Category Archive: 5.) China

China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

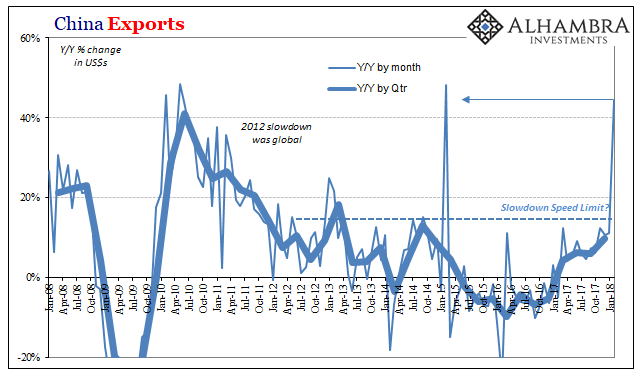

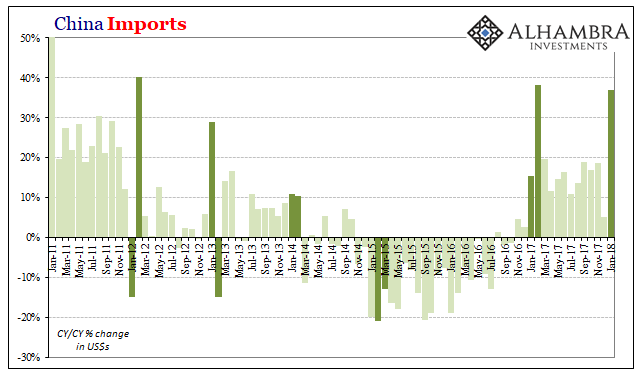

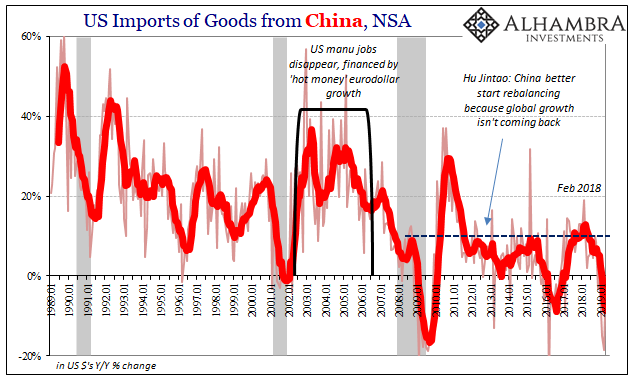

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a trade war (but isn’t really,...

Read More »

Read More »

Just A Few More Pips

On Page 1, Chapter 1 of the Central Banker Crisis Handbook it states very clearly, “do not make it worse.” It’s something like the Hippocratic oath where monetary authorities must first assess what their actions might do to an already fragile system. It’s why they take great pains to try and maintain composure, appearing calm and orderly while conflagration rages all around. The last thing you want to do is confirm the run.

Read More »

Read More »

The Boom Reality of Uncle He’s Globally Synchronized L

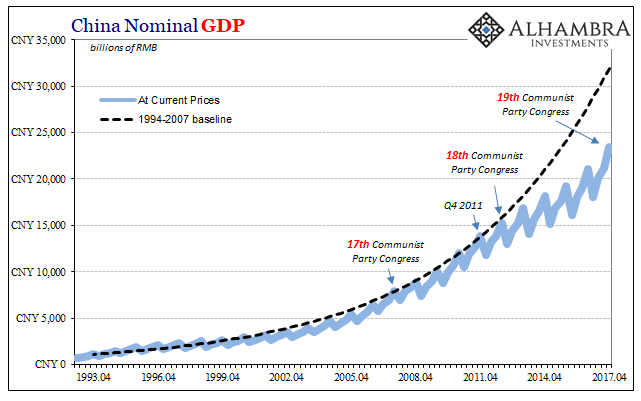

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been expecting that outgoing PBOC...

