Category Archive: 4) FX Trends

FX Daily, May 26: Anxiety Levels Rise Ahead of Weekend

The markets are unsettled. It is not so much in the magnitude of moves as the breadth of the move. The nearly 1% rally in gold is a tell, but also the inability of equity market to follow the lead of the US markets, where the S&P 500 and NASDAQ set new records. US yields are softer, and the yen is the strongest of the major currencies, up 0.7% against the greenback.

Read More »

Read More »

Great Graphic: OIl and the S&P 500

The fluctuation of oil prices is often cited as an important factor driving equities. Our work shows that this is not always the case and that the correlation between the price of oil and the S&P 500 continues to ease.

Read More »

Read More »

FX Daily, May 25: Euro Strength more than Dollar Weakness

The Dollar Index is heavy, just above the lows set earlier this week set near 96.80. However, this exaggerates the dollar's weakness because the weight of the euro and currencies that shadow it, like the Swiss franc and Swedish krona. As the North American session is about to start, the dollar is higher against the dollar-bloc currencies and the Japanese yen.

Read More »

Read More »

Economic Update: Marc Chandler-Does the World Have Too Much Capital?

Please Click Below to SUBSCRIBE for More “Special Report Radio” Videos https://goo.gl/nKkpGr Thanks for watching!!! *********************************************

Read More »

Read More »

Marc Chandler-Does the World Have Too Much Capital?

Marc Chandler opposes conventional understanding of international economics by suggesting the challenge modern economies face is not scarcity, but surplus.

Read More »

Read More »

Marc Chandler-Does the World Have Too Much Capital?

Marc Chandler opposes conventional understanding of international economics by suggesting the challenge modern economies face is not scarcity, but surplus.

Read More »

Read More »

FX Daily, May 24: Dollar Consolidates, While Market Shrugs Off China Downgrade

After staging a modest recovery in North America yesterday afternoon, the greenback is consolidating in narrow ranges. Momentum traders, who appeared to dominate activity recently, paused. To be sure, the greenbacks upticks have been modest, and little technical damage has been inflicting on the major foreign currencies.

Read More »

Read More »

Four Numbers to Watch in FX

The dollar's downside momentum faded today, but it has not shown that it has legs. Watch 96.45 in the DXY and $1.3055 in sterling. The US 2-year note yield is low, given expectations for overnight money. The US premium needs to widen.

Read More »

Read More »

FX Daily, May 23: Greenback Remains Soft

The US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny collusion with Russia.

Read More »

Read More »

FX Daily, May 22: Dollar Pushes Back

After being shellacked last week, the US dollar is trading with a firmer bias against all the major currencies, but the euro and New Zealand dollar. To be sure, it is not that a new development has emerged to take investors' minds from intensifying political uncertainty in the US.

Read More »

Read More »

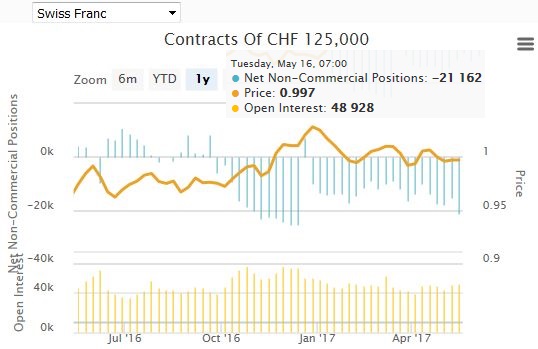

Weekly Speculative Positions (as of May 16): Yen and Aussie Bears Push Forward, while Sterling Bears Continue to Run for Cover

The net short CHF position has risen from 15.2 short to 21.1K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the Commitment of Traders reporting week ending May 16, speculators in the futures market made three significant adjustments in the currency futures.

Read More »

Read More »

FX Weekly Preview: Nothing Like A Good US Drama

US drama distracts from the difficult and ambitious economic program. European and Japanese developments have been constructive. Bank of Canada is the only G7 central bank that meets, and it is not expected to shift from its cautious stance.

Read More »

Read More »

Merkel Sends Euro Higher

Markel said the euro was too weak, so it rallied. This is not a new position for Germany. Merkel may now tack to the left since the AfD appears to have been dispatched. Look for Weidmann to begin moderating views or becoming less antagonistic.

Read More »

Read More »

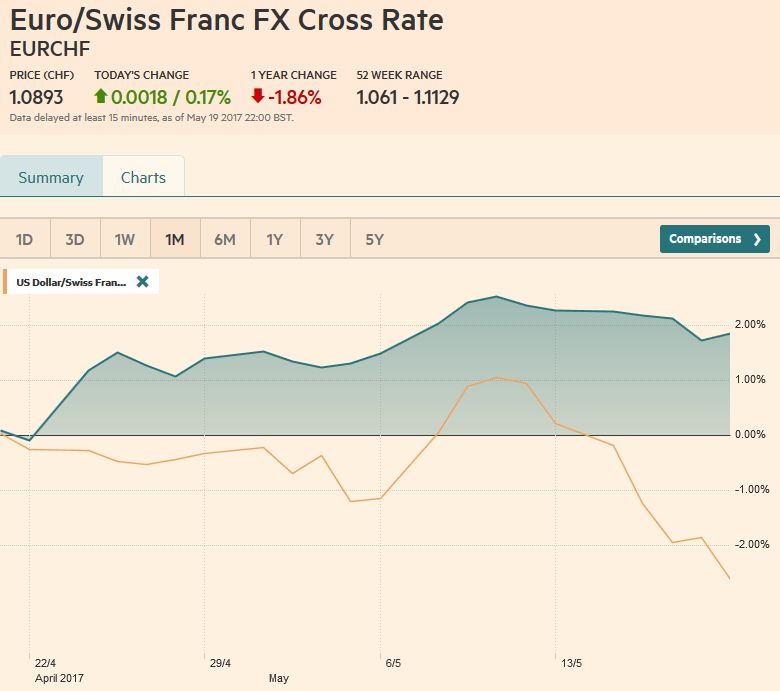

FX Weekly Review, May 15-20: Swiss Franc recovering against EUR

The Swiss Franc recovered a lot of the losses that came with the French elections. That political event was mostly driven by speculators that will close their positions. We expected the EUR to trade around 1.07 to 1.0750 CHF in some time.

Read More »

Read More »

Markozy, Merde, and now Meron

German Chancellor Merkel is one of the outstanding leaders of our era. She leads the world's fourth largest economy, which is still the locomotive for Europe. Recent state elections and polls leave little doubt that barring some kind of shock, she will be re-elected as Chancellor in September. It will be her fourth term.

Read More »

Read More »

FX Daily, May 19: Markets Trying to Stabilize Ahead of Weekend

Judging from investors' reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices.

Read More »

Read More »

FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

Yesterday's dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI's investigation into Russia's attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump Administrations economic program is back the front burners, but it is sufficient to stem the time for the moment.

Read More »

Read More »

FX Daily, May 17: Drama In Washington Adds To Dollar Woes

The US dollar has drifted lower against most of the major currencies as the culmination of news from Washington, escalating already rising concerns about the economic agenda that was to bolster growth with dramatic tax reform, infrastructure initiative, and re-orienting trade.

Read More »

Read More »

Cool Video: Oil, US Inflation

I was on Bloomberg's Day Break with the team and guest Anne Lester from JP Morgan discussing oil and inflation. Oil prices had bounced back at the end of last week and were lifted further on news that Saudi Arabia and Russia were inclined to support extending output cuts not just until the end of the year, but through Q1 18.

Read More »

Read More »

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »