Category Archive: 5.) Alhambra Investments

Weekly Market Pulse: Did Powell Just Blink?

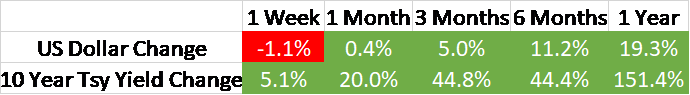

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close.

Read More »

Read More »

Market Currents: Fed Confusion

The Federal Reserve seems confused about its role in inflation and unemployment. Alhambra’s Steve Brennan and Joe Calhoun discuss it.

Read More »

Read More »

Weekly Market Pulse: Just A Little Volatility

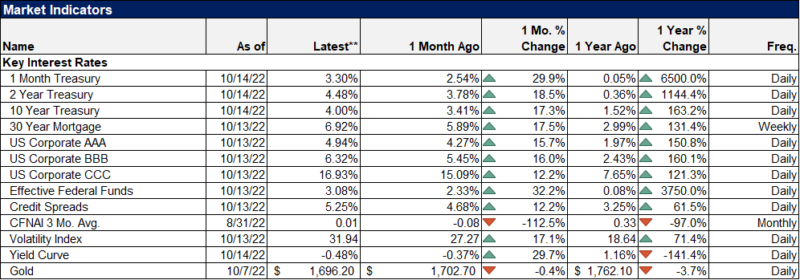

Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is.

Read More »

Read More »

It’s Time to Tackle the Year-End Financial Checklist

Here we are again in the final quarter of the year when thoughts turn to Thanksgiving and Christmas and… reviewing your financial house. Oh, that’s not on your list? Well, let’s put it there because financial issues cannot be on automatic pilot. Things change and you need to keep current. Here are 16 items you need to review before the end of the year.

Read More »

Read More »

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

Market Currents: Don’t Listen to Buy and Hold Investing Advice

For decades a Buy and Hold strategy was a staple of financial advice. But should it be? Alhambra CEO separates myth and reality.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Are investors at the point of maximum pessimism? Alhambra CEO Joe Calhoun talks about a horrible 3rd quarter, sentiment, and where investors can look right now.

Read More »

Read More »

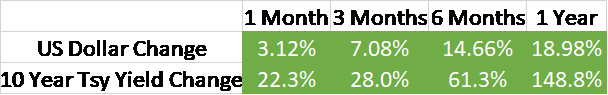

Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year.

Read More »

Read More »

Medicare Part B Premiums Will Go Down in 2023

In a world where the price of everything is going up, Medicare recipients get a price cut beginning January 1, 2023. The Centers for Medicare and Medicaid Services (CMS) just announced that the monthly premium for Medicare Part B, which covers doctor visits, diagnostic tests, and other outpatient services, is decreasing $5.20 per month to $164.90.

Read More »

Read More »

Market Currents: Impact of Fed Tightening on Home Prices

What impact does Fed tightening really have on home prices? Doug Terry, Alhambra’s Head of Investment Research, explains.

Read More »

Read More »

Market Currents – Is The Economy Contracting?

Is the economy contracting? Alhambra’s Steve Brennan poses that question to CEO Joe Calhoun.

Read More »

Read More »

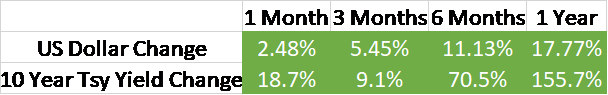

Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy.

Read More »

Read More »

Be Sure to Read the Medicare Fine Print

Medicare. The government defines it as “The federal health insurance program for people 65 and older.” That seems simple enough. But there’s more to it than meets the eye because Medicare, like so many other things, has fine print that could end up costing you a lot of money if you don’t know about it.

Read More »

Read More »

Weekly Market Pulse: The More Things Change…

I stopped in a local antique shop over the weekend. The owner is retiring and trying to clear out as much as she can before they close the doors so I paid a mere $3 for the Life magazine above. I think it might be worth many multiples of that price for investors who think our situation today is somehow uniquely bad. The cover headline could just as easily be describing today as 1970.

Read More »

Read More »

Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun compares the similarities between today’s bear market and past ones, plus last week’s data on the economy, employment, and whether the new data points to recession.

Read More »

Read More »

Goldilocks Calling

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now.

Read More »

Read More »

How Working Longer Affects Your Social Security Benefits

Since 1935, Social Security has been synonymous with retirement. It was always intended to supplement retirement income, never be a person’s total retirement income. Unfortunately, according to the Center on Budget and Policy Priorities, about half of older Americans rely on Social Security for at least 50% of their income, and 25% of retirees rely on it for 90% of their income. That’s why more Americans are choosing to work longer.

Read More »

Read More »