Category Archive: 5.) Brown Brothers Harriman

Dollar Firm in Thin Holiday Trading

The virus news stream is mostly positive today; yet risk assets are starting the week under some modest pressure. The dollar took a hit last week but we think it will recover; some US data releases from Good Friday are worth repeating. With most of Europe closed today, the news stream from the region is very light; oil prices could not extend their gains today after OPEC+ finalized output cuts over the weekend.

Read More »

Read More »

Dollar Under Modest Pressure as Europe Returns from Holiday

The tug of war between extending vs. softening lockdowns continues. The dollar remains under modest pressure but we think it will eventually recover; Bernie Sanders has endorsed Joe Biden. Europe reopens from holiday today but the news stream remains light; South Africa surprised with an emergency 100 bp rate cut.

Read More »

Read More »

Lessons from Singapore?

Singapore has been hailed for its quick response to the coronavirus that limited initial infections, but the outlook is shifting. Despite their early success, they will have to revert to a lockdown. Can Singapore’s experience offer any lessons for European and the US policymakers?

Read More »

Read More »

Dollar Firm as Europe Fails to Deliver

The dollar is stabilizing; reports suggest the White House is developing a plan to reopen the US economy sooner rather than later. Both Hong Kong and Singapore just tightened restrictions on gathering and movement. FOMC minutes for the March 15 decision will be released today.

Read More »

Read More »

Restricted Market Trading Comments

With many markets still under lockdown and some going out on Easter holidays this week, we continue to see amended trading hours. The most notable change has been in India with a reduction in trading hours, while in Nigeria we saw a small amount of liquidity being released by the Central Bank of Nigeria (CBN). Below are our updates for the week.

Read More »

Read More »

Dollar Mixed, Equities Higher as Virus News Stream Improves

It was a relatively good weekend in virus-related news; measures of implied volatility continue to trend lower. The dollar is trying to build on its recent gains; investors continue to try and gauge just how bad the US economy will get hit. The outlook for oil prices remains highly uncertain and volatile.

Read More »

Read More »

EM Preview for the Week Ahead

EM may get a little support from a potential OPEC+ deal to limit oil. Even if a deal is struck, the impact is likely to be fleeting as the global growth outlook remains terrible. We remain negative on EM for the time being.

Read More »

Read More »

Dollar Bid as Market Sentiment Worsens

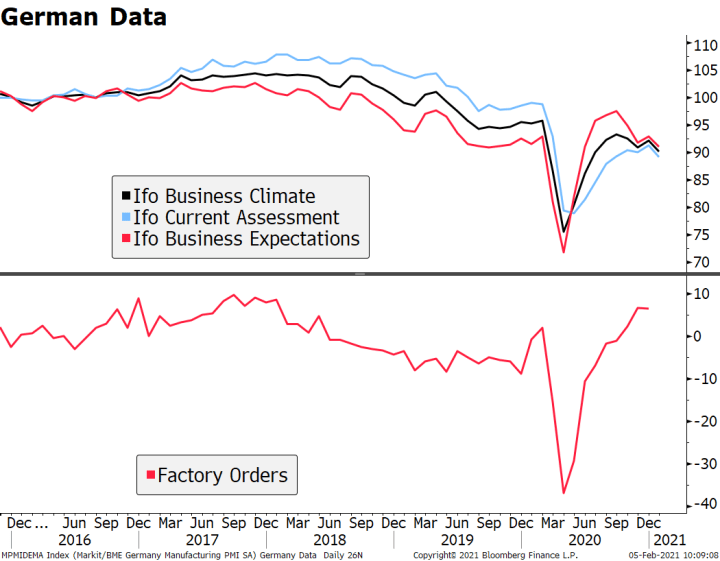

The virus news stream out of Europe has improved a bit. The US is already taking about the next relief bill; the Fed continues to roll out measures to address dollar funding issues. ADP and ISM manufacturing PMI are the US data highlights. Regulators across Europe are asking banks to stop paying dividends; eurozone and UK reported final manufacturing PMIs.

Read More »

Read More »

Drivers for the Week Ahead

Markets continue to digest the implications of the Fed’s bazooka moment last week. The data highlight this week will be March jobs data Friday; key manufacturing sector data will come out earlier in the week. On Friday, BOC delivered an emergency 50 bp rate cut to 0.25% and started QE.

Read More »

Read More »

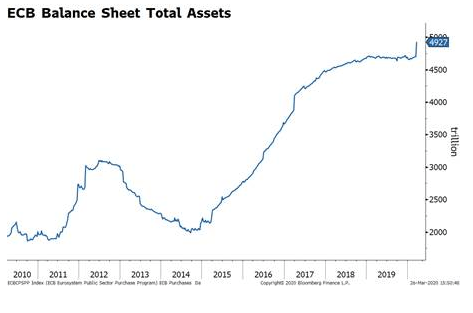

ECB Approaching its Bazooka Moment

The ECB appears to be moving closer to activating Outright Monetary Transactions (OMT). Despite being part of Draghi’s “whatever it takes” moment, OMT has never been used. If the Fed’s open-ended QE is seen as dollar-negative, then OMT should be seen as euro-negative.

Read More »

Read More »

Drivers for the Week Ahead

Risk sentiment is likely to remain under pressure this week as the impact of the coronavirus continues to spread; demand for dollars remains strong. As of this writing, the Senate-led aid bill has stalled; the US economic outlook is getting more dire; Canada is experiencing similar headwinds. This is a big data week for the UK; eurozone March flash PMIs will be reported Tuesday; oil prices continue to slide.

