Category Archive: 5.) Charles Hugh Smith

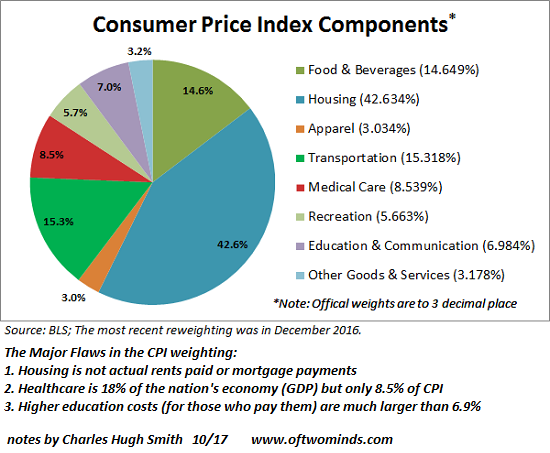

Be Careful What You Wish For: Inflation Is Much Higher Than Advertised

What the Federal Reserve is actually whining about is not low inflation--it's that high inflation isn't pushing wages higher like it's supposed to. It's not exactly a secret that real-world inflation is a lot higher than the official rates--the Consumer Price Index (CPI) and Personal Consumption Expenditures PCE).

Read More »

Read More »

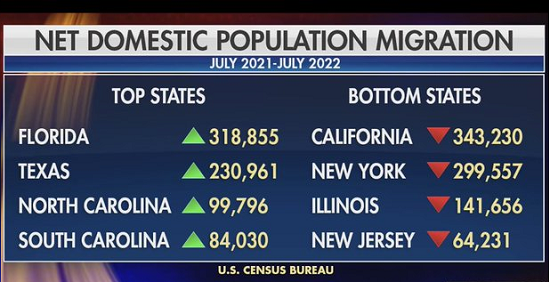

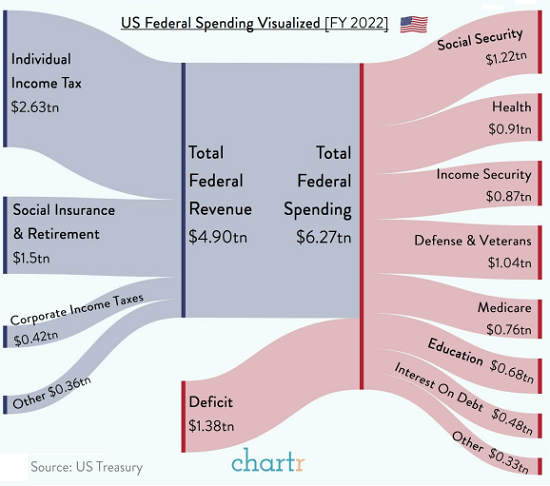

What If the Tax Donkeys Rebel?

I would hazard a guess that an increasing number of tax donkeys are considering dropping out as a means of increasing their happiness and satisfaction with life. Since federal income taxes are in the spotlight, let's ask a question that rarely (if ever) makes it into the public discussion: what if the tax donkeys who pay most of the tax rebel? There are several likely reasons why this question rarely arises.

Read More »

Read More »

Surprise! The Rules Will Change (But Not to Your Benefit)

These expedient fixes end up crippling the mechanisms that are needed to actually solve the systemic sources of the crisis. We can add a third certainty to the two standard ones (death and taxes): The rules will suddenly change when a financial crisis strikes. Why is this a certainty? The answer is complex, as it draws on human nature, politics and the structure of societies/economies ruled by centralized states (governments).

The Core Imperative...

Read More »

Read More »

♞ Charles Hugh Smith – TBuried In The Fed’s Report It Reveals The Truth About The Economy ♘

‘News Brief’ Report date: 10.05.2017 Guest: Charles Hugh Smith Books: Why Our Status Quo Failed and Is Beyond Reform Get a Job, Build a Real Career… Why Things Are Falling Apart and What We Can Do About It A Radically Beneficial World Most of artwork that are included with these videos have been created by …

Read More »

Read More »

