Category Archive: 4) FX Trends

FX Weekly Preview: The FOMC and US Jobs Headline the Week Ahead

There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance.

Read More »

Read More »

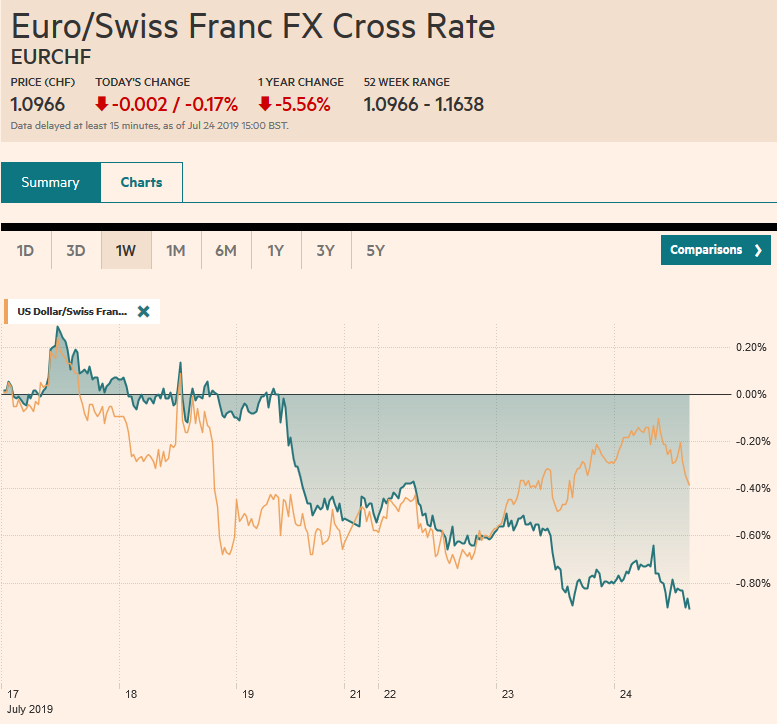

Seven Points on the ECB and the Price Action

As soon as it was clear that the ECB was not easing today, the euro began to recover, after making a marginal new low for the year (just above $1.11). Draghi made it clear that easing was going to be delivered in September and on several fronts including rates (with mitigating measures like tiering) and new asset purchases (not decided on instruments, which plays into speculation of equity purchases—though I strongly doubt this will materialize).

Read More »

Read More »

FX Daily, July 26: Markets Consolidate as the Dollar Index Extends its Advance for the Sixth Consecutive Session

Investors are happy for the weekend. Between the ECB, Brexit, and next week's FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data point of the week, though it is unlikely to impact next week's Fed decision.

Read More »

Read More »

FX Daily, July 25: ECB Takes Center Stage

The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are lower. The Turkish lira is weaker ahead of its central bank meeting, which is expected to deliver a large cut (~250 bp).

Read More »

Read More »

FX Daily, July 24: Poor PMI Weighs on Euro Ahead of ECB

Overview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow's ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and Spanish 10-year benchmark yields are off four-six basis points, while core bond yields are off two-three basis points.

Read More »

Read More »

Non trend transitions to trend. Has the EURUSD non-trended long enough?

There is a market truism that plays out eventually. That is non-trends transition to trends. The EURUSD is currently in a 463 pips tradig range for 2019. How does that compare to history? Not too favorably. The lowest trading range for a year is 1147 pips back in 2013. The recent average is around 1450 pips. There is room to roam. Be prepared.

Read More »

Read More »

Non trend transitions to trend. Has the EURUSD non-trended long enough?

There is a market truism that plays out eventually. That is non-trends transition to trends. The EURUSD is currently in a 463 pips tradig range for 2019. How does that compare to history? Not too favorably. The lowest trading range for a year is 1147 pips back in 2013. The recent average is around 1450 …

Read More »

Read More »

FX Daily, July 23: Debt Deal Help Lifts the Dollar

The gains in US equities and the apparent US budget agreement has underpinned equities today and the US dollar. Asia Pacific equities recouped yesterday's losses, and Europe's Dow Jones Stoxx is posting gains for the third consecutive session, helped by some earning beats, to probe two-week highs. US shares are firmer. Benchmark 10-year yields are mixed with the Asia Pacific softer and European firmer.

Read More »

Read More »

FX Daily, July 22: Greenback is Mostly Firmer to Start New Week, while the Euro is Pinned near $1.12

What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new Prime Minister.

Read More »

Read More »

FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market's attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa.

Read More »

Read More »

What will happen with Brexit and Adam’s top trade idea

Adam Button from ForexLive talks about the outlook for the Canadian dollar, why there is far too much worry about a hard Brexit and his favourite trade right now.

LET'S CONNECT!

Facebook ► http://facebook.com/forexlive

Twitter ► https://twitter.com/ForexLive

Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

What will happen with Brexit and Adam’s top trade idea

Adam Button from ForexLive talks about the outlook for the Canadian dollar, why there is far too much worry about a hard Brexit and his favourite trade right now. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an Iranian drone in the Gulf helped spur gold to new six-year highs. There was some attempt to clarify the (NY Fed's) comments and the dollar has pared yesterday's losses.

Read More »

Read More »

FX Daily, July 18: Dollar on Back Foot as Equities Slide

Overview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second straight session and has now retraced half of the gains scored since early June. The Shanghai Composite is at its lowest level in a month.

Read More »

Read More »

FX Daily, July 17: Back to the Well Again

Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff freeze was in exchange for ag purchases, but at the time it seemed as if granting licenses to US companies to sell to Huawei was the quid pro quo.

Read More »

Read More »

FX Daily, July 16: Sterling Weakness Punctures Subdued Session

Overview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan, South Korea, and India. Europe's Dow Jones Stoxx 600 is flattish, struggling to extend its three-day rally.

Read More »

Read More »

FX Daily, July 15: Marking Time on Monday

Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed today, but equities were mostly firmer in the Asia Pacific regions, markets in China, Hong Kong, Taiwan, and India firmed.

Read More »

Read More »

FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell's testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB's move is more debatable, an adjustment at the July 25 meeting appears to have increased.

Read More »

Read More »

FX Daily, July 12: Greenback Limps into the Weekend

Overview: Higher than expected US CPI and the second tepid reception to a US bond auction this week pushed US yields higher and helped stall the equity momentum. Asia Pacific yields, especially in Australia and New Zealand jumped 8-10 bp in response, and Spanish and Portuguese bonds bore the burden in Europe.

Read More »

Read More »

FX Daily, July 11: Powell Spurs Equity and Bond Market Rally, While the Greenback Falls Out of Favor

Overview: Fed's Powell confirmed a Fed rate cut at the end of this month by warning that uncertainties since the June FOMC had "dimmed the outlook" and that muted price pressures may be more persistent. It ignited an equity and bond market rally (bullish steepening) while the dollar was sold.

Read More »

Read More »