Read More »

Read More »

Dollar Firm, Markets Unsettled Despite Aggressive Policy Responses Worldwide

Markets remain unsettled even as policymakers worldwide continue to take aggressive emergency measures; the dollar continues to power higher. Fed rolled out another crisis-era program last night; US Senate passed the House virus relief bill by a 90-8 vote. ECB held an emergency call last night and announced an additional bond purchase program to the tune of €750 bln that now includes commercial paper.

Read More »

Read More »

EM Preview for the Week Ahead

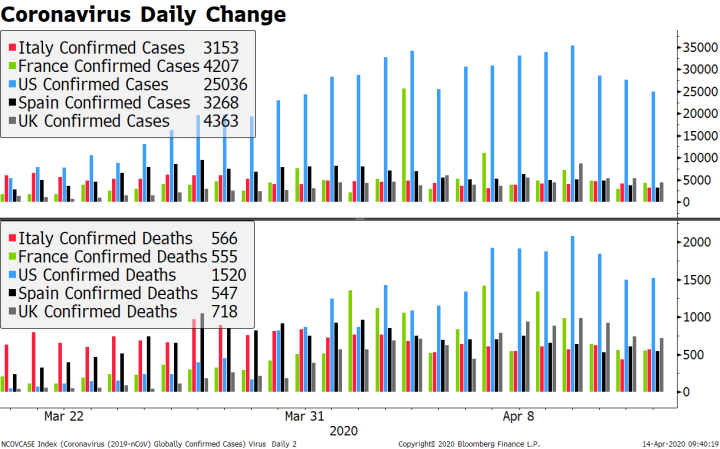

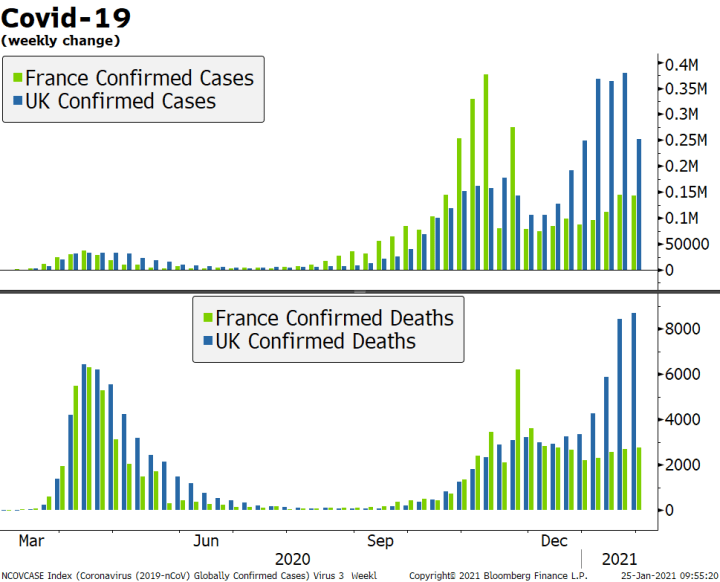

Market sentiment is likely to open this week on an upswing after the Fed’s emergency rate cut and expanded QE were announced Sunday afternoon local time. Yet as we have seen time and again this past couple of weeks, added stimulus has had little lasting impact on markets as the virus numbers continue to worsen. Europe is now reporting more daily cases than China did at its peak. We remain negative on EM until the global growth outlook becomes...

Read More »

Read More »

Dollar Firms, Equities Sink Ahead of ECB Decision as US Fails to Deliver

President Trump spoke to the nation last night and did little to calm markets; reports suggest that the Democrats are working on a bill. Fed easing expectations are intensifying. The ECB decision will be out at 845 AM ET; over the past 17 ECB decision days, the euro has finished lower in 11 of them.

Read More »

Read More »

Dollar Soft as BOE Surprises Ahead of UK Budget

The dollar is stabilizing but remains vulnerable to disappointment as markets await details of US fiscal measures. US reports February CPI; Joe Biden moved closer to clinching the Democratic nomination. BOE delivered a surprise 50 bp rate cut to 0.25% and initiated a new lending scheme; UK government releases its budget today; UK reported weak data.

Read More »

Read More »

ECB Preview, March 11

Christine Lagarde will chair her third ECB meeting Thursday. She faces growing risks of recession but also widespread skepticism within the ECB regarding the efficacy of negative rates. Markets have priced in several rate cuts this year. Here, we discuss what measures the ECB may take this week.

Read More »

Read More »

Dollar Firm as Global Financial Markets Calm

Global financial markets are finally seeing a measure of calm return; local Chinese media is sounding more confident that the situation is now under control. The White House will announce fiscal measures today; five states hold primaries and one holds a caucus with 352 total pledged delegates up for grabs.

Read More »

Read More »

Drivers for the Week Ahead

Risk-off sentiment continues to build as the coronavirus spreads. Fed easing expectations continue to intensify; February inflation readings for the US will be reported this week. The ECB meets Thursday and markets are split; the stronger euro is doing the eurozone economy no favors. The UK has a heavy data release schedule Wednesday; UK government also releases its budget that day.

Read More »

Read More »

Updated Democratic Primary Timeline

Super Tuesday has come and gone. Bloomberg has suspended his campaign after an extremely poor showing, and Warren is expected to follow suit soon. Here is our updated take on the likely Democratic candidate.

Read More »

Read More »

Drivers for the Week Ahead

The dollar has softened as Fed easing expectations have picked up. Late Friday, Chair Powell issued an unscheduled statement saying the Fed is monitoring the virus and will act as appropriate. This is a big data week for the US; the Fed releases its Beige Book report Wednesday. Super Tuesday comes this week; Bank of Canada meets Wednesday.

Read More »

Read More »