Category Archive: 5.) Charles Hugh Smith

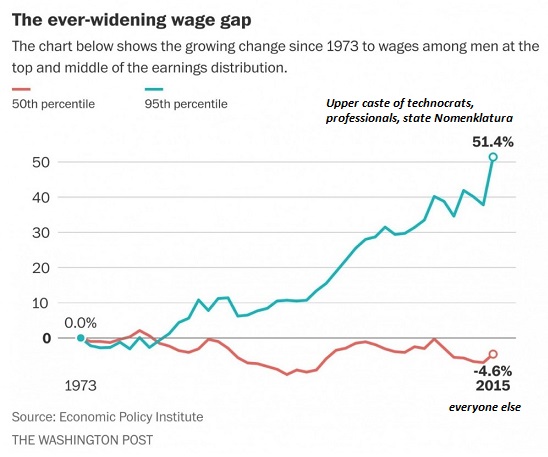

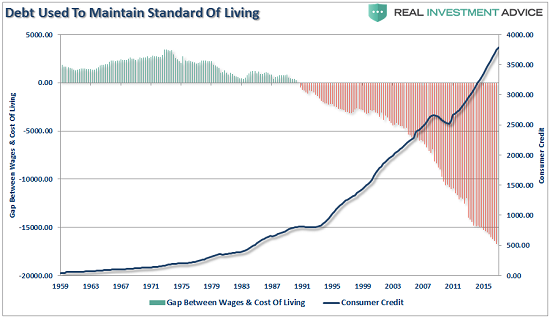

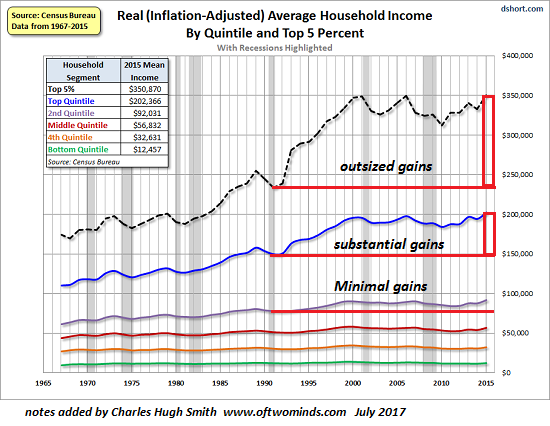

The Insanity of Pushing Inflation Higher When Wages Can’t Rise

In an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing. The official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade. In other words, those with fixed incomes that don't keep pace with inflation will have lost a third...

Read More »

Read More »

Charles Hugh Smith ( Sep 11, 2017 ) – sheds interesting light upon cause of the retail apocalypse

Charles Hugh Smith ( Sep 11, 2017 ) – sheds interesting light upon cause of the retail apocalypse #charleshughsmithhealthcare #charleshughsmithpodcast

Read More »

Read More »

