Category Archive: 5.) Charles Hugh Smith

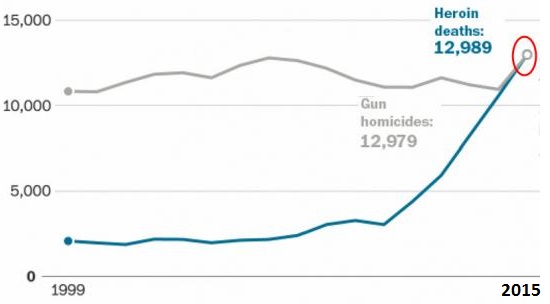

The Real Cause of the Opioid Epidemic: Scarcity of Jobs and Positive Social Roles

The employment rate for males ages 25-54 has been stairstepping down for 30 years, but it literally fell off a cliff in 2009. We all know there is a scourge of addiction and premature death plaguing the nation, a scourge that is killing thousands and ruining millions of lives: the deaths resulting from the opioid epidemic (largely the result of "legal" synthetic narcotics) are mounting at an alarming rate: We also know that the proximate cause of...

Read More »

Read More »

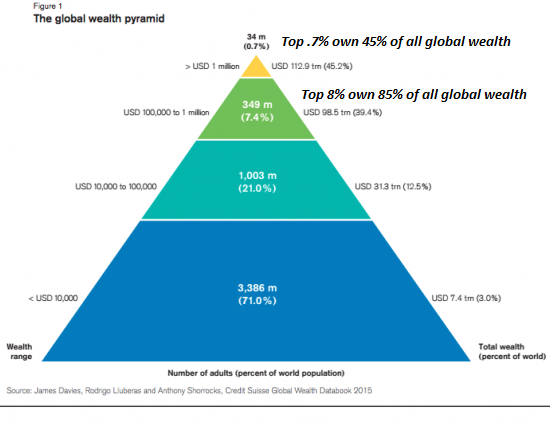

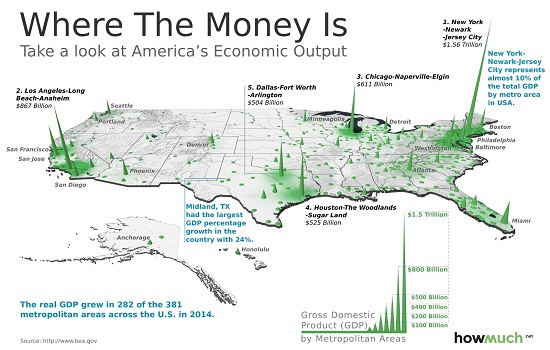

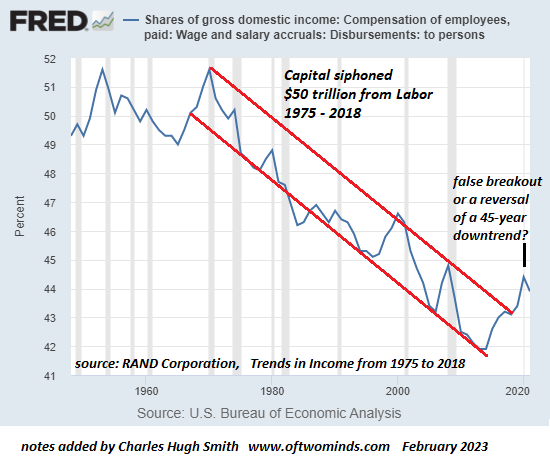

If We Don’t Change the Way Money Is Created, Rising Inequality and Social Disorder Are Inevitable

Centrally issued money optimizes inequality, monopoly, cronyism, stagnation and systemic instability. Everyone who wants to reduce wealth and income inequality with more regulations and taxes is missing the key dynamic: central banks' monopoly on creating and issuing money widens wealth inequality, as those with access to newly issued money can always outbid the rest of us to buy the engines of wealth creation.