Read More »

Read More »

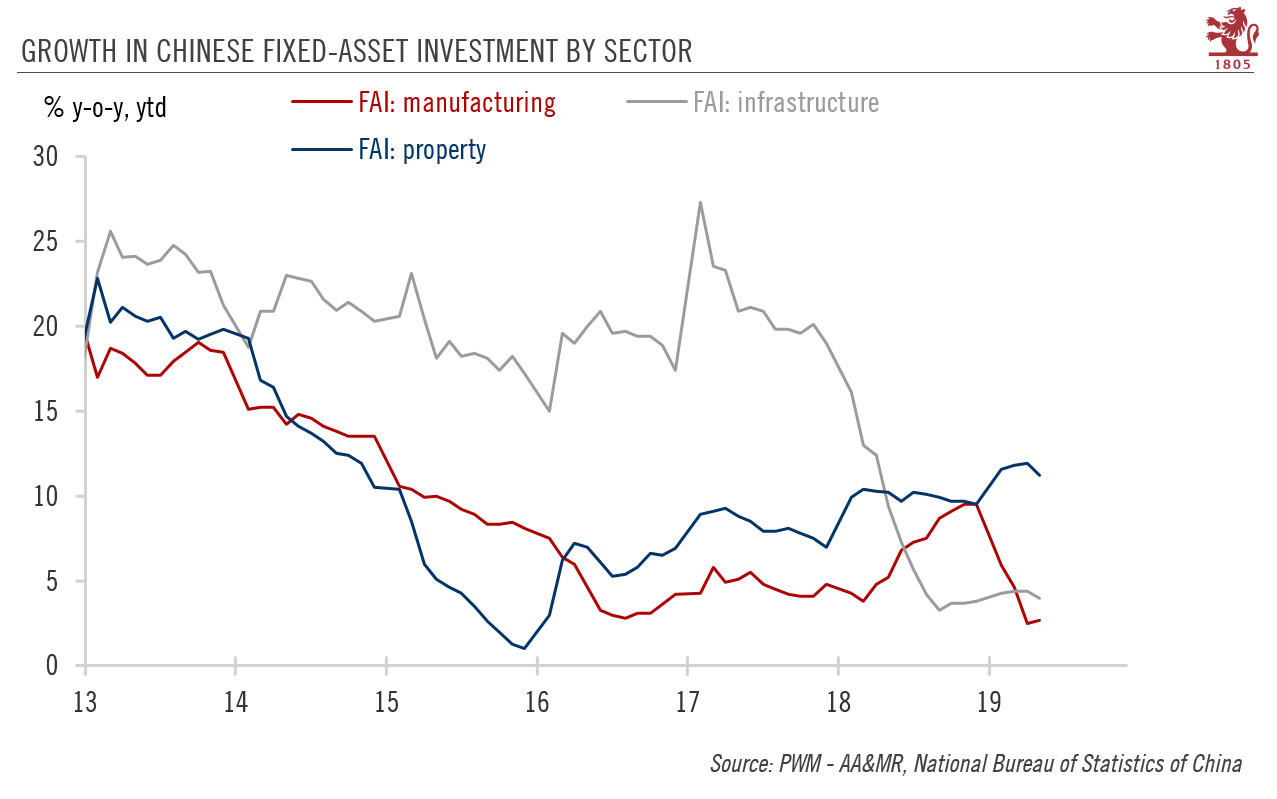

China’s Questionable Start to 2018

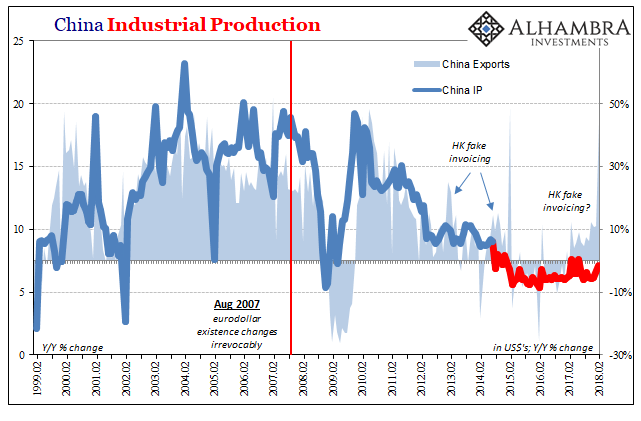

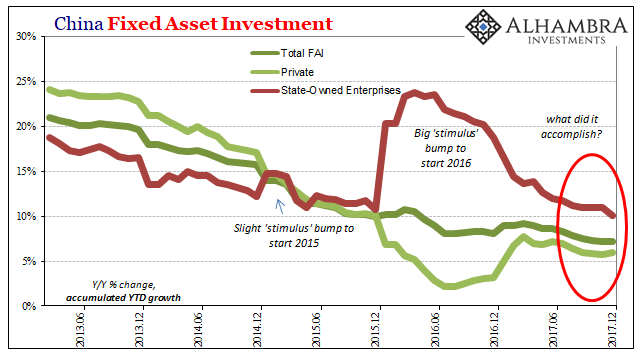

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week).