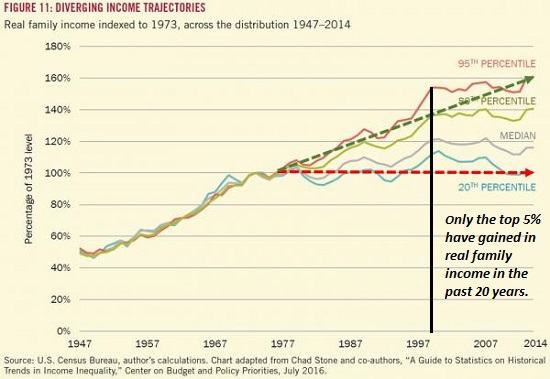

Why We’re Doomed: Stagnant Wages

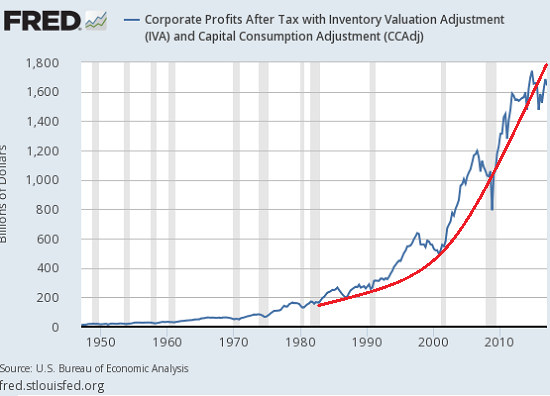

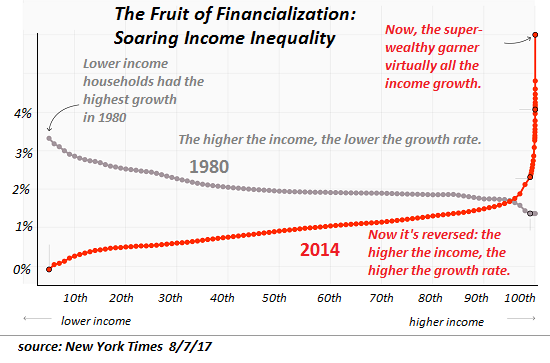

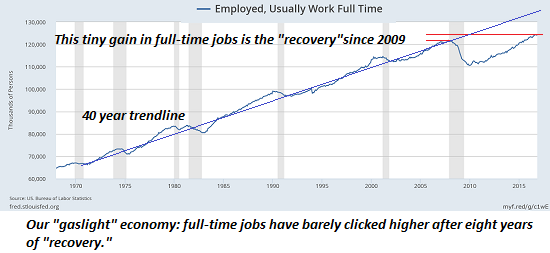

The point is the present system cannot endure. Despite all the happy talk about "recovery" and higher growth, wages have gone nowhere since 2000--and for the bottom 20% of workers, they've gone nowhere since the 1970s. Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply an extension of a 47-year downtrend.

Read More »

Read More »

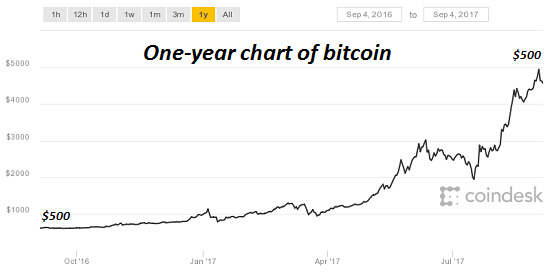

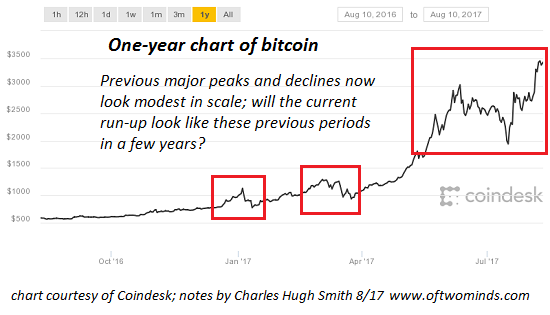

Bitcoin, Sour Grapes and the Institutional Herd

The point is institutional ownership of bitcoin is in the very early stages.

If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I'd be a billionaire. There are three problems with opining that bitcoin and cryptocurrencies are bubblicious:

Read More »

Read More »

Why Wages Have Lost Ground in the 21st Century

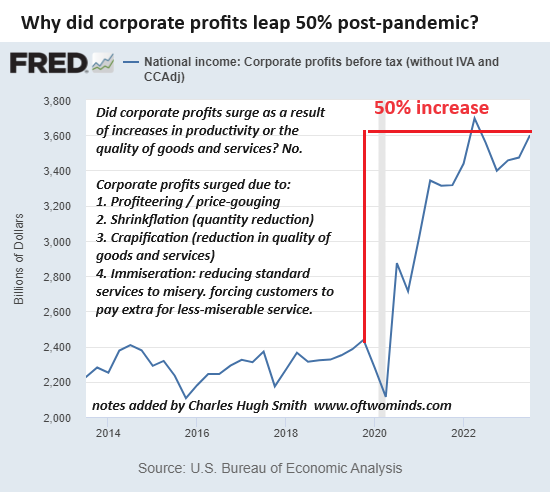

One of the enduring mysteries for conventional economists is why wages aren't rising for the bottom 95% even as unemployment is low and hiring remains robust. According to classical economics, the limited supply of available workers combined with strong demand for workers should push wages higher.

Read More »

Read More »

Jim Rogers 2017 ✪ GoldSeek Radio SEPT 2, 2017 CHARLES HUGH SMITH & JIM ROGERS

Jim Rogers 2017 ✪ GoldSeek Radio SEPT 2, 2017 CHARLES HUGH SMITH & JIM ROGERS #CLIFHIGH #CLIFHIGH2017 #CLIFHIGHTHISWEEK #CLIFHIGHNEW #CLIFHIGHTODAY #CLIFHIGHBITCOIN #CLIFHIGHWILLEND #CLIFHIGHREVIEWS #JIMROGERS #JIMROGERS2017 #JIMROGERSTHISWEEK #JIMROGERSNEW #ECONOMIST #FINANCIAL #JIMROGERSTODAY #JIMROGERSONBITCOIN Jim Rogers This Week: https://goo.gl/4iebdy Jim Willie 2017 Reviews: https://goo.gl/4iebdy Subcribers For Chanel:...

