Category Archive: 4) FX Trends

Cool Video: Clip from CNBC Squawk Box

The combination of divergence and the US policy mix is underpinning the dollar and I was invited to share my views on CNBC's Squawk Box earlier today. It dovetailed nicely Matthew Diczok (from Merrill Lynch) views on Fed policy and US interest rates.

Read More »

Read More »

FX Daily, October 08: China and European Woes Weigh on Equities but Buoy the Dollar

Overview: The markets are having a rough adjustment to the return of the Chinese markets are the week-long holiday. The cut in the required reserves failed to lift investor sentiment. The Shanghai and Shenzhen Composites fell almost 4%, and the yuan slid nearly 0.8%. It is an unusually large decline for the closely managed currency. The offshore yuan fell by a little more than 0.5%.

Read More »

Read More »

FX Weekly Preview: Has an Inflection Point been Reached for Investors?

Interest rates, led by the US, have accelerated to the upside. With price pressures generally rising and oil prices at four-year highs, it is understandable. Market participants need to see the breakout that has lifted US 10-year yields to their highest level in seven years is confirmed in subsequent price action.

Read More »

Read More »

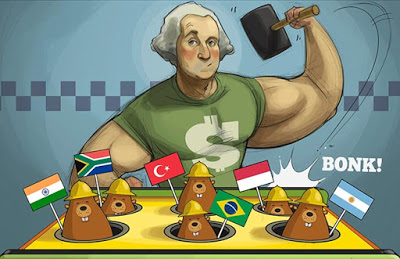

Great Graphic: The Dollar’s Role

This Great Graphic comes from Peter Coy and team's article in Business Week. It succinctly shows three metrics for the internationalization of domestic currencies: global payments, international bonds, and foreign exchange reserves. It does not strike me as surprising, and the role of the euro as a payments currency reflects its role in intra-European trade.

Read More »

Read More »

FX Daily, October 05: US Jobs Data will Test Dollar Bulls and Bond Bears

The US dollar is firmer against most of the major and emerging market currencies. The yen and sterling are resisting the pressure, while the South African rand and Russian rouble are paring some of this week's declines. US equity losses yesterday weighed on Asian and European trading today.

Read More »

Read More »

FX Daily, October 04: Dollar Consolidates Gains while Yields Continue to Rise

The US dollar is consolidating yesterday's gains against most of the major currencies, though the dollar bloc is underperforming. Bond yields are moving higher, and equities are lower. With a light data and events stream, the price action itself is the news.

Read More »

Read More »

Lessons for traders courtesy of Amazon’s Jeff Bezos

Jeff Bezos is the richest person in the world. Can his lessons for business, work for you in your trading? On September 19th, 2018, Jeff Bezos gave a somewhat rare interview at the Air Force Association Air and Space Conference. Although his comments were from his experience from running Amazon and his space company Blue …

Read More »

Read More »

Cool Video: Bloomberg Clip from Discussion on Emerging Markets

In my first television appearance since joining Bannockburn Global Forex, I joined Tom Keene and Francine Lacqua on the Bloomberg set. In this nearly 2.5 min clip, we talk about the Indonesia rupiah and the dollar's move above the IDR15000 level for the first time since the 1997-1998 Asian financial crisis.

Read More »

Read More »

FX Daily, October 02: Greenback Advances

The US dollar is rising against most of the major and emerging market currencies. The Swiss franc and the Japanese yen are the exceptions and are holding their own. Global equities are mixed. Asia, excluding Japan, was mostly lower, with 1.2% losses in Taiwan and South Korea and 2.5% drop in Hong Kong and in the H-shares that trade there.

Read More »

Read More »

A Word About the Q2 COFER Report

The IMF reports the most authoritative currency allocation of global reserves at the end of every quarter with a quarter delay. Invariably, an economist, strategist, or journalist is inspired to write why some data nugget confirms the demise of the dollar as the dominant currency.

Read More »

Read More »

FX Daily, October 01: NAFTA Deal Struck, Softer EMU Mfg PMI, and Firm Greenback Starts Week

The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar is firm. China's mainland and Hong Kong markets are closed for a national holiday.

Read More »

Read More »

Fed Delivers, Market Yawns

The Federal Reserve did what it was widely to do. The fed funds target range was lifted 25 bp to 2.00-2.25%. Three-quarters of Fed officials anticipate a hike in December. The market had discounted around an 80% chance. The Fed sticks with the three rate hikes in 2019 and one in 2020. The year-end rate in 2021 is the same as in 2020.

Read More »

Read More »

FX Daily, September 28: Dollar Remains Firm While Italy is Punished

The US dollar's post-Fed gains have been extended, though the upside momentum appears to be stalling. Japan's Nikkei advanced 1.35% on the back of the yen's declines and reached its highest level since 1991. Chinese shares (A and H) rallied amid reports that MSCI and FTSE-Russell are boosting Chinese shares in their benchmarks.

Read More »

Read More »

Canada can win the global trade war

How Canada can come out on top. Adam Button from ForexLive.com talks with BNNBloomberg. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, September 26: The Dollar Index has Fallen Four of the Five Times the FOMC met this Year

The US dollar is trading with a softer bias in tight ranges. The euro and sterling have been confined to yesterday's ranges, while the greenback briefly traded above JPY113.00 for the first time in two months. The South African rand and Turkish lira are leading the most emerging market currencies higher. Asian equities moved higher, led by Hong Kong, which returned from yesterday's holiday.

Read More »

Read More »

FX Daily, September 25: Greenback Remains at the Fulcrum

The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few exceptions in Asia, where the Indonesian rupiah and the Chinese yuan are off about 0.3%, while the Indian rupee and Malaysian ringgit are around 0.2% lower.

Read More »

Read More »

FX Weekly Preview: Next Week’s Drivers

It is a testament to the Federal Reserves communication and the evolution of investors' understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME's model, there is about an 85% chance of December hike discounted as well.

Read More »

Read More »

Portfolio Re-Balancing and the Dollar

Boosted by tax reform, deregulation, and strong earnings growth, US equities have motored ahead, leaving other benchmarks far behind. As the Great Graphic here shows, most of the other benchmarks are lower on the year. The S&P 500 (yellow line) is up 8.8% for the year before the new record highs seeing seen now, while the Dow Jones Stoxx 600 from Europe (purple line) is still off 1.7%.

Read More »

Read More »

FX Daily, September 20: The Mixed Performance Makes it Difficult to Talk about The Dollar

Sometimes the dollar is the key mover, but sometimes, like today, it seems to be the fulcrum, reflecting disparate moves among other currencies. While the euro is at two-month highs, the yen is near two-month lows. The euro is bouncing off two-month lows and the 100-day moving average against sterling. Most emerging market currencies are advancing against the dollar today.

Read More »

Read More »