Category Archive: 5.) Emerging Markets

Emerging Markets: What Changed

China eased curbs on coal use for heating in the northern provinces to cope with colder weather. Poland announced a cabinet shuffle. Poland’s lower house approved the controversial judicial reform bill. President Trump announced that the US recognizes Jerusalem as Israel’s capital. Brazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Chile central bank cut its 2017 and 2018 inflation forecasts and shifted to a more dovish...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

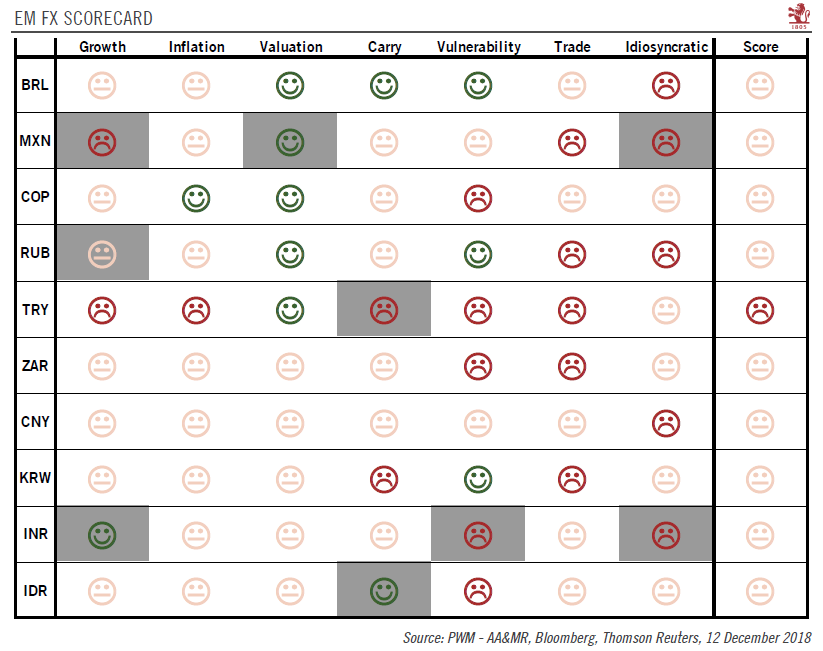

EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks.

Read More »

Read More »

Emerging Markets: What Changed

Bank of Korea hiked rates by 25 bp to 1.50%, the first hike in six years. Egypt central bank lifted the last remaining currency controls. S&P cut South Africa’s foreign currency rating one notch to BB with stable outlook. Turkey President Erdogan was implicated in an alleged plot to help Iran evade US sanctions. Moody’s upgraded Argentina one notch to B2 with stable outlook.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the holiday-shortened week on a soft note. While most were up on the entire week, notable laggards were TRY, CLP, and ZAR. All three currencies underperformed due to rising political risks, and we suspect that will continue. We believe MXN and BRL are likely to rejoin the laggards in the coming days.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the week firm, and capped off a good week overall. Best performers last week for ZAR and KRW, while the worst were TRY and IDR. Until we get higher US rates, the dollar may remain under modest pressure. This would help EM maintain some traction, though we remain cautious.

Read More »

Read More »

Emerging Markets: What has Changed

Moody's raised India's sovereign debt rating for the first time since 2004 by a notch to Baa2. Nigerian officials are on a global roadshow to support plans to issue its longest-dated Eurobonds ever. The head of South Africa’s budget office resigned.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed the week on a soft note. For the week as a whole, best performers were MYR, PLN, and COP, while the worst were BRL, ZAR, and INR. US inflation and retail sales data will likely set the tone for EM. Also, the US fiscal debate is set to continue this week, so expect lots of choppy trading across many markets.

Read More »

Read More »

Emerging Markets: What has Changed

China announced that it will remove foreign ownership limits on banks and other measures to open up the financial sector. Central Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. US-Turkey relations appear to be thawing slightly. Middle East tensions are rising on a variety of fronts. Argentina central bank unexpectedly hiked rates again.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week under pressure. News of the Venezuela debt restructuring was digested well, but sentiment went south as the day wore on. Weakness was concentrated in the weakest links TRY, BRL, RUB, and ZAR, while MXN and COP were dragged along for the ride. We see EM selling pressures persisting into 2018.

Read More »

Read More »

Emerging Markets: What has Changed

Russia’s Finance Ministry announced plans to increase its dollar. purchases in November. Bahrain has reportedly asked its Gulf allies for financial assistance. S&P upgraded Argentina a notch to B+ with stable outlook. Brazil raised BRL6.15 bln ($1.9 bln) by auctioning off the rights to explore 6 of the 8 deep-water oil blocks. Venezuela bowed to the inevitable, announcing that it would have to restructure its debt.

