Category Archive: 4) FX Trends

FX Daily, December 20: Sterling Trades Higher after Test on $1.30

Overview: The holiday mood has tightened its grip on the capital markets, and global investors have nearly completely ignored the impeachment of the US President as it has little economic or policy significance. US equities reached new record highs yesterday with the S&P 500 moving above 3200.

Read More »

Read More »

FX Daily, December 19: Whiff of Inflation in the Air

It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around $61, having tested $50 a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year. The US yield curve (2-10 year) has been steepening after being inverted for a few days in August, and now at nearly 29 bp, also is new highs for the year.

Read More »

Read More »

FX Daily, December 18: Markets Turn Quiet Ahead of Central Bank Meetings

Overview: The capital markets have turned quiet as the year-end positioning drives prices in lieu of fresh developments. Equities in the Asia Pacific region were narrowly mixed. The smaller markets in Asia performed better than the large bourses of Japan, China, and Korea, which eased. European equities are off to a firm start, and the Dow Jones Stoxx 600 is consolidating near the record high set Monday.

Read More »

Read More »

FX Daily, December 17: Sterling Drops as New Brinkmanship Begins

Overview: Efforts by a UK Prime Minister emboldened by a strong electoral victory to ensure that trade negotiations with the EU are not extended as the divorce has encouraged further profit-taking on sterling. After testing the $1.35 area on the exit polls last week, sterling had returned to where it closed before the results were known near $1.3160.

Read More »

Read More »

FX Daily, December 16: China Data Surprises to the Upside while Europe’s Manufacturing PMI Disappoints

Overview: Despite better than expected Chinese data, and last week's investor-friendly developments, Asia Pacific equities were mixed. Australia led the advancing bourses with a 1.6% gain, its largest for the year despite the government revising down growth and wages. China, Taiwan, and Indian markets also moved higher.

Read More »

Read More »

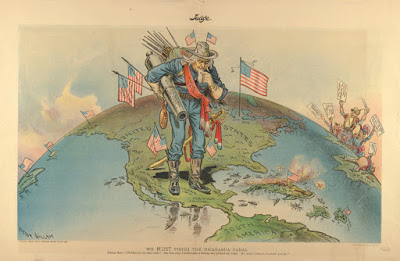

FX Weekly Preview: Central Bank Meetings and Flash PMI Reports, but its Over except for the Shouting

After last week's flurry of events, market activity is set to slow over the next three weeks. But what a flurry of events it was. A new NAFTA apparently has been agreed, and it is set to be approved by the US House of Representatives next week and the Senate early next year. The US and China struck an agreement that will get rid of the immediate tariff threat and unwind half of the punitive tariffs in exchange for a commitment to buy twice the...

Read More »

Read More »

FX Daily, December 13: Stunning Tory Victory and US-China Trade Boosts Risk Assets

Overview: The combination of a US-China trade deal and exit polls showing the Tories securing a majority in the House of Commons boosted risk assets, sent sterling flying, and the euro sharply higher. Separately, the Fed stepped up its efforts to make as smooth as possible funding over the turn of the year.

Read More »

Read More »

FX Daily, December 12: Enguard Lagarde

With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading the way. In Asia Pacific, Taiwan and South Korea rallied more than 1%, while the Hang Seng gapped higher to almost its best level in three weeks.

Read More »

Read More »

FX Daily, December 11: Sterling Holds Firm Despite Tighter Poll

Overview: The capital markets continue to tread water as investors await this week's key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde's first ECB meeting at the helm. Global equities continue consolidating the recent gains. Asia Pacific equity markets were mostly higher.

Read More »

Read More »

FX Daily, December 10: Capital Markets: Still Seems to be the Calm before the Storm

Overview: Equities are trading lower, and bonds are mixed as the FOMC, UK election, and the US decision on the December 15 tariffs draw near. The MSCI Asia Pacific Index three-day rally ended today as only China and South Korea's markets rose. Europe's Dow Jones Stoxx 600 gapped slightly lower at the open.

Read More »

Read More »

FX Daily, December 09: China’s Steps-Up Import Substitution Strategy while USMCA Comes Down to the Wire

The important week is off to a slow start. While the MSCI Asia Pacific benchmark extended its gains for a third session, European and US shares are struggling. The Dow Jones Stoxx 600 is consolidating its pre-weekend 1%+ rally, while US shares are trading heavier after rallying for the last three sessions.

Read More »

Read More »

FX Weekly Preview: An Eventful Week Ahead

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year.

Read More »

Read More »

FX Daily, December 6: And Now for the Employment Report

Overview: Asia Pacific equities closed higher today, with India being a notable exception. Hong Kong and South Korea led with 1% rallies. For the week, the MSCI index for the region advanced to snap a three-week decline. European and US bourses have not fared as well. The Dow Jones Stoxx 600 is paring this week's losses, but it is still off around 0.9% through the European morning session.

Read More »

Read More »

The key trade deal detail everyone is missing

It’s impossible to separate fact from fiction with all the noise in the China-US trade talks but a report this week was notable for an intriguing detail. It said that Trump’s son-in-law Jared Kushner had gotten involved in talks.

Adam Button speaks about why that might be telling. He also talks about the state of global growth and why the optimists are early.

LET'S CONNECT!

Facebook ► http://facebook.com/forexlive

Twitter ►...

Read More »

Read More »

The key trade deal detail everyone is missing

It’s impossible to separate fact from fiction with all the noise in the China-US trade talks but a report this week was notable for an intriguing detail. It said that Trump’s son-in-law Jared Kushner had gotten involved in talks. Adam Button speaks about why that might be telling. He also talks about the state of … Continue...

Read More »

Read More »

FX Daily, December 5: Sterling Sent Higher as Market Discounts Next Week’s Election

Overview: Global equity markets have resumed their climb after a wobble at the end of last week and earlier this week. A strong recovery in the S&P 500 on Tuesday signaled yesterday's strong advance that left a bullish one-day island low in its wake. MSCI Asia Pacific Index snapped a two-day decline today with nearly all the market with the notable exception of South Korea advanced.

Read More »

Read More »

FX Daily, December 4: Hope Springs Eternal

Overview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite PMI, are snapping a four-day 2.75% slide.

Read More »

Read More »

FX Daily, December 3: US Brandishes Tariff Weapon and Weakens Animal Spirits

Asia Pacific equities mostly declined in sympathy with yesterday's large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia's 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the move lower. Europe's Dow Jones Stoxx 600 fell 1.6% yesterday, the largest loss in two months, and is extending the losses for a third session today.

Read More »

Read More »

FX Daily, December 2: PMIs Provide Latest Fuel for Equity Markets

Mostly better than expected manufacturing PMI readings for December, including in China, is providing the latest incentive for equity market bulls. Led by the Nikkei, which was aided by a weaker yen major equity markets in Asia Pacific rallied and recouped most of the nearly 1% loss before the weekend. Europe's Dow Jones Stoxx 600 is also shrugging off the pre-weekend loss and to challenge the multiyear high recorded last week.

Read More »

Read More »

FX Daily, November 29: Equities Slip While Investors Mark Time

Overview: Global equities are trading heavily. Both the MSCI Asia Pacific and the Dow Jones Stoxx 600 snapped four-day advancing streaks yesterday and have seen some follow-through selling today. In the Asia Pacific region, all the markets fell but Jakarta. Hong Kong's Hang Seng slipped a little more than 0.2% yesterday but dropped 2% earlier today to record its biggest decline in three weeks.

Read More »

Read More »