Category Archive: 4) FX Trends

Cool Video: A Look Ahead to 2021

I joined Ben Lichtenstein, host of the morning futures program at TDAmeritrade. It is in the futures market that I began my career, and where I gained respect for local traders, who do not have a large institutional backing such as a bank or hedge fund, and are trading their own capital, and taking the risk often from those institutional participants.

Read More »

Read More »

The Dollar’s Evolving Outlook

The foreign exchange market sees an average daily turnover of something on the magnitude of $6.6 trillion a day. In a week, the turnover is sufficient to more than cover world trade for a year. It is the largest of the capital markets. Trends in the currency market can last for years.

Read More »

Read More »

FX Daily, December 21: Happy Holidays

No daily commentary until the New Year, but watch this space for thematic pieces over the next two weeks. Here is to a safe, healthy, and prosperous 2021. Thank you for your support.

Read More »

Read More »

FX Daily, December 17: Dollar Thumped

Overview: The prospects of a UK-EU deal and US stimulus continue to underwrite risk appetites and weigh on the dollar. Equity markets are moving higher. Led by Australia and China, the MSCI Asia Pacific Index rose to new record highs, while Dow Jones Stoxx 600 in Europe is at its best level since February.

Read More »

Read More »

FX Daily, December 16: Greenback Slides Ahead of FOMC as Optimism Underpins Risk Appetites

Overview: The S&P 500 snapped a four-day downdraft helped by optimism over the progress toward fiscal stimulus and some hope that a new trade deal can still be negotiated between the UK and EU. Europe reported better than expected PMIs. Equities are broadly higher, as are interest rates, while the dollar slumps.

Read More »

Read More »

FX Daily, December 15: The Bulls are Emboldened

The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the Chinese recovery failed to lift the Shanghai Composite.

Read More »

Read More »

Cool Video: CNBC-Asia–Brexit, Sterling, the Euro, and Dollar

I had the privilege to join Sri Jegarajah at CNBC Asia at the start of today's Asia Pacific session. We had a broad chat about the dollar, Brexit, and the euro. He gave me the opportunity to sketch out my views:1. The dollar's entered a cyclical decline, and the "twin deficit" issue will likely frame the narrative.

Read More »

Read More »

FX Daily, December 14: Brexit Deal Hopes Lift Sterling

The fact that the UK and EU negotiators are still talking is seen as a constructive development and has spurred a sharp bounce in sterling. It traded below $1.3150 before the weekend and is pushing above $1.3400 in the European morning.

Read More »

Read More »

FX Daily, December 11: Brexit Fears Weigh on Sterling

Overview: The odds of a UK-EU agreement and new stimulus before year-end in the US have faded and are sapping risk appetites ahead of the weekend. Although most Asia Pacific equity markets gained, China and Australia were notable exceptions, European shares are heavy, and the Dow Jones Stoxx 600 is near three-week lows.

Read More »

Read More »

FX Daily, December 10: Brexit and US Stimulus are Unresolved as Attention Turns to the ECB

Overview: US threats to break-up Facebook and the stalled stimulus talks spurred profit-taking in US shares yesterday and is dampening enthusiasm today. The MSCI Asia Pacific Index fell for the third time this week, and Europe's Dow Jones Stoxx 600 is little changed.

Read More »

Read More »

FX Daily, December 9: Hope Burns Eternal

The market is hopeful today. The Johnson-von der Leyen dinner is seen as evidence that both sides see one more opportunity, and sterling is among the strongest currencies today. Hopes of a $900 bln+ fiscal stimulus package in the US helped stir animal spirits and lift US stocks to record highs yesterday.

Read More »

Read More »