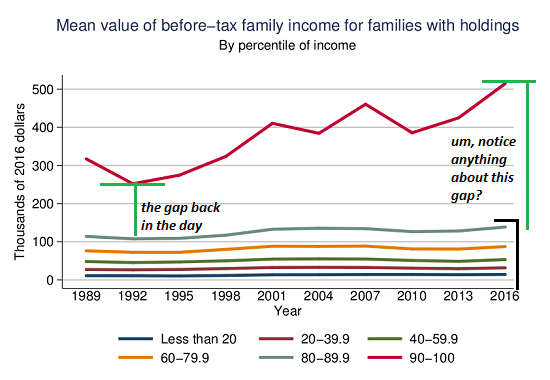

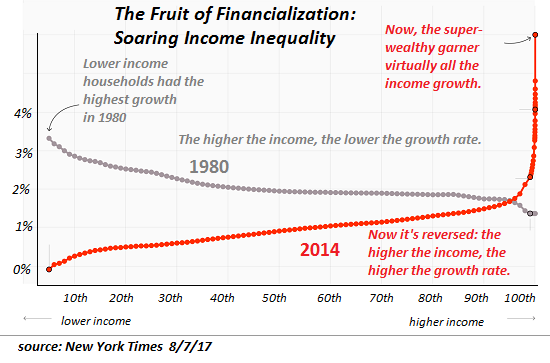

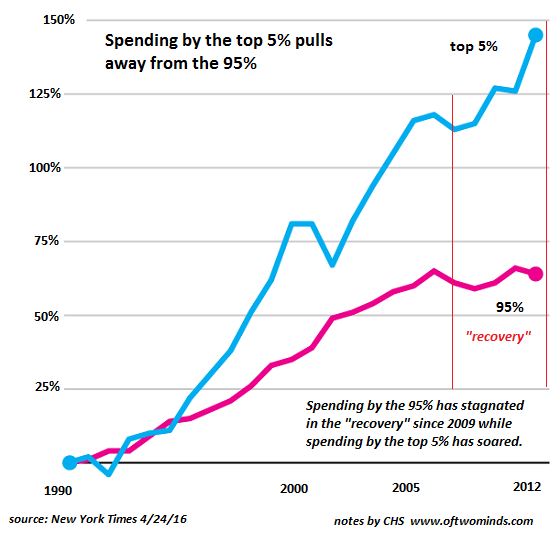

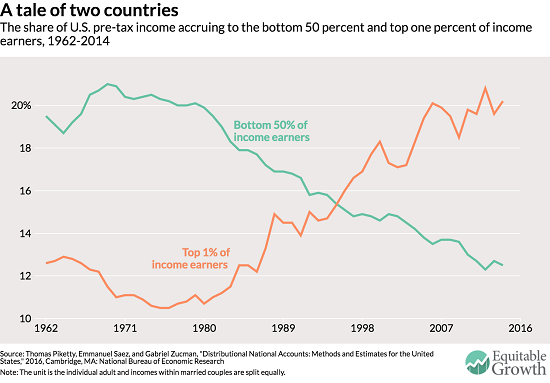

This Chart Defines the 21st Century Economy

There is nothing inevitable about such vast, fast-rising income-wealth inequality; it is the only possible output of our financial and pay-to-play political system. One chart defines the 21st century economy and thus its socio-political system: the chart of soaring wealth/income inequality. This chart doesn't show a modest widening in the gap between the super-wealthy (top 1/10th of 1%) and everyone else: there is a veritable Grand Canyon between...

Read More »

Read More »