Read More »

Read More »

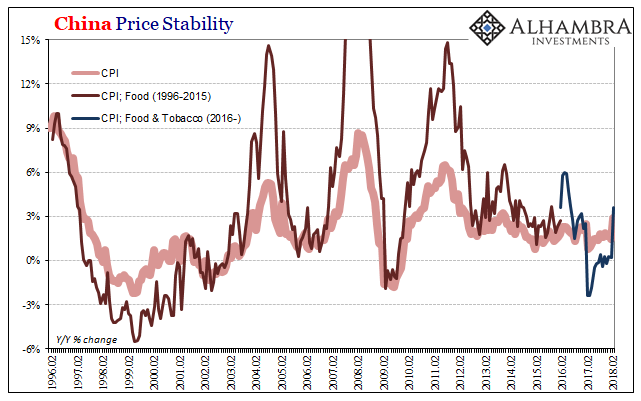

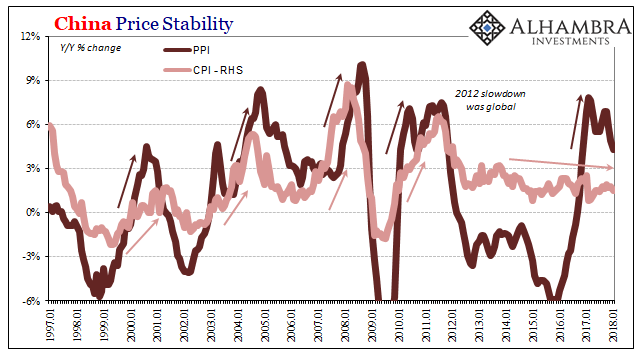

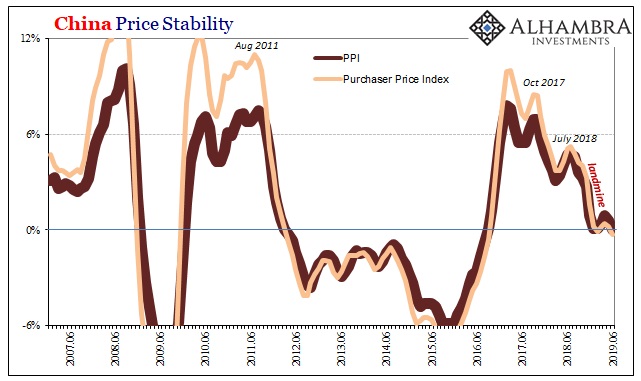

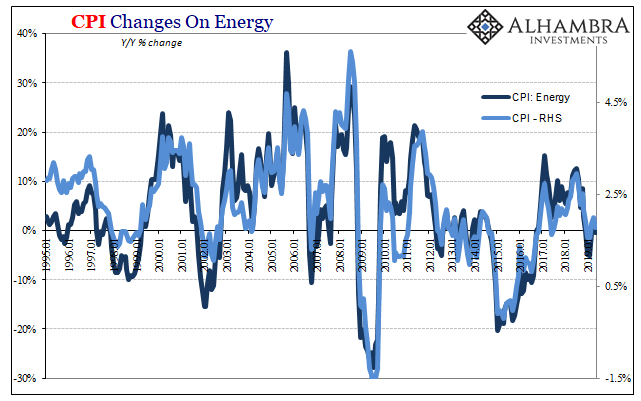

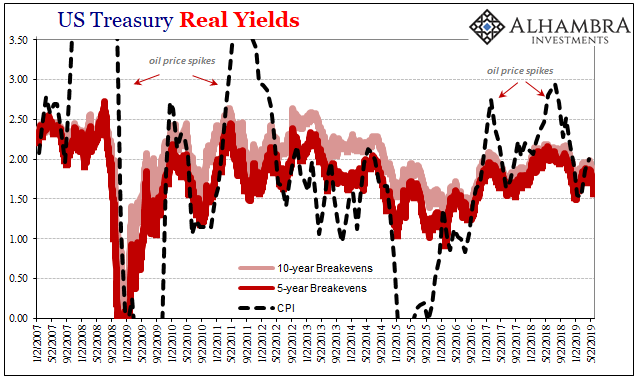

China Prices Include Lots of Base Effect, Still Undershoots

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices.

