Category Archive: 5.) Charles Hugh Smith

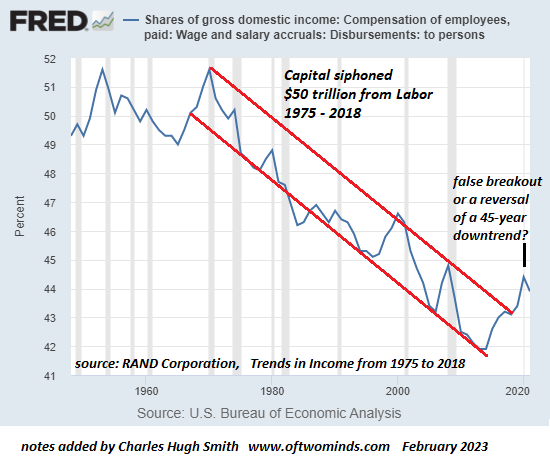

America’s Metastasizing Class Wars

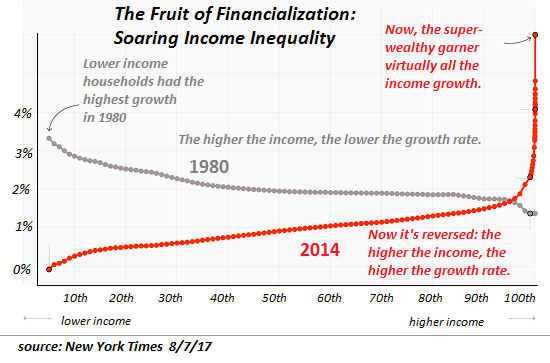

Class wars are the inevitable result of an economic system in which 'anything goes if you're rich enough and winners take most'. The traditional class war has been waged between wage-earners (who sell their labor) and their employers (owners of capital and the means of production).

Read More »

Read More »

Will Skilled Hands-On Labor Finally Become More Valuable?

The sands beneath what's scarce and what's over-abundant are shifting. On a recent visit to the welding shop where my niece's husband works, I asked him if they had enough welders for their workload.

Read More »

Read More »

* WTF: What The Fed?! – Mike Maloney, Chris Martenson, Grant Williams, Charles Hugh Smith, A. Tagga

Watch the full event free at https://goldsilver.com/wtf

“The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs…

Something is not adding up.

And Mike Maloney agrees…

He recently recorded a free event dedicated exclusively to the topic of the Fed’s recent actions... to help you understand what it’s doing and what it means...

Read More »

Read More »

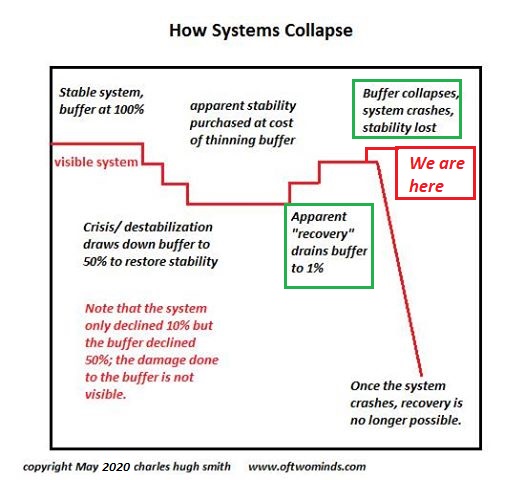

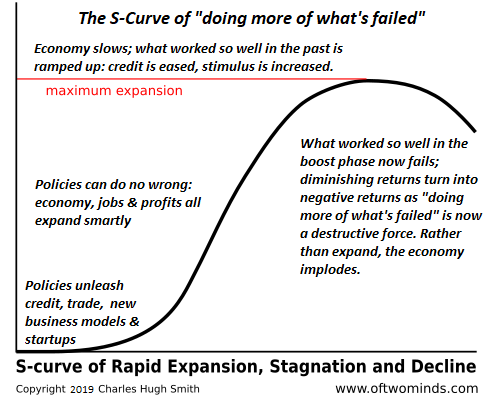

Our Systemic Drift to Collapse

Thus do the lazy complacent passengers drift inexorably toward the cataracts of collapse just ahead. The boat ride down to the waterfall of systemic collapse is not dramatic, it's lazy drifting: a lazy complacency that doing more of what worked in the past will work again, and an equally lazy disregard for how far the system has drifted from the point when things actually worked.

