Category Archive: 4) FX Trends

Five G10 Central Banks Meet and US CPI on Tap

Half of the G10 central banks meet in the week ahead. The Fed is first on December 14, and the ECB, BOE, Swiss National Bank, and Norway's Norges Bank meet the following day. Before turning a thumbnail sketch of the central banks, let us look at the November US CPI, which will be reported as the Fed's two-day meeting gets underway on December 13.

Read More »

Read More »

Chinese Stocks Extend Rally Even Though Covid Infections Appear to be Spreading

Overview:

The easing of vaccination, quarantine, and some travel protocols

related to Covid in China (and Hong Kong) continues to draw funds back into Chinese

stocks, wherever they trade. The Hang Seng rose 2.3% today to close the week

with a nearly 6.6% advance. The index of mainland companies that trade there

rose 2.5% on the day for a7.3% weekly gain. The CSI 300 of mainland shares rose

1% today and almost 3.3% for the week. Japan’s 1% gain...

Read More »

Read More »

HMMMMM.. What are the forex technicals saying heading into the last day of the trading week?

A technical look at the EURUSD, USDJPY, AUDUSD and NZDUSD.

The USD has a lower bias heading into Friday's trading vs the EUR, AUD and NZD helped by the run lower on Thursday.

The USDJPY is more neutral as it trades between the 100/200 hour MAs

With the EURUSD, AUDUSD and NZDUSD tilting more to the upside, what targets lie above and what are the risk levels that might hurt the bullish bias heading into the new trading day?

With the USDJPY...

Read More »

Read More »

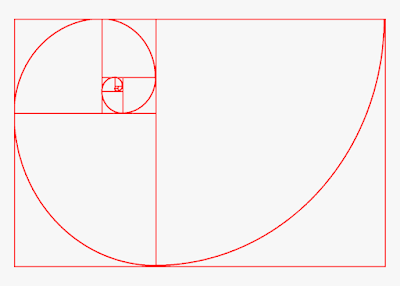

The Head and Shoulders Pattern Checklist

Technical analysis uses a head-and-shoulders pattern. It forecasts a bullish-to-bearish trend reversal. The pattern is a baseline with three peaks, with the middle peak tallest.

To recognize a head-and-shoulders trend reversal, grasp how they're formed.

When investors lose interest, the left shoulder develops. The head develops when excitement rises and falls to the stock's prior low. The right shoulder occurs when the stock price climbs then...

Read More »

Read More »

Political Developments Overshadow Economics

Overview: There is nervous calm in the capital

markets today. The weakness of US shares

yesterday is taking a toll today. An exception in the Asia Pacific region is

the Hang Seng and the index of mainland shares that trade there, which up

around 3.5% today on thUe easing of some Covid protocols. Europe’s Stoxx 600 is off for a fifth day,

its longest losing streak in nearly two months. US futures are posting minor

gains. Benchmark 10-year yields...

Read More »

Read More »

What technical levels are in play for some of major currency pairs today.BOC rate decision

The EURUSD is running back to the upside after moving above the 100 hour MA. The 200 hour MA stalled the fall earlier in the day giving the buyers some hope.

The USDJPY is moving lower and below its 200 hour MA in early trading after the break above failed.

The GBPUSD is moving higher and looks toward the 100 hour MA above at 1.2220.

The USDCAD will be influenced by the BOC rate decision at 10 AM ET. The expectations are between 25 and 50...

Read More »

Read More »

Risk Appetites Challenged after US Equities Tumble

Overview: The sharp sell-off of US stocks yesterday as

sapped the risk appetite today. Equities are being sold. Hong Kong and the

index of mainland shares that are listed there led the regional decline with

3.2%-3.3% losses. Europe’s Stoxx 600 is off about 0.65% in late morning

turnover, the fourth day of losses. US futures are trading with a lower bias as

well. European 10-year bonds are mostly 1-2 bp firmer. The US 10-year Treasury is

practically...

Read More »

Read More »

The major forex currency pairs are seeing up and down price action.What to look for today?

A technical look at the EURUSD, USDJPY, GBPUSD and AUDUSD after the RBA rate hike.

There is up and down price action in some of the major currency pairs. In the morning forex technical report, I look at the EURUSD, GBPUSD, USDJPY and the AUDUSD after the RBA rate hike and outline the levels in play after up and down activity dominated the trading action so far today.

Read More »

Read More »

Yesterday’s Dollar Recovery Questioned Today

Overview: The 11 bp jump in the 10-year US yield yesterday after dropping nearly 26 bp in the previous three sessions, helped the greenback recover and took a toll on stocks. Still, the S&P 500 is above the low set on November 30 (~3939) before Fed Chair Powell's talk that day.