Read More »

Read More »

China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

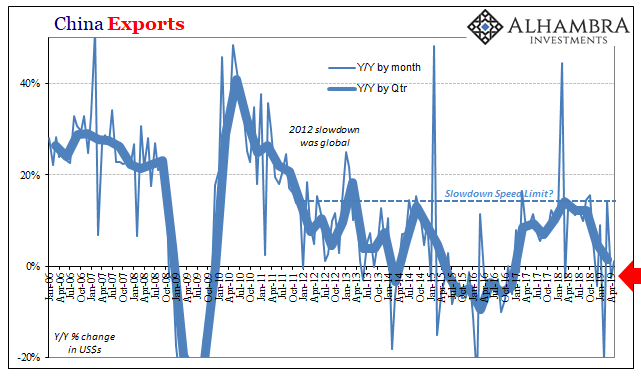

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative.

Read More »

Read More »

China: February PMIs point to deceleration in industrial activity

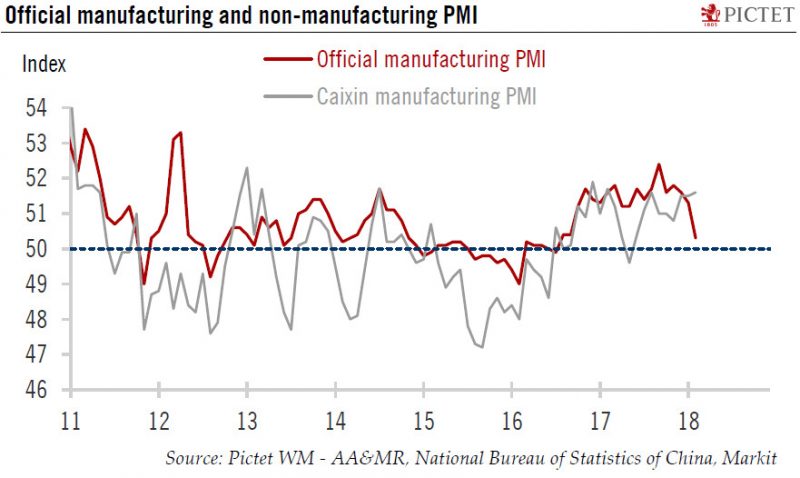

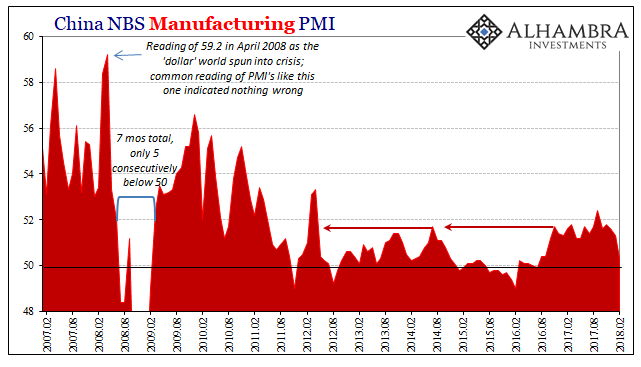

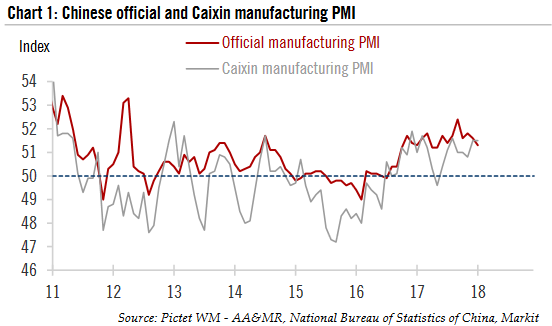

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

Data Distortions One Way Or Another

Back in October, we noted the likely coming of two important distortions in global economic data. The first was here at home in the form of Mother Nature. The other was over in China where Communist officials were gathering as they always do in their five-year intervals. That meant, potentially. In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes.