Read More »

Read More »

Emerging Markets: What has Changed

EM FX gained some limited traction Friday but still capped off another awful week. So far this quarter, the worst EM performers are TRY (-6%), MXN (-5%), ZAR (-4%), COP, and BRL (both -2.5%). We expect these currencies to remain under pressure as political concerns are unlikely to dissipate anytime soon.

Read More »

Read More »

Emerging Markets: What has Changed

President Xi Jinping’s concepts of socialist thinking were written into China’s constitution. Malaysia Prime Minister Najib presented an expansionary budget for 2018 ahead of elections. Czech billionaire Andrej Babis’ ANO party won the elections. South Africa's mid-term budget statement acknowledged the deteriorating outlook but offered little in the way of solutions. Press reports suggest Germany is working to cut funding for Turkish banks.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week on a soft note. Indeed, nearly every EM currency was down for the entire week, led by ZAR, BRL, and TRY. While higher US rates will pressure EM FX as a whole, we think heightend political risk will continue to hit these three currencies particularly hard, plus perhaps MXN too.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed the week on a firm note, as softer than expected US CPI data weighed on the dollar. We continue to believe that investors are underestimating the Fed’s tightening potential. Meanwhile, idiosyncratic political risk remains high for MXN, TRY, and ZAR.

Read More »

Read More »

Emerging Markets: What has Changed

Thailand announced general elections will be held in November 2018. Czech police filed criminal charges against ANO leader Andrej Babis. South Africa President Zuma may face corruption charges that were previously dropped. The US suspended visa services for travelers from Turkey. Kenyan opposition candidate Odinga withdrew from a redo of the annulled presidential election. Saudi Arabia will take a more gradual approach to removing fuel subsidies....

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week under pressure, as US data points to a rate hike in December and perhaps more in 2018. FOMC minutes this Wednesday will be closely studied for clues. US retail sales and CPI data Friday will also be important. We believe the most vulnerable currencies in this environment are ZAR and TRY, but one could also add MXN and perhaps RUB to that mix too.

Read More »

Read More »

Emerging Markets: What has Changed

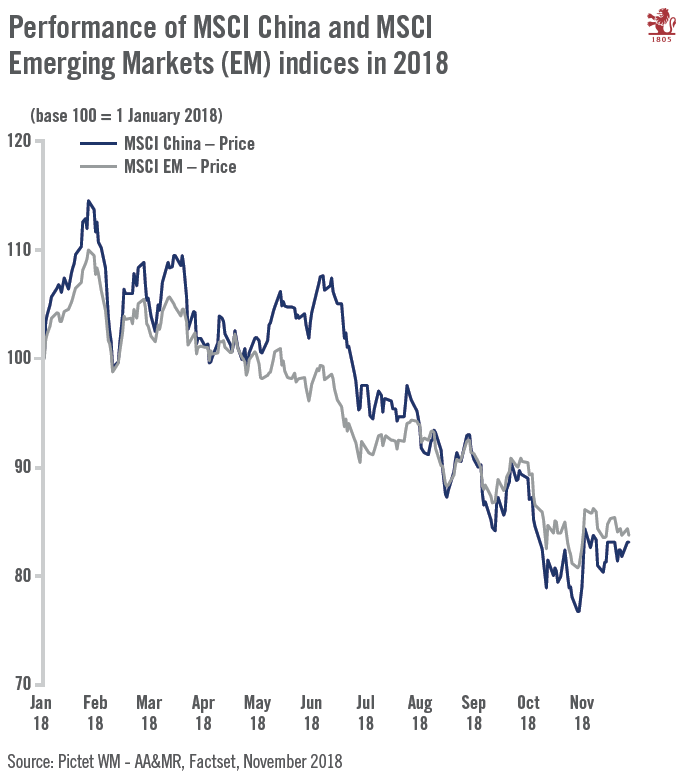

In the EM equity space as measured by MSCI, China (+4.1%), South Africa (+3.2%), and Hungary (+2.4%) have outperformed this week, while Egypt (-2.8%), Qatar (-2.7%), and Mexico (-1.7%) have underperformed. To put this in better context, MSCI EM rose 1.9% this week while MSCI DM rose 0.6%.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX firmed Friday, but capped off a bad week overall. US jobs data this Friday is unlikely to provide much clarity on Fed policy, though we think it remains on track to hike again in December. The Fed’s balance sheet reduction will start this month. We remain negative on EM, and believe selling pressures are likely to persist in Q4.

Read More »

Read More »

Emerging Markets: What has Changed

India Prime Minister Modi announced an INR163.2 bln program to deliver electricity to all households. Poland’s President Duda is trying to reach a compromise on judicial reforms. Fitch raised the outlook on Russia’s BBB- rating from stable to positive. Saudi Arabia announced it will remove the ban on women driving. South Africa’s biggest labor organization stepped up its opposition to President Zuma.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mostly firmer on Friday, but capped off a week of broad-based losses. US rates gave back some of post-FOMC rise, and that weighed on the dollar. Not much in the way of US data until Friday’s core PCE reading and Chicago PMI.

Read More »

Read More »