Read More »

Read More »

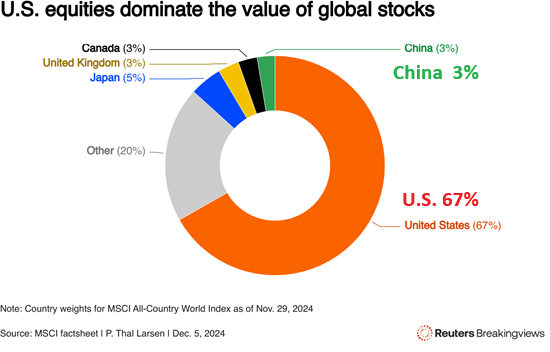

The 5 Steps to World Domination

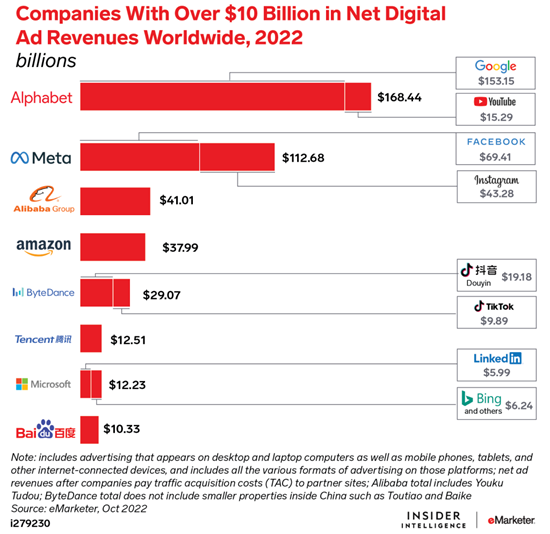

You don't need an army to achieve World Domination; all you need is enough cheap credit to buy up everything that generates the highest value and/or income.

Read More »

Read More »

Did the Economy Just Stumble Off a Cliff?

This is more intuitive than quantitative, but my gut feeling is that the economy just stumbled off a cliff. Neither the cliff edge nor the fatal misstep are visible yet; both remain in the shadows of the intangible foundation of the economy: trust, animal spirits, faith in authorities' management, etc.

Read More »

Read More »

We Need a Social Revolution

In the conventional view, there are two kinds of revolutions: political and technological. Political revolutions may be peaceful or violent, and technological revolutions may transform civilizations gradually or rather abruptly—for example, revolutionary advances in the technology of warfare.

Read More »

Read More »