Read More »

Read More »

China: Inflation? Not Even Reflation

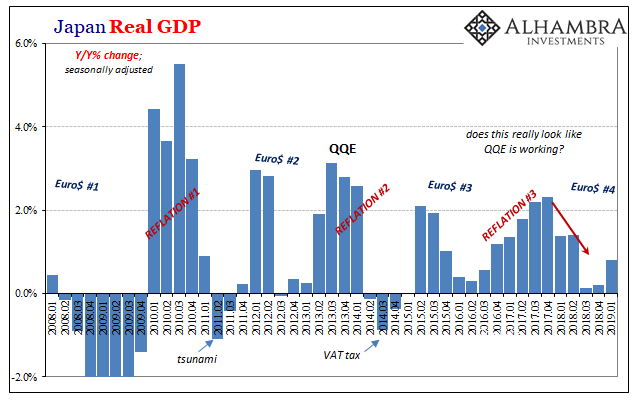

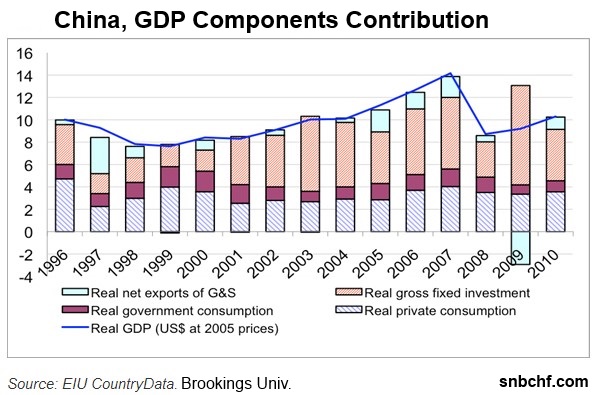

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference.

Read More »

Read More »

China: CNY, Not Imports

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February.

Read More »

Read More »

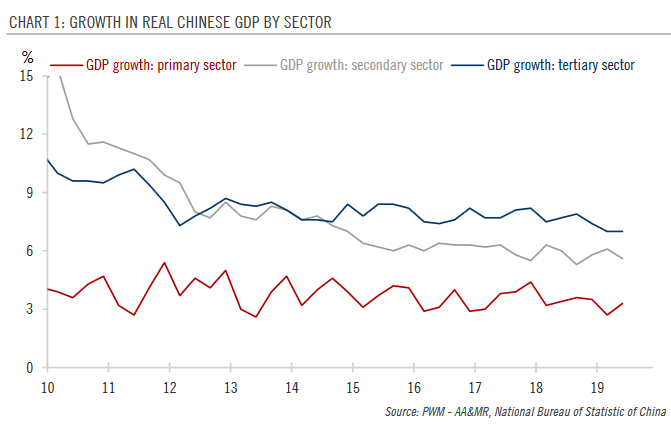

China: PMIs suggest moderation in momentum in Q1

China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non - manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month.

Read More »

Read More »

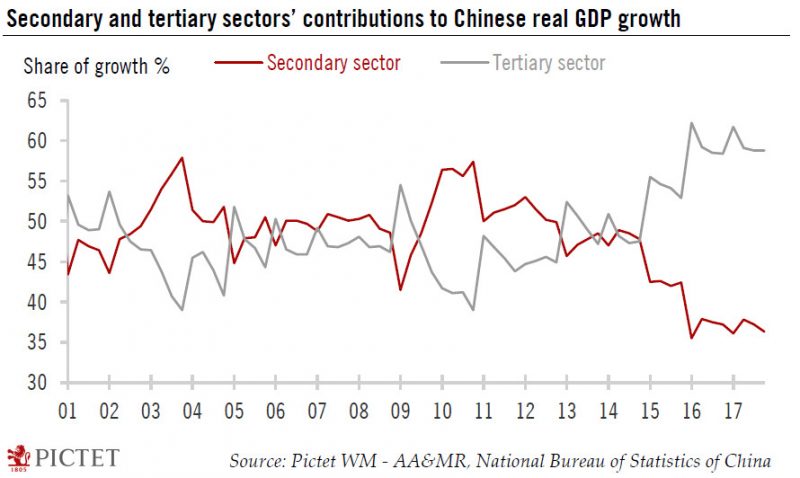

China: 2018 GDP forecast revised up

The Chinese economy ended 2017 on a strong note. In Q4 2017, China’s GDP amounted to Rmb23.4 trillion (about USD3.7 trillion), rising 1.6% over the previous quarter and 6.8% year-over-year (y-o-y) in real terms. Full-year GDP came in at Rmb82.7 trillion (about USD12.9 trillion), growing by 6.9% in real terms and beating the consensus forecast as well as our own estimate (both at 6.8%).

