Category Archive: 4.) Marc to Market

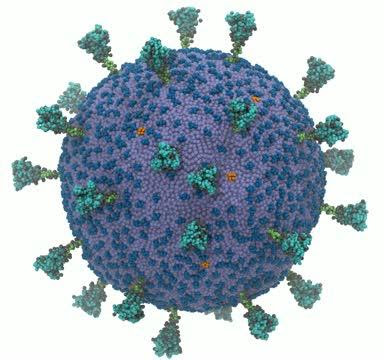

US CPI to Accelerate, while Omicron adds Color to Covid Wave that was Already Evident

At the risk of over-simplifying, there seem to be three sources of dynamism in the investment climate: Covid, the Federal Reserve, and market positioning. The last of these is often not given its due in narratives in the press and market commentary, so let's begin there. The anthropologist Clifford Gertz once posed the question about distinguishing between someone winking and someone with a twitch in their eye, and a person mimicking the wink or...

Read More »

Read More »

The Greenback Finds Traction ahead of the Jobs Report

Overview: The Omicron variant has been detected in more countries, but the capital markets are taking it in stride. Risk appetites appear to be stabilizing. The MSCI Asia Pacific Index rose for the third consecutive session, though Hong Kong and Taiwan markets did not participate in the advance today. Europe's Stoxx 600 is struggling to hold on to early gains, while US futures are narrowly mixed. The US 10-year yield is a little near 1.43%,...

Read More »

Read More »

FX Daily, December 02: Calm Surface Masks Lack of Conviction

The downside reversal in US stocks yesterday seemed to accelerate after the first case of the Omicron variant was found in the US. In itself, it should not be surprising, but perhaps, what was especially disheartening is that the person had been fully vaccinated.

Read More »

Read More »

December Monthly

The pandemic is still with us as the year winds down and has not yet become endemic, like the seasonal flu. Even before the new Omicron variant was sequenced, Europe was being particularly hard hit, and social restrictions, especially among the unvaccinated, were spurring social strife. US cases, notably in the Midwest, were rising, and there is fear that it is 4-6 weeks behind Europe in experiencing the surge. Whatever herd immunity is, it has...

Read More »

Read More »

Fragile Calm Returns and Powell’s Anti-Inflation Rhetoric Ratchets Up

Overview: Into the uncertainty over the implications of Omicron, the Federal Reserve Chairman injected a particularly hawkish signal into the mix in his testimony before the Senate. These are the two forces that are shaping market developments. Travel restrictions are being tightened, though the new variant is being found in more countries, and it appears to be like closing the proverbial barn door after the horses have bolted. Equities are...

Read More »

Read More »

Pessimistic Omicron Assessment Squashes Risk Appetites

Overview: A pessimistic assessment offered by the CEO of Moderna shattered the fragile calm seen yesterday after the pre-weekend turmoil. Risk appetites shriveled, sending equity markets lower and the bond markets higher. Funding currencies rallied, with the euro and yen moving above last week's highs. The uncertainty weighs on sentiment and makes investors question what they previously were certain of. The MSCI Asia Pacific Index fell over 1%...

Read More »

Read More »

Sentiment Remains Fragile

Overview: The fire that burnt through the capital markets before the weekend, triggered by the new Covid mutation, burned itself out in the Asian Pacific equity trading earlier today. A semblance of stability, albeit fragile and tentative, has emerged. Europe's Stoxx 600 is up about 1%, led by real estate, information technology, and energy. US index futures are trading higher, with the NASDAQ leading. Benchmark 10-year yields are firmer. The US...

Read More »

Read More »

The Dollar Moves Back to the Fulcrum between the Funding and Higher Beta Currencies

The new covid variant injected a new dynamic into the foreign exchange market. The World Health Organization cautioned against the need to impose travel restrictions, but policymakers, by and large, do not want to be bitten by the same dog twice. To err on the side of caution is to minimize one's biggest regret. The risk is that the uncertainty is not lifted quickly but lingers, which would likely unpin volatility. US and European benchmark...

Read More »

Read More »

Jobs (US) and Inflation (EMU) Highlight the Week Ahead

The new covid variant and quick imposition of travel restrictions on several countries in southern Africa have injected a new dynamic into the mix.

Read More »

Read More »

Covid Strikes Back

Overview: Concerns that a new mutation of the Covid virus has shaken the capital markets. Equities are off hard, and bonds have rallied. In the foreign exchange market, the Japanese yen and Swiss franc have rallied. While there may be a safe haven bid, there also appears to be an unwinding of positions that require the buying back of the funding currencies, which is also lifting the euro. The currencies levered from growth, the dollar-bloc and...