Read More »

Read More »

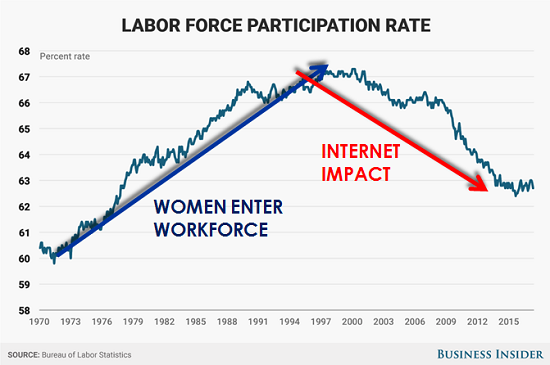

Automation’s Destruction of Jobs: You Ain’t Seen Nothing Yet

Automation--networked robotics, software and processes--has already had a major impact on jobs. As this chart from my colleague Gordon T. Long illustrates, the rise of Internet technologies is reflected in the steady, long-term decline of the labor force participation rate-- the percentage of the populace that is actively in the labor market.

Read More »

Read More »

RMR: Exclusive Interview with Charles Hugh Smith (06/27/2017)

Charles Hugh Smith author of the blog “Of Two Minds” joins “V” for a great discussion regarding the cryptocurrency market, a stock market crash scenario, what the markets are telling us and “The Over-Criminalization of American Life.” You can learn about Charles’s work at: http://charleshughsmith.blogspot.com/ We are political scientists, editorial engineers, and radio show developers …

Read More »

Read More »

Charles Hugh Smith On Central Bank Buying Of Equities

Click here for the full summary with slides: http://financialrepressionauthority.com/2017/06/25/the-roundtable-insight-charles-hugh-smith-on-central-bank-buying-of-equities/

Read More »

Read More »

Can We See a Bubble If We’re Inside the Bubble?

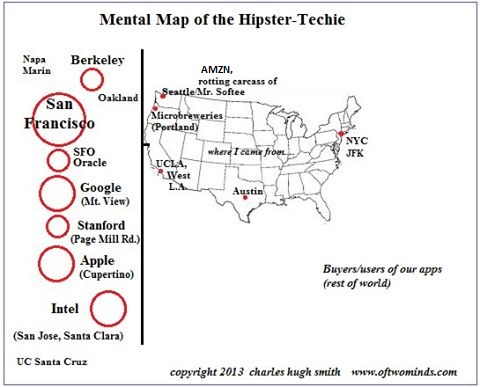

If you visit San Francisco, you will find it difficult to walk more than a few blocks in central S.F. without encountering a major construction project. It seems that every decrepit low-rise building in the city has been razed and is being replaced with a gleaming new residential tower.

Read More »

Read More »

The Path to Inflation: “Helicopter Money”

Yet conventional economists are virtually unanimous that deflation is the danger and inflation is a "good thing" we need to spur so servicing existing debt becomes easier for debtors. Due to the deflationary pressures of technology and stagnant wages for the bottom 90%, the consensus sees low inflation as far as the eye can see.

Read More »

Read More »

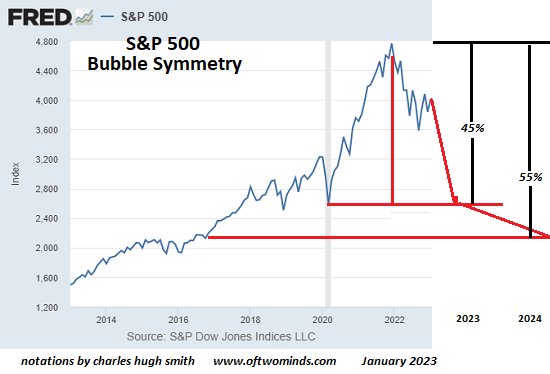

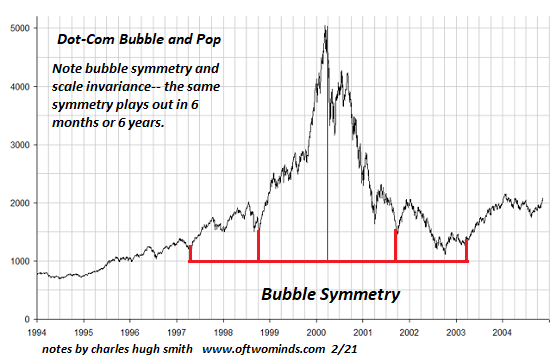

How Debt-Asset Bubbles Implode: The Supernova Model of Financial Collapse

Gravity eventually overpowers financial fakery. When debt-asset bubbles expand at rates far above the expansion of earnings and real-world productive wealth, their collapse is inevitable. The Supernova model of financial collapse is one way to understand this. As I noted yesterday in Will the Crazy Global Debt Bubble Ever End?, I've used the Supernova analogy for years, but didn't properly explain why it illuminates the dynamics of financial...

