Category Archive: 4.) Marc to Market

Daily FX, May 20: Divergence Reasserted, Extends Greenback’s Recovery

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed …

Read More »

Read More »

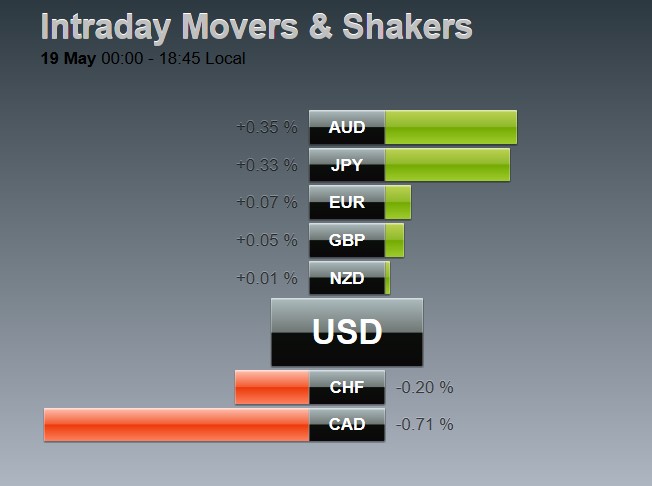

FX Daily, May 19: FOMC Minutes Extend Dollar Gains

We felt strongly that the FOMC minutes would be more hawkish than the statement that followed the meeting, and we were not disappointed. However, our caveat remains: the minutes dilute the signal that emanates from the Fed’s leadership, Yellen, Fischer, and Dudley. The latter two speak in the NY morning. Fischer and Dudley’s comment will be scrutinized …

Read More »

Read More »

Cool Video: CNBC Asia–Rare Double Feature

My two week trip to Asia is winding down. I had the privilege of being on CNBC in Asia earlier today and discussed the markets with Martin Soong from Singapore. There were two segments. The first segment (here) is about two minutes long and focuses on about Japan. The second segment (there) is 3.5 … Continue reading »

Read More »

Read More »

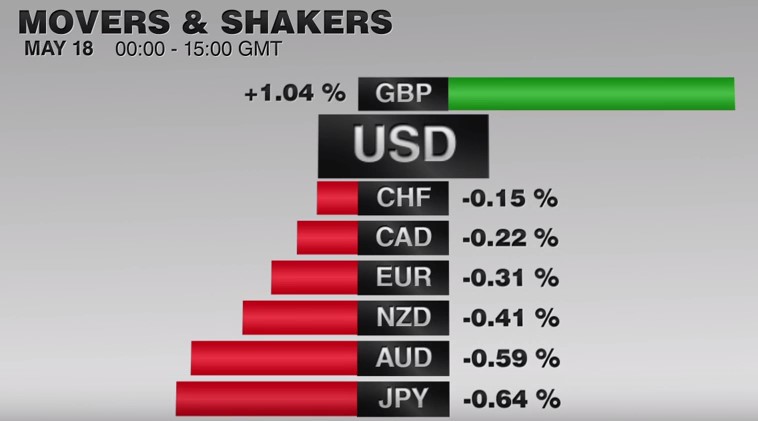

FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

Apart from GBP, the US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable …

Read More »

Read More »

Cool Video: Chatting with Bloomberg’s Angie Lau in Hong Kong

As the second week of this Asian business trip gets underway, I am in Hong Kong. I was on Bloomberg TV in the Asian morning to discuss market developments with Angie Lau. The 4.5 minute discussion covers a number of topics, including the outlook for Fed policy, the BOJ, dollar outlook and game theory. … Continue...

Read More »

Read More »

FX Daily, May 17: The Meaning of Sterling and Aussie’s Advance Today

The US dollar is mostly weaker today. It appears to be consolidating the gains scored since the reversal on May 3. Sterling and the Australian dollar are leading the way early in Europe. The Australian dollar’s gains appear more intuitively clear. The minutes from the recent RBA meeting indicated that it was a closer decision. This …

Read More »

Read More »

Brief Look at the Start of the New Week’s Activity

The most notable thing is not what has happened, but what has not happened. The market has not responded to the soft Chinese data over the weekend. Chinese equities began softer but recovered fully and the Shanghai Composite closed on its highs. The MSCI Asia Pacific Index is snapping a two-day losing streak with a … Continue reading...

Read More »

Read More »

Are Dollar Fundamentals Lagging the Technical Improvement?