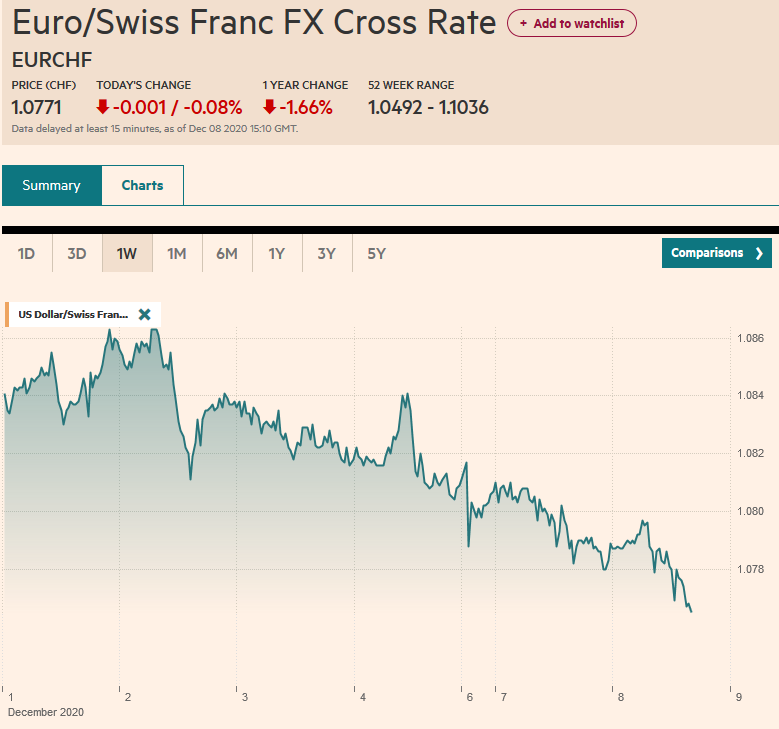

FX Daily, December 8: Consolidative Moment as Markets Wait for Fresh Developments

Overview: Three brinkmanship dramas continue to play out. The UK-EU trade talks have reportedly made little progress and may have even moved backward, according to some reports, over the past two days. The EU and Poland, and Hungary will be butting heads at the leaders' summit that begins Thursday. The US federal spending authorization is exhausted at the end of the week.

Read More »

Read More »

FX Daily, December 7: Holy Mackerel Will UK-EU Talks Really Flounder?

Overview: Optimists see the belabored talk between the UK and EU as providing for a dramatic climax of a deal, while the pessimists warn that the divergence is real. Sterling opened three-quarters of a cent lower in early turnover and is now off around two cents.

Read More »

Read More »

FX Daily, December 4: The Employment Report may not Give Greenback much of a Reprieve

After wobbling late yesterday on what appears to be old news from Pfizer about a disruption of the vaccine's supply chain, equity markets have recovered, and risk appetites remain intact. With more than 1% gains in South Korea's Kospi and Taiwan's Taiex, the MSCI Asia Pacific benchmark secured its fifth consecutive weekly gain.

Read More »

Read More »

FX Daily, December 03: Euro Rally Stalls while Brexit Concerns Trip Sterling

The selling pressure that drove the dollar lower yesterday has abated, and the greenback is paring yesterday's loss, though the dollar-bloc currencies are showing some resilience. EC negotiator Barnier briefed ministers that the same three issues that have bedeviled the trade talks with the UK remain unresolved (fisheries, level playing field, and a conflict resolution mechanism).

Read More »

Read More »

FX Daily, December 2: Euro Rally Stalls while Brexit Concerns Trip Sterling

The selling pressure that drove the dollar lower yesterday has abated, and the greenback is paring yesterday's loss, though the dollar-bloc currencies are showing some resilience. EC negotiator Barnier briefed ministers that the same three issues that have bedeviled the trade talks with the UK remain unresolved (fisheries, level playing field, and a conflict resolution mechanism).

Read More »

Read More »

FX Daily, December 1: No Follow-Through After Month-End Adjustments

The near-record rallies seen in the major equity markets in November may have contributed to the month-end drama yesterday. There has been no follow-through activity. Stocks bounced back, and the US dollar is heavy, with few exceptions.

Read More »

Read More »

FX Daily, November 30: Equities are Heavy and the Dollar Softer to Start New Week

Overview: Month-end profit-taking saw Asia Pacific shares tumble earlier today. Most markets are off 1-2.5% today after the MSCI Asia Pacific Index rose 2.25% last week. European shares are mixed, but little changed. US shares are also trading lower.

Read More »

Read More »

FX Daily, November 27: Dollar Offered Ahead of the Weekend

Equities are finishing the week on a firm tone, while the US dollar remains heavy. In the Asia Pacific, only Australia and India did not end the week on a firm note. The MSCI Asia Pacific completed its fourth consecutive weekly gain, for around a 13% gain.

Read More »

Read More »

FX Daily, November 25: Risk Appetites Stall Ahead of the US Thanksgiving Holiday

The global equity rally appears to be stalling after the US markets rallied strongly yesterday. Chinese, Taiwan, Korean, and Indian indices fell, and the MSCI Asia Pacific Index appears to have posted only its second loss this month. European shares are narrowly mixed, leaving the Dow Jones Stoxx 600 little changed.

Read More »

Read More »