Read More »

Read More »

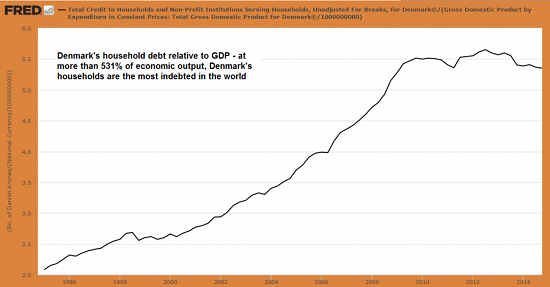

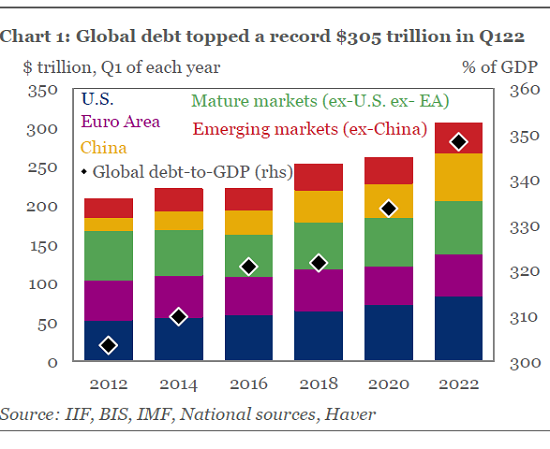

Will the Crazy Global Debt Bubble Ever End?

We've been playing two games to mask insolvency: one is to pay the costs of rampant debt today by borrowing even more from future earnings, and the second is to create wealth out of thin air via asset bubbles. The two games are connected: asset bubbles require leverage and credit.

Read More »

Read More »

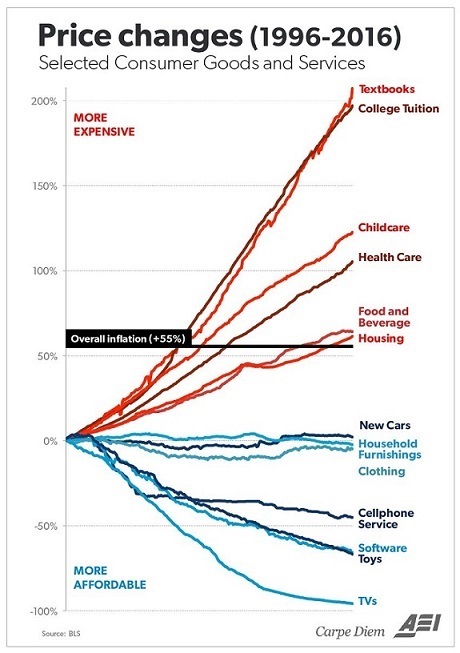

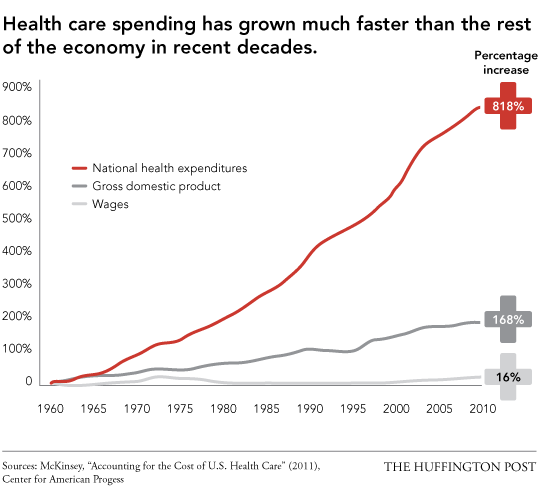

Inflation Isn’t Evenly Distributed: The Protected Are Fine, the Unprotected Are Impoverished Debt-Serfs

The Consumer Price Index (CPI) measure of inflation is bogus on a number of fronts, a reality I've covered a number of times: though the heavily gamed official CPI is under 2% for the past four years, the real rate is 7% to 12%, depending on whether you happen to live in locales with soaring rents/housing and healthcare costs.

