Category Archive: 4) FX Trends

FX Daily, December 06: Equity Slump Continues, Lifts Bonds, Bolsters Yen

The swoon in equities, perhaps sparked by a rotation spurred by potential US tax changes, is continuing today. It is providing a risk-off mood, which is expressed in the foreign exchange market as a stronger yen. The most compelling answer of yen strength is not that investors are buying yen as a haven.

Read More »

Read More »

FX Daily, December 05: Sterling Sold on Negotiating Snafu, Aussie Bounces on Retail Sales and RBA

The US dollar is confined to narrow ranges against the euro and yen, straddling unchanged levels in the Asian session and the European morning. The action in elsewhere. The British pound is the weakest of the majors, paring 0.4% against the greenback, though around $1.3425, it can hardly be considered weak. A month ago, sterling was a few cents lower. Still, its gains reflected two things: broader dollar weakness and optimism on Brexit talks.

Read More »

Read More »

FX Daily, December 04: US Dollar Marked Higher After Senate Passes Tax Reform

The US dollar opened higher in Asia and retained those gains through the European morning. The greenback has recouped most of the pre-weekend losses recorded in the wake of the indictment of a fourth former Trump Administration official by the special investigation into Russia's involvement in last year's election. However, two weekend developments seemed to blunt the impact of the guilty plea and admission of cooperation.

Read More »

Read More »

FX Weekly Preview: Politics may Continue to Overshadow Economics

The new monthly cycle of high frequency economic data has begun. The manufacturing PMI shows the synchronized global recovery is continuing. The service sector and composite PMI will be reported in the week ahead. They are unlikely altering the general expectation for robust growth in Q4.

Read More »

Read More »

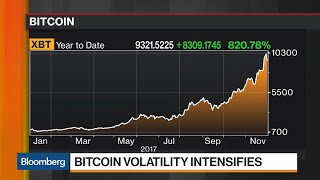

Cool Video: Short Take on Bitcoins

I stopped by Bloomberg near midday to talk with Vonnie Quinn and Shery Ahn. We talked about many macro issues, but this clip that Bloomberg provided covers is the one topic that has overshadowed the big rally in US equities, tax reform and Matt Lauer: Bitcoins. In this two minute clip, I mention that despite Bitcoins capturing the headlines, most Americans are not and cannot be involved.

Read More »

Read More »

FX Daily, December 01: Dollar Consolidates Weekly Gain, while Equities Ease to Start New Month

The release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another grand coalition in Germany. The US dollar is mixed, with the dollar-bloc currencies and Scandis pushing higher.

Read More »

Read More »

Great Graphic: US 2-year Yield Rises Above Australia for First Time since 2000

The US and Australian two-year interest rates have diverged. There is scope for a further widening of the spread. Directionally the correlation between the exchange rate and the rate differentials is strong, but not stable. Near-term technicals are supportive but the move above trendline resistance is needed to confirm.

Read More »

Read More »

Why Brown Brothers’ Chandler Is Staying Away From Bitcoin

Nov.30 -- Marc Chandler, Brown Brothers Harriman's global head of currency strategy, discusses the volatility in bitcoin with Bloomberg's Vonnie Quinn and Shery Ahn on "Bloomberg Markets."

Read More »

Read More »

Why Brown Brothers’ Chandler Is Staying Away From Bitcoin

Nov.30 — Marc Chandler, Brown Brothers Harriman’s global head of currency strategy, discusses the volatility in bitcoin with Bloomberg’s Vonnie Quinn and Shery Ahn on “Bloomberg Markets.”

Read More »

Read More »

FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between...

Read More »

Read More »

FX Daily, November 29: Sterling Charges Ahead on Brexit Hopes

Prospects of a deal with the EU has sent sterling to its best level in two months against the dollar. It reached $1.3430 in early European turnover. It had sunk to nearly $1.3220 yesterday as European markets were closing, which was a four-day low. It is the strongest of the major currencies today, gaining about 0.4%. With today's gains has met our retracement target near $1.3415. The momentum appears to give it potential toward $1.3500 in the...

Read More »

Read More »

FX Daily, November 28: Greenback Ticks Up in Cautious Activity

The US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed's Powell prepared remarks for his confirmation hearing to succeed Yellen as Chair. Unlike last year, this year's BOE stress test saw all seven banks pass.

Read More »

Read More »

FX Daily, November 27: Slow Start to Busy Week

The US dollar is narrowly mixed and is largely consolidating last week's losses as the market waits for this week's numerous events that may impact the investment climate. These include the likelihood of the US Senate vote on tax reform, preliminary eurozone November CPI, a vote of confidence (or lack thereof) in the deputy PM in Ireland, Powell's confirmation hearing as Yellen's successor, the BOE financial stability report, and stress test, and...

Read More »

Read More »

FX Weekly Preview: Events + Market = Potential for Combustible Price action

There are a number of events and economic reports in the week ahead that will help shape the investment climate in the weeks and months ahead. In recognition of the importance of initial conditions, let's briefly summarize the performance of the dollar and main asset markets.

Read More »

Read More »

Great Graphic: Is that a Potential Head and Shoulders Pattern in the Euro?

The euro is breaking out to the upside. The measuring objective is near $1.2150, which is near the 50% retracement of the euro's drop from the mid-2014 high. Key caveat: It is about the upper Bollinger Band and rate differentials make it the most expensive to hold since the late 1990s.

Read More »

Read More »

FX Daily Rates, November 24: Euro Continues to Push Higher

The euro is edging higher to trade at its best levels since the middle of last month. It is drawing closer to the $1.1880 area, which if overcome, could point to return to the year's high seen in early September near $1.2100. There is a combination of factors lifting the euro. The recent data, including yesterday's flash PMI, suggests that the regional economy is re-accelerating here in Q4.

Read More »

Read More »

German Politics: What’s Next?

Coalition talks will resume in the coming days, and failing this a minority government is more likely than new elections. The is a general agreement among the political elites, and a hubris of small differences. The rate differentials and cross currency swaps show the incentive structure for holding dollars is increasing.

Read More »

Read More »

Cool Video: Bitcoin Discussion on Bloomberg

I had to be on Bloomberg's Day Break with David Westin and Alix Steel earlier today. We talked about the collapse of talks to put together a new coalition following the results of the September election. I suggested that the initial reaction was exaggerated, negotiations will likely resume in some fashion, and speculation of Merkel's demise are premature.

Read More »

Read More »