Read More »

Read More »

The Empire Will Strike Back: Dollar Supremacy Is the Fed’s Imperial Mandate

Triffin's Paradox demands painful trade-offs to issue a reserve currency, and it demands the issuing central bank serve two competing audiences and markets. Judging by the headlines and pundit chatter, the U.S. dollar is about to slide directly to zero. This sense of certitude is interesting, given that no empire prospered by devaluing its currency.

Read More »

Read More »

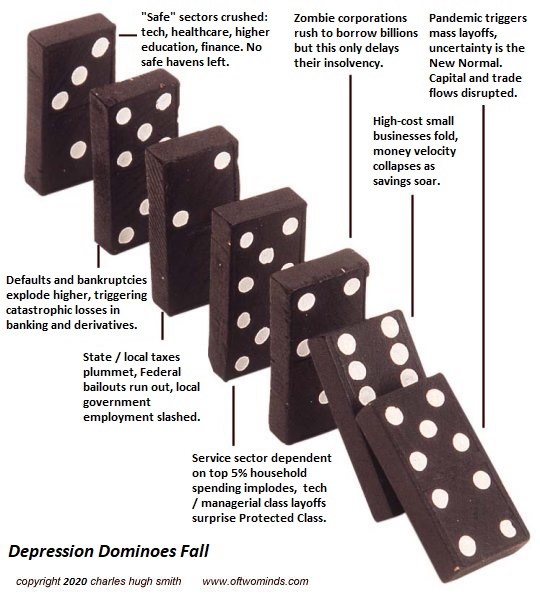

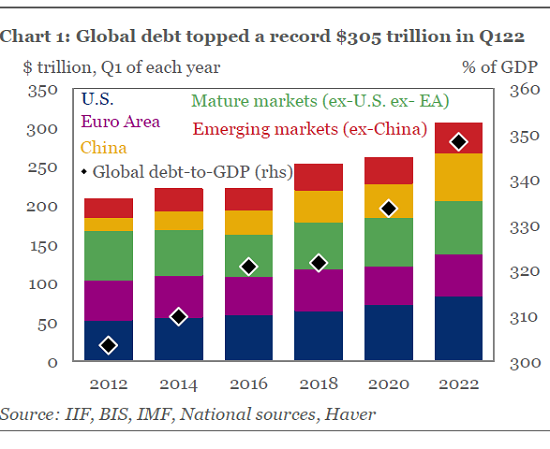

Here’s Why the “Impossible” Economic Collapse Is Unavoidable

This is why denormalization is an extinction event for much of our high-cost, high-complexity, heavily regulated economy. A collapse of major chunks of the economy is widely viewed as "impossible" because the federal government can borrow and spend unlimited amounts of money because the Federal Reserve can create unlimited amounts of money: the government borrows $1 trillion by selling $1 trillion in Treasury bonds, the Fed prints $1 trillion...

Read More »

Read More »

It’s Do-or-Die, Deep State: Either Strangle the Stock Market Rally Now or Cede the Election to Trump

With only 56 trading days and fewer than 80 calendar days to the election, the Deep State camps seeking to torpedo Trump's re-election have reached the do-or-die point. Back in June I speculated that the only way the Deep State could deep-six Trump's re-election was to sink the stock market rally, which the president has long touted as evidence of his economic leadership.

Read More »

Read More »

Charles Hugh Smith – In The World Change Process

The world is in the process of change. Especially in terms of health and economy, the world has experienced the biggest chaos of recent times. We are seeing signs of transition to the new economic order. What are the plans?

SUBSCRIBE For The Latest Issues About ;

#useconomy2020

#economynews

#useconomy

#coronaviruseconomy

#marketeconomy

#worldeconomy

#reopeneconomy

#openeconomy

#economynews

#reopeningeconomy

#globaleconomy

#silverprice...

Read More »

Read More »

The Economy Is Mortally Wounded

A fully financialized, totally debt and speculation-dependent economy is terminal once leverage and debt stop expanding exponentially. We all know the movie scene in which the character is wounded but dismisses it as no big deal, and then lurches into the closing sequence where we discover the wound was not inconsequential, it was mortal, and the character expires.

