Category Archive: 5.) Charles Hugh Smith

Charles Hugh Smith: Entrepreneur Skills A Must for Any Job

Jason Burack of Wall St for Main St interviewed economic blogger and author Charles Hugh Smith from the popular blog Of Two Minds

Read More »

Read More »

Will the Stock Market Be Dragged to the Guillotine?

The Fed's rigged-casino stock market will be dragged to the guillotine by one route or another. The belief that the Federal Reserve and its rigged-casino stock market are permanent and forever is touchingly naive. Never mind the existential crises just ahead; the financial "industry" (heh) projects unending returns of 7% per year, or is it 14% per year?

Read More »

Read More »

Why We’re Doomed: Our Delusional Faith in Incremental Change

Better not to risk any radical evolution that might fail, and so failure is thus assured. When times are good, modest reforms are all that's needed to maintain the ship's course. By "good times," I mean eras of rising prosperity which generate bigger budgets, profits, tax revenues, paychecks, etc., eras characterized by high levels of stability and predictability.

Read More »

Read More »

Our Simulacrum Economy

In the hyper-real casino, everyone has access to the terrors of losing, but only a few know the joys of the rigged games that guarantee a few big winners by design. Readers once routinely chastised me for over-using simulacrum to describe our economy and society.

Read More »

Read More »

A Hard Rain Is Going to Fall

The status quo is about to discover that it can't stop the hard rain or protect its fragile sandcastles. You'll recognize A Hard Rain Is Going to Fall as a cleaned-up rendition of Bob Dylan's classic "A Hard Rain's a-Gonna Fall".

Read More »

Read More »

Things Change

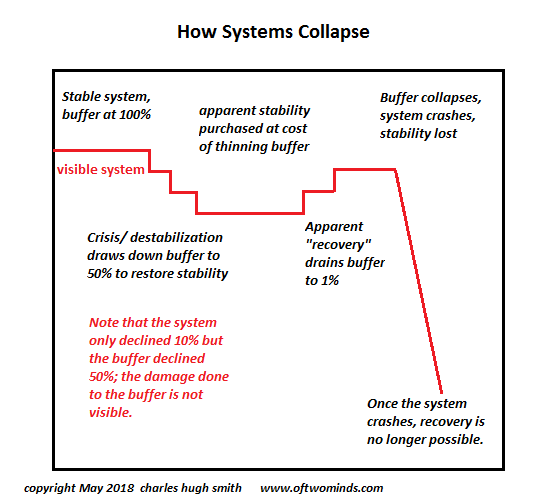

Things change, supposedly immutable systems crumble and delusions die. That's the lay of the land in the The Empire of Uncertainty I described yesterday.

Read More »

Read More »

Things Change: Charles Hugh Smith

Https://rebrand.ly/rawealthpartners1

Join Now

Things Change: Charles Hugh Smith , Keyword

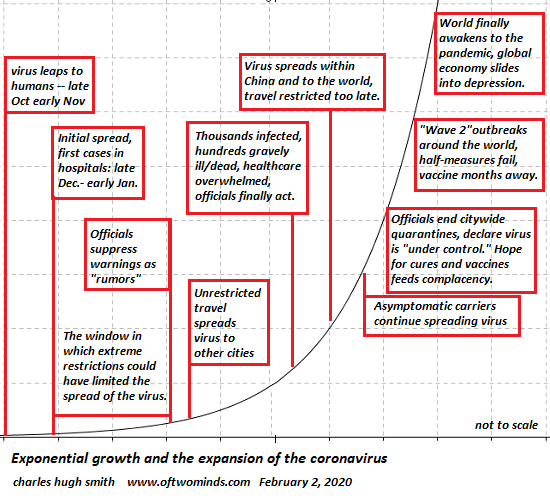

"Doing more of what's hollowed out our economy and society" is a slippery

path to ruin. Things change, supposedly immutable systems crumble and delusions die. That's the lay of

the land in the The Empire of Uncertainty I described yesterday. It's difficult not to be reminded of the Antonine Plague of 165 AD that crippled the Western Roman

Empire....

