Category Archive: 4) FX Trends

Subdued Ending to a Quiet Week, Ahead of Next Week’s Fireworks

Overview: Leaving aside the Australian dollar, which

is benefiting from the optimism over China's re-opening and a reassessment of

the trajectory of monetary policy after a stronger than expected inflation

report, the other G10 currencies traded quietly this week and are +/- less than

0.5%. The risk-on honeymoon to start the year remains intact. The MSCI Asia

Pacific Index has risen every day this week and index of mainland shares that

trade in...

Read More »

Read More »

Euro Closed above $1.09 but Follow-Through Buying Limited

Overview: After

some intraday penetration, the euro finally settled above $1.09 yesterday. However,

follow-through buying has been limited and technical and option-related

resistance is seen in the $1.0940-50 area. The dollar is more broadly mixed

today, with the dollar-bloc and Norwegian krone leading the advancers. The

euro, yen, and sterling are nursing small losses near midday in Europe. The

recovery of US equity indices yesterday after gap...

Read More »

Read More »

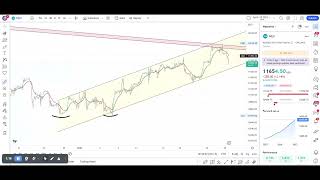

An eye opening forecast for the stock market in 2023 aided by volume profile analysis @ForexLive.com

Learn about the powerful technique of Volume Profile and how it can give you insight into the market's future direction. See how @Forexlive expert Itai Levitan uses it to predict the stock market by identifying key levels of support and resistance. Understand how volume activity at different price levels can indicate market sentiment and potential price movements.

Don't miss out on this valuable information and visit ForexLive.com for more...

Read More »

Read More »

Nasdaq technical analysis for 26 Jan 2023

The market reaction to Tesla's earnings release will be closely watched today. See how Nasdaq futures respond and if the uptrend is sustained. Learn about key resistance zones and what it means for bulls and bears.

Stay informed with expert analysis on ForexLive.com

Read More »

Read More »

Nasdaq technical analysis with the bearish MSFT earnings reversal

Learn how to spot key technical levels and potential bearish patterns in the market. Watch the video to see the next junctions to watch and the importance of the EMA20 on the daily chart. Stay ahead of the market with expert analysis.

Read More »

Read More »

The Bank of Canada rate decision is the key event today. All you need to know to be prepared.

Get ahead of the game with the latest market insights for the Bank of Canada's rate decision. Tune in to find out what's expected, potential surprises, and key technical levels to watch. Plus, a quick look at the EURUSD and USDJPY to start your trading day off right. Don't miss out, watch now!

Read More »

Read More »

Bank of Canada may say Pause, but the Market Hears Finished

Overview: Amid sharp losses in the US equity futures, the US dollar is mostly firmer against the G10 currencies. The notable exception is the Australian dollar, where high-than-expected inflation boosts the risk of a more aggressive central bank.

Read More »

Read More »

Nasdaq futures update after MSFT reversed in afterhours. Bears have the ball now. Next target is….

Learn about the impact of Microsoft's cloud business forecast on the stock market and how it affected the index. See how the stock trended during after-hours and what key levels to watch for. Don't miss out on expert analysis and stay informed with the latest market updates.

Read More »

Read More »

ES, S&P 500 Futures, post MSFT earnings, what’s next?

Stay ahead of the game with the latest update on MSFT's post-market performance and what it means for the ES index. Get expert insights and analysis on the impact of Microsoft's earnings report. Tune in now and visit ForexLive.com for more perspectives.

Read More »

Read More »

The EURUSD is trying to stay in the “Red Box”. This technical story &more in the AM video.

In this morning's technical forex report, we take a closer look at the EURUSD and its attempts to remain within a key "Red Box" level. We also analyze the USDJPY, GBPUSD, and USDCHF and their current trends.

Join us as we delve into the latest market movements and what they could mean for your trades.