The US dollar extended its recovery that began on May 3. Its technical condition remains constructive, even though up until now, the gains are still consistent with a modest correction rather than a trend reversal. The details of the employment report, if not the headline, coupled with the 1.3% increase in retail sales, have boosted …

Read More »

Read More »

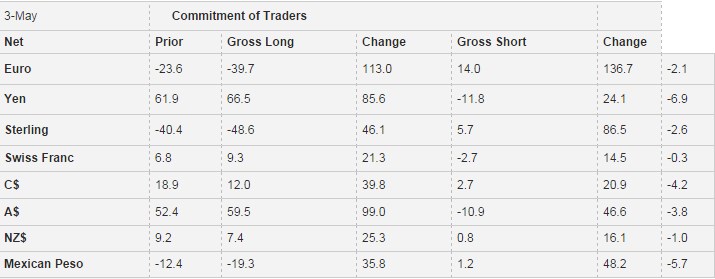

Weekly Speculative Positions: Significant Position Adjustments

The US dollar staged an impressive reversal against many of the major foreign currencies on May 3. In the following week, speculators in the currency futures market made significant adjustment in their holdings. We identified a change in the gross position in the currency futures of 10k contracts or more to be significant. In the week …

Read More »

Read More »

Dollar’s Technical Tone Improves, but No Breakout (Yet)

The US dollar continued the recovery begun May 3 and rose against most of the major currencies over the past week. A nearly 3.5% rally in oil prices, the fifth weekly gain in the past six weeks (a $9.5 advance over the period), helped the Norwegian krone turn in a steady performance. The Canadian dollar’s 0.2% … Continue...

Read More »

Read More »

Daily FX, May 13: Toward a New Mouse Trap

The Great Financial Crisis has exposed a deep chasm in economics and economic policy. No single institution is this crystallized more than at the Bank of Japan. The former Governor, Shirakawa brought policy rates to nearly zero to combat deflation. His successor, Kuroda, took the central bank in the completely other direction. He has introduced three …

Read More »

Read More »

FX Daily, May 12: Yen Recovers After Being Thrown for 2 percent

The Japanese yen is recovering from two-day two percent decline. The yen is the strongest of the majors today, rising about 0.6%. The greenback initially extended its gains marginally in early Tokyo before the selling pressure emerging. Th...

Read More »

Read More »

Dollar Drivers in the Week Ahead

The key issue facing the foreign exchange market is whether the modicum of strength the US dollar demonstrated last week is the beginning of a sustainable move. It is possible that the market is again at a juncture in which the price action will...

Read More »

Read More »

Weekly Speculative Positions: Cutting Longs in Yen and Swiss Franc

Speculators in the futures market continued to pare short foreign currency positions but were cautious about expanding long positions in the CFTC reporting week ending May 3. In fact, two of the three largest adjustments were the cutting of gross long Japanese yen and Australian dollar positions. Yen Speculators took profits on 11.8k contracts of …

Read More »

Read More »

Key Dollar Developments Include Bottoming against the Dollar-Bloc

The US dollar rose against all the major currencies last week. The importance of the price action does not lie with the magnitude or the breadth of the advance. Instead, the two takeaway technical observations are 1) the seemingly one-way market for euro and yen ended and 2) the dollar-bloc currencies appear to have put … Continue reading...

Read More »

Read More »

Great Graphic: Non-Consensus Thinking on Trade

Low-skilled workers abroad do compete with low-skilled workers at domestic affiliates. However, employment of high-skilled workers abroad compliments (as in leads to more) high skilled domestic employment.

Read More »

Read More »

FX Daily, May 5: Dollar Performance Turns More Nuanced

The US dollar is firm, near the best levels of the week against the euro, yen, and sterling. However, against the dollar-bloc and several actively traded emerging market currencies, including the Turkish lira and South African rand, the greenbac...

Read More »

Read More »

Cool Video: Trump and the Dollar–Bloomberg TV

I was invited to discuss the potential impact of a Trump presidency on the US dollar with Bloomberg's with Joe Weisenthal, Oliver Renick, and Alix Steel on "What'd You Miss" show yesterday afternoon, Of course the topic lends itself to all sorts of partisanship. However, I put aside my own political axes and focused on two potential …

Read More »

Read More »

Political Crisis in Turkey is Not Good for Europe

It has been long recognized by the investment community that power in Turkey was concentrated in Erdogan’s hands. He enjoys incredible power in the ceremonial presidential post and brooks no rivals. Common among authoritarian leaders they habitually turn on hand-picked successors as they grow fearful of competitors. This is precisely what has played out …

Read More »

Read More »