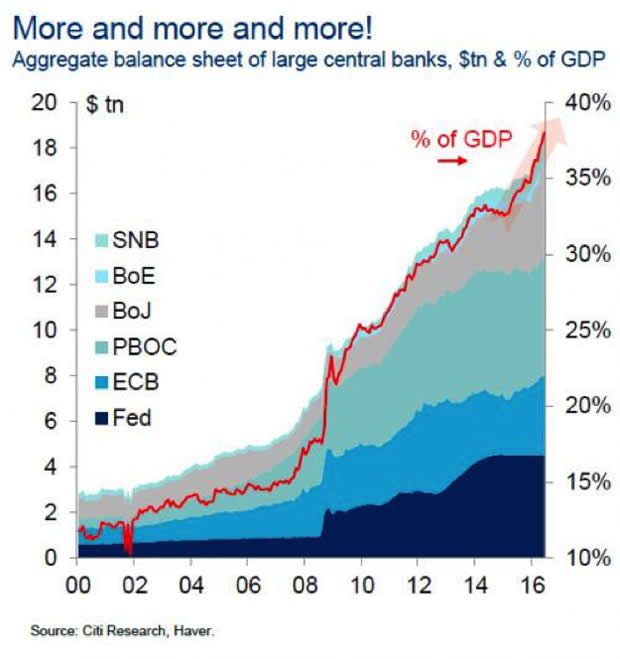

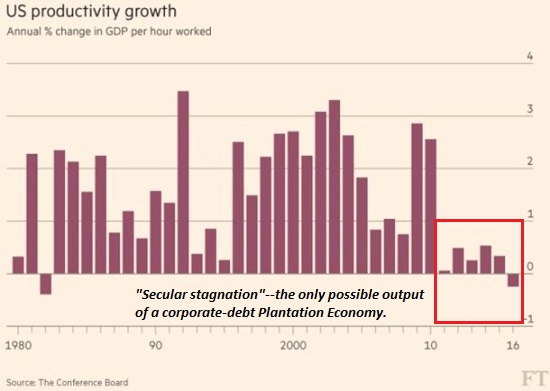

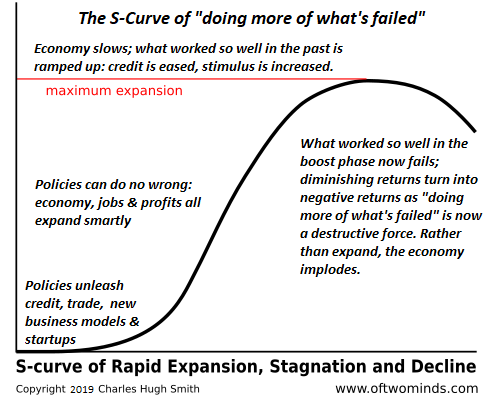

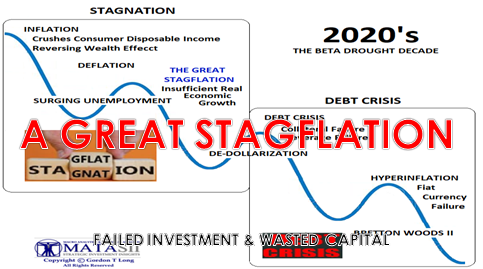

Stagnation Is Not Just the New Normal–It’s Official Policy

Japan is a global leader is how to gracefully manage stagnation. Although our leadership is too polite to say it out loud, they've embraced stagnation as the new quasi-official policy. The reason is tragi-comically obvious: any real reform would threaten the income streams gushing into untouchably powerful self-serving elites and fiefdoms.

Read More »

Read More »

Charles Hugh Smith On Why Wages Are Stagnant In The Developed World

Click here for the full transcript: http://financialrepressionauthority.com/2017/10/01/the-roundtable-insight-charles-hugh-smith-on-why-wages-are-stagnant-in-the-developed-world/

Read More »

Read More »

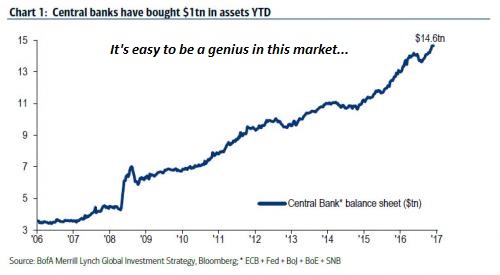

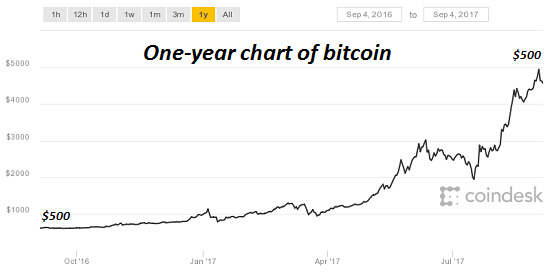

Dear Jamie Dimon: Predict the Crash that Takes Down Your Produces-Nothing, Parasitic Bank and We’ll Listen to your Bitcoin “Prediction”

This is the begging-for-the-overthrow-of-a-corrupt-status-quo economy we have thanks to the Federal Reserve giving the J.P. Morgans and Jamie Dimons of the world the means to skim and scam the bottom 95%. Dear Jamie Dimon: quick quiz: which words/phrases are associated with you and your employer, J.P. Morgan?