Read More »

Read More »

Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed.

Read More »

Read More »

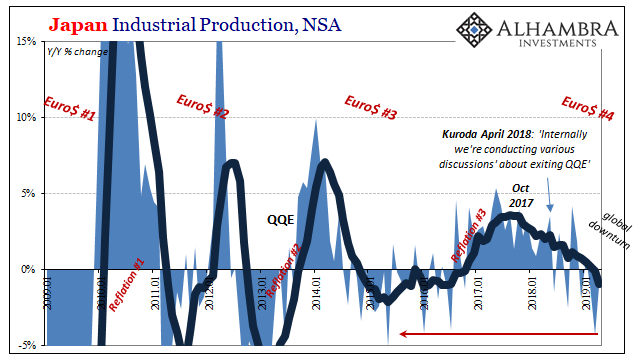

The Blatant Dishonesty of the ‘Boom’

Why do humans tend to behave in herds? It’s a fundamental question that only recently have researchers been able to better understand. On the one hand, it doesn’t take an advanced degree in some neurological science to see the basis behind it; survival for our ancestors often meant getting along with the crowd. There are times when that very trait applies still.

Read More »

Read More »

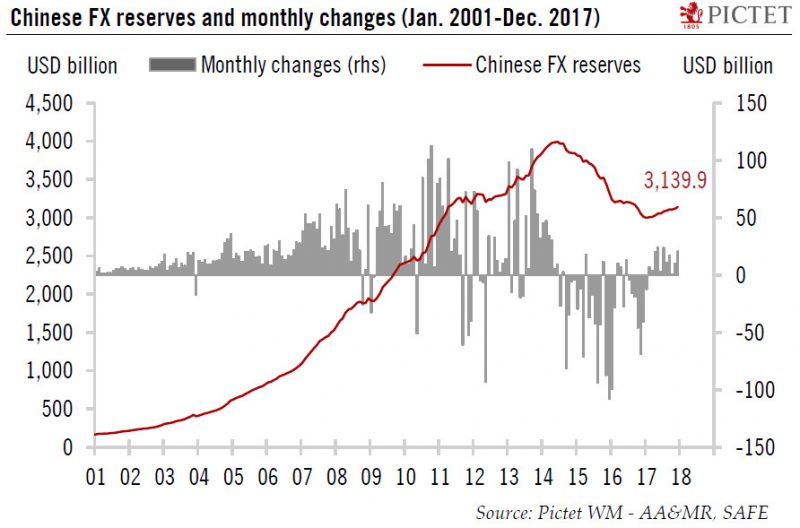

China: FX reserves rise again

According to the Chinese State Administration of Foreign Exchange (SAFE), China’s FX reserves amounted to USD3.14 trillion at end - December 2017, up USD20.7 billion from the previous month. This marks the 11th consecutive monthly increase in Chinese FX reserves since February 2017.

Read More »

Read More »

The Dea(r)th of Economic Momentum

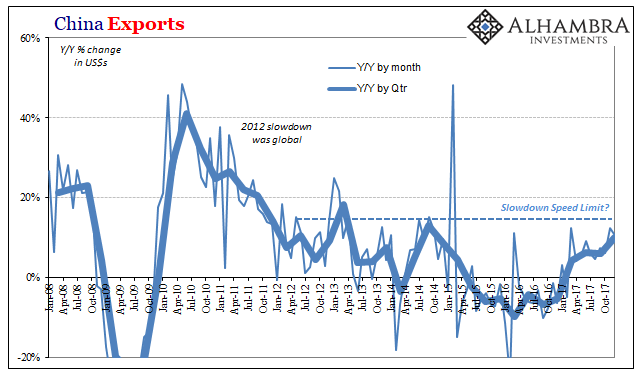

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape.

Read More »

Read More »

Inflation Correlations and China’s Brief, Disappointing Porcine Nightmare

Two years ago, China was gripped by what was described as an epic pig problem. For most Chinese people, pork is a main staple so rapidly rising pig prices could have presented a serious challenge to an economy already at that time besieged by massive negative forces. It was another headache officials in that country really didn’t need.