Read More »

Read More »

Turkey gets a Reprieve before US Thanksgiving, but Capital Strike may not be Over

Overview: The dramatic collapse of the Turkish lira was like an accident one could not help look at, but it was not an accident, but the result of a disregard for the exchange rate and compromised institutions. The lira was off around 15% at its worst yesterday, before settling 11.2% lower. After falling for 11 sessions, it has steadied today (~2.7%) but the capital strike may not be over. On the other hand, the Reserve Bank of New Zealand...

Read More »

Read More »

Tech Sell-Off Continues

Overview: The markets are unsettled. Bond yields have jumped, tech stocks are leading an equity slump, and yesterday's crude oil bounce reversed. Gold, which peaked last week near $1877, has been dumped to around $1793. The tech sell-off in the US carried into the Asia Pacific session, and Hong Kong led most markets lower. The local holiday let Japanese markets off unscathed, though the Nikkei futures are off about 0.4%. Australia and India...

Read More »

Read More »

Market Shrugs Off Chinese Signals and Keeps the Yuan Bid

Overview: The US dollar has come back bid from the weekend against most currencies following the talk by a couple of Fed governors about the possibility of accelerating the tapering at next month's FOMC meeting. The weekend also saw protests against the social restrictions being imposed by several European countries in the face of a surge in Covid cases. The Swedish krona, yen, and sterling are the weakest, while the dollar-bloc currencies are...

Read More »

Read More »

Covid Surge Compounds Monetary Divergence to give the Euro its Biggest Weekly Loss in Five Months

Strong US consumption and production figures kept the greenback well supported last week on the heels of the jump in CPI to 6.2%. Meanwhile, the surge of Covid cases in Europe underscores the divergences with the US, sending the euro to new lows for the year.

Read More »

Read More »

Flash PMIs Play Second Fiddle to US PCE Deflator and Accelerating Inflation

The flash November PMIs would be the main focus in the week ahead if it were more normal times. But these are not normal times, and growth prospects are not the key driver of the investment climate. This quarters' growth is largely baked into the cake. The world's three largest economies, the US, China, and Japan, are likely to accelerate for different reasons in Q4 from Q3. Europe is the weak sibling, and growth in the eurozone and UK may slow...

Read More »

Read More »

Covid Wave Knocks Euro Down and to new 6-year Lows Against the Swiss Franc

Overview: Concerns about the virus surge in Europe cut short the euro's bounce and sent it back below $1.1300 and are also weighing on central European currencies, including the Hungarian forint, despite yesterday's aggressive hike of the one-week deposit rate. Austria has reintroduced a hard 20-day lockdown. Germany's health minister warned that the situation deteriorated and vaccines were not enough to break the wave. He was explicit that a...

Read More »

Read More »

Euro Bounces Back, but the Turkish Lira Remains Unloved

Overview: The US dollar's sharp upside momentum stalled yesterday near JPY115 and after the euro met (and surpassed) a key retracement level slightly below $1.1300. Led by the Antipodean currencies today, the greenback is mostly trading with a heavier bias. Among the majors, helped by a steadying of US yields, the yen is soft. In the emerging market space, the Turkish lira continues its headlong plunge while the yuan softened and the Mexican...

Read More »

Read More »

European Gas Jumps, while the Euro and Yen Slump

Overview: The prospects that the 6.2% CPI will prompt the Fed to move quicker continue to underpin the dollar. The euro fell to about $1.1265, its lowest level since last September, and the Japanese yen slumped to a fresh four-year low. The JP Morgan Emerging Market Currency Index tumbled 1% yesterday, the largest decline since February. A more stable tone is evident in Europe, as the euro has recovered above $1.13, and the JP Morgan Index is...

Read More »

Read More »

Biden-Xi “Summit” Leaves Markets Unmolested, While Bailey Continues to Blame Investors for Misunderstanding Him

[unable to retrieve full-text content]Overview: The much-heralded Biden-Xi meeting left little impression on the capital markets. Equities in the region were mixed, and China's main markets fell, alongside Australia, South Korea, and India. European equities continue their upward market, with the Stoxx 600 gaining for a fifth consecutive session. US futures are softer. The bond market is quiet, with the US 10-year yield softer slightly below...

Read More »

Read More »

The Greenback Slips to Start the New Week

Overview: While the Belarus-Poland border remains an intense standoff, there have been a couple other diplomatic developments that may be exciting risk appetites today. First, Biden and Xi will talk by phone later today. Second, reports suggest the UK has toned down its rhetoric making progress on talks on the implementation of the Northern Ireland Protocol.

Read More »

Read More »