Read More »

Read More »

RMR: Exclusive Interview with Charles Hugh Smith (09/18/2017)

Returning guest Charles Hugh Smith delivers a great interview discussing cryptocurrencies, the concern over Google and Facebook and the truth about digital advertising and data mining. We are political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. Please …

Read More »

Read More »

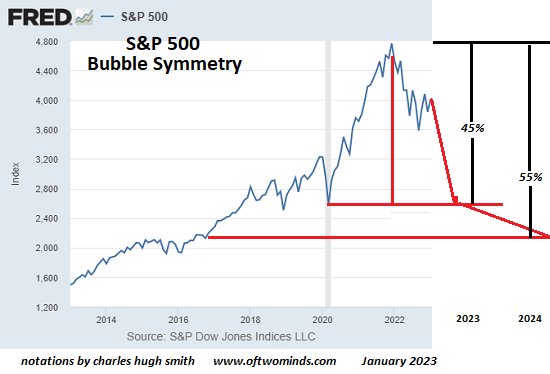

Yes, This Time It Is Different: But Not in Good Ways

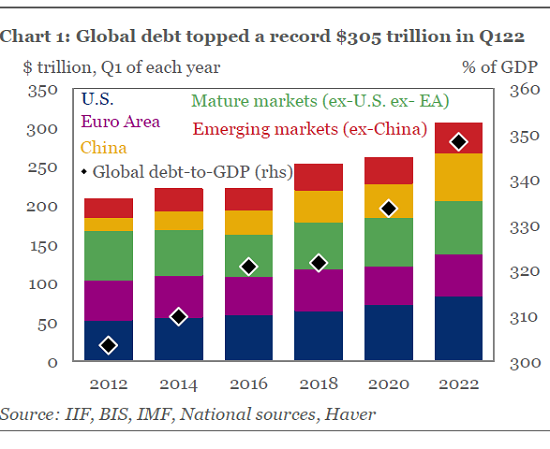

Yes, this time it's different: all the foundations of a healthy economy are crumbling into quicksand. The rallying cry of Permanent Bulls is this time it's different. That's absolutely true, but it isn't bullish--it's terrifically, terribly bearish. Why is this time it's different bearish going forward? The basic answer is that nothing that is structurally broken has actually been fixed, and the policy "fixes" have fatally weakened the global...

Read More »

Read More »

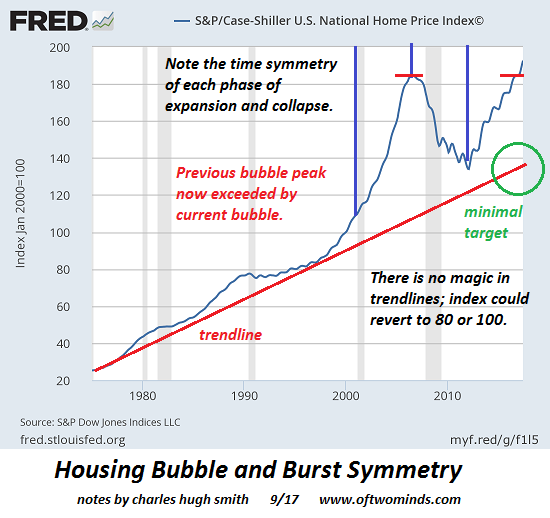

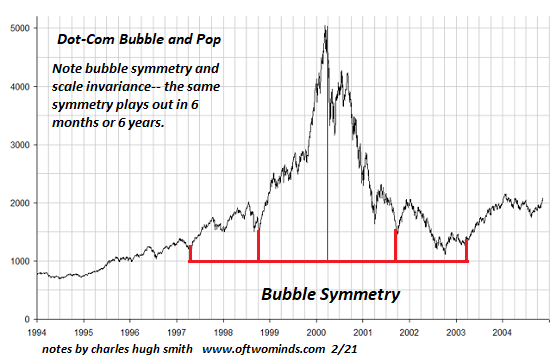

Housing Bubble Symmetry: Look Out Below

Housing markets are one itsy-bitsy recession away from a collapse in domestic and foreign demand by marginal buyers. There are two attractive delusions that are ever-present in financial markets:One is this time it's different, because of unique conditions that have never ever manifested before in the history of the world, and the second is there are no cycles, they are illusions created by cherry-picked data; furthermore, markets are now...