Read More »

Read More »

The Urban Exodus and How Greatness Goes Bankrupt

The best-case scenario is those who love their "great city" will accept the daunting reality that even greatness can go bankrupt. Two recent essays pin each end of the "urban exodus" spectrum.

Read More »

Read More »

The Empire of Uncertainty

Anyone claiming they can project the trajectory of the U.S. and global economy is deluding themselves. Normalcy depends entirely on everyday life being predictable. To be predictable, life must

be stable, which means that there is a high level of certainty in every aspect of life.

Read More »

Read More »

Helicopter Money and the End of Taxes

Rather than right the ship, the "easy fix" is to distribute "free money"--not just to billionaires and corporations but to everyone.

Read More »

Read More »

Charles Hugh Smith: Radical Changes in Jobs Market Now & in Future

Economy," "Get a Job, Build a Real Career and Defy a Bewildering Economy" and most recently, "A Radically Beneficial World: Automation, Technology and Creating Jobs for All." His work is published on a number of popular financial websites including Zero Hedge, Financial Sense, and David Stockman's Contra Corner.

Read More »

Read More »

People Are Now Aware Of What Will Happen

Recently, people are more aware of what can happen. This awareness raises in economic conditions and political realities make people think. Every new choice is a new beginning for people.

Read More »

Read More »

The Silent Exodus Nobody Sees: Leaving Work Forever

The "take this job and shove it" exodus is silently gathering momentum. The exodus out of cities is getting a lot of attention, but the exodus that will unravel our economic and social orders is getting zero attention: the exodus from work. Like the exodus from troubled urban cores, the exodus from work has long-term, complex causes that the pandemic has accelerated.

Read More »

Read More »

Inflation and “Socialism-Lite” Are Just What the Billionaires Want

After a bout of inflation and "socialism-light", we could end up with even more extreme inequality when the whole rotten structure collapses.

Read More »

Read More »

Charles Hugh Smith: What Would A Better System Look Like?

Writer, philosopher and long-time contributor to PeakProsperity.com, Charles Hugh Smith, returns to the podcast to explain the new socio-economic model he has just introduced to the world through his new book A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet.

Read More »

Read More »

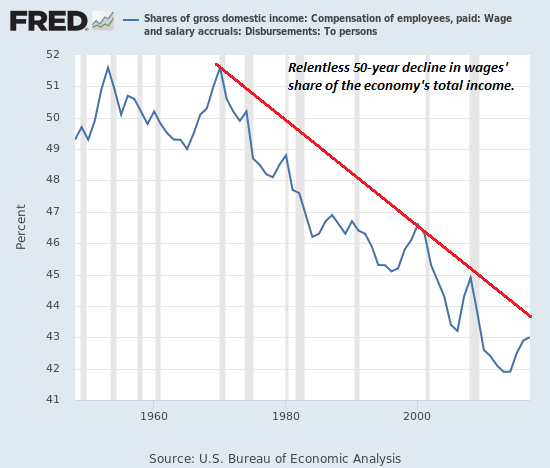

“Inflation” and America’s Accelerating Class War

Those who don't see the fragmentation, the scarcities and the battlelines being drawn will be surprised by the acceleration of the unraveling. I recently came across the idea that inflation is a two-factor optimization problem.

Read More »

Read More »

Sacrifice for Thee But None For Me

The banquet of consequences for the Fed, the elites and their armies of parasitic flunkies and factotums is being laid out, and there won't be much choice in the seating. Words can be debased just like currencies. Take the word sacrifice.

Read More »

Read More »

The Four D’s That Define the Future

When the money runs out or loses its purchasing power, all sorts of complexity that were previously viewed as an essential crumble to dust. Four D's will define 2020-2025: derealization, denormalization, decomplexification and decoherence. That's a lot of D's. Let's take them one at a time.

Read More »

Read More »