Read More »

Read More »

MORNING VIDEO: A look at the EURUSD, USDJPY and GBPUSD from a technical perspective

What levels are in play for the EURUSD, USDJPY and GBPUSD and why?

The new trading week is underway, with the EURUSD making a new cycle high and backing off.

The USDJPY started below its 200 day MA after closing below that key level on Friday, but has moved back higher and looks toward the 38.2% of the range last week (and high from Friday).

The GBPUSD has seen up and down action in that pair today. A new cycle high was made above an upside...

Read More »

Read More »

Chinese Yuan Jumps While the Dollar recovers After Losses were Extended Against the Euro and Sterling

Overview: The markets remain hopeful about a re-opening in

China and continue to pour into Chinese stocks on the mainland and in Hong Kong. The

index of Chinese companies that trade in the US rose nearly 22.4% last week. Large

bourses in the Asia Pacific region were mixed, but China and Hong Kong stand out.

Europe’s Stoxx 600 is nursing a small loss for the second consecutive session. US

equity futures have a slightly heavier bias. European 10-year...

Read More »

Read More »

Dollar Bears have the Upper Hand

Once again, the dollar was sold into a shallow bounce as the bears maintained the upper hand. There is a growing conviction that the peak in the Fed's tightening cycle is within view, despite more robust than expected jobs growth and an unexpectedly strong rise in average weekly earnings.

Read More »

Read More »

Light crude oil futures technical analysis & trade idea

Setting up a short swing trade for a 3 to 1 short on CL1 (light crude oil futures). Trade oil at your own risk and visit ForexLive.com for additional perspectives.

Read More »

Read More »

Opinion: DOGE Coin to 24.5 cents. 136% profit potential

This is an opinion only for potetential Doge coin buyers or holders, not investmenet advice. Doge coin is riskly and can go to zero, too. However, the technicals show me a 136% upside potential. Furthermore, fundamentally, if Elon Musk and Twitter announce at any future stage, a deeper integration for Doge coin, or some other news catalyst comes out of the top Doge coin fan named Elon Musk, who is still one of the biggest influencers in the world,...

Read More »

Read More »

The Weekend Forex Report: A look back and ahead to the Dec 5, 2022 trading week

What levels are in play technically. What are the major bias and risk defining levels.

In the weekend forex report, Greg Michalowski of Forexlive.come, reviews the fundamentals in play and the importance, and then outlines the bias and risk defining levels for each of the major currencies vs the USD:

EURUSD (5:51)

USDJPY (10:13)

GBPUSD- (13:18)

USDCHF (16:42)

USDCAD (18:21)

AUDUSD (19:52)

NZDUSD (22:53)

Read More »

Read More »

Week Ahead: RBA and BOC Meetings Featured and China’s Inflation and Trade

The week ahead

is more than an interlude before five G10 central banks meet on December

14-15. The data highlights

include the US ISM services and producer prices, Chinese trade and inflation

measures, Japanese wages, household consumption, and the current account.

Also, the Reserve Bank of Australia and the Bank of Canada hold policy

meetings. Central banks from India, Poland, Brazil, Peru, and Chile also meet.The dollar appreciated in Q1 and Q2...

Read More »

Read More »

USDCHF bounces higher on the jobs report. Holding support on the dip. What next?

Buyers have work to do in the USDCHF pair to take back more control. What levels are in play for the USDCHF now?

Read More »

Read More »

What next in the forex after the stronger US jobs report

The US jobs data came in much stronger than expected at 263K versus 200 K expected. The unemployment rate remained steady at 3.7%. The average hourly earnings rose 0.6% versus 0.3% expected.

The USD moved higher. What next?

Read More »

Read More »

The key technical levels in play before the US jobs report

What levels are in play ahead of the US (and Canada) jobs reports at 8:30 AM ET. I will look at the EURUSD, USDJPY, GBPUSD and the USDCAD ahead of the US and Canada jobs reports

Read More »

Read More »

Attention turns to US Jobs while the Yen’s Surge Continues

Overview: There have been significant moves in the capital markets this week

and participants are turning cautious ahead of the US employment report. After the

US equity market rally stalled yesterday, nearly all the Asia Pacific bourses fell

today. The strength of the yen (~3.8% this week) has weighed on Japanese equities

(Nikkei -1.8% this week) and spurred the BOJ to buy ETFs today for the first

time in five months. Europe’s Stoxx 600 is...

Read More »

Read More »