Read More »

Read More »

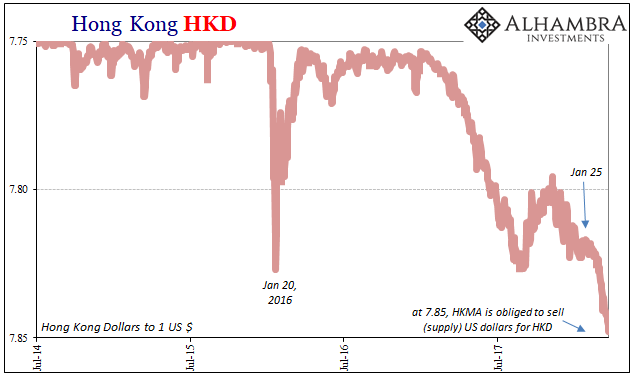

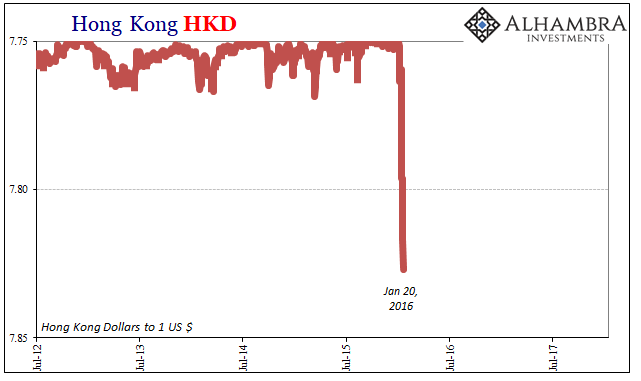

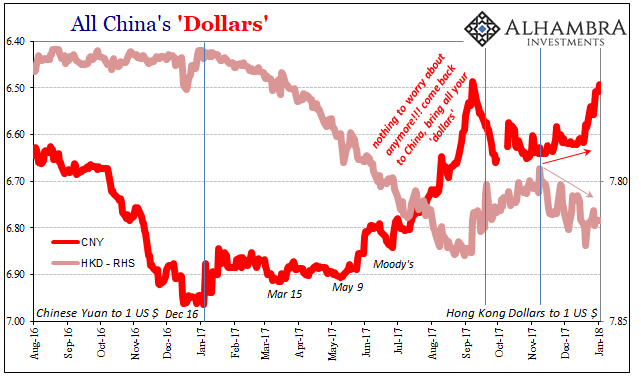

Industrial production: The Chinese Appear To Be Rushed

While the Western world was off for Christmas and New Year’s, the Chinese appeared to have taken advantage of what was a pretty clear buildup of “dollars” in Hong Kong. Going back to early November, HKD had resumed its downward trend indicative of (strained) funding moving again in that direction (if it was more normal funding, HKD wouldn’t move let alone as much as it has). China’s currency, however, was curiously restrained during that...

Read More »

Read More »

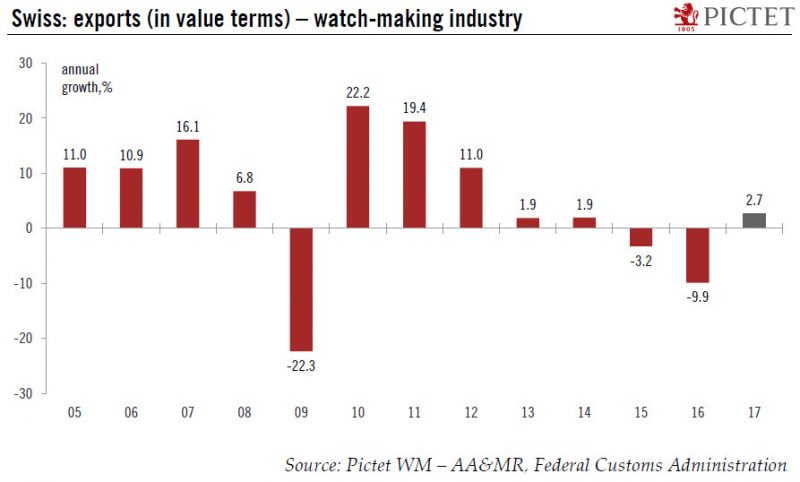

Chinese demand leads the Swiss watch industry’s recovery

The most important driver of the Swiss watch industry’s recovery has been the revival of the mainland China market. After years of impressive growth, the Swiss watch industry faced difficult conditions in 2015 and 2016, when exports declined by 3.2% and 9.9% respectively in value terms.

Read More »

Read More »

China Exports and Industrial Production: Revisiting Once More The True Worst Case

As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s negative it’s bad (though in 2015...

Read More »

Read More »