Read More »

Read More »

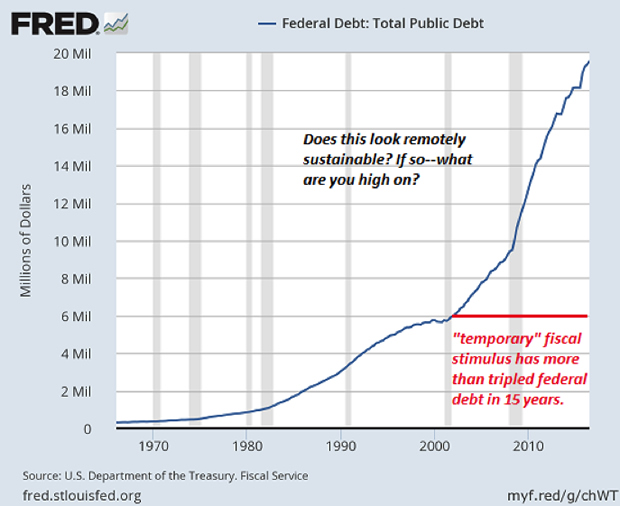

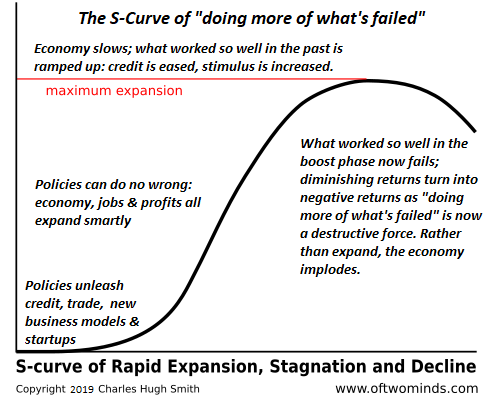

The Keynesian Cult Has Failed: “Emergency” Stimulus Is Now Permanent

Can we finally admit that eight years of following the Keynesian coloring-book have not just failed, but failed spectacularly? What do we call a status quo in which & emergency measures" have become permanent props? A failure. The "emergency" responses to the Global Financial Meltdown of 2008-09 are, eight years on, permanent fixtures.

Read More »

Read More »

RMR: Exclusive Interview with Charles Hugh Smith (05/27/2017)

“V” welcomes back Charles for an in-depth discussion regarding Charles’s blogs: TINA’s Legacy: Free Money, Bread and Circuses and Collapse, How Higher Education Became an Obscenely Profitable Racket That Enriches the Few at the Expense of the Many (Student Debt-Serfs) and Want to Understand Rising Wealth Inequality? Look at Debt and Interest. Charles’s website: http://www.oftwominds.com/ …

Read More »

Read More »

State of Denial: The Economy No Longer Works As It Did in the Past

If there is one reality that is denied or obscured by the Status Quo, it is that the economy no longer works as it did in the past. This is the fundamental economic context of our current slide into political-social disintegration.

Read More »

Read More »

Charles Hugh Smith On How Financial Repression Is Affecting Millennial Generation Values

Today’s topic is the millennial generation and how financial repression has resulted in asset bubbles that ultimately have affected the millennials in terms of their values and how they view the economy and life. As well as what they’re facing in terms of the housing market and the job situation. Click here for the full …

Read More »

Read More »

Charles Hugh Smith: Millennials Will Change The Economy Forever

Get Immediate Access to our Exclsuive Crypto Report At: http://www.wealthresearchgroup.com/bi… Get Immediate Access To Wealth Research Group’s Complete Junior Stocks Manual AT: http://www.wealthresearchgroup.com/go… Get Immediate Access to Our Exclusive Report On The New Cryptocurrency Following Bitcoin Footsteps AT: http://www.wealthresearchgroup.com/bi… Get our Full Analysis on Gold, Silver & Mining here:...