Read More »

Read More »

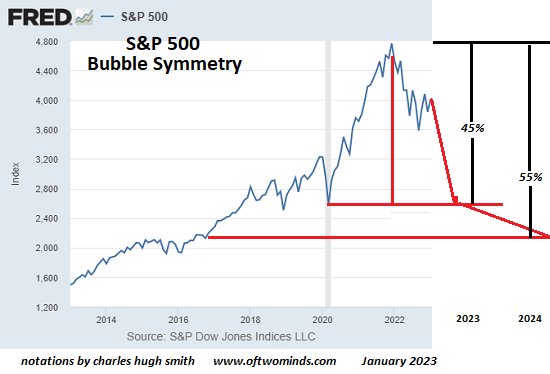

If the “Market” Never Goes Down, The System Is Doomed

"Markets" that never go down aren't markets, they're signaling mechanisms of the Powers That Be. Markets are fundamentally clearing houses of information on price, demand, sentiment, expectations and so on--factual data on supply and demand, shipping costs, cost of credit, etc.--and reflections of trader and consumer emotions and psychology.

Read More »

Read More »

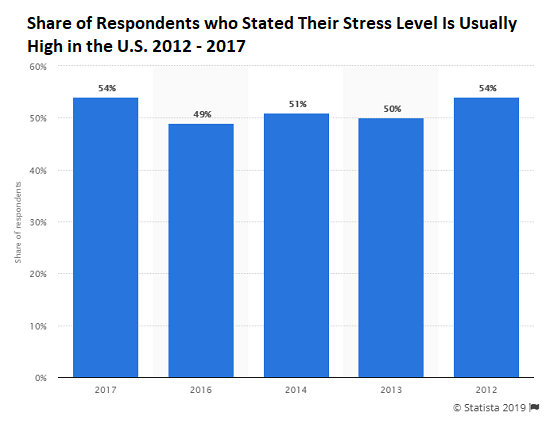

The Bogus “Recovery,” Stress and Burnout

We have three basic ways to counter the destructive consequences of stress.We have all experienced the disorientation and "brain freeze" that stress triggers. The pandemic and the responses to the pandemic have been continuous sources of stress, i.e. chronic stress, which is the pathway to burnout, the collapse of our ability to cope with the burdens pressing on us.

Read More »

Read More »

A Vaccine May Not Be the “Magical Cure” Everyone Anticipates

Few appear willing to follow the probabilities of a future in which a vaccine cannot possibly be the "magic cure" everyone wants. Let's attempt the impossible and set aside all preconceptions we might have about a vaccine for Covid-19, and think it through somewhat dispassionately.

Read More »

Read More »

Memo from Insiders: Dear Bagholders, Thanks for Buying Our Shares at the Top

The self-sustaining recovery is a fantasy that's evaporated.What looks like a powerful, can't-lose rally to newbies is recognized as distribution by old hands. In low-volume markets (as in the past few months), insiders holding large positions can't dump all their shares at once or the price of the stock would plummet due to the thinness of the bid.

Read More »

Read More »

? Charles Hugh Smith | Economic analysis with what is happening

Charles Hugh Smith | Economic analysis with what is happening

These are the kind of sharp economic analysis that is missing from Charles on the Axis of Easy salons.

Read More »

Read More »

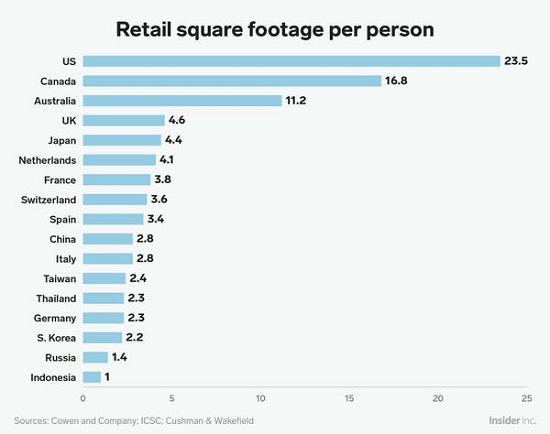

The Nation Is Falling Into the Abyss Between Wall Street and Main Street

The abyss between the Fed's illusion of phantom wealth for Wall Street and the collapse of Main Street is bottomless, and our descent into the abyss is accelerating. I know this runs counter to every dominant narrative, but a vaccine doesn't really matter, opening up doesn't really matter, and the size of the "free money" stimulus checks doesn't matter.