Read More »

Read More »

No Follow-Through Euro Buying while S&P Holds Yesterday’s Breakout

Overview: A quiet consolidative session has been recorded

so far today as North American leadership is awaited. The preliminary PMI

readings are mixed. Japan and the eurozone look somewhat better, but Australia

and the UK disappointed. The dollar is trading with a mostly firmer bias,

but largely confined to yesterday's ranges. The markets seem to be looked

ahead toward next week's Fed, ECB, and BOE meetings, and the return of China

from this...

Read More »

Read More »

Done with the Nasdaq Bear Market for Good? Watch this Strong Technical Hint

Are you tired of the Nasdaq bear market? Want to know when it's time to make a move? Watch this video to learn about a powerful technical hint that may indicate a market attitude shift.

Weekly candle charts in technical analysis can reveal key support and resistance levels, patterns, and successive candles that can assist traders in making better decisions. Don't miss this opportunity to improve your profit potential.

Watch now!

Read More »

Read More »

Euro Pokes Above $1.09. Will it be Sustained?

Overview: The Lunar New Year holiday has shut many centers in Asia until the middle of the week, though China's mainland is on holiday all week. The signaling of a downshift in the pace of Fed tightening by some notable hawks helped lift risk appetites ahead of the weekend and saw the

S&P 500 snap a four-day decline.

Read More »

Read More »

Waller breaks down a wall, and other technical walls are also broken. What next in Forex?

Get a closer look at the latest market trends with our in-depth analysis of the major currency pairs and indexes.

In this video, we'll be discussing Fed official Waller's recent statements and how they've impacted the US stock market. Plus, we'll be reviewing the technical levels and potential trade opportunities for the Nasdaq, S&P, and more. Don't miss the start times for each review in the video description.

Tune in now!

Below are the...

Read More »

Read More »

Are We Still on the New Year Honeymoon? A Look at the Week Ahead

There are several macro

highlights in the week ahead, during which Chinese markets are closed for the

Lunar New Year celebration. The preliminary January purchasing managers surveys

pose headline risk. However, the survey data, for example, had the US composite below the 50 boom/bust level every month in H2 22, which likely overstates the case, as the first look at Q4 22 US GDP will probably show. While some improvement is expected, composite PMI...

Read More »

Read More »

Bitcoin technical analysis for 21 Jan, 2023

Join us as we take a closer look at the history of Bitcoin price predictions. We'll be revisiting the original views and analyzing the factors that have influenced them over time. Learn about the key players and developments that have shaped the trajectory of the world's most popular cryptocurrency. Don't miss out on this in-depth analysis of the past, present, and future of Bitcoin.

Watch now!

Read More »

Read More »

A trading lesson in the technical analysis of the AUDUSD

Learn the ins and outs of technical analysis with expert Greg Michalowski. In this video, he breaks down the price action in the AUDUSD and explains why the market behaves the way it does. Get a better understanding of the bias, risk and technical views supported by the price action!

Read More »

Read More »

Wake up! The morning forex technical report explains the USDJPYs move higher and more

Get the latest insights on the forex market with our morning technical report!

In this episode, we cover the impact of BOJ Governor Kuroda's comments on the USDJPY and the broader market. Don't miss out on this informative and actionable analysis, tune in now!

Read More »

Read More »

Dismal UK Retail Sales Weigh on Sterling, While the Yen Softens

Overview: The US dollar is mostly softer today against the G10

currencies, with the notable exception, yen, Swiss franc, and sterling. The

risk-on mood is seen in the foreign exchange market with the Antipodean and

Scandi currencies leading the move against the greenback. The yen has fallen by

about 1.3% this week, leading losers, while sterling's 1.1% gain puts it at the

top. Despite the poor showing of US equities yesterday, risk appetites...

Read More »

Read More »

Bitcoin technical analysis, shorting at the top of this channel

Learn how to navigate the reward vs risk of trading BTC with a short attempt strategy. Use caution and visit ForexLive.com for expert insights.

Trade at your own risk.

Read More »

Read More »