Category Archive: 4) FX Trends

Week Ahead: US Dollar to Extend Recovery while Stocks Correct Lower

The consolidative phase for the dollar, we anticipated last week, after its recent drop, is evolving into a proper upside correction. We expect the dollar to trade broadly firmer over the next week or so. It is also part of a larger picture, where US interest rates also look to have put in a near-term bottom and are set to recover. Ideas that next US administration may favor a weaker dollar has become a talking point. Yet, of all the forces that...

Read More »

Read More »

AUDUSD runs into a cluster of support as the week moves toward the close.

The area between 0.6676 to 0.6689 is key support defined by a cluster of technical levels.

Read More »

Read More »

USDCAD higher on the day. Retail sales weak pave the way for a BOC rate cut next week.

The price of the USDCAD steps above trend line at 1.3720 area continuing the trend to the upside over the last week or so.

Read More »

Read More »

USDCHF rebounds into a key resistance area. Sellers are leaning near 0.8900.

The falling 100 hour MA is at 0.8899. The top of a swing area is at at 0.8898. That is being tested. On the downside the 200 day MA and retracement level at 0.8883 is close support.

Read More »

Read More »

Kickstart the FX trading day for July 19 w/a technical look at the EURUSD, USDJPY & GBPUSD

What technical levels are driving the 3 major currency pairs to start the US trading day

Read More »

Read More »

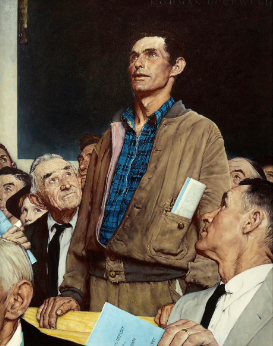

Dollar Consolidation is Morphing into Correction

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The failure of computer systems has disrupted airlines, banks, media companies, and the London Stock Exchange, ostensibly stemming from an update from a third-party software update, according to Microsoft. The dollar is trading with a firmer bias. The consolidation, we anticipated, appears to be morphing into a correction. Weaker than expected retail sales...

Read More »

Read More »

Gold Technical Analysis – Is this just a pullback or a fakeout?

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:42 Technical Analysis with Optimal Entries....

Read More »

Read More »

The technical bias in NASDAQ is tilting more to the downside after break of 200 hour MA. What next?

What will keep the pressure on the NASDAQ index today and going forward. What are the next targets?

Read More »

Read More »

USDCAD technical bias has a little tilt to the upside this week. Can the buyers push more?

The low yesterday stalled near the 100 bar MA on the 4-hour chart at 1.36604. The price is above the 200 bar MA as well at 1.3684. Staying above gives a bullish tilt to the pair.

Read More »

Read More »

USDCHF bounces off the support target at 0.8819. Buyers are making a play.

If the bottom is in play a move back toward a cluster of resistance near 0.8880 is in play.

Read More »

Read More »

Kickstart the FX trading day for July 18 w/a technical look at the EURUSD, USDJPY & GBPUSD

What levels are in play? What are the bias defining levels? What are the risks for the 3 major currency pairs?

Read More »

Read More »

Euro Trades Quietly Ahead of ECB Meeting

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The US dollar enjoys a firmer bias today, in mostly quiet turnover in narrow ranges. The Australian dollar is a noted exception, and the better than expected jobs growth may have lent it some resilience today. The greenback initially was sold to almost JPY155.35, a new low (since June 7) before recovering to nearly JPY156.60 in Europe. The UK's employment...

Read More »

Read More »

USDJPY Technical Analysis – A key breakout increased the bearish momentum

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:03 Technical Analysis with Optimal Entries.

2:16 Upcoming Economic Data....

Read More »

Read More »

AUDUSD sellers push the price back toward key MA, retracement and swing area support

The Australian jobs report will be released in the new trading day and will be an influence on the price action. Strong support outlined below.

Read More »

Read More »

NZDUSD respecting technical levels Where are those levels? Find out in this video

The NZDUSD bounced off key trend line and retracement support yesterday/today. The run higher has found willing sellers against a MA level. What next?

Read More »

Read More »

USDCHF breaks lower below technical levels, increasing the bearish bias. What next?

The USDCHF breaks below its 200 day moving average and 38.2% retracement of the move up from the December 2023 low

Read More »

Read More »

Kickstart the FX trading for July 17 with a technical look at the EURUSD, USDJPY & GBPUSD.

The USD is lower with the EURUSD stretching higher ahead of the ECB decision tomorrow. The GBPUSD is above the 1.3000 level and at a new high for the year.

Read More »

Read More »

Dollar Crushed, Stocks Slump

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The dollar is broadly lower, and stocks are under pressure. Comments by a Japanese official, which did not appear to break new ground, coupled with Trump's interview in BusinessWeek, where he was critical that Japan was benefiting from a weak yen, despite having apparently spent some $80 bln this year trying to stop it from falling, may have been the trigger....

Read More »

Read More »

Gold Technical Analysis – We reached a new all-time high

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:38 Technical Analysis with Optimal Entries.

2:08 Upcoming Economic Data....

Read More »

Read More »