Read More »

Read More »

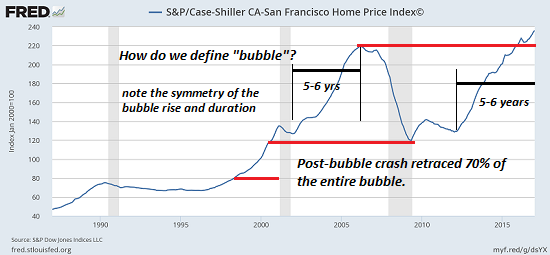

Housing’s Echo Bubble Now Exceeds the 2006-07 Bubble Peak

A funny thing often occurs after a mania-fueled asset bubble pops: an echo-bubble inflates a few years later, as monetary authorities and all the institutions that depend on rising asset valuations go all-in to reflate the crushed asset class.

Read More »

Read More »

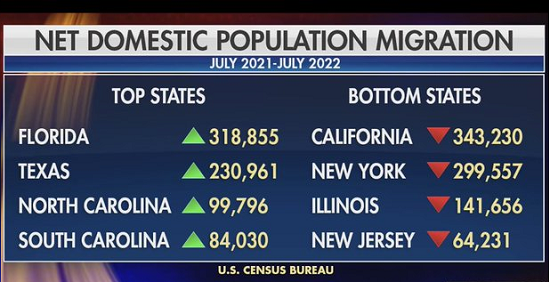

Who Will Live in the Suburbs if Millennials Favor Cities?

Who's going to pay bubble-valuation prices for the millions of suburban homes Baby Boomers will be off-loading in the coming decade as they retire/ downsize?Longtime readers know I follow the work of urbanist Richard Florida, whose recent book was the topic of Are Cities the Incubators of Decentralized Solutions?(March 14, 2017).

Read More »

Read More »

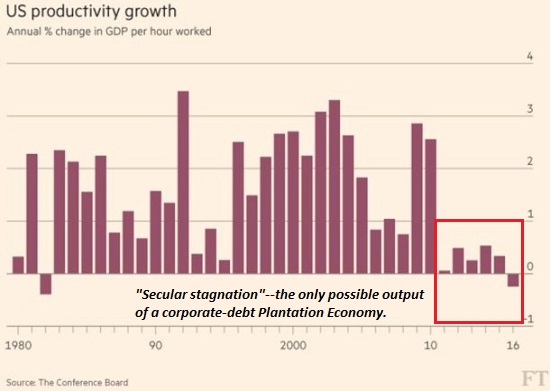

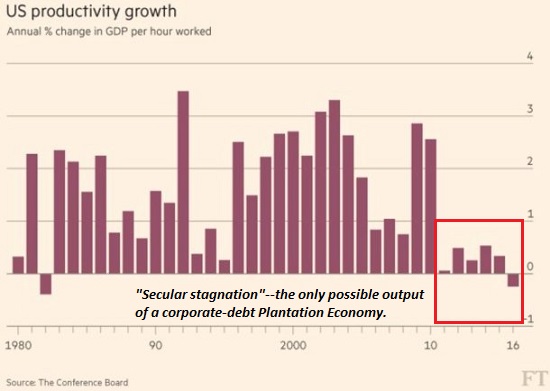

Our State-Corporate Plantation Economy

I have often discussed the manner in which the U.S. economy is a Plantation Economy, meaning it has a built-in financial hierarchy with corporations at the top dominating a vast populace of debt-serfs/ wage slaves with little functional freedom to escape the system's neofeudal bonds.

Read More »

Read More »

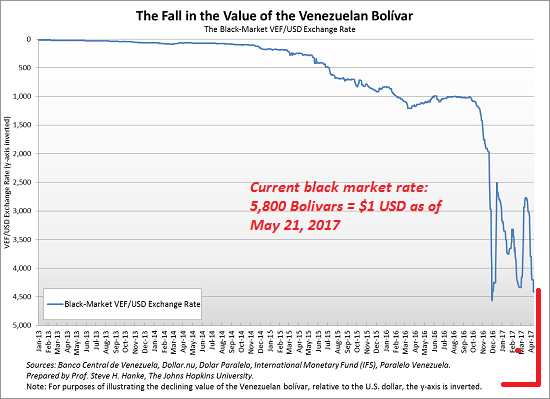

Marx, Orwell and State-Cartel Socialism

When "socialist" states have to impose finance-capital extremes that even exceed the financialization of nominally capitalist economies, it gives the lie to their claims of "socialism." OK, so our collective eyes start glazing over when we see Marx and Orwell in the subject line, but refill your beverage and stay with me on this.

Read More »

Read More »