Category Archive: 4.) Marc to Market

Equities Wish it were Turn Around Tuesday as Rout Continues and No Relief for the Yen

Overview: A sell-off in equities is continuing while the foreign exchange market is quiet with the greenback confined mostly to narrow ranges. It is firmer against most currencies, though the dollar bloc is the most resilient today. The dollar reached a new nine-month high against the yen. Despite some escalating rhetoric from the MOF, the …

Read More »

Read More »

Downgraded Chances of Fed Cut Next Month Help Underpin the Greenback

Overview: The US dollar is slightly firmer against most of the G10 currencies, with the Antipodeans, leading the move with around 0.25% losses. Rising tensions between Japan and China, coupled with shift in expectations away from a Fed cut and a BOJ hike next month keeps the dollar within strike distance of JPY155, where $1.4 …

Read More »

Read More »

Week Ahead: US Data Resumes and Shifting Central Bank Outlooks

Last week will be recalled as the end of the longest government shutdown in US history. Despite the poor optics and disruptions for many, the lasting impact is likely to be marginal though the shutdown may weigh on Q4 economic activity. Nevertheless, perhaps swayed the comments of most of the 14 Fed officials that spoke …

Read More »

Read More »

Sterling and Gilts Weighed Down by UK Government Budget Shift

Overview: The US dollar is trading with a firmer bias today but is mostly within yesterday's range. There are four developments to note. First, China's October data mostly disappointed, but the PBOC set the dollar's reference rate at a new low since October 2024. Second, the UK government reportedly has shifted strategies to focus on …

Read More »

Read More »

US Dollar Remains Soft Despite Disappointing UK Growth and Eurozone Industrial Output

Overview: The US dollar is trading heavier against most of the world's currencies today. Better than expected Australian employment data, which boosts speculation that the central bank's easing cycle is over, helps explain the Australian dollar's gain to its best level of the month. However, sterling is firm and extended yesterday's gains despite news that …

Read More »

Read More »

Yen Slumps but Material Intervention Still Seems Unlikely, Sterling Holds $1.31, and PBOC Fix USD at New Low

Overview: The US dollar is mostly consolidating in narrow ranges against the major currencies. The notable exception is the Japanese yen, which has slumped to a new nine-month low as the greenback approached JPY155. Despite repeated warnings by Japan's finance minister, the market seems undaunted. Actual material intervention seems unlikely, especially outside of Tokyo markets. …

Read More »

Read More »

Yen and Sterling Weakness Featured

Overview: The US dollar is mixed. Sterling is the weakest of the G10 currencies after unexpectedly poor employment reported boosted chances of rate cut next month. The dollar also made marginal new high against the Japanese yen since February, but so far has remained below JPY154.50. The dollar-bloc currencies are softer while the Scandis are …

Read More »

Read More »

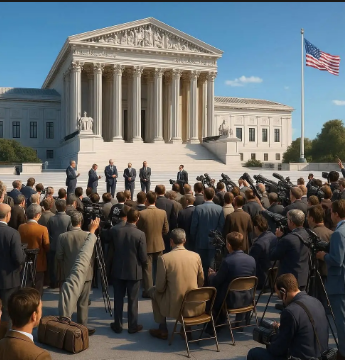

Deal to Re-Open the US Government Helps Boost Risk Appetites

Overview: The prospect that the longest US government shutdown in history may end in the next few days has bolstered risk appetites, driven equities broadly higher and left the dollar non-plussed. The greenback is mixed against the G10 currencies. The Japanese yen, which appears have been dragged lower by the jump in US rates. The …

Read More »

Read More »

Week Ahead: Dollar Recovery Getting Tired

The markets were not impressed with the ADP private sector jobs estimate. Although it increased for the first time since July, the average over the three months through October was 3.3k, the weakest since August 2020. The Dollar Index snapped a five-day advance after the mid-week report and will begin the new week with a … Continue...