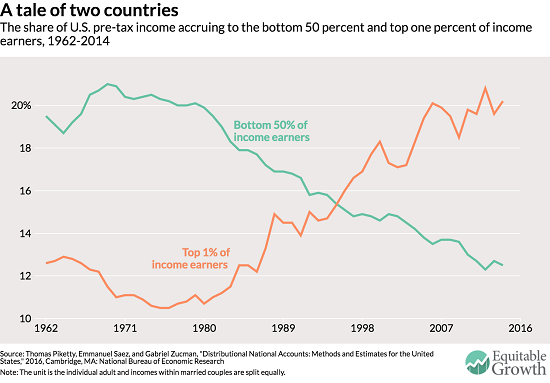

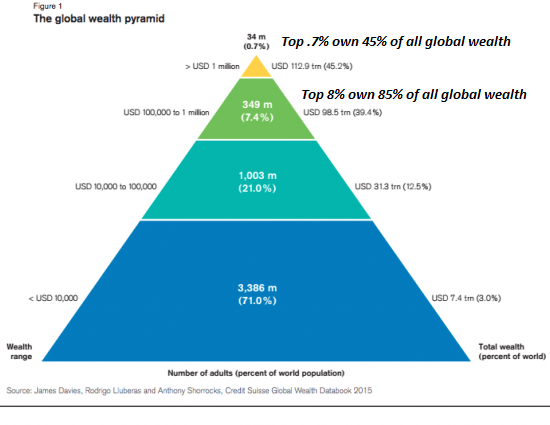

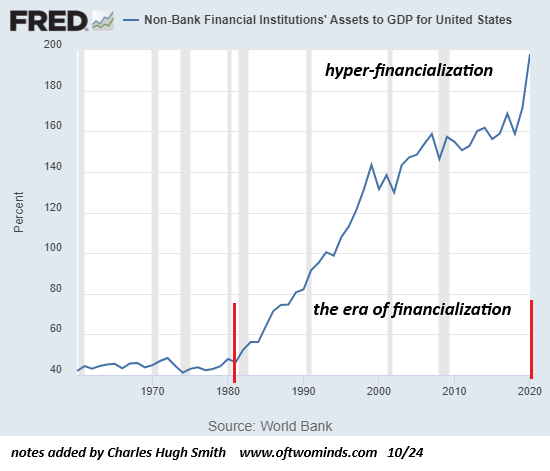

Why We’re Doomed: Our Economy’s Toxic Inequality

Why are we doomed? Those consuming over-amped "news" feeds may be tempted to answer the culture wars, nuclear war with North Korea or the Trump Presidency. The one guaranteed source of doom is our broken financial system, which is visible in this chart of income inequality from the New York Times: Our Broken Economy, in One Simple Chart.

Read More »

Read More »

Are We Already in Recession?

How shocked would you be if it was announced that the U.S. had just entered a recession, that is, a period in which gross domestic product (GDP) declines (when adjusted for inflation) for two or more quarters? Would you really be surprised to discover that the eight-year long "recovery," the weakest on record, had finally rolled over into recession?

Read More »

Read More »

ALERT ! ! ! USA’S DAY OF ECONOMIC RECKONING 2017 – Charles Hugh SMITH

Please Click Below to SUBSCRIBE for More “Special Report Radio” Subscribe & More Videos: https://goo.gl/1bvkco Thank for watching, Please Like Share And SUBSCRIBE!!! #dollarcollapse2017, #geraldcelente

Read More »

Read More »

What the Mainstream Doesn’t Get about Bitcoin

The real demand for bitcoin will not be known until a global financial crisis guts confidence in central banks and politicized capital controls. I've been writing about cryptocurrencies and bitcoin for many years. For example: Could Bitcoin Become a Global Reserve Currency? (November 7, 2013) I am an interested observer, not an expert. As an observer, it seems to me that the mainstream--media, financial punditry, etc.--as a generality don't really...

Read More »

Read More »

The Real Rate of Inflation | Charles Hugh Smith

Listen to the full interview at the Solari Report – solari.com “I can track the real-world inflation of the Burrito Index with great accuracy: the cost of a regular burrito from our local taco truck has gone up from $2.50 in 2001 to $5 in 2010 to $6.50 in 2016. That’s a $160% increase since … Continue reading...

Read More »

Read More »

Is Another Oil Head-Fake Brewing?

Over the past decade I've addressed what I call Head-Fakes in the cost of oil/fossil fuel: even though we know the cost of extracting and processing oil will rise over time as the easy-to-get oil is depleted, oil occasionally plummets to such low prices that we're fooled into thinking it will remain cheap for a long time to come.

Read More »

Read More »

Why We’re So Risk-Averse: “We Can’t Take That Chance”

If our faith in the future and our resilience is near-zero, then we can't take any chances. You've probably noticed how risk-averse Hollywood has become: the big summer movies are all extensions of existing franchises--mixing up the superheroes in new combinations, or remaking hit films from the past--all safe bets.

Read More »

Read More »

13 April 2017 Charles Hugh Smith sheds interesting light upon cause of the retail apocalyp

While much has been written about the massive retail decline in America, Charles Hugh Smith sheds interesting light upon another core cause of the retail . While much has been written about the massive retail decline in America, Charles Hugh Smith sheds interesting light upon another core cause of the retail . While much has …

Read More »

Read More »

Charles Hugh Smith On Where The Jobs Are

Click here for the full summary and slides: http://financialrepressionauthority.com/2017/08/02/the-roundtable-insight-charles-hugh-smith-on-where-the-jobs-are/

Read More »

Read More »

The Two Charts That Dictate the Future of the Economy

The stock market, bond yields and statistical measures of the economy can be gamed, manipulated and massaged by authorities, but the real economy cannot. This is espcially true for the core drivers of the economy, real (adjusted for inflation) household income and real disposable household income, i.e. the real income remaining after debt service (interest and principal), rent, healthcare co-payments and insurance and other essential living expenses.

Read More »

Read More »