Read More »

Read More »

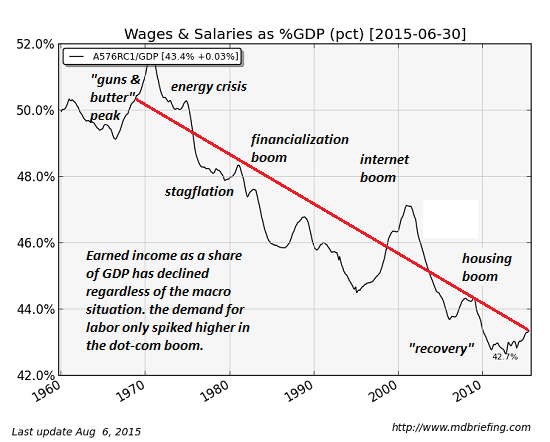

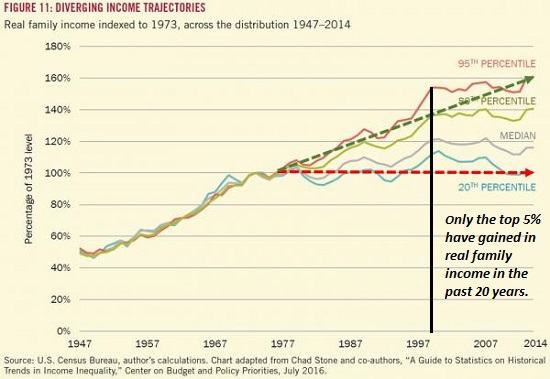

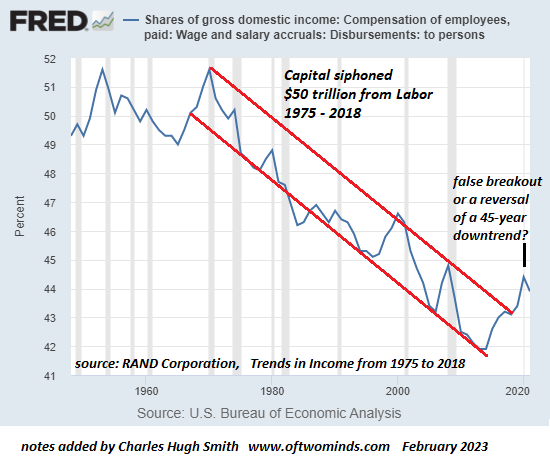

The Real Reason Wages Have Stagnated: Our Economy is Optimized for Financialization

Labor's share of the national income is in freefall as a direct result of the optimization of financialization. The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing wealth will be distributed...

Read More »

Read More »

Is the High Cost of Housing Crushing Wages?

The authors' thesis doesn't explain the 47-year downtrend of labor's share of the economy. A provocative essay, Don't Blame the Robots, makes the bold claim that "Housing Prices and Market Power Explain Wage Stagnation." (Foreign Affairs) In other words, the stagnation of the bottom 95% of wages isn't caused by automation or offshoring, but by the crushingly high cost of housing:

Read More »

Read More »

The Insanity of Pushing Inflation Higher When Wages Can’t Rise

In an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing. The official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade. In other words, those with fixed incomes that don't keep pace with inflation will have lost a third...

Read More »

Read More »

Charles Hugh Smith ( Sep 11, 2017 ) – sheds interesting light upon cause of the retail apocalypse

Charles Hugh Smith ( Sep 11, 2017 ) – sheds interesting light upon cause of the retail apocalypse #charleshughsmithhealthcare #charleshughsmithpodcast

Read More »

Read More »

Why We’re Doomed: Stagnant Wages

The point is the present system cannot endure. Despite all the happy talk about "recovery" and higher growth, wages have gone nowhere since 2000--and for the bottom 20% of workers, they've gone nowhere since the 1970s. Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply an extension of a 47-year downtrend.

Read More »

Read More »

Bitcoin, Sour Grapes and the Institutional Herd

The point is institutional ownership of bitcoin is in the very early stages.

If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I'd be a billionaire. There are three problems with opining that bitcoin and cryptocurrencies are bubblicious:

Read More »

Read More »