomberg #neworldorder #finance #bitcoin

Jeff Snider talks INFLATION, DEFLATION

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 24, Part 2: Peering Behind The (Unemployment Rate) Curtain

———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Castbox: https://bit.ly/3fJR5xQ

Breaker: https://bit.ly/2CpHAFO

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

SoundCloud: https://bit.ly/3l0yFfK...

Read More »

Read More »

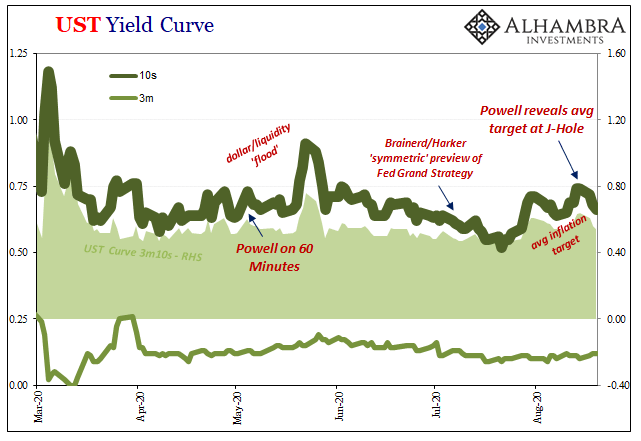

Powell Would Ask For His Money Back, If The Fed Did Money

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!!

Read More »

Read More »

Eurodollars & Global Deflation Risk W/ Jeff Snider | Expert View | Real Vision™

Is the global economy poised to enter another deflationary cycle? Jeff Snider, head of global research and chief investment strategist at Alhambra Partners, believes that we have never enjoyed a true recovery from the global financial crisis - but instead, have merely bounced between cycles of deflation and reflation. In this piece, Snider unpacks the importance of Eurodollars as a key to understanding where the global economy is headed next....

Read More »

Read More »

China v America: why universities are on the front line | The Economist

The covid-19 pandemic could cause a massive drop in the number of Chinese students travelling abroad. That would be disastrous for many Western universities—but for the Chinese government, it is a geopolitical opportunity. Read more here: https://econ.st/3557Pxz

Further reading:

Find The Economist’s most recent coverage of covid-19: https://econ.st/2CQRUr2

Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19...

Read More »

Read More »