Category Archive: 4) FX Trends

Weekly Speculative Positions: Last Reduction of Euro Short Positions?

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure.

Read More »

Read More »

FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it may not be several more months.

Read More »

Read More »

FX Weekly Review, March 27 – 31: Euro breaks down against USD and CHF

Weak inflation figures in the euro zone let the common currency fall against both the dollar and the Swiss franc. Still last week, the Swiss Franc index had some losses against the US dollar index.

Read More »

Read More »

Great Graphic: Emerging Market Stocks

MSCI Emerging Market Index is up 12.25% here in Q1. The index is approaching long-standing technical objectives. Look for profit-taking ahead of quarter-end as fund managers rebalance.

Read More »

Read More »

Five Keys to Understand Trump

The election of Donald Trump as the 45th President of the United States surprised many people, even seasoned political observers and astute investors. He failed to win the popular vote but did carry the electoral college, which is how the US elects its chief executive. His victory is a bit of a Rorshcach test, where people project the issues that allowed Trump to succeed, with different observers making different claims.

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

Cool Video: “Turn Around Tuesday” Call in Early Asia Yesterday

I had time this afternoon, as I prepare for my TMA presentation tomorrow night here in Hong Kong, to find my clip from yesterday on CNBC, where I suggested the risk of a dollar recovery after it lost downside momentum in North America on Monday.

Read More »

Read More »

Cool Video: Brexit, Europe and EU Challenges

Earlier today, I had the opportunity to discuss the outlook for sterling and the US dollar on Bloomberg TV with Rishaad Salamat and Haidi Lun. It is a momentous day with Article 50 of the Lisbon Treaty being formally triggered by UK Prime Minister May, nine months after what was, at least initially, a non-binding referendum.

Read More »

Read More »

FX Daily, March 28: Prospects for Turnaround Tuesday?

The slide in the US dollar and US interest rates faded in the North American session on Monday. US participants also had a fairly relaxed initial response to news that after years of complaining, the Republicans could not agree on an alternative to the Affordable Care Act.

Read More »

Read More »

Weekly Speculative Positions: Continued reduction of Euro Shorts

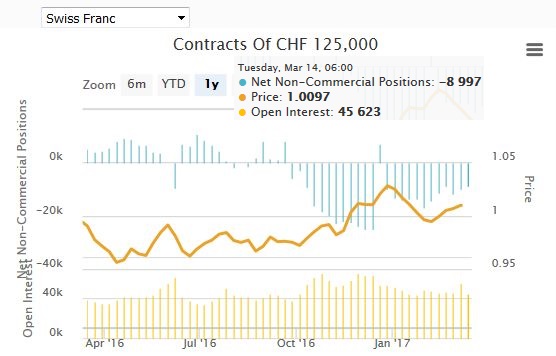

Another time speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »

FX Weekly Preview: After US Health Care, Now What?

The first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar's whose 5.8% rally includes last week's 1% drop. The worst performing major currency has been the Canadian dollar.

Read More »

Read More »

Brexit is here: How to trade the Article 50 trigger

On March 29, Theresa May will trigger Article 50. That sets a two year negotiation period for the UK to leave the European Union — the Brexit is here. The foreign exchange market has built up an incredibly large short position against the pound in anticipation of Article 50. In this video, Adam Button from …

Read More »

Read More »

FX Weekly Review, March 20 – March 25: Dollar Bottom Near?

In the last week, the Swiss Franc index recovered and gained about 2%. The dollar index lost 1.5%. Position adjustments: The dollar tended to trade heaviest against those currencies that speculators were short, like the euro, yen, and sterling.

Read More »

Read More »

FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

The US dollar has been stabilizing over the past couple of sessions. This broad stability of the dollar is impressive because of the questions of the prospects of US President Trump's economic agenda. Expectations for tax reform and infrastructure spending have bolstered investor confidence and helped boost equity prices despite what appears to be stretched valuation.

Read More »

Read More »

FX Daily, March 23: Some Thoughts about the Recent Price Action

The gains the US dollar scored last month have been largely unwound against the major currencies. The dollar's losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has also seen the US 10-year yield slide 25 bp in less than two weeks. The two-year yield is off 17 bp.

Read More »

Read More »

Status of US Pivot To Asia

Pivot still taking place, but without TPP, more militaristic. President Trump seems a little less confrontational toward China. China is unlikely to be cited as a currency manipulator in next month's Treasury report.

Read More »

Read More »

FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

Growing confidence that Le Pen will not be the next president of France following the televised debate for which two polls showed Macron doing best has lifted the euro and reduced the French interest rate premium over Germany. The euro pushed through $1.0800 after initially dipping below yesterday's lows.

Read More »

Read More »

Weekly Speculative Position: After ECB, Reduction of Euro Shorts

Speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »