Category Archive: 4) FX Trends

AUDUSD buyers run into a cluster of resistance. Seeing some corrective selling.

AUDUSD trades above and below 0.6500 after testing cluster of resistance between 0.6500 to 0.6521

Read More »

Read More »

USDCAD rebounds helped by weaker Ivy PMI and higher US rates. What next?

The US rates are higher today and acting as a tail wind for the USD including the USDCAD. Having said that, there is work to do to give the buyers additional confidence after the sharp falls from last week.

Read More »

Read More »

The USDCHF broke lower on Friday and moved below key 200 day and 100 bar MA on 4H chart.

Bearish break on Friday in the USDCHF below the 200 day MA at 0.9002 and the 100 bar MA on the 4-hour chart at 0.8997. Stay below is more bearish going forward.

Read More »

Read More »

Kickstart your FX trading for November 6 with technical look at EURUSD, USDJPY and GBPUSD

In this morning video on November 6, 2023, I kickstart the Forex trading day with a technical look at the EURUSD, USDJPY and GBPUSD. What are the biases, the risks, the targets for those three major currency pairs?

Read More »

Read More »

The Dollar Remains Mostly Softer but Near-Term Consolidation is Likely

Overview: The US dollar, which was sold last week

after the FOMC and soft employment report, remains on the defensive today. The

Antipodean currencies and yen are struggling, but the other G10 currencies are

firm. The dollar is also lower against most emerging market currencies. Still,

given the magnitude of the dollar's pullback, we suspect some consolidation is

likely.Asia Pacific equities rallied,

helped by the sharp gains in the US before the...

Read More »

Read More »

S&P 500 Technical Analysis

Here's a quick technical analysis on the S&P 500 with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Week Ahead: Have the Markets Turned?

An inflection point may have been reached last week. Despite,

Chair Powell's insistence that the Fed did not adopt an easing bias and

confirmed that there is still no talk of a cut, the market knows better. The

implied yield of December 2024 Fed funds futures contract is about 4.45%, which

is to say, the market is discounting not only the two cuts in the Fed's

September projections, but a third cut, and the risk again (~60%),

of a fourth cut. The...

Read More »

Read More »

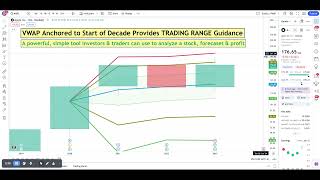

Apple stock long term price analysis, forecast & trading range

Dive into the depths of Apple stock's trading strategy with our latest ? analysis! Anchoring the mighty VWAP from the start of 2020, we're giving you the insider's edge on long-term trading ranges and price forecasting. ?

? In this video, we break down the powerful Volume Weighted Average Price (VWAP) and its role in defining Apple's stock journey. Whether you're a seasoned trader or just starting out, understanding the VWAP's signals is crucial...

Read More »

Read More »

Barring Upside Surprise on US Jobs, the Greenback Looks Vulnerable

Overview: The US dollar has been confined to narrow

ranges today as the market awaits the October employment report. Barring a

significant upside surprise, we suspect the dollar is more likely extend this

week's losses. The Dollar Index is off about 0.5% this week. Within the narrow

ranges, it is sporting a slightly softer profile again nearly all the G10

currencies. It is also lower against most emerging market currencies, but tight

ranges...

Read More »

Read More »

USDJPY Technical Analysis

Here's a quick technical analysis on the USDJPY pair with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Kickstart your FX trading for Nov 3, 2023. A technical look at EURUSD, USDJPY and GBPUSD.

Kickstart your FX trading for November 3, 2023 with technical look at EURUSD, USDJPY and GBPUSD

Read More »

Read More »

Dollar Extends Losses Post-FOMC

Overview: We suspect that if Martians read the FOMC

statement, which was nearly identical to the September statement and listened

to Chair Powell, they would conclude there was nothing new. Yet, the market

habitually hears Powell as dovish and this has weighed on rates and the dollar,

while lifting risk appetites. Follow-through selling of the greenback has

dragged it lower against all the major currencies, with the Antipodean leading

the way, and...

Read More »

Read More »

S&P 500 Technical Analysis

Here's a quick technical analysis on the S&P 500 with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Kickstart your FX trading for Nov 2, 2023. A technical look at EURUSD, USDJPY and GBPUSD.

Kickstart your FX trading for November 2, 2023 with technical look at EURUSD, USDJPY and GBPUSD

Read More »

Read More »

Japanese Fireworks Continue as the Market Turns to the FOMC

Overview: The FOMC meeting is today's highlight but

the drama in Japan continues to rivet the market. The Ministry of Finance

warned of the risk of material intervention in the foreign exchange market, and

the BOJ bought bonds in an unscheduled operation a day after its downgraded the

1.0% cap to a reference rate, whatever that means. The yen is trading with a

slightly firmer bias. The Swiss franc is also trading a little firmer, but the

other G10...

Read More »

Read More »

USDJPY Technical Analysis

Here's a quick technical analysis on the USDJPY pair with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

AUDUSD sellers push the price below the 100/200 hour MA. Ups and downs continue for the pair.

AUDUSD trades below 100/200 hour MAs near 0.6374. Can the sellers keep the pressure on the pair?

Read More »

Read More »