Read More »

Read More »

Equities Slide, the Greenback is Bid, while the Yen Recovers with more Verbal Intervention

Business travel will interrupt the commentary for the remainder of the week. The next update will be the weekly commentary on November 8. Good luck to us all. Overview: Tumbling equities and softer yields mark a risk-off session. The US dollar, though, is mostly higher. Among the G10 currencies, it took another round of verbal …

Read More »

Read More »

Greenback is Firm: Government Still Closed

Overview: The US dollar is beginning the new month on a firm note. It has edged higher against most currencies. Among the G10, the Australian dollar and Norwegian krone are leading the pack with negligible gains. Among emerging market currencies, the Mexican peso's gain of around 0.15% puts its atop the complex. The news stream …

Read More »

Read More »

November 2025 Monthly

The world economy is limping into November 2025, buffeted by geopolitical crosswinds, policy fragmentation, and structural shifts that defy easy categorization. Despite record highs in many equity markets, beneath the surface, the global order is being re-engineered—one export restriction, cyberattack, and parliamentary deadlock at a time.US-China Tensions Move Away from the Immediate BrinkLet’s start with …

Read More »

Read More »

Bullish Dollar Consolidation

Overview: After extending this week's rally yesterday, the US dollar is consolidating yesterday's gains in what appears to be favorable price action. The pullback from greenback's best level has been shallow. The US struck several trade deals this week, and secured a trade truce with China, even if many are skeptical of its longevity, and …

Read More »

Read More »

US-China Agree to Unwind Recent Actions, while Greenback Consolidates Post Fed Move, and Yen Slumps after BOJ Stands Pat

Overview: The US agreed to not to block subsidiaries of Chinese companies that were sanctioned and not to enforce the port fee on Chinese ships that had ostensibly triggered the tightening of China's rare earth/magnet export restrictions. China agreed to suspend those for a year and dropped its levy on US made/operated ships port calls. …

Read More »

Read More »

Japanese Verbal Intervention was More Effective than Bessent’s, and the Dollar is Bid Ahead of FOMC Outcome

Overview: The market is optimistic a deal will be struck between the US and China tomorrow. A reduction in the fentanyl tariff is expected, and a one-year delay in the broad export licensing requirement for rare earths and related technology has been tipped. Reports suggest China purchased two cargoes of US soy for the first …

Read More »

Read More »

Japan’s Warning and Successful US-Japan Talks See Yen Snap Seven-Day Slide

Overview: The dollar is mixed against the G10 currencies today. Fanned by Japanese official caution about exchange rate developments, and perhaps what seems like a successful between President Trump and Japanese Prime Minister Takaichi, the dollar is snapping a seven-day advance against the yen. The dollar bloc and sterling are under-performing, while the roughly 1.75% …

Read More »

Read More »

Risk-On as US-China Take Step Away from Brink, Market Shrugs off new US Levy on Canada, and Milei Does Better than Expected in Argentina

Overview: A combination the US and China moving away from the trade brink, more US trade agreements (and frameworks) in Southeast Asia (Cambodia, Thailand, Vietnam, and Malaysia), and a strong showing by Milei's party in Argentina have boosted risk appetites in today's activity. The US S&P 500 and Nasdaq are poised to gap higher for …

Read More »

Read More »

Week Ahead: A Most Consequential Week

The week ahead could be one of the most consequential weeks here in Q4. Four G10 central banks meet, and two, the Federal Reserve and the Bank of Canada, the market is confident will cut policy rates. The market is also confident that the other two central banks, the European Central Bank and the Bank … Continue reading »

Read More »

Read More »

Trump Cancels Trade Talks with Canada even as US Seeks Broad Alliance to Check China’s Rare Earth Dominance

Overview: The US dollar is trading higher against all the G10 currencies today, but it has not broken out of this week's ranges. The Dollar Index is rising for the fourth session this week and has recovered last week's 0.55% decline. The greenback is more mixed against emerging market currencies. While the JP Morgan Emerging …

Read More »

Read More »

Tighter Sanctions on Russia Spurs Oil’s Surge and Lifts Yields

Overview: The dollar is trading quietly in mostly narrow ranges against the most of the G10 currencies. The key development has been the escalation of pressure on Russia from a new round of sanctions by the US and EU. The US sanctioning of two of Russia's largest oil companies will disrupt Chinese and Indian buyers …

Read More »

Read More »