Category Archive: 4) FX Trends

FX Daily, July 02: Third Quarter Begins With a Thump

The window dressing ahead of the end of Q2 failed to signal a turn in sentiment. Equity markets have taken back those gains and more. The US dollar is broadly firmer, though it was coming off its best levels near midday in Europe, and the three-basis-point slippage puts the US 10-year yield at 2.83%, its lowest in more than a month.

Read More »

Read More »

FX Weekly Preview: Trade and Data Driving Markets

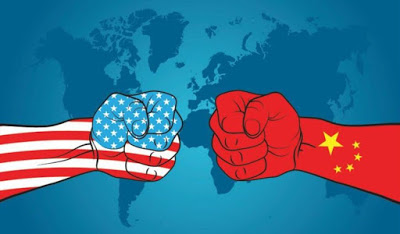

US President Trump is intent on disrupting the post-WWII arrangement that prioritized and ideological conflict over economic rivalries. Last week, it was reported that Trump told his counterparts at the G7 summit that NATO was as bad as NAFTA. NATO's annual meeting is July 12.

Read More »

Read More »

From Good to Great in Fishing or Forex Trading

ForexLive’s Adam Button takes a break from fishing in Northern Canada to talk about how to go from good to great in forex trading. Whether it’s catching fish or pips, the principles of getting better are similar in all things. It’s not just about putting in the time but how you structure that time and …

Read More »

Read More »

FX Daily, June 28: US Dollar Remains Firm, Sends Yuan, Rupee, Sterling and Kiwi to New 2018 Lows

The US dollar is consolidating its gains against most of the major currencies, but the underlying strength remains evident. Several major and emerging market currencies are at new lows for the year, including sterling and the New Zealand dollar, but also the yuan, rupee, and the rupiah.

Read More »

Read More »

FX Daily, June 27: Renminbi Slide Continues and Oil Extends Surge

The US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi. The decline is the sharpest since the 2015 devaluation.

Read More »

Read More »

FX Daily, June 26: Trade Tensions and Approaching Quarter-End Cast Pall Over Markets

The global capital markets have stabilized today after yesterday's rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China's retaliatory tariffs on the US is still ten days off. The immediate focus is on actions expected to curb the technology transfer.

Read More »

Read More »

FX Weekly Preview: Trade Tensions and EU Summit Highlight Q2’s Last Week

We argue there are three major disruptive forces that are shaping the investment climate: the US policy mix in relative and absolute terms, the escalation of trade tensions, and immigration. In the week ahead, trade issues may eclipse the US policy mix, and immigration will compete with the economic and financial agenda at the European heads of state summit at the end of the week.

Read More »

Read More »

FX Daily, June 22: BOE Spurs Dollar Pullback

The Bank of England's hawkish hold yesterday, spurred by three dissents in favor of an immediate hike, changed the near-term dynamics in the foreign exchange market. Both the euro and sterling fell to new lows for the year before reversing higher. Yesterday's gains are being extended today.

Read More »

Read More »

Canadian dollar hits one-year low. What’s next

Adam Button visits BNN Bloomberg on June 21, 2018 to talk about the outlook for the Canadian dollar

Read More »

Read More »

FX Daily, June 21: Dollar Driven Higher

The half-hearted and shallow attempts by the currencies to recover appear to be emboldening the dollar bulls today, The greenback is higher against all major and emerging market currencies today. Demand for dollars is strong enough to offset the broader risk-off environment that is pulling stocks and core yields lower that is usually supportive of the yen.

Read More »

Read More »

FX Daily, June 20: Fragile Stability

The day began out with equity losses in Asia before a sharp recovery, perhaps initiated in China. The MSCI Asia Pacific Index was up a little more than 0.5%. The Shanghai Composite fell more than 1% before closing 0.25% better.

Read More »

Read More »

FX Daily, June 19: America First Clashes With Made in China 2025

The escalation of trade tensions between the world's two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady as it too is benefiting from the unwinding of risk trades.

Read More »

Read More »

FX Daily, June 18: Politics and Economics Weigh on European Currencies

The US dollar is rising against most of the major and emerging market currencies. The prospects of escalating trade tensions and the divergence of policy that was confirmed by the major central banks are disrupting the markets. Norway's central bank meets later this week.

Read More »

Read More »

FX Weekly Preview Warning: Treacherous Week Ahead

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data.

Read More »

Read More »

FX Daily, June 15: Dollar Slips While Escalating Trade Tensions may Roil Markets

The Dollar Index edged higher to its best level this year before turning down as market attention shifts from central banks to trade tensions. Reports confirm that the US will go ahead with the 25% tariff on $50 bln of Chinese goods and provide some specificity today. The final list is expected to be similar to the goods that had been identified in the preliminary list, with an emphasis on electronic goods, apparently on ideas that they may have...

Read More »

Read More »

FX Daily, June 14: Dollar Punished Ahead of ECB

The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed's hike, optimism on the economy, and the signal of hikes in September and December, foretold today's push lower.

Read More »

Read More »

FX Daily, June 13: Dollar Edges Higher Ahead of FOMC

The US dollar is trading firmly as the FOMC decision looms. In many ways, the actionable outcome of this meeting has hardly been in doubt this year. By all accounts, the Fed will deliver its second hike of the year today.

Read More »

Read More »

FX Daily, June 12: US-Korea Summit Fails to Impress Investors

The US dollar initially rallied in early Asia ahead of the US-North Korea summit but has subsequently shed the gains and more. As North American dealers return to their desks, the dollar is lower against nearly all the major currencies, but the yen and Canadian dollar.

Read More »

Read More »

FX Weekly Preview: Busy Week Ahead

The week ahead is eventful. The Federal Reserve, the European Central Bank, and the Bank of Japan hold policy meetings. This would make for a busy week by themselves, but there is more. Trade tensions are likely to escalate further, if the US, as scheduled provides a list of $50 bln of Chinese goods that will face another 25% tariff for intellectual property violations.

Read More »

Read More »

Dollar and Yen Rise Amid Heightened Anxiety

With what promises to be an acrimonious G7 meeting, from which the isolated US President will depart early, and a broadening pressure in emerging markets, the US dollar turned better bid late yesterday and is recovering further today.

Read More »

Read More »