Read More »

Read More »

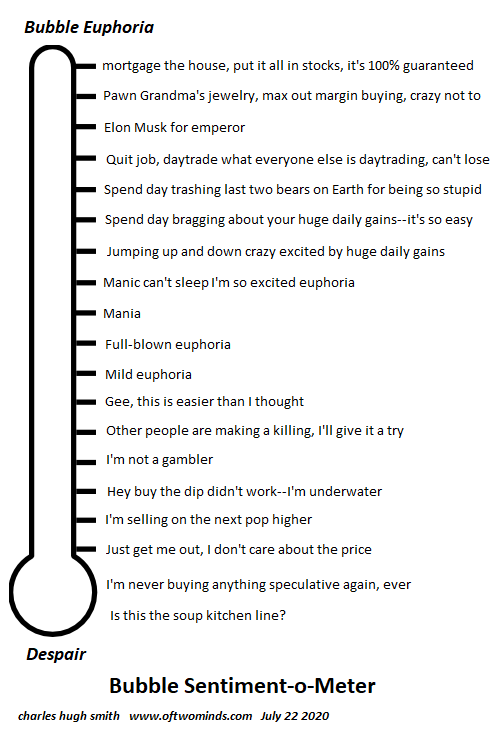

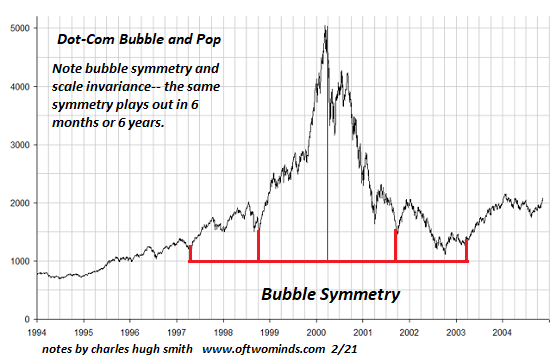

Introducing the “Everything Bubble” Sentiment-o-Meter

Since human wetware remains stuck in OS1.01, we can predict a remarkable reversal. The "Everything Bubble" has been a sight to behold. With central banks providing trillions to the big players and margin debt enabling small punters to leverage up, the hot money rotation has been a real merry-go-round as one asset and sector after another is ignited by a massive flood of money seeking a quick return.

Read More »

Read More »

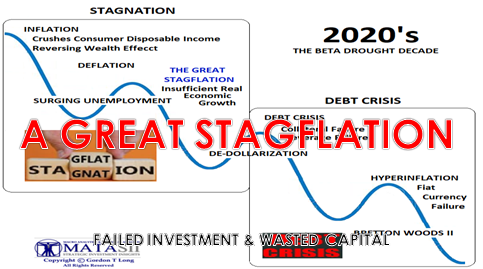

Inflation/Deflation: The Economy Is an Elephant

This is the key dynamic of the economy going forward: defaults on debt, declining wealth as assets are relentlessly repriced lower and sharp declines in income due to layoffs and debt defaults. The economy is like an elephant surrounded by blindfolded economists and pundits: what each blindfolded person reports about the elephant depends on what part they happen to touch.

Read More »

Read More »

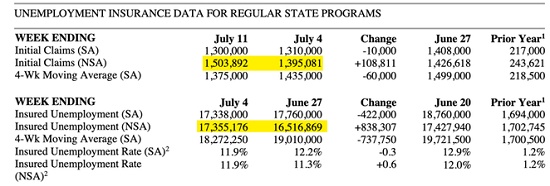

The Real Unemployment Rate is 21 percent and Heading Higher

As businesses, agencies and organizations recalibrate to the reality that the V-shaped recovery was nothing but a brief fantasy, 6 million additional jobs lost may be a best-case scenario rather than the worst-case scenario.

Read More »

Read More »

Welcome to the Crazed, Frantic Demise of Finance Capitalism

The cognitive dissonance required to ignore the widening gap between the real economy and the fraud's basic machinery--speculation funded by "money" conjured out of thin air--has reached a level of denial that can only be termed psychotic.

Read More »

Read More »

This Is a Financial Extinction Event

The lower reaches of the financial food chain are already dying, and every entity that depended on that layer is doomed. Though under pressure from climate change, the dinosaurs were still dominant 65 million year ago--until the meteor struck, creating a global "nuclear winter" that darkened the atmosphere for months, killing off most of the food chain that the dinosaurs depended on.

Read More »

Read More »