Category Archive: 5.) Emerging Markets

Emerging Markets: What has Changed

China plans to issue its first USD-denominated bond since 2004. China’s largest banks banned North Koreans from opening new accounts. The UN Security Council approved new sanctions on North Korea. Relations between Poland and the European Commission remain tense. Brazil’s central bank appears to be signaling discomfort with ongoing BRL strength.

Read More »

Read More »

Les «diamants de sang» zimbabwéens circulent librement sur les marchés internationaux. La Tribune

L’ONG britannique Global Witness vient de publier ce 11 septembre un rapport explosif qui met à nu des opérations de détournement des revenus du secteur minier zimbabwéen par l’élite militaire et politique du pays pour financer les opérations répressives du régime du président Mugabe.

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

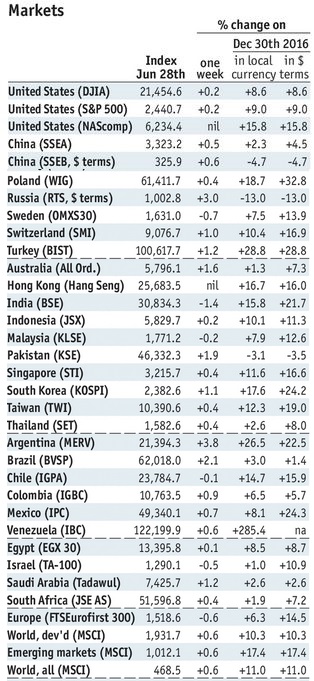

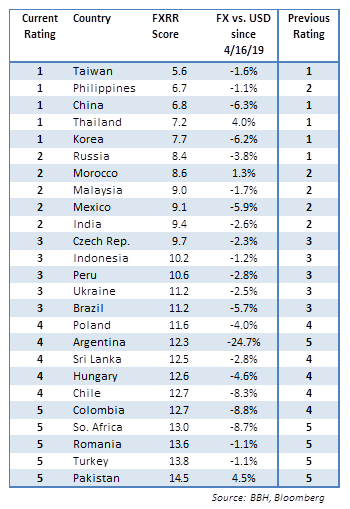

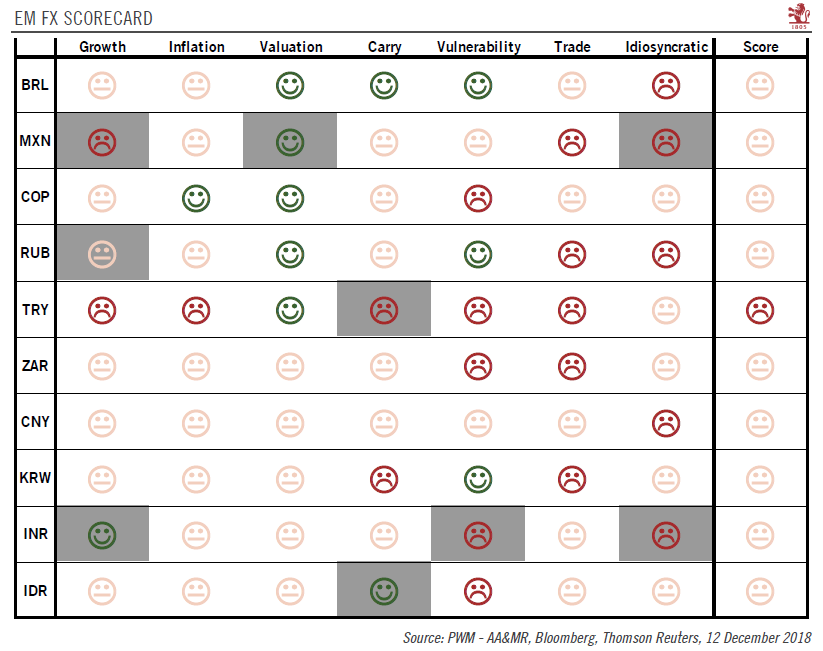

EM FX ended the week on a mixed note, but still capped off a strong week overall. US data this week could challenge the market’s dovish take on the Fed. For now, though, the global liquidity outlook still seems to favor further gains in EM.

Read More »

Read More »

Emerging Markets: What has Changed

South Korea completed installation of the THAAD missile shield. Indonesia is considering issuing its first global IDR-denominated sovereign bonds. Taiwan is undergoing a cabinet shuffle. Brazil has seen some positive political developments.

Brazil’s central bank signaled that the easing cycle is nearing an end and that the pace of easing will slow. Chile’s central bank boosted its growth forecasts.

Read More »

Read More »

Emerging Markets: What has Changed

India Prime Minister Modi has started a cabinet shuffle. Freeport McMorAn ceded control of the world’s second largest copper mine to the Indonesian government. Central Bank of Russia took over Bank Otkritie, once Russia’s largest private bank. Kenya’s top court nullified last month’s presidential election. Fitch cut Qatar’s rating by one notch to AA- with negative outlook.

Read More »

Read More »

Emerging Market: Preview of the Week Ahead

EM FX ended last week on a strong note, buoyed by perceived dovishness from Yellen at the Jackson Hole symposium. However, US jobs data this Friday could test the market’s convictions. Within EM, data are likely to support our view that EM central banks can retain their largely dovish posture into 2018.

