Category Archive: 4) FX Trends

The USD is the weakest of the major currencies ahead of the FOMC rate decision tomorrow

The morning technical video looks at the price action dominating in the EURUSD, USDJPY, GBPUSD and USDCHF.

The USD is the weakest of the major currencies in trading today ahead of the Fed rate decision as markets react to the hope of China abandoning their zero-covid policy. Stocks are higher. Yields are lower. Hopes are the Fed is more dovish tomorrow or at least they signal the near end of policy rate hikes.

- EURUSD (2:04)- The EURUSD is...

Read More »

Read More »

RBA Hikes by 25 bp, Chinese Stocks Surge, and the Greenback Trades Heavier

Overview: Risk appetites have returned today. Bonds

and stocks are advancing, while the dollar is better offered. Unsourced claims

that Beijing has formed a committee to assess how to exit the zero-Covid policy

sent Chinese shares sharply higher. An index of mainland companies list in Hong

Kong jumped nearly 7% and closed up almost 5.5%. The Hang Seng surged 5.2%,

while all the large markets in the region advanced. Europe’s Stoxx 600

recovered...

Read More »

Read More »

Coffee Price Forecast: Looking Strong!

The price of coffee is predicted to rise for the rest of 2022 and into 2023, based on the following technical analysis and price chart of coffee futures, provided by ForexLive.com

For additional perspectives on a variety of financial assets, please visit: https://www.forexlive.com/technical-analysis

Trade cofee futures at your own risk.

Read More »

Read More »

The Dollar Returns from the Weekend Bid

The dollar has come back from the weekend bid. After the ECB and BOJ meetings last week, the focus has shifted back to the US where the FOMC meeting concludes in the middle of the week and the October employment report is out ahead of the weekend. Sterling and the yen are the weakest performers among the G10 currencies and are off 0.45%-0.50%. The Antipodeans are performing best and are straddling little changed levels.

Read More »

Read More »

Three down.Three to go. The RBA, BOE and Fed will be the next CBs to report policy changes

IN the weekend report, I also look at the technicals that will drive the major currency pairs in the new trading week

Read More »

Read More »

Russell 2000 technical analysis

There is a double magnet pulling price to 1885 to 1900 where partial profit taker will probabably be waiting. But on the medium term, this will probably be temporary selling within a bigger bullish reversal up.

Read More »

Read More »

November 2022 Monthly

With this month's hike, the Federal Reserve would have raised overnight rates by 300 bp while doubling the pace that its balance sheet is shrinking over the past 100 days. The US economy is the largest in the world, and US interest rates and the dollar are vital benchmarks.

Read More »

Read More »

Apple stock forecast for 2023: Going to $170

37 analysts have predicted a 12-month median price of $180 for Apple Inc.

Apple stock forecasts range from $200 to $122.

Read More »

Read More »

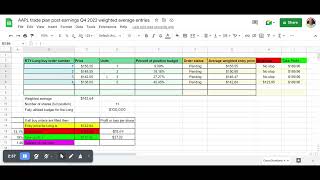

AAPL trade plan post earnings Q4 2022 weighted average entries – Google Sheets

This is a supplement video explaining one advanced way to scale into a buy of Apple stock, part of the stock price forecast at

The method includes heavier buying as the price declines, a stop loss and take profit target with a note that buyers can consider taking partial profit (eg, 50%) if the target is reached.

Read More »

Read More »

RBA, FOMC, BOE Meetings Featured while the Greenback’s Recovery can be Extended

The week ahead is important from a macro perspective. The data highlights include China's PMI, eurozone preliminary October CPI and Q3 GDP, and the US (and Canadian) employment reports. In

addition, the Federal Reserve meeting on November 2 is sandwiched between the Reserve Bank of Australia meeting and the Bank of England meeting.

Read More »

Read More »

The technicals are having a profound impact in the major currency pairs today.Find out why

Being in tune with the rhythm of the markets is just as important as a musician's instrument being in tune with the orchestra's instruments. If you are not in tune, you will not do well in your trading/sound well in your orchestra. In the morning technical report, I look to get you in tune with the technicals that are driving the markets and show why. So take a few minutes to get in tune with the market.

Read More »

Read More »

BOJ Doesn’t Surprise, but EMU does with October CPI and Q3 Growth

Bonds and stocks are being sold ahead of the weekend. Poor corporate earnings and higher inflation in Japan and Europe are weighing on sentiment. The dollar is mostly higher. Hong Kong and mainland China led large Asia Pacific markets lower. India and Singapore were notable exceptions.

Read More »

Read More »

EURUSD moves toward session low. What next?

The 0.99515 level in the EURUSD is being eyed as the next downside target.

Close risk is now the parity level at 1.0000. Say below would be the best news for the sellers now.

Read More »

Read More »

The EURUSD trades above and below the parity level as the market digests the ECB rate move

The EURUSD, USDJPY and GBPUSD are analyzed in the morning forex technical report.

The ECB raised rates by 75 basis points as expected, but the bias is lower. The EURUSD is trading above and below the parity level with support target at 0.9951. ON the topside, the 100 day MA did a good job of stalling the rise at 1.0088. It would take a move above that level to give the buyers more control. Right now the sellers are more in control in the short...

Read More »

Read More »

Dollar Slump Stalls Ahead of ECB Meeting

The dollar’s recent losses have left it stretched on a near-term basis after today’s ECB meeting, the focus will shift to the Federal Reserve, next week’s meeting, and the employment report. The greenback is trading with a firmer bias against the G10 currencies, while the emerging market currencies are more mixed.

Read More »

Read More »

AUDUSD runs higher but runs into some MA resistance. Can the buying continue?

The AUDUSD ran up to some MA resistance at the 200 bar MA on the 4-hour chart, but failed on the first look. What now?

Read More »

Read More »

The USD is moving lower but seeing a little of a rebound in early NY trading. What next?

Bank of Canada rate decision on tap. The 1.3500 level defined a low. What about the upside ahead of the rate decision.

The USD moved lower vs the major currency pairs:

- EURUSD moved to the highest levels since September 19 and back above the parity level. The price has rotated back down to the parity level. Do buyers stall the fall and continue the upside run. What are the charts saying?

- GBPUSD is also higher on the day and rotated above...

Read More »

Read More »

Dollar Slumps, Yuan Rallies by Most this Year amid Intervention Talk

Overview: The US dollar is having one of toughest days of the year. It has been sold across the board and taken out key levels like parity in the euro, $1.15 in sterling, and CAD1.36. The Chinese yuan surged over 1%. Chinese officials promised healthy bond and stock markets.

Read More »

Read More »

The morning forex technical report for October 25, 2022 looks at 4 major currency pairs

In the morning forex technical report, Greg Michalowski looks at 4 major currency pairs vs the USD.

Read More »

Read More »