Read More »

Read More »

La mondialisation de l’esclavage permet la croissance des entreprises. Dossier.

Un Indien travaillant dans une fabrique de briques à l’extérieur de Calcutta, le 7 mai 2017. DIBYANGSHU SARKAR / AFP Nous avons parlé ces derniers temps d’excédents et de déficits de balances commerciales. Pourtant aucune rubrique de cette comptabilité de l' »intégration » d’un Etat dans le monde globalisé ne pénalise celui-ci en matière d’abus de travailleurs, voire d’esclavagisme. Pire, les abus sont en croissance. Il faut dire que l’affaire est...

Read More »

Read More »

Emerging Markets: What has Changed

Tensions on the Korean peninsula are still rising. Hong Kong boosted its 2017 growth forecast. S&P affirmed Israel’s A+ rating but moved the outlook from stable to positive. The corruption investigation against Israeli Prime Minister Netanyahu has intensified. South Africa's parliament voted down the no confidence motion against President Zuma. Argentina officials are taking steps to support the peso. Banco de Mexico has ended its tightening cycle.

Read More »

Read More »

Emerging Markets: The Week Ahead

EM FX appears to be rolling over (see our recent piece “Is EM FX Finally Turning?”). Technical indicators are stretched as many EM currencies bump up against strong resistance levels. Strong US jobs data is bringing Fed tightening back into focus. We think ZAR could be shaping up to be the canary in a coalmine. It was -3% vs. USD last week and by far the worst in EM.

Read More »

Read More »

Emerging Markets: What has Changed

The Reserve Bank of India started an easing cycle by cutting all policy rates 25 bp. Bank Indonesia has tilted more dovish after signaling earlier this year that the easing cycle was over. Czech National Bank became the first in Europe to hike. Political risk is rising in Israel. President Trump signed the Russia sanctions bill. Nigeria is trying to unify its system of multiple exchange rates.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed last week, as markets await fresh drivers. Jobs report this Friday could provide greater clarity with regards to Fed policy. BOE and RBA meet but aren’t expected to change policy. Data is likely to reinforce the notion that inflation remains low in EM, allowing those central banks to remain dovish. Czech National Bank is the main exception, as it may start the tightening cycle this week.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesia’s parliament approved a revised budget for 2017 that sees a wider deficit. Pakistan’s Supreme Court has ousted Prime Minister Sharif. Polish President Duda vetoed portions of the judicial reform bill submitted by the Law and Justice party.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mixed on Friday, but largely firmer over the entire week. Top performers were BRL, KRW, and ZAR, while the worst were ARS, MXN, and RUB. FOMC meeting this week poses some potential risks to the global liquidity story that’s supporting EM. Within EM, the low inflation/easy monetary policy narrative should continue with data and events this week.

Read More »

Read More »

Emerging Markets: What has Changed

South Korea proposed resuming military and humanitarian exchanges with North Korea. The European Union may sanction Poland over its controversial judicial overhaul. Turkish Prime Minister Yildirim announced a cabinet shuffle after meeting with President Erdogan. Turkey’s worsening relations with Germany will come with economic costs. South African Reserve Bank surprised markets by starting the easing cycle with a 25 bp cut to 7.0%.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

Emerging Markets FX ended the week on a firm note, helped by softer than expected US data. Indeed, EM FX was up across the board for the entire week and was led by BRL, MXN, and ZAR. The ECB meeting this week will draw some interest, especially after the BOC last week became the second major central bank to hike rates.

Read More »

Read More »

Emerging Markets: What has Changed

Pakistani Prime Minister Nawaz Sharif may face trial on corruption charges. Turkey will reportedly pay $2.5 bln for a Russian missile defense system. Nigeria said it was willing to cap its oil production to support OPEC efforts to cut global supply. Former Brazilian President Lula was sentenced to nine and half years in prison on corruption charges. S&P downgraded Chile one notch to A+ with a stable outlook.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed last week on a firm note, as the stronger than expected US jobs gain was mitigated by lower than expected average hourly earnings. Still, we believe that global liquidity conditions will continue to move against EM, as the Fed continues tightening and others join in.

Read More »

Read More »

Emerging Markets: What has Changed

The US confirmed North Korea's claims that it tested an intercontinental ballistic missile. The Pakistani rupee was devalued, prompting a new central bank governor to be named. Vietnam’s central bank cut interest rates for the first time since March 2014. Egypt’s central bank surprised markets with a 200 bp hike to 18.75%. South Africa's ruling ANC reportedly proposed that SARB be state-owned. Petrobras announced two separate cuts to fuel prices.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a mixed note, as investors await fresh drivers. US jobs data on Friday could provide more clarity on Fed policy and the US economy. Within EM, many countries are expected to report lower inflation readings for June that support the view that most EM central banks will remain in dovish mode for now. We remain cautious on the EM asset class near-term.

Read More »

Read More »

Emerging Markets: What has Changed

Chinese President Xi visited Hong Kong for the first time. The US has proposed $1.3 bln of arms sales to Taiwan. The Egyptian government raised fuel and cooking gas prices. significantly as part of the IMF program. South Africa’s parliament has scheduled the no confidence vote on President Zuma. Brazil’s central bank lowered its inflation target. Brazil after President Temer was charged with corruption.

Read More »

Read More »